Russia’s war on Ukraine sets the stage for worst food crisis in decades

Russia’s invasion of Ukraine has roiled commodity markets and set the stage for the worst food crisis in decades, one that risks not just sharply higher prices at grocery stores but the spread of social unrest around the globe.

Russia and Ukraine make up a quarter of global wheat exports, and are near the top of the production list when it comes to other agricultural goods such as barley, corn, potatoes, sunflowers and sugar beets.

Food shipments from the two countries have already ground to a halt, sending shock waves through commodity markets. Wheat futures in Chicago were up by 70 per cent this year at the start of last week before tumbling. They remain up 40 per cent from mid-February.

Inside a frantic race to get Ukrainian corn and wheat to world markets

How Russia’s invasion of Ukraine is affecting investments in the agriculture sector

The collapse in grain supplies, sparked by both the war and Western retaliatory sanctions, have led to fears of shortages in countries that depend heavily on wheat from the region.

Egypt, which draws more than two-thirds of its wheat imports from Russia and Ukraine, imposed its own ban on the export of food staples such as flour and lentils last week.

Other countries, such as Lebanon and Indonesia, have banned exports of some vegetables, grains and palm oil in an effort to safeguard domestic food supplies. Those protectionist measures are in turn leading to higher prices.

“Having interconnected global markets was always a huge benefit, because we gained from trade and lower prices, but we’re seeing how shocks can ripple across many markets and countries when you get a huge disruption like this,” said Jill Hobbs, a professor of agricultural and resource economics at the University of Saskatchewan.

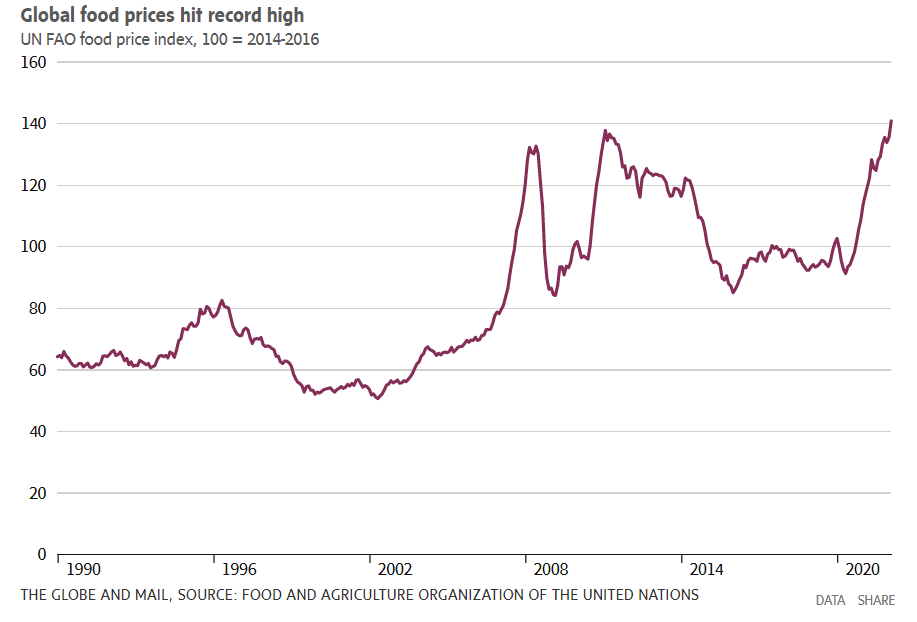

Global food prices reached record levels, even before the full shock to commodity prices from the Russian invasion had been felt, according to the benchmark index of the United Nation’s Food and Agricultural Organization (FAO).Global food prices hit record highUN

On Friday, the agency warned that other grain-producing countries could only partly make up for the shortfall in exports from Russia and Ukraine, meaning international feed and food prices could jump by another eight to 22 per cent in the coming months.

“The likely disruptions to agricultural activities of these two major exporters of staple commodities could seriously escalate food insecurity globally,” FAO director-general Qu Dongyu said in a statement.

With Russia’s bombardment of Ukraine widening by the day, planting season in a country often described as Europe’s breadbasket is certain to be disrupted.

One Ukrainian farmer near Odesa, Oleksandr Chumak, said he expects wheat output from his farm to at least be cut in half. “Every day, I see rockets fly over my house,” he said.

But the war in Ukraine is also wreaking havoc on global food supplies in less direct, yet critical ways.

Energy prices have surged to historic highs amid concerns of tight oil supplies and disruptions to the supply of oil and gas from Russia. The U.S. has banned energy imports from Russia, while Moscow is threatening to shut off gas to Europe. Soaring energy prices are making it vastly more expensive to produce, process and transport food.

The war has also threatened the global supply of fertilizer, which farmers rely on to boost crop yields. Russia is the world’s top exporter of nitrogen fertilizers and the second largest supplier of both potassic and phosphorous fertilizers.

Moscow has proposed a ban on raw-material exports, but has yet to say which commodities it will cover, with some analysts saying that fertilizer nutrients could be among them. Fertilizer prices have begun to climb higher on concerns of a supply disruption.

The combination of factors pushing up food prices are sparking fears of widespread suffering, particularly in developing countries. French President Emmanuel Macron last week warned that “several African countries will be affected by famine within 12 to 18 months precisely because of this war.”

Some in the fertilizer industry share that concern.

“For me, it’s not whether we are moving into a global food crisis, it’s how large the crisis will be,” said Svein Tore Holsether, president of Norway’s Yara International, the world’s largest maker of nitrogen-based fertilizers.

Mr. Holsether said he worries that food shortages will leave tens of millions of people around the world without enough to eat.

It’s a volatile situation, given the history of how food shortages and hunger have contributed to unrest. Food insecurity is widely seen as one of the contributing factors behind the Arab Spring revolts in the early part of the past decade.

In a report last week, BCA Research warned that the disruption to food and fertilizer markets will have far-reaching geopolitical consequences.

“Lenin famously called wheat the ‘currency of currencies,’ implying that those who control the distribution of wheat can control the political system,” BCA chief strategist Peter Berezin wrote. “With countries such as Egypt desperately dependent on Russian and Ukrainian wheat exports, a shortage of this critical foodstuff could lead to political turmoil in a number of developing nations.”

In Canada, the cost of food is already rising at the fastest pace in 13 years. That’s a result of the effects of the COVID-19 pandemic such as labour shortages, rising energy prices and disruptions to supply chains.

Canadians will get the latest update on food costs on Wednesday when Statistics Canada releases consumer prices for the month of February, which are expected to confirm the pain grocery shoppers are already feeling.

In the United States, where inflation numbers for February were released last week, food prices jumped 7.8 per cent over the year before.

Farmers in Canada are eyeing the surge in grain prices as they decide what to plant in the spring, said Prof. Hobbs. However, they will also have to contend with skyrocketing energy and fertilizer costs, which could erase any windfall gains from higher prices.

At the same time, farmers in Western Canada had already seen their output of wheat last year slashed by drought, with wheat production down 38.5 per cent from the year before, according to Statistics Canada.

The latest drought assessment from the federal government for February found that 65 per cent of Canada’s agricultural areas were experiencing some level of drought conditions, suggesting another bleak year.

“It sounds great for farmers when people say prices are high, but it’s a more complex picture than that,” Prof. Hobbs said.