Major North American stock indexes slipped on Thursday as hotter-than-expected producer prices data likely muddied bets around the timing of the Federal Reserve’s first rate cut and high-flying chip stocks extended their losses.

A Labor Department report showed the Producer Price Index (PPI) rose 0.6% month-on-month in February, compared with a 0.3% increase expected by economists polled by Reuters. It rose 1.6% in the 12 months to February, versus an estimated growth of 1.1%.

Meanwhile, U.S. retail sales rebounded in February, rising 0.6% last month but below expectations of a 0.8% advance.

“In a way, today was the past month in microcosm – sticky inflation combined with signs of softness elsewhere in the economy,” said Chris Larkin, managing director of trading and investing at E*TRADE from Morgan Stanley.

“Retail sales may have come in below estimates, but the PPI was even more of an upside surprise than Tuesday’s CPI.”

Traders now see a 63.5% chance of the Fed cutting rates in June, according to the CME FedWatch tool, down from 67% prior to the data.

Meanwhile, the number of Americans filing for unemployment claims stood at 209,000 for the week ended March 9, compared to an estimated 218,000 claims, according to another Labor Department report.

The slew of economic data comes ahead of the Fed’s policy meeting next week, where the focus will be on possible cues about how soon the central bank could kick off the rate-easing cycle.

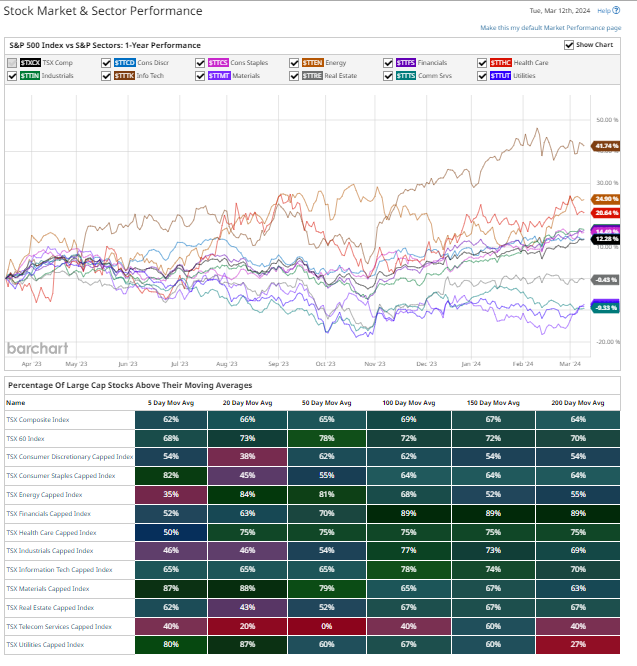

At 10:11 a.m. ET, the Toronto Stock Exchange’s S&P/TSX composite index was down 142.28 points, or 0.65%, at 21,827.83.

Yields on the 10-year U.S. and Canadian benchmark bond rose by 2-3 basis points after the U.S. producer prices data. The Canadian dollar also weakened.

“We still believe the Federal Reserve’s first rate cut is at least not until June and perhaps with some of the sticky inflation data could be pushed out further,” said Kevin Headland, co-chief investment strategist at Manulife Investment Management.

Communication services on the TSX fell 1.3% to notch a fresh four-month low and led the sectoral declines amid a broad selloff in equities. Technology shares that opened in the green also reversed course to fall 0.6%.

Shares of Lithium Americas jumped 12.9% after the U.S. Department of Energy granted the miner a conditional commitment loan of $2.26 billion to finance the construction of its Thacker Pass project in Nevada.

Restaurant Brands International was down 1.3%. Burger King parent named Sami Siddiqui as its chief financial officer and made a slew of other leadership changes, as the company pushes ahead with its long-term goals and navigates weakness in some international markets.

Meanwhile, Canadian factory sales grew by 0.2% in January from December on higher sales of motor vehicles, as well as chemical products, Statistics Canada said on Thursday.

At 10:01 a.m. ET, the Dow Jones Industrial Average was down 168.41 points, or 0.43%, at 38,874.91, the S&P 500 was down 26.56 points, or 0.51%, at 5,138.75, and the Nasdaq Composite was down 96.03 points, or 0.59%, at 16,081.74.

Ten of the 11 major S&P 500 sectors fell, with real estate leading losses, down 1.6%.

Most megacap growth and technology stocks inched higher, but artificial intelligence (AI) giant Nvidia fell 3.4%.

Other chipmakers including Intel and Advanced Micro Devices fell 1.5% and 2.0%, respectively, while the Philadelphia SE Semiconductor Index shed 1.4%.

Shares of Robinhood Markets jumped 6.0% after the trading app operator said its assets under custody rose 16% in February.

Aerospace and defense company RTX gained 1.9% after Wells Fargo upgraded its rating to “overweight” from “equal weight”.

Declining issues outnumbered advancers for a 3.86-to-1 ratio on the NYSE and a 2.86-to-1 ratio on the Nasdaq.

The S&P index recorded 36 new 52-week highs and no new lows, while the Nasdaq recorded 41 new highs and 77 new lows.

Reuters, Globe staff