There are any number of items you could include on a list of Canada’s defence spending failures.

There’s the fact the Canadian Armed Forces has a chronic recruitment problem that has left it short 10,000 personnel and counting.

There’s our minuscule and antiquated submarine fleet – four diesel-powered vessels purchased from the British army in the 1990s. The Victoria-class subs cost billions to keep in service, and their last-century vintage sinks Ottawa’s claim that it can preserve Canada’s sovereignty in the Arctic.

That naval deficit is made worse by Canada’s embarrassing exclusion from the AUKUS military pact, in which three of our biggest allies – the United States, Britain and Australia – will together equip Australia with nuclear-powered submarines to respond to China’s growing aggression in the Pacific.

And no list would be complete without Ottawa’s inability to procure armaments and equipment in a timely manner – a reality illustrated by the long-overdue agreement made earlier this year to purchase 88 F-35 fighter jets. That deal was first announced by former prime minister Stephen Harper in 2010; the F-35s will not be operational until 2029 at the earliest.

Federal budget 2023

This is part of a series on the federal budget to be unveiled on March 28. Check our editorials section for more instalments this week. Other topics include:

Seniors: The growing gap between what Ottawa spends on older and younger Canadians

Child care: Ottawa must follow through on subsidized system

Health care: Ottawa should give provinces more tax room, not a blank cheque

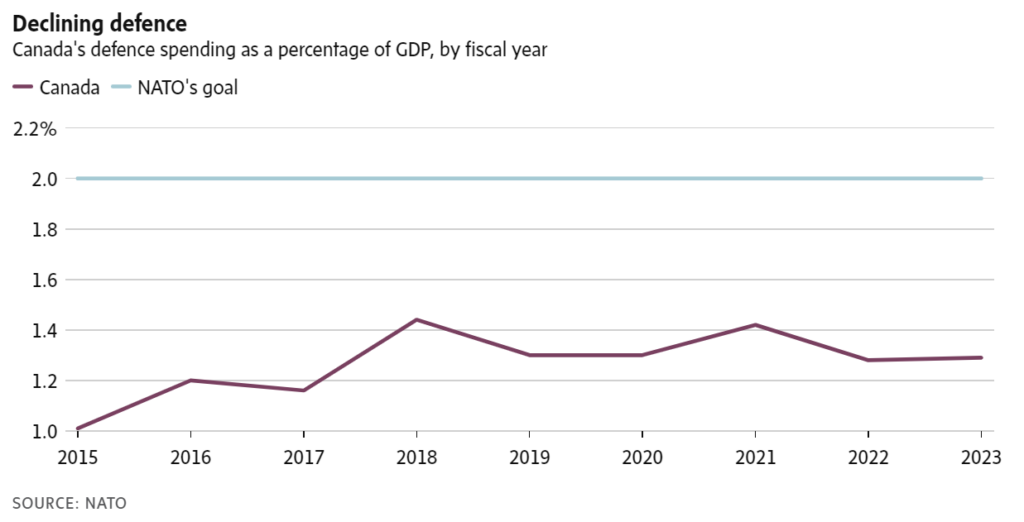

But taking three decades to upgrade a critical air defence capability, and all the other failings listed above, do not represent the worst of it. That honour goes to Ottawa’s refusal to meet its NATO obligation to spend 2 per cent of gross domestic product on defence.

Even as Russia continued to bombard and kill Ukrainian civilians this week, NATO said on Tuesday that Canada’s defence spending will amount to just 1.29 per cent of GDP in fiscal 2022-2023. That’s essentially the same percentage as 2021-2022, when it stood at 1.28 per cent and Russia had only just begun its invasion.

It’s also well below the highwater mark of 1.44 per cent that Canada hit in 2017-2018.

In constant 2015 Canadian dollars adjusted for inflation, Canada is this fiscal year spending less on defence than it did five years ago.

It is frankly astonishing that Russia’s illegal war and China’s increasingly aggressive posture have not pierced the Trudeau government’s isolationist armour.

While allies such as Britain, Germany and Japan (which is not part of NATO) are ramping up their defence spending in response to clear and present threats, and the U.S. continues its pump billions of dollars worth of cash, equipment and weapons into Ukraine, Canada hovers near the bottom of the NATO rankings, beside Slovenia, Spain and Luxembourg.

Over the past four years, the gap between Canada’s actual defence spending, as recorded by NATO, and the amount that would be required to hit 2 per cent of GDP has risen to $21-billion from $17-billion.

That’s a lot of money, but Canada’s $2.86-trillion economy can absorb it. Much smaller NATO economies that don’t have the luxury of naiveté – Poland, Estonia, Lithuania, Latvia – routinely meet and surpass the 2-per-cent benchmark.

Even more damning is the fact that Canada is by far the lowest NATO contributor as a share of GDP among Group of Seven countries.

It comes down to a choice for Ottawa: spend less on some programs so that more can go to defence. That’s what writing a federal budget is all about – prioritizing. And right now, in the world we live in, the Trudeau government patently has its priorities wrong.

Ottawa needs to rapidly increase its defence spending, with the ultimate goal of meeting the NATO threshold. Doing so would put our armed forces on a better standing. More importantly, it would demonstrate that Canada is shoulder to shoulder with NATO in the defence of our values.