The close: OCT 6 – Major indexes lower as central banks pound rate hike drum; pot stocks surge on Biden

Major North American indexes closed lower on Thursday as concerns mounted ahead of closely watched monthly jobs reports Friday that the Federal Reserve’s aggressive interest rate stance will lead to a recession.

The slide in the TSX was steeper than in U.S. indexes, with heavily weighted financials losing nearly 3%. But pot stocks had one of their biggest rallies in years after U.S. President Joe Biden said he intends to offer criminal pardons to anyone convicted of simple possession of marijuana under federal law, and also signalled he wants to revisit how cannabis is classified as a controlled substance.

The S&P/TSX composite index ended down 256.08 points, or 1.3%, at 18,979.01. That was the second straight day of declines for the index after it rallied 5% over the course of Monday and Tuesday.

Financials fell 2.6%, while the consumer staples sector was down 2.9%.

Energy rose 1.9% as oil settled 0.8% higher at $88.45, adding to its gains on Wednesday when OPEC+ agreed to cut production targets by 2 million barrels per day, the largest reduction since 2020.

The TSX materials group, which includes precious and base metals miners and fertilizer companies, added 1.5% and healthcare ended 8.7% higher.

It included the sharp gains for cannabis producers, with Tilray Brands Inc up 32.6% and Canopy Growth 23.4%.

The Bank of Canada has also been raising rates at a rapid pace. Its governor, Tiff Macklem, made clear in a speech Thursday that the central bank will not yet be pivoting away from its hawkish stance. Macklem said the currency’s recent weakness will offset some easing of inflation pressures that could come from improving global supply chains and lower commodity prices.

Money markets raised bets on a 50-basis-point hike at the BoC’s next policy announcement on Oct. 26, pricing in a 70% chance of such a move versus roughly 50% before the governor’s speech.

Canadian government bond yields rose across a more deeply inverted curve, with the 2-year moving above the 4% threshold for the first time since October 2007. It was up 14.7 basis points at 4.013% by late afternoon.

Equity markets on both sides of the border briefly took comfort from data that showed U.S. weekly jobless claims rose by the most in four months last week, raising a glimmer of hope the Fed could ease the implementation since March of the fastest and highest jump in rates in decades.

Equities have been slow to acknowledge a consistent message from Fed officials that rates will go higher for longer until the pace of inflation is clearly slowing.

Chicago Fed President Charles Evans was the latest to spell out the central bank’s outlook on Thursday, saying policymakers expect to deliver 125 basis points of rate hikes before year’s end as inflation readings have been disappointing.

“The market has been slowly getting the Fed’s message,” said Jason Pride, chief investment officer for private wealth at Glenmede in Philadelphia.

“There’s a likelihood that the Fed with further rate hikes pushes the economy into a recession in order to bring inflation down,” Pride said. “We don’t think the markets have fully picked up on this.”

Pride sees a mild recession, but in the average recession there has been a 15% decline in earnings, suggesting the market could fall further. The S&P 500 has declined 22% from its peak on Jan. 3.

Despite the day’s decline, the three major U.S. indexes were poised to post a weekly gain after the sharp rally on Monday and Tuesday.

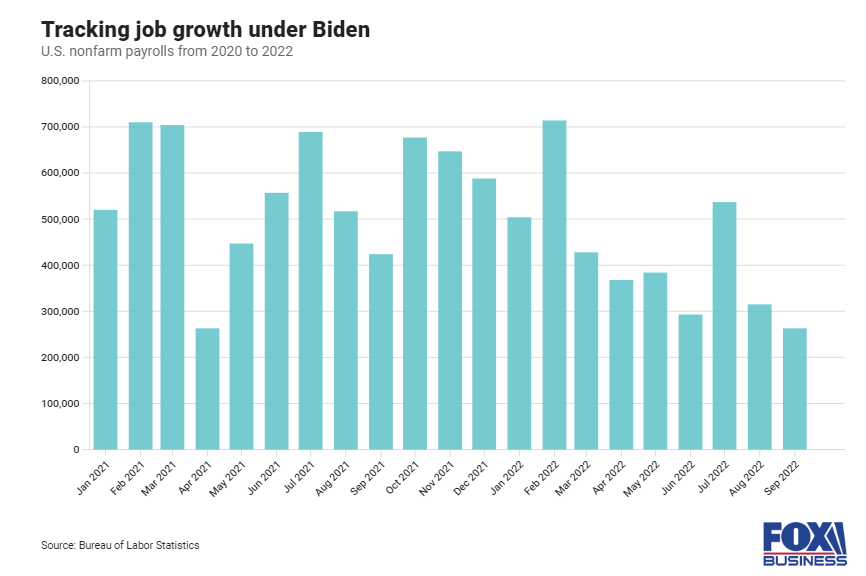

The labor market remains tight even as demand begins to cool amid higher rates. On Friday the nonfarm payrolls report on employment in September will help investors gauge whether the Fed alters its aggressive rate-hiking plans.

Money markets are pricing in an almost 86% chance of a fourth straight 75 basis-point rate hike when Fed policymakers meet on Nov. 1-2.

To be clear, not everyone foresees a hard landing.

Dave Sekera, chief U.S. market strategist at Morningstar Inc , said growth will remain sluggish for the foreseeable future and likely will not start to reaccelerate until the second half of 2023, but he does not see a sharp downturn.

“We’re not forecasting a recession,” Sekera said. “The markets are looking for clarity as to when they think economic activity will reaccelerate and make that sustained rebound.

“They’re also looking for strong evidence that inflation will begin to really trend down, moving back towards the Fed’s 2% target,” he said.

Ten of the 11 major S&P 500 sectors fell, led by a 3.3% decline in real estate. Other indices also fell, including semiconductors, small caps and Dow transports. Growth shares fell 0.76%, while value dropped 1.18%.

Energy was the sole gainer, rising 1.8%.

The Dow Jones Industrial Average fell 346.93 points, or 1.15%, to 29,926.94, the S&P 500 lost 38.76 points, or 1.02%, to 3,744.52 and the Nasdaq Composite dropped 75.33 points, or 0.68%, to 11,073.31.

Tesla Inc fell 1.1% as Apollo Global Management Inc and Sixth Street Partners, which had been looking to provide financing for Elon Musk’s $44 billion Twitter deal, are no longer in talks with the billionaire.

Alphabet Inc closed basically flat after the launch of Google’s new phones and its first smart watch.

Volume on U.S. exchanges was 10.57 billion shares, compared with the 11.67 billion average for the full session over the past 20 trading days. Declining issues outnumbered advancing ones on the NYSE by a 2.32-to-1 ratio; on Nasdaq, a 1.42-to-1 ratio favored decliners. The S&P 500 posted three new 52-week highs and 31 new lows; the Nasdaq Composite recorded 46 new highs and 118 new lows.