Major stock indexes rose on Wednesday, but the Canadian benchmark underperformed Wall Street as money market traders continued to raise bets that the country’s central bank will hike interest rates another time following a hotter-than-expected inflation report this week.

Gains in North American equity markets were fueled by optimism over a potential deal on the US$31.4 trillion debt ceiling and as a rebound in regional bank shares eased concerns about an escalation in the sector’s troubles.

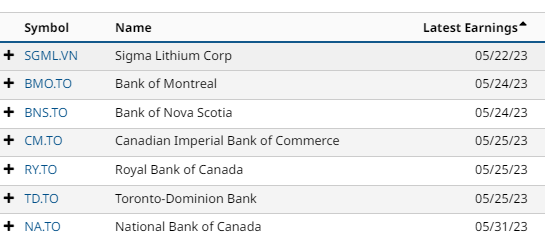

But the advance was uneven in Toronto. The utilities sector, which is particularly negatively impacted by rising interest rates because of high debt levels among its companies, was down 0.6%, on top of a 1.1% decline on Tuesday when the inflation data was released. But the real estate sector bounced back, rising 0.7%. Industrials and consumer staples sectors were marginally lower, but financials gained 0.8% and energy rose 1.4%.

Canada’s annual inflation rate ticked up to 4.4% in April, as higher shelter costs contributed to the first acceleration in the consumer price index in 11 months. The reading surprised the Street, which was looking for a rise of 4.1%.

Interest rate probabilities based on trading in swaps markets immediately priced out any expectations that the Bank of Canada would cut interest rates by the end of this year, and started pricing in a modest risk the bank would hike rates again. Those bets continued to intensify on Wednesday. They now imply a greater than 60% chance of a further quarter-point rate hike by the end of this summer.

While many economists continue to believe the bank will stick to its current overnight rate, some are expressing less confidence. Some market observers believe the bank, which has left the door open to possible further rate hikes if needed, will need to tighten policy further.

“The Bank of Canada will likely be forced into hiking rates on June 7th because the upside risks to its inflation projections are materializing and the downside risks have begun to fade,” Jay Zhao-Murray, FX Analyst at Monex Canada, a foreign currency firm, said in a note.

“Instead of cooling to the point of near-stagnation, the Canadian economy has consistently proved more resilient than the Bank had expected: in April, the Bank revised its Q1 GDP forecast from 0.5% to 2.3%, yet nowcast models point to 3.0% growth for Q1, which suggests the economy has even more excess demand than they had thought,” he said.

Capital Economics, which had been forecasting the Bank of Canada would cut interest rates before the year is out, changed its stance on Wednesday.

“The rapid turnaround in the housing market and the upside surprise to CPI inflation in April have raised the case for another interest rate hike from the Bank of Canada, which we now judge is slightly more likely than not,” said Capital Economics deputy chief North America economist Stephen Brown in a note late in the day.

“The potential for US debt ceiling negotiations to go down to the wire, with negative effects for financial markets in early June, is one reason for the Bank to stay on the side-lines at its meeting next month. But we now anticipate another 25 basis point hike in July and doubt the Bank will cut rates until 2024.

Reflecting the threat of another move higher in the Bank of Canada’s key lending rate as well as action in the U.S. Treasury market Wednesday, bond yields in Canada continued to rise.

The Canadian 2-year yield touched its highest level since March 10 at 4.072% before dipping to 4.058%, up 8.7 basis points on the day. The gap between it and the equivalent U.S. rate was at 9.2 basis points, its narrowest since Sept. 16.

The S&P/TSX composite index ended up 54.36 points, or 0.3%, at 20,296.43.

The health-care sector was up 4.9%. It was boosted by a 24.1% jump in Bausch Health Companies Inc shares after a Delaware court ruling helped guard the patent for the company’s antibiotic drug for traveler’s diarrhea.

Elsewhere, shares of BlackBerry Ltd advanced 5.9% as the company forecast sales jumping as much as 54% in 2026 from 2023 on the back of growth in its cybersecurity business.

President Joe Biden and top U.S. congressional Republican Kevin McCarthy on Wednesday reiterated their determination to strike a deal soon to raise the debt ceiling and avoid an economically catastrophic default.

If an agreement is not reached by June 1, the U.S. Treasury has said it could begin to run out of funds to pay the government’s bills, potentially igniting a recession.

A jump in regional bank shares lifted sentiment, led by a 10.19% surge in Western Alliance Bancorp a day after the bank said deposits grew by more than $2 billion in the quarter ended May 12.

The KBW regional bank shot up 7.28% to notch its biggest one-day percentage gain since Jan. 6, 2021 to close at its highest level since May 1. The S&P 500 banks index also surged 4.46% for its biggest daily percentage gain since Nov. 10.

“It is optimism over the debt ceiling. It is continued optimism the banking crisis is in the rear-view mirror. Every day we go without a new problem, the closer we get to maybe putting it behind us,” said Rick Meckler, partner at Cherry Lane Investments in New Vernon, New Jersey.

“Definitely the catalyst is when you get both Biden and McCarthy to say that we are close the assumption is they probably will go with some kind of agreement.”

The Dow Jones Industrial Average rose 408.63 points, or 1.24%, to 33,420.77; the S&P 500 gained 48.87 points, or 1.19%, to 4,158.77; and the Nasdaq Composite added 157.51 points, or 1.28%, at 12,500.57.

The gains marked the biggest one-day percentage climb for each of the three major indexes since May 5.

Also providing support was a 4.41% advance in Tesla shares after its annual shareholder meeting on Tuesday.

Top boss Elon Musk downplayed market speculation he may step down as CEO of Tesla, touched upon two new mass-market models the company is developing, and reaffirmed that deliveries of its long-delayed Cybertruck pickup would start this year.

In addition, a source with direct knowledge of the matter told Reuters the electric vehicle maker has proposed setting up a factory in India for domestic sale and export.

With the rally the S&P is once again near the top of a recent trading range, at about 4,160, which has acted as a resistance point. Analysts said a major catalyst such as a debt ceiling agreement or clarity on the path of interest rate hikes from the Federal Reserve would be needed to push stocks much higher.

Recent data has indicated slowing in the U.S. economy following a string of Fed rate hikes to fight high inflation. That, along with recent negotiations over the U.S. debt ceiling, has focused attention on when the central bank will pause hiking, or cut interest rates.

While the market is pricing in at least a rate cut by the year-end, recent comments from Fed officials suggested they are not ready to cut rates soon.

Retailers Target Corp and TJX Companies Inc forecast current-quarter profit below expectations despite beating estimates for the first quarter.

Shares of Target rose 2.58%, while TJX Companies closed 0.93% higher after a choppy session. The gains, along with Tesla’s rally, helped lift the consumer discretionary sector about 2%.

Volume on U.S. exchanges was 10.35 billion shares, compared with the 10.59 billion average for the full session over the last 20 trading days. Advancing issues outnumbered decliners on the NYSE by a 2.95-to-1 ratio; on Nasdaq, a 2.45-to-1 ratio favored advancers. The S&P 500 posted 20 new 52-week highs and 14 new lows; the Nasdaq Composite recorded 69 new highs and 123 new lows.