U.S. stock futures are flat ahead of Wednesday’s Fed meeting

Stock futures were flat in overnight trading after the major indexes rallied and oil prices tumbled below $100 a barrel ahead of Wednesday’s Federal Reserve meeting.

Futures on the Dow Jones Industrial Average dipped 40 points, while S&P 500 futures fell 0.1% and Nasdaq 100 futures were flat.

The gains came ahead of a critical Federal Reserve meeting on Wednesday, where the agency is widely expected to raise rates by a quarter-point, the first hike since 2018. Watchers are also expecting the central bank to offer a new quarterly forecast that could indicate five or six more hikes this year.

“My guess is it’s going to sound a little more hawkish than people want it to sound, and that’s going to be a little tough to digest, particularly in the fixed income markets,” David Zervos, chief market strategist at Jefferies told CNBC’s “Closing Bell” on Tuesday. “I think the equity market might digest it a little bit better, but it’s going to be a tough swallow.”

The Fed is expected to announce an interest rate decision and economic projections at 2 p.m. on Wednesday, which will followed by a briefing from Federal Reserve Chair Jerome Powell.

Meanwhile, oil prices cooled off on Tuesday, dropping below $100 after topping a multiyear high of $130 earlier this month, while commodities such as gold, which have been volatile in recent days, fell 1.59%.

The U.S. and global oil benchmarks both settled below $100 a barrel, with West Texas Intermediate and Brent crude falling 6.4% and 6.5%, respectively. The fallback put pressure on some energy stocks, including Exxon and Chevron, which sank about 6% and 5% on Tuesday.

During regular trading on Tuesday, the Dow Jones Industrial Average gained 599 points, or 1.8%, while the S&P 500 jumped more than 2.1%, and broke a three-day losing streak. Meanwhile, the tech-heavy Nasdaq Composite rose about 2.9%.

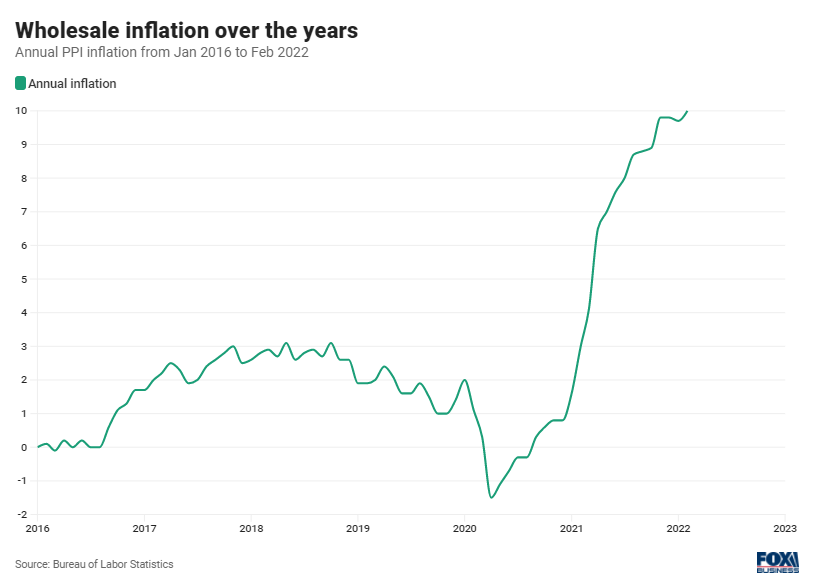

“U.S. stocks are trading higher Tuesday as investors react positively to a ‘Goldilocks’ mix of economic reports (lower PPI and eroding Empire survey) and another sharp drop in oil prices — all suggesting that the path to sustained high inflation may be less certain than some think,” wrote Goldman Sachs analyst Chris Hussey in a note Tuesday.

Tuesday’s market rally was broad-based, led by sharp gains among technology stocks. Microsoft rose nearly 4%, while chipmakers Nvidia and Advanced Micro Devices climbed roughly 8% and 7%. Peloton rose 12% after Bernstein initiated coverage of the stock with an “outperform” rating, and Coupa Software plummeted 19% on the back of a weaker-than-expected outlook.

Investors continued to monitor the ongoing situation in Ukraine on Tuesday, as Kyiv announced a 35-hour curfew after Russian missile strikes hit some residential buildings. Meanwhile, President Joe Biden signed a government funding bill that included $13.6 billion in aid to Ukraine.

Some European leaders also announced they will visit Ukraine to meet with the country’s president and prime minister, while Russia is expected to default on its debt for the first time in decades as it nears a Wednesday deadline for two payments.

Traders continued to keep an eye on the situation in China, where one of the country’s largest manufacturing hubs has shut down amid rising Covid-19 cases.

Investors will be watching Ukrainian President Volodymyr Zelenskyy address Congress on Wednesday and are awaiting economic data, including the retail sales report for February.