Electric vehicle start-up Nikola has begun production of its first battery-electric semitruck

https://www.cnbc.com/2022/03/23/nikola-begins-production-of-battery-electric-tre-semitruck.html

Electric vehicle start-up Nikola has begun production of its first battery-electric semitruck

https://www.cnbc.com/2022/03/23/nikola-begins-production-of-battery-electric-tre-semitruck.html

Bank of Montreal Shares Fall on C$2.7B Stock Offering

Bank of Montreal shares fell early Wednesday after the company said it would seek to raise around 2.7 billion Canadian dollars, or US$2.15 billion, in a public offering.

At 9:38 a.m. ET, shares were down 2.9% at C$149.23.

The Canadian financial institution said Tuesday it would offer 18.1 million common shares at C$149 apiece.

On Tuesday, shares closed at C$153.72.

The bank has also granted its underwriters an option to purchase up to an additional 2.7 million common shares at the same price at any time up to 30 days after the closing of the offering.

BMO said it plans to use the proceeds to finance a portion of its acquisition of Bank of the West and its subsidiaries.

March 21 – March 25

Monday March 21

Japanese markets closed

(8:30 a.m. ET) U.S. Chicago Fed National Activity Index for February.

(12 p.m. ET) U.S. Fed Chair Jerome Powell speaks at the NABE Economic Policy Conference in Washington.

Earnings include: Nike Inc.; Orla Mining Ltd.

—

Tuesday March 22

(8:30 a.m. ET) Canada’s industrial product and raw materials price index for February. Estimates are increases of 2.0 per cent and 5.5 per cent, respectively, from January.

(8:30 a.m. ET) Canadian household and mortgage credit for January.

(10 a.m. ET) U.S. Richmond Fed Manufacturing Index for March.

Also: Quebec and New Brunswick budget.

Earnings include: Adobe Systems Inc.; Converge Technology Solutions Corp.; Filo Mining Corp.; Victoria Gold Corp.

—

Wednesday March 23

Japan machine tool orders

Euro zone consumer confidence

(8 a.m. ET) U.S. Fed Chair Jerome Powell speaks on a BIS panel.

(10 a.m. ET) U.S. new home sales for February. The consensus projection is an annualized rise of 1.8 per cent.

Also: Saskatchewan budget

Earnings include: Boyd Group Income Fund; Cintas Corp.; Cresco Labs Inc.; Fortuna Silver Mines Inc.; General Mills Inc.; Seabridge Gold Inc.

—

Thursday March 24

Japan PMI and department store sales

Euro zone PMI and ECB economic bulletin

(8:30 a.m. ET) U.S. initial jobless claims for week of March 19. Estimate is 211,000, down 3,000 from the previous week.

(8:30 a.m. ET) U.S. current account deficit for Q4. Consensus is US$218-billion, up from US$214.8-billion in Q3.

(8:30 a.m. ET) U.S. durable goods orders for February. The Street expects a decline of 1.4 per cent.

(9:45 a.m. ET) U.S. Markit PMIs for March.

(11 a.m. ET) U.S. Kansas City Manufacturing Activity for March.

Earnings include: Atalaya Mining Ltd.; SiverCrest Metals Inc.

—

Friday March 25

Germany business climate

(8:30 a.m. ET) Canada’s manufacturing sales for February.

(10 a.m. ET) U.S. University of Michigan Consumer Sentiment for March.

(10 a.m. ET) U.S. pending home sales for February.

Also: Ottawa’s budget balance for January.

Earnings include: BRP Inc.; Dentalcorp Holdings Ltd.; Skeena Resources Ltd.

Saudi oil deal with China

News that Saudi Arabia is considering pricing oil sales to China using the Chinese yuan instead of the U.S. dollar has Sen. Ben Sasse, R-Neb., concerned the U.S. could be losing its footing on the world stage.

In an interview with “Fox News Sunday,” Sasse said this development, along with how the war between Russia and Ukraine develops, could send a message to the rest of the world that could have a significant impact.

SAUDI ARABIA CONSIDERS ACCEPTING YUAN INSTEAD OF DOLLARS FOR CHINESE OIL SALES

“Just this point of the Saudis pricing some of their commodity in Chinese currency or signaling that that’s where they’re headed, that is a big, bad thing,” Sasse said. “But let’s take a bigger step up. The 10-year-out existential battle on the globe is between the United States and Western values against the Chinese Communist Party’s exported surveillance state oppression of peoples around the globe.”Video

Sasse then addressed why, if China is really a main concern, he is so worried about Russia and Ukraine.

“Partly because Chairman Xi greenlit this invasion,” Sasse explained. “And so we need to recognize that defeating Vladirmir Putin or helping the Ukrainians defeat Putin here is an important shot across the bow of Chairman Xi, who wanted to see if the West had any will to stand up to Putin because Xi desires to seize Taiwan.”

STATE DEPT REFUSES TO DETAIL ‘RED LINE’ IF CHINA PROVIDES SUPPORT TO RUSSIA AMID WAR IN UKRAINE

Sasse went on to say that China’s objective of trying to “displace the dollar” is something the U.S. must monitor.

Sen. Ben Sasse, R-Neb.

“We need to keep our eye on this because we need to demonstrate that freedom-loving peoples around the world would rather have U.S. leadership than Chinese oppression,” Sasse said.

CLICK HERE TO GET THE FOX NEWS APP

Sasse claimed that other countries would not gravitate toward China out of preference for its policies but out of concern that “America is weak.”

“We need our commander in chief to be strong, both in these conversations with Chairman Xi but more proximately in this moment with arming the Ukrainians immediately and rapidly,” Sasse concluded.

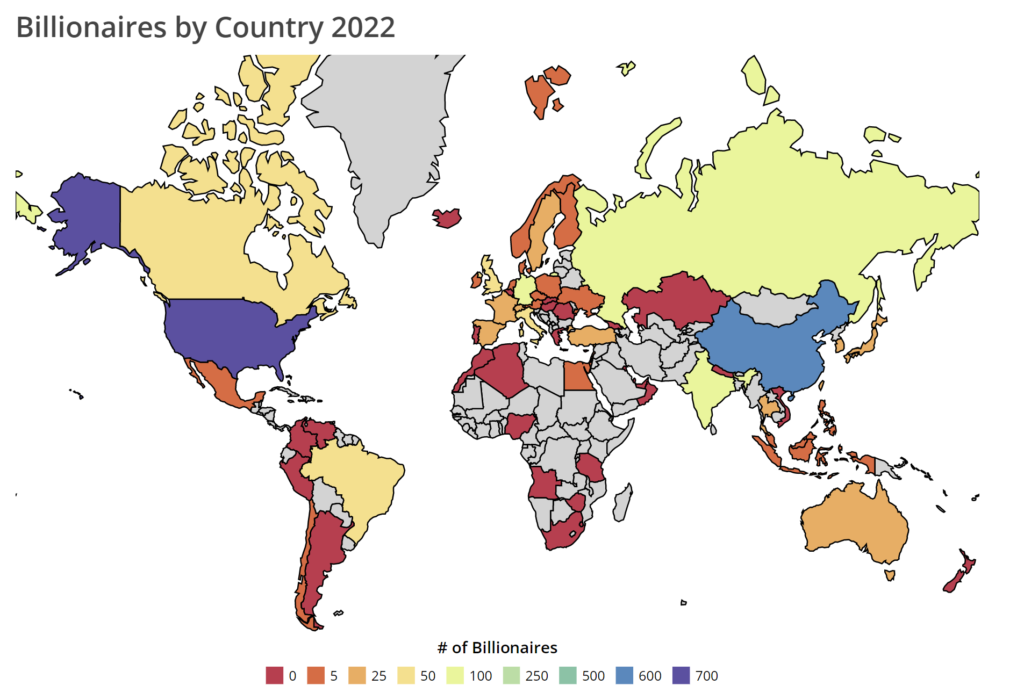

Billionaires By Country 2022

Canadian retail sales rose 3.2% to $58.9-billion in January amid Omicron surge

Statistics Canada says retail sales rose 3.2 per cent to $58.9-billion in January, helped by higher sales at new car dealers to start the year.

However, the agency says its early estimate for February suggests retail sales fell 0.5 per cent for that month, though it cautioned the figure will be revised.

The rise in sales in January came despite public health restrictions in several parts of the country to deal with the Omicron surge in COVID-19 cases.

Sales at motor vehicle and parts dealers led the way higher as they climbed 5.3 per cent helped by a 5.5 per cent increase at new car dealers and a 9.7 per cent rise at used car dealers.

Excluding motor vehicle and parts dealers and gasoline stations, retail sales rose 2.9 per cent.

In volume terms, overall retail sales rose 2.9 per cent in January.

Russia’s invasion of Ukraine will lower car production by millions of units over two years, S&P says

DETROIT – The war in Ukraine is expected to lower global light-duty vehicle production through next year by millions of units, according to S&P Global Mobility.

The automotive research firm, formerly known as IHS Markit, on Wednesday downgraded its 2022 and 2023 global light vehicle production forecast by 2.6 million units for both years, to 81.6 million for 2022 and 88.5 million units for 2023.

The conflict has caused logistical and supply chain problems as well as parts shortages of critical vehicle components. Most notably, many automakers source wire harnesses, which are used in vehicles for electrical power and communication between parts, from Ukraine. The problems add to an already strained supply chain due to the coronavirus pandemic and an ongoing shortage of semiconductor chips.

European auto production is expected to experience the most disruption, according to S&P. The firm cut 1.7 million units from its forecast for Europe, including just under 1 million units from lost demand in Russia and Ukraine. The rest of the cuts are from parts shortages involving chips and wiring harnesses caused by the war.

That compares to S&P cutting its North America light-duty vehicle production by 480,000 units for 2022 and by 549,000 units for 2023.

About 45% of Ukraine-built wiring harnesses are normally exported to Germany and Poland, placing German carmakers at high exposure, according to S&P. Automakers such as Volkswagen and BMW have been among the most impacted since Russia’s invasion of Ukraine about three weeks ago.WATCH NOWVIDEO07:48President Biden: We’re authorizing additional $800M in security aid for Ukraine

Volkswagen CEO Herbert Diess earlier this week said the war has put the company’s 2022 outlook into question, as the automaker experiences parts problems. He said the company was moving some of its production out of Europe to North America and China in response to war-related supply-chain disruptions.

BMW cut its car division’s 2022 profit margin forecast on Wednesday from 8%-10% to 7%-9%, due to the impact of the unfolding Ukraine crisis.

BMW’s plants will be back to full production next week following the luxury automaker halting or lowering production output at some German plants after the invasion, said the company’s chief technology officer, Frank Weber.

Weber said the company has worked with suppliers to duplicate, not relocate, the wire harnessing production to attempt to keep jobs in the country.

“When you look at Ukraine, this wire harnessing industry gives work to maybe 20,000 people,” Weber told reporters Wednesday during a remote roundtable. “We didn’t just want to take away the work there.”

In total, S&P on Wednesday said it removed nearly 25 million units from global light-duty vehicle production from its forecast between now and 2030.

Inflation rate hits new three-decade high as price pressures broaden

Canada’s inflation rate hit a new three-decade high in February as consumers faced an onslaught of price hikes, adding pressure on the Bank of Canada to tame the situation with a speedy course of policy tightening.

The Consumer Price Index (CPI) rose 5.7 per cent in February from a year earlier, up from 5.1 per cent in January, Statistics Canada said Wednesday. That was the highest inflation rate since August, 1991, and it marked the 11th consecutive month that inflation has surpassed the Bank of Canada’s target range of 1 per cent to 3 per cent.

Households are feeling the pinch on several fronts. Shelter costs rose 6.6 per cent for the largest annual increase since 1983. Groceries rose 7.4 per cent, the most since 2009. And gas prices jumped 6.9 per cent in a single month.

Canadian dollar notches nine-day high as inflation accelerates

Wholesale sales rose 4.2 per cent in January: Statscan

The average of the central bank’s core measures of inflation – which strip out volatile components and give a better sense of underlying price pressures – rose to 3.5 per cent, also the highest since 1991.

Around two-thirds of the goods and services that make up the CPI basket are experiencing inflation of more than 3 per cent, showing how sticker shock is getting tougher to avoid.

“If it feels like everything is getting more expensive, it’s because it is,” Royce Mendes, head of macro strategy at Desjardins Securities, said in a note to clients.

Central bankers are now trying to tamp down inflation. The U.S. Federal Reserve joined the Bank of Canada on Wednesday in raising its benchmark interest rate from record lows and for the first time since 2018. Both central banks are expected to raise borrowing costs several times this year and next.

Throughout the pandemic, central bankers have consistently underestimated the scale and duration of inflation. The Bank of Canada in January projected that inflation rates would average 5.1 per cent in the first quarter of 2022 – a forecast that is already short of reality. The U.S. inflation rate hit a 40-year high of 7.9 per cent in February.

The latest threat to consumer prices is the Russia-Ukraine war, which has led to surging costs of wheat, gasoline, fertilizer and other products, on fears of supply shortages. There is, however, very little that central bankers can do to calm volatility in global commodity markets, making the situation even more complicated.

Several analysts said Wednesday that Canada’s inflation rate could reach – or exceed – 6 per cent in short order.

“Whether it’s a supply or demand shock is becoming less and less consequential,” said Jean-François Perrault, chief economist at Bank of Nova Scotia. The central bank is “behind the curve” on rate hikes “and they need to move aggressively to try and signal that they’re very serious about bringing inflation back to target.”

In a recent speech, Bank of Canada Governor Tiff Macklem would not rule out a rate hike of 50 basis points later this year. (A basis point is 1/100th of a percentage point.) A hike of that magnitude has not happened since 2000.

A key concern is that consumers, who are sensitive to price hikes at gas pumps and supermarkets, come to think that steep inflation is a long-term reality.

Inflation can be self-fulfilling, in that companies set prices and workers negotiate wages in anticipation of expected costs. Their expectations of inflation over the next two years have risen substantially, but remain “well anchored” over a five-year horizon, the central bank has said.

Not everyone agrees. Scotiabank said Tuesday that inflation expectations have already become unmoored. “This recent de-anchoring of expectations means that the bank’s monetary policy will need to be more aggressive to bring inflation back to target,” read the report, which was co-written by a former research director at the Bank of Canada.

Scotiabank estimates the central bank’s policy rate – now at 0.5 per cent – will end the year at 2.5 per cent, which is the quickest pace of rate hikes that a major bank is projecting.

That would heap pressure on a Canadian consumer that’s loaded up on debt. The household debt burden – more formally known as the ratio of credit market debt to disposable income – rose to 186 per cent in the fourth quarter, the highest on record. The pandemic debt surge has been entirely driven by demand for residential mortgages.

Mr. Perrault said Canadians can handle a quick pace of rate hikes. The economy is growing quickly, highlighted by the addition of nearly 340,000 jobs in February, which took the employment rate back to pre-pandemic levels.

“Rates are rising in a remarkably strong growth environment,” he said. “To us, that means households are going to have much greater flexibility and greater ability to manage these higher rates than would be the case if inflation was going up and growth was not there.”

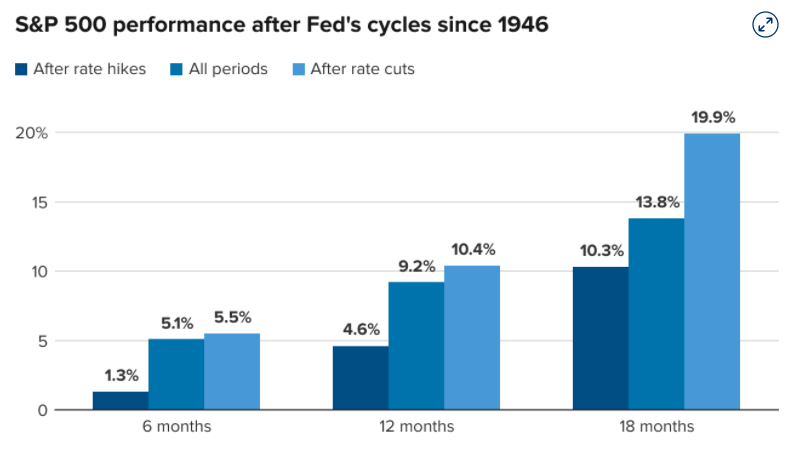

The Fed is about to hike rates. Here’s what history shows should happen to the stock market next

The Federal Reserve is set to raise interest rates for the first time since 2018 to rein in inflation, and here’s how the stock market could react to the move, if history is any guide.

The central bank is widely expected to raise its target fed funds rate by a quarter-percentage point from zero at the end of its two-day meeting Wednesday. The Fed will also release its new forecasts for rates, inflation and the economy, given the uncertainty from the escalated geopolitical tensions.

Here’s the bottom line: When the Fed embarks on a series of rate hikes in a row, the stock market still typically manages to go higher during that time, but the gains are harder to come by than normal times, or when the central bank is lowering rates.

It especially struggles in the short term, according to Sam Stovall, CFRA chief investment strategist, who studied market performance and the Fed’s moves going back to 1946.

The S&P 500 has edged up an average of 1.3% six months after the start of a rate-hiking cycle since 1946, compared to an average gain of 5.5% six months after a rate cut, according to the data.

The underperformance continues 12 months and 18 months later with the S&P 500′s returns significantly lagging the periods after an easing cycle begins, the data showed.

Perhaps it’s not too surprising that the market tends to underperform during a tightening cycle as contractionary monetary policy is intended to slow down overheated economic growth and curb surging price pressures. Boosting interest rates increases the cost of borrowing and could negatively impact growth-oriented company performance.

Tech stocks are seen as sensitive to rising rates because increased debt costs can hinder growth and can make their future cash flows appear less valuable. They have suffered a particularly severe sell-off recently with the Nasdaq Composite falling into bear market territory recently, or down more than 20% from its record high.

Some investors believe history may not be the best guide this time around and the stock market could struggle even more because the Fed is not dealing with a typical economic upturn. Inflation is the highest in four decades, which could cause the central bank to act faster and bigger than is typical of past rate cycles.

“Investors need to recognize that this hiking cycle could in all probability look very different than recent ones, and its exact nature is still ill-defined,” said Scott Ruesterholz, a portfolio manager at Insight Investment.

“Higher inflation could force the Fed to move even more quickly than our expected 5 hikes this year while additional growth shocks could mean the economy needs fewer hikes than currently expected to slow sufficiently to stifle inflation,” Ruesterholz added.

Inflation hit a fresh 40-year high of 7.9% in February. Notable investor Jeffrey Gundlach said he sees the likelihood for inflation to hit 10% this year, calling for more aggressive tightening than the market expects. Current pricing indicates the equivalent of seven total rate increases this year — or one at each meeting.

“To the extent that the Fed can continue down the path the market expects — deliberate rate hikes all year long — the areas that have held up since the stock market became unglued five months ago look set to continue functioning as havens,” said Jeff Weniger, Head of Equity Strategy for WisdomTree.

Weniger said opportunity lies in indexes that have lighter exposures to “trouble” groups such as consumer discretionary and speculative tech stocks.