Wall Street closed sharply higher on Tuesday as widespread fears over liquidity in the banking sector abated and market participants eyed the Federal Reserve, which is expected to conclude its two-day policy meeting on Wednesday with a 25-basis-point hike to its policy rate.

All three major U.S. stock indexes were bright green as the session closed, with energy, consumer discretionary and financials enjoying the most sizable gains.

Canada’s benchmark stock index also rose, closing at its highest level in a week, helped by gains in energy and financial shares after domestic data showed consumer prices easing more than expected in February.

A one-two punch of regional bank failures last week, followed by the rescue of First Republic Bank and the takeover of Credit Suisse, sparked a rout in banking stocks and fueled worries of contagion in the financial sector which, in turn, heightened global anxieties over the growing possibility of recession.

But banking stocks bounced back on Tuesday, building on Monday’s reversal. Still, despite its recent resurgence, the S&P Banks index has lost more than 18% of its value just this month.

Both the SPXBK and the KBW Regional Banking index jumped 3.6% and 4.8%, respectively, their biggest one-day percentage jumps since late last year.

“The stock market is coming to a recognition that the banking crisis wasn’t a crisis after all, and was isolated to a handful of banks,” said Oliver Pursche, senior vice president at Wealthspire Advisors in New York. “Both the public and the private sector have shown they are more than able to backstop and shore up weak institutions.”

Treasury Secretary Janet Yellen, in prepared remarks before the American Bankers Association, said the U.S. banking system has stabilized due to decisive actions from regulators, but warned more action might be required.

Attention now shifts to the Fed, which has gathered for its two-day monetary policy meeting, at which the members of the Federal Open Markets Committee (FOMC) will revisit their economic projections and, in all likelihood, implement another increase to the Fed funds target rate in their ongoing battle against inflation.

“The Fed will raise interest rates by 25 basis points and the market won’t care,” Pursche added. “It will all be about (Chairman Jerome) Powell’s statement on the economy and inflation, and if he can do a good enough job convincing the public that the banking noise” can be attributed to bad management on the part of a few banks.

Financial markets have now priced in an 83.4% likelihood of a 25 basis-point rate hike, and a 16.6% probability that the central bank will leave its policy rate unchanged, according to CME’s FedWatch tool.

Economic data released early in the session showed a 14.5% jump in U.S. existing home sales, blasting past expectations and snapping a 12-month losing streak.

Treasury yields gained, as improving risk sentiment reduced safe-haven demand for U.S. debt before the Federal Reserve concludes its two-day meeting on Wednesday.

Interest rate-sensitive U.S. two-year yields rose to 4.177% and are also up from a six-month low of 3.635% on Monday, but are sharply below the almost 16-year high of 5.084% hit on March 8.

The closely watched yield curve between U.S. two-year and 10-year notes remains deeply inverted at minus 58 basis points, a level that still indicates a looming recession, though it remains off its extreme levels of minus 111 basis points reached on March 8.

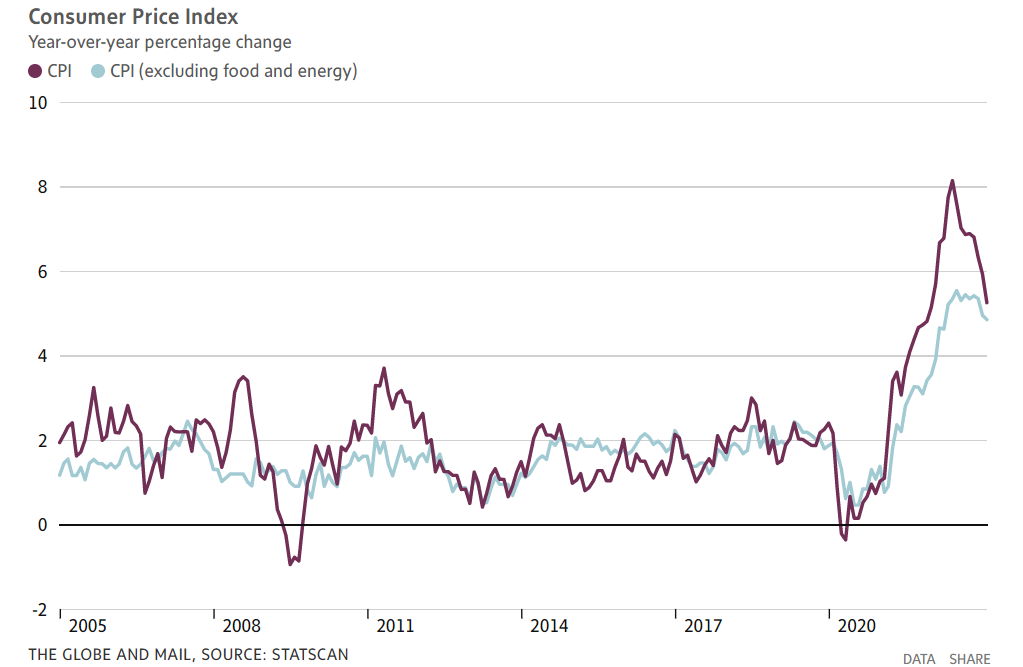

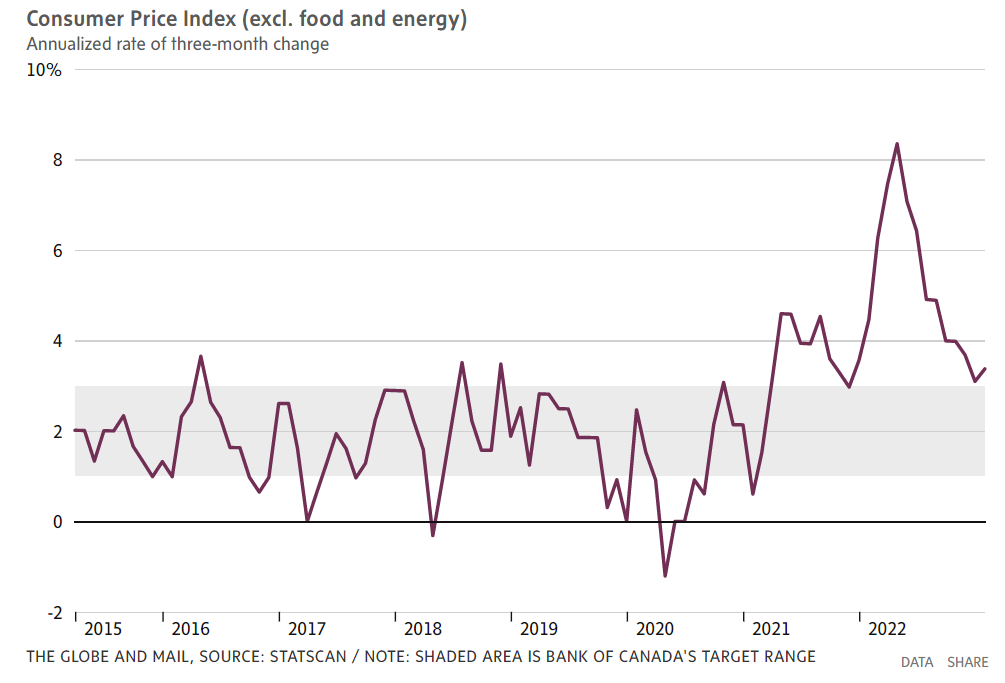

Canada’s annual inflation rate slowed more than expected in February to 5.2%, its lowest level in 13 months, backing up the Bank of Canada’s plans to hold off on further interest rates hikes.

Despite the tamer than anticipated inflation numbers, Canada’s 2-year bond yield was up more than 10 basis points in late afternoon trading – although the rise was more muted than the move in the equivalent U.S. yield.

Credit markets are continuing to bet an interest rate cut at the Bank of Canada is only months away. While they are currently pricing in only about a 12% chance of a cut next month, they are positioned for at least a quarter-point cut this summer, according to Refinitiv Eikon data late Tuesday.

The Dow Jones Industrial Average rose 316.02 points, or 0.98%, to 32,560.6, the S&P 500 gained 51.3 points, or 1.30%, to 4,002.87 and the Nasdaq Composite added 184.57 points, or 1.58%, to 11,860.11.

Eight of the 11 major sectors in the S&P 500 ended the session in positive territory, with energy stocks, boosted by rising crude prices, posting the largest percentage gains.

Shares of First Republic Bank soared by 29.5%, the company’s biggest-ever one-day percentage jump as JPMorgan CEO Jamie Dimon leads talks with other big banks aimed at investing in the lender, according to the Wall Street Journal.

Peers PacWest Bancorp and Western Alliance Bancorp also surged, leaping 18.8% and 15.0%, respectively.

Tesla Inc advanced 7.8% after the electric automaker appeared on track to report one of its best quarters in China, according to car registration data.

The Toronto Stock Exchange’s S&P/TSX composite index ended up 135.49 points, or 0.7%, at 19,654.92.

Heavily-weighted financials in Toronto rose 1.2%, while energy added 3.2% as the price of oil settled 2.5% higher at $69.33 a barrel.

Advancing issues outnumbered declining ones on the NYSE by a 3.22-to-1 ratio; on Nasdaq, a 2.73-to-1 ratio favored advancers. The S&P 500 posted 5 new 52-week highs and 2 new lows; the Nasdaq Composite recorded 48 new highs and 114 new lows. Volume on U.S. exchanges was 11.75 billion shares, compared with the 12.63 billion average over the last 20 trading days.