- Retail sales rose 0.3% in November, stronger than the 0.2% decline in October and better than the Dow Jones estimate for a decrease of 0.1%.

- Sales held up despite a 2.9% slide in receipts at gas stations, as energy prices broadly slumped during the month.

- Initial claims for unemployment insurance totaled a seasonally adjusted 202,000, lower than the 220,000 estimate.

Author: Consultant

-

Retail sales rose 0.3% in November vs. expectations for a decline

-

Cenovus Energy forecasts higher production from its U.S. refineries in 2024

Cenovus Energy CVE-T +1.83%increase said on Thursday it expects higher production from its U.S. refineries in 2024 as the Canadian company’s two refineries restarted operating at full capacity.

The company had been grappling with production snags following a deadly fire at its refinery in Toledo, Ohio last year and an explosion at the refinery in Superior, Wisconsin in 2018.

Cenovus forecast downstream throughput for 2024 between 630,000 and 670,000 barrels per day (bpd), compared with 580,000 bpd to 610,000 bpd expected this year.

The company’s U.S.-listed shares rose 1.6 per cent before the bell.

Cenovus also expects higher operating costs in 2024 due to maintenance and repair activities.

The Calgary, Alberta-based company forecast expenses between $4.5-billion and $5-billion in 2024, higher than its estimated 2023 costs of $4-billion to $4.5-billion.

“We will remain focused on reducing costs and continued capital discipline,” Cenovus CEO Jon McKenzie said.

Global oil prices have cooled compared with last year, but still remain at a level when companies can drill profitably.

Cenovus also said it plans to expand production at its Foster Creek, Christina Lake and Sunrise oil sands projects.

The company forecast total upstream production for 2024 between 770,000 and 810,000 barrels of oil equivalent per day (boepd), compared with 775,000 boepd to 795,000 boepd expected this year.

-

Canadian manufacturing sales down 2.8% to $71.0-billion in October

Statistics Canada says manufacturing sales fell 2.8 per cent to $71.0-billion, led by a drop in petroleum and coal product sales as well as lower sales in the machinery and computer and electronic product subsectors.

The agency says sales fell in 12 of 21 subsectors it tracks.

The petroleum and coal products subsector fell 10.3 per cent to $8.4-billion in October as it saw lower prices as well as a decline in volumes.

The machinery subsector dropped 6.6 per cent to $4.4-billion, while computer and electronic products fell 15 per cent to $1.4-billion.

Sales of aerospace products and parts rose 6.9 per cent to $2.2-billion.

Statistics Canada says total sales in constant dollars fell 2.2 per cent in October, indicating a lower volume of goods sold.

-

World oil demand next year to rise faster than expected, IEA says

World oil demand will rise faster than expected next year, the International Energy Agency (IEA) said on Thursday, a sign that the outlook for near-term oil use remains robust despite this week’s COP28 agreement to transition away from fossil fuels.

Despite the upgrade, there is still a sizable gap between the IEA, which represents industrialized countries, and producer group OPEC over 2024 demand prospects. The two have clashed in recent years over issues such as long-term demand and the need for investment in new supplies.

World consumption will rise by 1.1 million barrels per day(bpd) in 2024, the Paris-based IEA said in a monthly report, up 130,000 bpd from its previous forecast, citing an improvement in the outlook for the United States and lower oil prices.

The IEA, which advocates a speedy transition away from fossil fuels, detailed the increase to its 2024 forecast only at the bottom of Page 4 of its report, after discussing other findings including a demand slowdown in the last three months of 2023 and rising supply.

The 2024 revision reflects “a somewhat improved GDP outlook compared with last month’s report,” the IEA said. “This applies especially to the U.S. where a soft landing is coming into view.”

“Falling oil prices act as an additional boost to oil consumption,” it said.

Oil has weakened to a six-month low near $72 a barrel this week, even after OPEC+, which includes OPEC oil-exporting nations and allies such as Russia, on Nov. 30 announced a new round of production cuts for the first quarter of 2024.

Crude was up almost 2 per cent on Thursday after the IEA report was released to trade near $76.

In the report, the IEA also trimmed its forecast for oil demand growth in 2023 by 90,000 bpd to 2.3 million bpd and lowered its fourth-quarter estimate by almost 400,000 bpd.

A halving in the rate of demand expansion next year is due to below-trend economic growth in major economies, efficiency improvements and a booming electric vehicle fleet, the IEA said.

The extension of OPEC+ supply cuts into the first quarter of next year had done little to boost prices and higher output in other nations would act as a headwind, it added.

“The continued rise in output and slowing demand growth will complicate efforts by key producers to defend their market share and maintain elevated oil prices,” it said.

OPEC in a monthly report on Wednesday kept its forecast for world oil demand growth in 2023 at 2.46 million bpd. In 2024, OPEC sees demand growth of 2.25 million bpd, also unchanged from last month.

The difference between the IEA and OPEC 2024 forecasts has narrowed slightly but stands at 1.15 million bpd – equivalent to roughly 1 per cent of daily world oil use and the daily production of an OPEC member such as Libya.

Oil demand forecasters often have to make sizable revisions given changes in the economic outlook and geopolitical uncertainties, which this year included China’s lifting of coronavirus lockdowns and rising interest rates.

-

Sobeys parent Empire sees profit slip despite gains in grocery business

Sobeys parent company Empire Co. Ltd.EMP-A-T -7.45%decrease reported sales and earnings growth in its grocery business in the second quarter, while income from investments and other operations led to an overall decline in profits.

The Stellarton, N.S.-based retailer reported on Thursday that net earnings fell to $181.1-million or 72 cents per share in the quarter ended Nov. 4, compared to $189.9-million or 73 cents per share in the same period last year.

Empire recorded a $20.6-million insurance recovery related to a cybersecurity breach that hit the company last November. It also recorded $16.8-million in restructuring costs related to a plan to improve efficiencies in the company. Not including those items, adjusted net earnings were lower, at $178.3-million or 71 cents per share. Both sales and adjusted earnings per share came in below analysts’ estimates for the quarter.

The company, which owns chains including Sobeys, Safeway, IGA and FreshCo, reported that both sales and profits were up in its grocery operations, with adjusted net earnings in the food retailing segment rising 8.5 per cent to $171.5-million. Income from its investments and other operations declined, mostly because fewer property sales led to lower equity earnings from Empire’s interest in Crombie Real Estate Investment Trust.

Grocery retailers have faced scrutiny over whether they are doing enough to fight food inflation. Growth in grocery prices slowed in October, when prices were up by 5.4 per cent on an annual basis. That was a significant improvement compared to peak levels of more than 11 per cent in late 2021 and early 2022. But even food inflation slows down, shoppers are still faced with significantly higher grocery bills than compared to a couple of years ago.

In an appearance before the House of Commons agriculture committee last week, Empire chief executive officer Michael Medline expressed frustration at being compared to other grocers who have higher profit margins. He also noted that Canada has done better than other countries when it comes to food price growth.

“Although our country’s food inflation has been among the lowest in the world, and Canada is among the most competitive nations on earth when it comes to grocery retail, this provides little comfort to Canadians who are struggling,” he told the committee.

In October, Empire was among the grocery chains who complied with a request from the federal government to submit plans to stabilize prices, though some critics pointed out the plans mostly included strategies the sector already employs, such as discounts and price matching. Like other food retailers, Empire reported that its internal measures of food inflation have continually fallen slightly below the the food price growth tracked by Statistics Canada’s Consumer Price Index.

“Although it is difficult to estimate how long these inflationary pressures will last, the company continues to focus on supplier relationships and negotiations to ensure competitive pricing for customers whose shopping behaviours become more price sensitive in a heightened inflationary environment,” the company stated in a press release on Thursday.

Empire’s sales grew by 1.4 per cent in the second quarter compared to the prior year, to nearly $7.8-billion. Grocery sales were up, especially in the company’s FreshCo discount stores. But some growth was offset by the effects of Empire’s sale of its 56 gas stations in Western Canada in the first quarter, leading to lower fuel sales in the second quarter compared to the prior year. Sales from Empire’s e-commerce service, Voilà, increased by 15.4 per cent in the quarter.

Same-store sales – an important industry metric that tracks sales growth not tied to new store openings – grew by 2.2 per cent in the quarter, or 2 per cent excluding fuel. That represents slower growth compared to a year ago, but in a press release on Thursday the company said that same-store sales growth has improved in the first five weeks of the current quarter.

Empire is continuing to make claims under its cyber insurance policies related to last year’s breach. The company’s management said they are anticipating further insurance recoveries throughout this fiscal year, according to a press release on Thursday. Empire has previously estimated the cost of the breach will represent approximately a $32-million impact after insurance recoveries, and that estimate remains unchanged.

-

Pembina Pipeline to buy Enbridge’s JV interests for $3.1-billion

Pembina Pipeline PPL-T -2.97%decreasesaid on Wednesday it would buy Enbridge’s ENB-T -0.10%decreaseinterests in the Alliance Pipeline, Aux Sable and NRGreen joint ventures for $3.1 billion.

Alliance delivers liquids rich natural gas sourced in Northeast B.C., Northwest Alberta and the Bakken region to Chicago.

Aux Sable operates natural gas liquids (NGL) extraction and fractionation facilities in both Canada and the U.S., with extraction rights on Alliance, offering connectivity to key U.S. NGL hubs.

Pembina would assume $327-million of debt as part of the deal, helping Enbridge offload some leverage.

Investors fretted over Enbridge’s debt load from the US$14 billion bid for three of Dominion Energy’s natural gas distribution companies in September.

“The sales proceeds will fund a portion of the strategic U.S. gas utilities acquisitions and be used for debt reduction,” Enbridge said in a separate statement.

Pembina added the deals are expected to be completed in the first half of 2024.

Pembina currently owns 50% of the equity interests in Alliance, Aux Sable’s Canadian operations and NRGreen.

It also owns about 42.7% of the equity interests in Aux Sable’s U.S. operations.

-

Retail sales rose 0.3% in November vs. expectations for a decline

- Retail sales rose 0.3% in November, stronger than the 0.2% decline in October and better than the Dow Jones estimate for a decrease of 0.1%.

- Sales held up despite a 2.9% slide in receipts at gas stations, as energy prices broadly slumped during the month.

- Initial claims for unemployment insurance totaled a seasonally adjusted 202,000, lower than the 220,000 estimate.

-

Dollarama profit jumps 31.4% as shoppers continue to look to discount retailers for inflation relief

Dollarama Inc. DOL-T -1.68%decrease reported a 31.4-per-cent increase in profit in its third quarter, as Canadians continue to turn to discount stores looking for some relief from the pressures of inflation.

This has been an ongoing trend for Dollarama, which stocks products at prices up to $5 and has seen significant sales increases over the past two years. The Montreal-based discount retailer reported on Wednesday that comparable sales – an important industry metric that tracks sales growth not tied to new store openings – grew by 11.1 per cent in the quarter ended Oct. 29. That marked the sixth consecutive quarter in which comparable sales grew by a double-digit percentage.

While on average, the size of shoppers’ baskets on each trip are only slightly higher than they were a year ago, people are visiting discount stores more often. Dollarama reported that it saw a 10.4-per-cent increase in the number of transactions at its stores in the quarter.

The company’s net earnings grew to $261.1-million or 92 cents per share in the 13 weeks ended Oct. 29, compared to $201.6-million or 70 cents per share in the third quarter the prior year.

Sales are up across product categories, and people continue to buy more “consumables” than usual at Dollarama, such as food and household products.

But competition for those shoppers is ramping up as other retailers push back with their own discounted prices on those consumable products, chief executive officer Neil Rossy said on a conference call Wednesday to discuss the financial results.

“On core consumables, we are seeing that the market is becoming more competitive,” Mr. Rossy said. “Extremely competitive, in fact.”

Dollarama has seen some costs rise: its general, administrative and store expenses grew by 17.6 per cent in the third quarter compared to the same period the prior year, as store labour costs were up and the timing of some other operating costs fell within the quarter. But the company also saw its grow profit margin expand, as costs to ship products into the country decreased, as did logisticsexpenses.

Sales grew by 14.6 per cent to nearly $1.5-billion. The increase was due to both new store openings – Dollarama had 1,541 as of the end of October, compared to 1,462 a year earlier – and sales growth at existing stores.

Dollarama has opened 55 net new stores so far this fiscal year, and is on track to meet its goal of opening 60 to 70 new locations by the end of the year, Mr. Rossy said.

On Wednesday, Dollarama boosted its sales outlook for the year, predicting that comparable store sales will increase by 11 to 12 per cent for the fiscal year ending Jan. 28, 2024. Its previous outlook, provided in mid-September, predicted comparable sales would grow by 10 to 11 per cent for the year.

While Dollarama benefits from a tight economic environment, where consumers are looking for discounted products – a habit known in the industry as “trading down,” – Mr. Rossy noted that the retailer is not overly reliant on inflationary pressures to drive its business.

“Consumers tend to look at Dollarama as a solution to having to trade down, and when the market and the economy are strong, there are just more dollars to spend. So Dollarama gets its share of those dollars, even if the percentage is smaller than it would be when there’s a trade down,” Mr. Rossy said. “I think that’s part of the strength of our business model, is that it’s resilient on both sides.”

-

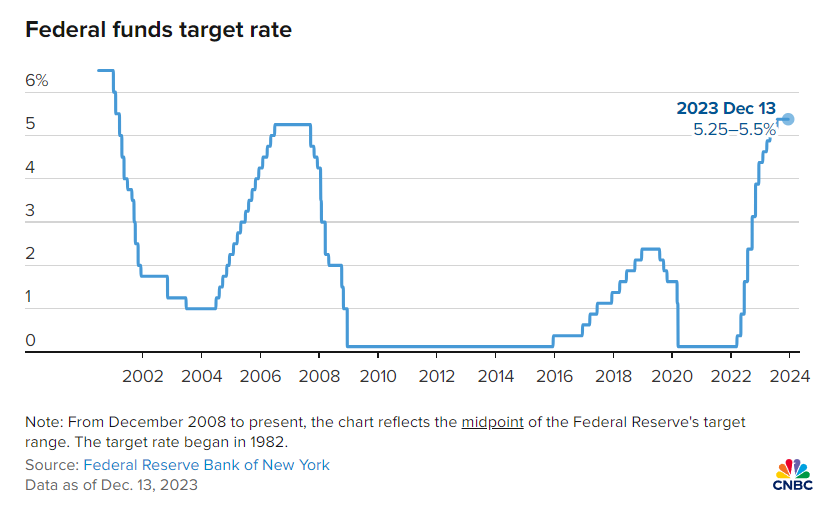

Fed holds rates steady, indicates three cuts coming in 2024

The Federal Reserve on Wednesday held its key interest rate steady for the third straight time and set the table for multiple cuts to come in 2024 and beyond.

With the inflation rate easing and the economy holding in, policymakers on the Federal Open Market Committee voted unanimously to keep the benchmark overnight borrowing rate in a targeted range between 5.25%-5.5%.

Along with the decision to stay on hold, committee members penciled in at least three rate cuts in 2024, assuming quarter percentage point increments. That’s less than market pricing of four, but more aggressive than what officials had previously indicated.

Markets had widely anticipated the decision to stay put, which could end a cycle that has seen 11 hikes, pushing the fed funds rate to its highest level in more than 22 years. There was uncertainty, though, about how ambitious the FOMC might be regarding policy easing. Following the release of the decision, the Dow Jones Industrial Average jumped more than 400 points, surpassing 37,000 for the first time.

The committee’s “dot plot” of individual members’ expectations indicates another four cuts in 2025, or a full percentage point. Three more reductions in 2026 would take the fed funds rate down to between 2%-2.25%, close to the long-run outlook, though there was considerable dispersion in the estimates for the final two years.

In a possible nod that hikes are over, the statement said that the committee would take multiple factors into account for “any” more policy tightening, a word that had not appeared previously.

Along with the interest rate hikes, the Fed has been allowing up to $95 billion a month in proceeds from maturing bonds to roll off its balance sheet. That process has continued, and there has been no indication the Fed is willing to curtail that portion of policy tightening.

Inflation ‘eased over the past year’

The developments come amid a brightening picture for inflation that had spiked to a 40-year high in mid-2022.

“Inflation has eased from its highs, and this has come without a significant increase in unemployment. That’s very good news,” Chair Jerome Powell said during a news conference.

That echoed new language in the post-meeting statement. The committee added the qualifier that inflation has “eased over the past year” while maintaining its description of prices as “elevated.” Fed officials see core inflation falling to 3.2% in 2023 and 2.4% in 2024, then to 2.2% in 2025. Finally, it gets back to the 2% target in 2026.

Economic data released this week showed both consumer and wholesale prices were little changed in November. By some measures, though, the Fed is nearing its 2% inflation target. Bank of America’s calculations indicate that the Fed’s preferred inflation gauge will be around 3.1% year over year in November, and actually could hit a 2% six-month annualized rate, meeting the central bank’s goal.

https://www.cnbc.com/2023/12/13/fed-interest-rate-decision-december-2023.html