David Rosenberg: Canada is in economic decay. Prepare for BoC rate cuts and big returns in this asset class.

There may be lies, damned lies, and statistics as Mark Twain posited. But statistics, as flawed as they may be, are all we have to go by. And the statistics show a Canadian economy that very likely has already slipped into a recession, even as Tiff Macklem doth protest too much.

The Bank of Canada will be singing like a canary within the next several months. The recession here promises to come earlier and be far more severe than what we will see unfold south of the border — that won’t be a pretty picture, either — with negative implications for the loonie, but highly positive implications for the long end of the government of Canada bond market as inflation completely melts away by the time spring arrives.

Spring refers to the seasonal weather pattern, not the economy, which is going to be feeling a chill for most of 2024 — even as the snow begins to melt, the pace of activity will still be melting.

But an even more deeply rooted problem is that we have had a government that caused the economy to become addicted to debt and excessive house price inflation, and papered over these problems by promoting an immigration boom. But the issue with the unprecedented population growth is that it isn’t paying for itself (quite the opposite).

That is my opinion.

But now, let’s assess the facts: The Canadian yield curve has been inverted since July 2022, and only four other times in recorded history has it been as inverted as it is today. Except for the summer of 1962, every inversion has touched off a recession. But when the negative gap between longer-term bond yields and rates at the front end of the GoC curve was as steep as it is now, the Canadian economy entered a recession 100% of the time. Why are the Canadian banks tightening their credit guidelines and boosting their loan loss provisioning of late? Because they are being forward-looking and see things unfolding just as I do.

Economic decay is already underway. Real GDP growth in Canada has slowed markedly on a four-quarter trailing trend basis from a hot +4% pace a year ago to a chilly +0.5% as of the third quarter, as fiscal stimulus lags fade away and the bite from the radical tightening in monetary policy lingers on. This is a stall-speed economy and is either in recession or rapidly approaching one. When you adjust for the immigration-fueled +2.7% population boom, what this means is that the economy, in real per-capita terms, has contracted -2.2% over the past four quarters. You can only camouflage the dismal economic reality via unprecedented inbound migration flows for so long.

Putting this dismal economic situation into its proper context, Canadian GDP growth, given this population boom, “should be” expanding at over a +4% pace. But it isn’t — it is as flat as a beavertail. Statistics Canada estimates that Q3 real GDP contracted at a -1.1% annual rate which offset most of the tepid +1.4% uptick in the second quarter. Tack on the fact that industrial production has been flat or negative in each of the past four months, and in five of the past six, and the year-over-year pace has been slashed to -1.3% from +5.4% a year ago. That is a massive swing in a deeply cyclical part of the economy.

Even the once-hot service sector has cooled off in dramatic fashion: the year-over-year trend here was clipped to +1.6% as of September, about half the +3.1% year-ago trajectory.

The buildup of recessionary pressures is unmistakable, and yet the Bank of Canada seems to be whistling past the graveyard. Only the bond market seems to have figured it out, but what else is new?

Real Gross Domestic Income (GDI), meanwhile, paints an even darker picture. This metric of economic activity has contracted in four of the past five quarters and is down nearly -1% on a year-over-basis, even with the population bulge. This metric tells us that there is an 80% chance the recession that no Bay Street economist sees has already begun! I hate to break the news to the Bank of Canada, but I am sure it is aware of this fact even if it won’t address it publicly. More important to Tiff Macklem & Company is fighting yesterday’s inflation battle. Plus ça change, plus c’est la même chose. Disciples of John Crow, for those with long enough memories of how things looked back in the early 1990s.

The fallout from the gap between population growth and the real economy is visibly seen in the woeful productivity performance, which definitely is in a recession of its own. After years of inept government policy that fueled a housing and consumer debt boom instead of nurturing expansion in the private sector capital stock, we are left with productivity declining for five consecutive quarters and down -1.7% from year-ago levels. If I were Pierre Poilievre (very likely the country’s next prime minister), I would try and teach Canadian voters in the coming campaign trail how critical it is to promote policies that enhance productivity growth — the critical ingredient for any country’s long-run growth potential and vitality. Instead, Canada has focused its supply-side policies on massive immigration which has been largely responsible for the housing shortage and affordability crisis the country now confronts. Having been around the track for a while, I don’t think it would be a stretch to declare that we have not seen a government in Ottawa understand the basic economic concept otherwise known as “capital deepening” and the link to multi-factor productivity growth since the excellent Brian Mulroney-Michael Wilson tag team in the second half of the 1980s.

Instead of promoting productivity and capital investment,the Canadian government for years, if not decades, has pursued policies aimed at spurring a housing and credit bubble of epic proportions, and now it is time to pay the piper. Household debt relative to disposable income has mushroomed to 172% — that is about 30 percentage points higher than the epic credit bubble peak in 2006-07 in the U.S. that brought the house down (both literally and figuratively). Remember — this is an aggregate statistic. The number is even higher when you consider that nearly one-third of Canadian households are debt-free — for the other two-thirds, a dire situation has taken hold. Delinquency rates are on the rise and the banks are now being forced to bolster their loan loss reserve provisioning in anticipation of a recessionary default cycle.

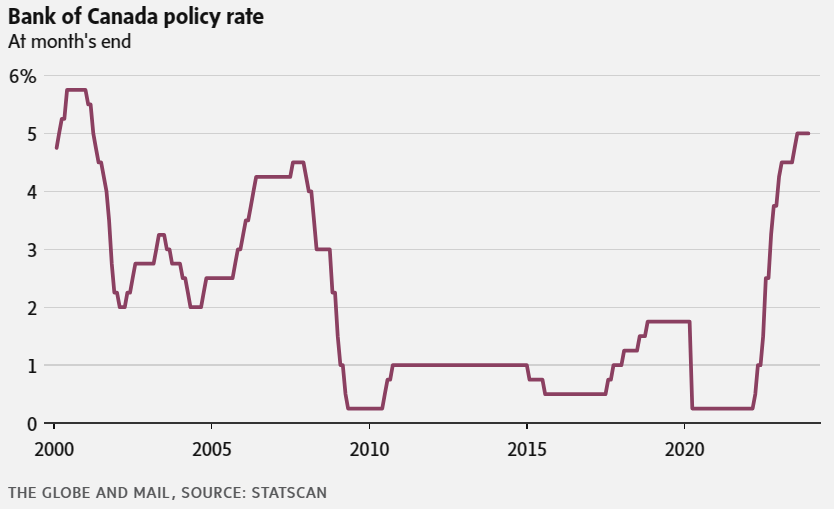

We have reached the point where nearly 15 cents of every after-tax dollar are being drained from household pocketbooks to service the mountain of debt — right where this ratio was prior to the 2001 and 2008 economic downturns. In fact, the total debt-service ratio for the personal sector is higher now than it was in the spring of 1990 when it was 12.7% — Canada was in the midst of a horrible recession back then. But what is key is that the BoC policy rate was 13% at a time when the household debt ratio, at 89%, was about half of today’s disturbing level. Today, we have a 5% interest rate doing the damage a 13% interest rate used to unleash because of the fact that the debt has ballooned as much as it has.

This debt bubble is now set to unwind, and likely not in a very orderly fashion. And the property bubble is already being burst —the YoY trend in the new house price index moving from +11.5% two years ago to +5% a year back to nearly -1% currently. There is so much air underneath the residential real estate market that just to mean-revert the homeowner affordability ratio wouldrequire a 20% plunge in home prices — and that is a conservative estimate.

The deflation underway on the largest component of both household and banking sector balance sheets promises to be spectacular — as the peak impact of the damage the BoC has unleashed still lies ahead of us. This is by no means an exaggeration and is only problematic for those who aren’t prepared.

What promises to make the situation more acute is that as unemployment rises, we can expect nominal wage growth to slow — the denominator in that debt/income quotient. We already are seeing the early signs of a contraction in credit, evident in the fact that the growth in total household debt and residential mortgages has slowed in the past year to +3% (negative in real terms). This is the weakest trend in two decades, if not more. There is absolutely nothing inflationary about the declining trajectory we are seeing in both money and credit — in fact, I sense thatthis time next year we will be back to talking about deflation and the BoC will be singing like a canary as most, if not all, of the rate hikes since the spring of 2022 is unwound.Seriously, what is there in theory or practice that leads to anything but disinflation (or even deflation) from these sharp downtrends in both money and credit? Is the central bank even aware of what its own data are revealing?

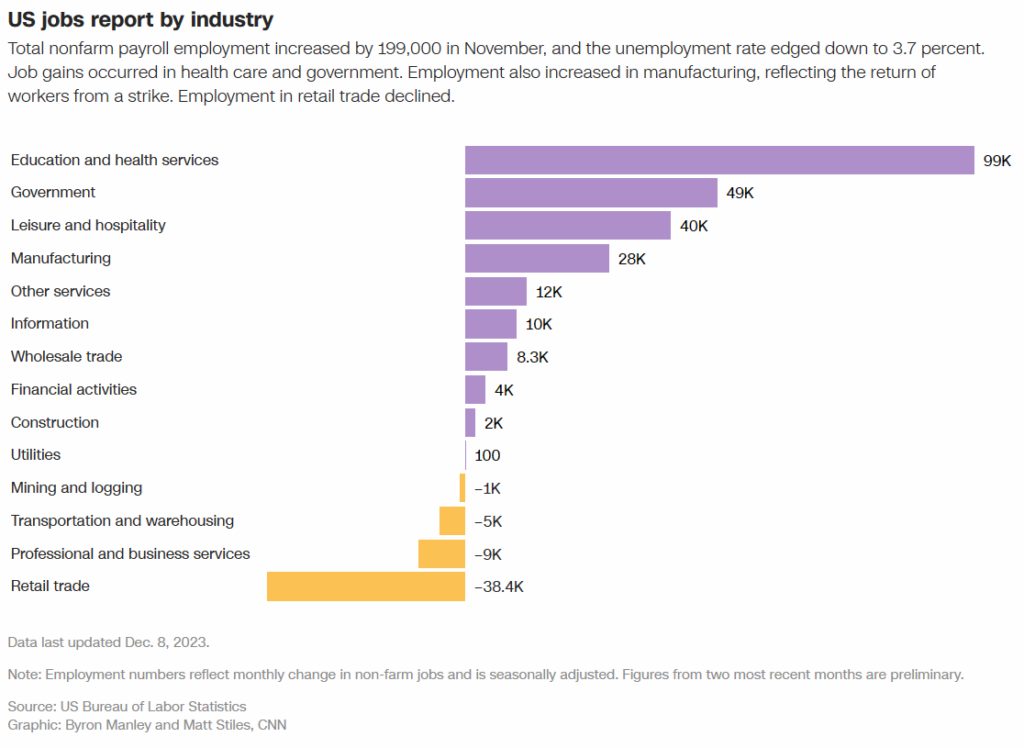

Now what about the labour market? While job growth has continued to this very day, the fact of the matter is that Canadians, now facing the end to Covid-era fiscal goodies and a rising debt-servicing burden, are coming back into the labour force in droves. The labour force has expanded at a +3.3% annual rate over the six months to November, well above the +2% pace of job creation (though the overall expansion in labour input is far lower than that, seeing as the workweek has been cut -0.4%). What this has done is trigger a huge +147,000 run-up in the ranks of the unemployed, one of the biggest increases in joblessness over a six-month interval since September 2020. The YoY trend in unemployment is at over +16% and, like the inverted shape of the yield curve, is another sure-fire recessionary signpost. The widening differential between the number of folks re-entering the labor market in search of a job and the actual number of positions being absorbed has precipitated a notable rise in the unemployment rate to 5.8% from the cycle low of 4.9%. While some may claim that 5.8% is still a “low number,” what matters most is the change, not the level. Not once in the past seven decades has Canada escaped a recession (NBER-defined downturn, with no intended disrespect to the C.D. Howe Institute) with a 0.9 percentage point increase in the jobless rate from the cycle trough.

The Bank of Canada has unleashed a whole whack load of pain on the Canadian economy and, so far, has shown no sign of reversing course. Never mind that once shelter is removed from the CPI data, particularly the bizarre inclusion of mortgage interest costs (+31% YoY), the inflation rate is sitting below target at +1.9%. This time last year, this underlying inflation rate was hovering just below +7%. Before Covid struck, back in February 2020, that inflation rate was +2.1%. It is now running below that mark!

The unemployment rate back in February 2020 was 5.7% and now it is 5.8%. And yet, despite the jobless rate being higher, and the lower underlying inflation rate, the policy rate today sits at 5.0% whereas it was 1.75% back then. And the 10-year government of Canada yield was sitting at half of today’s 3.5% level — hence our continued bullish stance on the bond market.

A bull-steepener – when the short-end of the yield curve falls faster than the long-end – is the theme for 2024, with the greatest total return potential at the long end of the GoC curve.

David Rosenberg is founder of Rosenberg Research, and author of the daily economic report, Breakfast with Dave.