This earnings news release for Great-West Lifeco Inc. should be read in conjunction with the Company’s Management Discussion & Analysis (MD&A) and Consolidated Financial Statements for the periods ended December 31, 2023, prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board unless otherwise noted. These reports are available on greatwestlifeco.com under Financial Reports. Additional information relating to Great-West Lifeco is available on sedarplus.com. Readers are referred to the cautionary notes regarding Forward-Looking Information and Non-GAAP Financial Measures and Ratios at the end of this release. All figures are expressed in millions of Canadian dollars, unless otherwise noted.

Author: Consultant

-

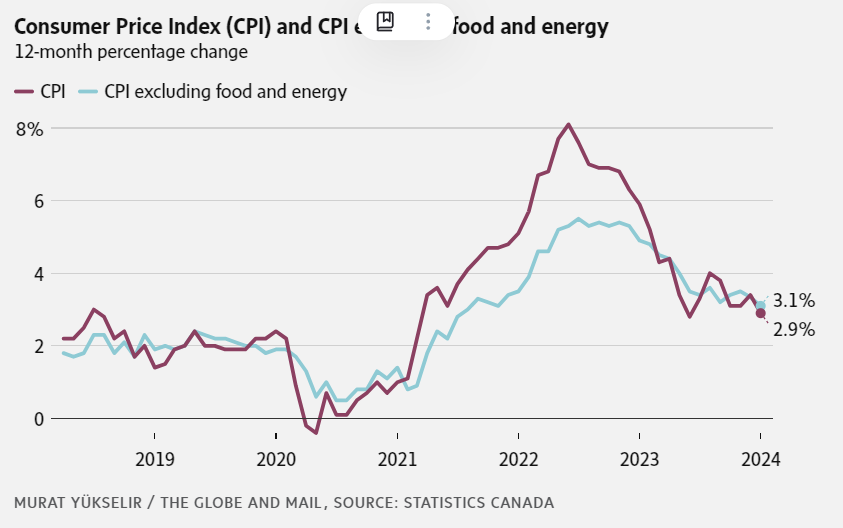

Canada’s inflation rate fell to 2.9% in January. Here’s what happens next

Canada’s inflation rate fell to a surprising degree in January and returned to the Bank of Canada’s target range, highlighted by a moderation at the supermarket.

The Consumer Price Index rose 2.9 per cent in January on an annual basis, down from 3.4 per cent in December, Statistics Canada said Tuesday in a report. Analysts were expecting a slight easing to 3.3 per cent.

-

Magnificent 7 profits now exceed almost every country in the world. Should we be worried?

- The so-called “Magnificent 7” U.S. tech behemoths encompass Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla.

- In a research note Tuesday, Deutsche Bank analysts highlighted that the Magnificent 7′s combined market cap alone would make it the second-largest country stock exchange in the world.

- However, this level of concentration has led some analysts to voice concerns over related risks in the U.S. and global stock markets.

-

Economic Calendar: Feb 19 – Feb 23

Monday February 19

China’s current account balance

Japan machine tool orders

U.S. and Canadian markets closed.

(8:30 a.m. ET) Canada’s industrial product and raw materials price indexes for January. Estimates are month-over-month increases of 0.5 per cent and 1.0 per cent, respectively.

(8:30 a.m. ET) Canadian household and mortgage credit for December.

Tuesday February 20

(8:30 a.m. ET) Canadian CPI for January. The Street is expecting a rise of 0.4 per cent from December and up 3.3 per cent year-over-year.

(10 a.m. ET) U.S. leading indicator for January. Consensus is a month-over-month decline of 0.3 per cent.

Earnings include: B2Gold Corp.; Chemtrade Logistics Income Fund; GFL Environmental Holdings Inc.; Gibson Energy Inc.; Home Depot Inc.; IA Financial Corp. Inc.; Medtronic PLC; Palo Alto Networks Inc.; Walmart Inc.

Wednesday February 21

Japan trade deficit and machine tool orders

Euro zone consumer confidence

(8:30 a.m. ET) Canada’s new housing price index for January. Estimate is a decline of 0.1 per cent from December and down 0.7 per cent year-over-year.

(2 p.m. ET) Minutes from U.S. Fed’s Jan. 30-31 meeting are released.

Earnings include: Alamos Gold Inc.; Bausch + Lomb Corp.; CCL Industries Inc.; Crombie REIT; Gildan Activewear Inc.; Innergex Renewable Energy Inc.; Northland Power Inc.; Nutrien Ltd.; Nvidia Corp.; SSR Mining Inc.; Suncor Energy Inc.; Stelco Holdings Inc.; Storage Vault Canada Inc.; Superior Plus Corp.; Whitecap Resources Inc.

Thursday February 22

Japan and Euro zone PMI

(8:30 a.m. ET) Canadian retail sales for December. Consensus is a rise of 0.8 per cent from November.

(8:30 a.m. ET) U.S. initial jobless claims for week of Feb. 17. Estimate is 218,000, up 6,000 from the previous week.

(9:45 a.m. ET) U.S. S&P Global PMIs for February.

(10 a.m. ET) U.S. existing home sales for January. The Street is projecting an annualized rate rise of 5.0 per cent.

Also: B.C. budget

Earnings include: Altus Group Inc.; Boardwalk REIT; Canadian Apartment Properties REIT; Capstone Mining Corp.; Cascades Inc.; Eldorado Gold Corp.; Exchange Income Corp.; Intuit Inc.; Loblaw Companies Inc.; Lundin Gold Inc.; Maple Leaf Foods Inc.; Newmont Goldcorp Corp.; Pembina Pipeline Corp.; Primo Water Corp.; Quebecor Inc.; Teck Resources Ltd.

Friday February 23

Germany GDP

Also: Ottawa’s budget balance for December.

Earnings include: Centerra Gold Inc.; CI Financial Corp.; Docebo Inc.; Onex Corp.; TransAlta Corp.

-

TC Energy reports $1.46B Q4 profit, raises quarterly dividend

TC Energy Corp. raised its dividend as it reported a fourth-quarter profit of $1.46 billion.

The pipeline operator says it will now pay a quarterly dividend of 96 cents per share, up from 93 cents per share.

The increased payment to shareholders came as TC Energy reported its profit amounted to $1.41 per share for the quarter ended Dec. 31.

The result compared with loss of $1.45 billion or $1.42 per share in the last three months of 2022 when it took a large one-time charge related to rising cost at its Coastal GasLink project.

TC Energy says its comparable earnings per share came to $1.35 in its latest quarter, up from comparable earnings of $1.11 per share a year earlier.

Revenue for the quarter totalled $4.24 billion, up from $4.04 billion in the fourth quarter of 2022.

This report by The Canadian Press was first published Feb. 16, 2024.

-

Air Canada reports $184M Q4 profit, operating revenue up 11% from year earlier

Air Canada reported a fourth-quarter profit of $184 million, up from $168 million a year earlier, as its operating revenue rose 11 per cent.

The airline says the profit amounted to 41 cents per diluted share for the quarter ended Dec. 31, compared with 41 cents per diluted share in the last three months of 2022.

Operating revenue totalled $5.18 billion, up from $4.68 billion in the fourth quarter of 2022.

The airline says the increase came as its operated capacity increased nine per cent compared with a year earlier.

Operating expenses increased eight per cent due to higher costs reflecting the increased capacity and traffic, partially offset by lower jet fuel prices.

On an adjusted basis, Air Canada says it lost 12 cents per diluted share in its latest quarter, compared with an adjusted loss of 61 cents per diluted share a year earlier.

This report by The Canadian Press was first published Feb. 16, 2024.

-

IGM FINANCIAL REPORTS FOURTH QUARTER AND 2023 EARNINGS

IGM HIGHLIGHTS

- Fourth quarter net earnings of $419.6 million or 176 cents per share compared to $224.7 million or 94 cents per share in 2022. Adjusted net earnings, excluding a gain on the sale of IPC of $220.7 million,1 were $198.9 million or 84 cents per share for the fourth quarter of 2023 compared to $224.7 million or 94 cents per share in 2022.

- Annual net earnings of $1,148.9 million or $4.82 per share compared to $867.2 million or $3.63 per share in 2022. Annual adjusted net earnings, excluding other items,1 were $820.7 million or $3.44 per share compared to $867.2 million or $3.63 per share in 2022.

- Assets under management and advisement of $240.2 billion, up 5.6% from the prior quarter and up 7.1% from the fourth quarter of 2022.2

- IGM’s assets under management and advisement including strategic investments were $389.4 billion as at December 31, 2023, compared with $372.9 billion at September 30, 2023 and $288.3 billion at December 31, 2022.2

- Net outflows were $1.2 billion compared to net outflows of $520 million in 2022.2

-

AGNICO EAGLE REPORTS FOURTH QUARTER AND FULL YEAR 2023 RESULTS

-

Cenovus reports $743M Q4 profit, down from $784M a year earlier

Cenovus Energy Inc. reported a fourth-quarter of $743 million, down from $784 million a year earlier, as its revenue also edged lower.

The company says the profit amounted to 39 cents per diluted share for the quarter ended Dec. 31.

The result compared with a profit of 39 cents per diluted share a year earlier when it had more shares outstanding.

Revenue for the quarter totalled $13.13 billion, down from $14.06 billion in the fourth quarter of 2022.

Cenovus reported total upstream production of 808,600 barrels of oil equivalent per day, up from 806,900 a year earlier.

Downstream throughput was 579,100 barrels per day, up from 473,300 a year earlier.

This report by The Canadian Press was first published Feb. 15, 2024.