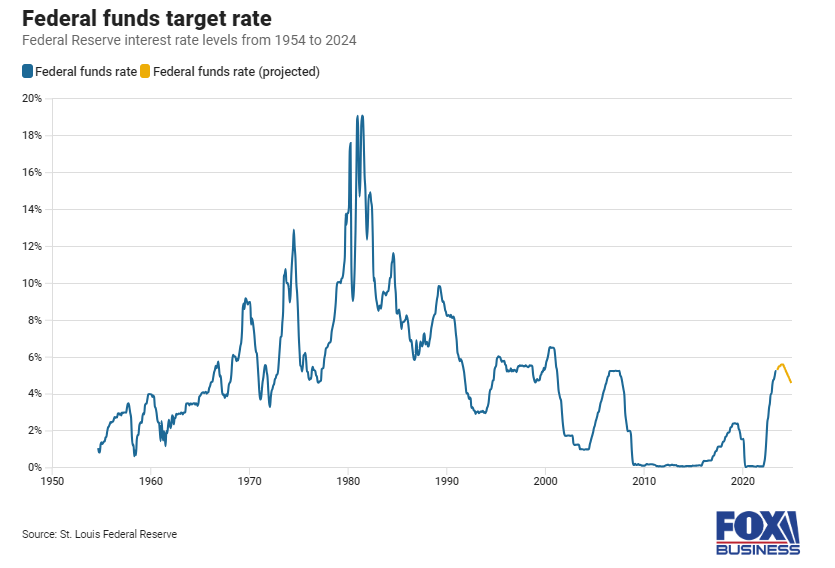

The Federal Reserve on Wednesday held interest rates steady for the third time this year even as central bankers confront a surprisingly resilient economy and still too-high inflation.

The widely expected decision left interest rates unchanged at a range of 5.25% to 5.5%, the highest level in 22 years. But policymakers also left the door open to an additional increase before the end of the year amid concerns that inflation “remains elevated.”

“In determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time, the committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments,” the Fed said in its post-meeting statement.

Policymakers have raised interest rates sharply over the past year, approving 11 rate increases in the hopes of crushing inflation and cooling the economy. In the span of just 16 months, interest rates surged from near zero to above 5%, the fastest pace of tightening since the 1980s.

Hiking interest rates tends to create higher rates on consumer and business loans, which then slows the economy by forcing employers to cut back on spending. Higher rates have helped push the average rate on 30-year mortgages above 8% for the first time in decades. Borrowing costs for everything from home equity lines of credit, auto loans and credit cards have also spiked.

Yet the rapid rise in rates has not stopped consumers from spending or businesses from hiring.

“Inflation has been coming down, but it’s still running well above our 2% target. The labor market has been re-balancing, but it’s still very tight by many measures. GDP growth has been strong, although many forecasters are forecasting that it will slow,” Powell told reporters at a post-meeting press conference in Washington, D.C. “As for the committee, we are committed to achieving a stance of monetary policy that is sufficiently restrictive to bring inflation down to 2% over time. We are not confident we have achieved that.”

Inflation has cooled from a peak of 9.1%, but it remains well above both the Fed’s 2% goal and the pre-pandemic average.

“The process of getting inflation sustainably down to 2% has a long way to go,” Powell added.

On top of that, economic growth unexpectedly accelerated last week, with gross domestic product — the broadest measure of goods and services produced in the country — rising at a 4.9% annualized rate from July through September. It marked the best gain since 2021.

nd against all odds, the labor market has remained very tight. Demand for workers continues to outstrip the number of jobs available, layoffs remain limited and the economy is still adding jobs at a solid clip.

Fed officials acknowledged that economy activity was “strong” in the third quarter — an upgrade from the September meeting, when policymakers described a “solid” pace of growth. They also noted that job growth has “moderated,” in comparison to earlier statements that said it had “slowed.” In fact, Powell indicated that there is a greater risk of inflation re-accelerating than there is of an economic recession.

But policymakers also cautioned that tighter credit and financial conditions could weigh on the economy in coming months. Several officials, including Powell, have indicated that a recent run-up in long-term Treasury yields, which influence financing costs for households and businesses, could mean the Fed is done tightening. Powell said Wednesday the central bank remains “attentive” to the increase in longer-term yields.

“In light of the uncertainties and risks and how far we have come, the committee is proceeding carefully,” Powell said. “We will continue to make our decisions meeting by meeting.”

The Fed is set to meet one more time this year, in December.