Spreads: A weaker recession clue in Canada

The Bank of Canada boosted its policy interest rate to 3.25 per cent last week in an effort to tame inflation. The idea being that higher rates will dissuade people from borrowing and thereby put a damper on an overheated economy.

The central bank has a difficult task because inflation is running at 7.6 per cent based on the latest year-over-year reading from July. The bank’s preferred measures of core inflation were also elevated, at between 5 per cent and 5.5 per cent.

Should inflation persist at similar rate, rather than decline to more moderate levels, as the bank hopes, monetary policy would still be expansive because borrowers get a free lunch thanks to inflation. The bank says, “given the outlook for inflation, we continue to judge that the policy interest rate will need to rise further.”

The bank’s job is made more difficult because the Canadian government bond yield curve recently inverted, with yields offered by short-term bonds now exceeding those on long-term bonds.

That’s worrisome because negative spreads (the difference between long-term and short-term yields) in the United States have heralded recessions almost like clockwork since the 1970s. The relationship is something Duke University finance professor Campbell Harvey pointed out in his 1986 PhD dissertation, and negative spreads have continued to presage economic downturns in the U.S. since then.

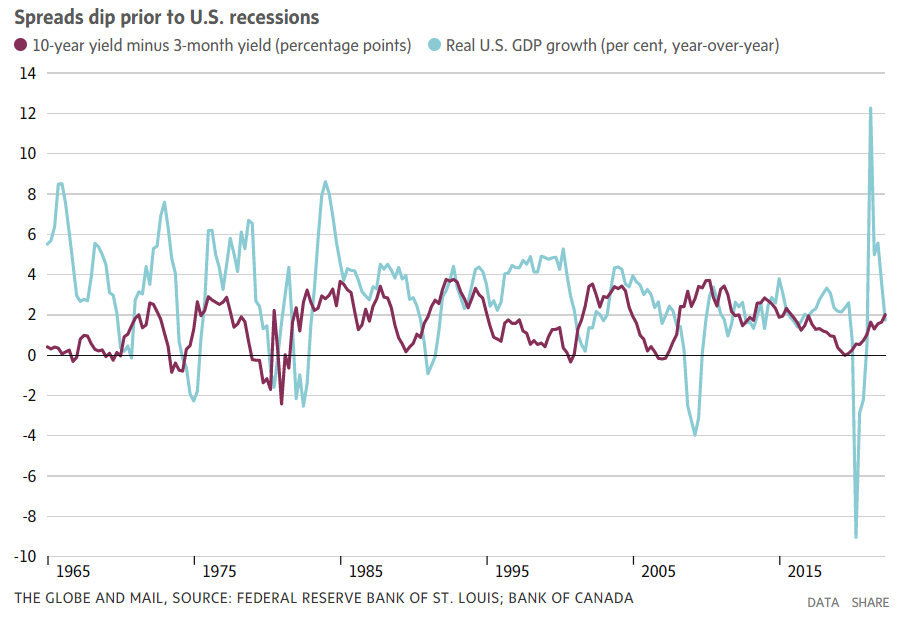

The first accompanying graph shows year-over-year growth in real gross domestic product (GDP) in the U.S. along with the spread between 10-year and three-month U.S. Treasury yields. (The graphs herein are based on calculations using data retrieved from the FRED service of the Federal Reserve Bank of St. Louis, with some supplemental data from the Bank of Canada. GDP growth is based on quarterly figures while the spreads use monthly data.)

You can see that spreads fall near, or below, zero roughly a year before GDP stalls.

I use GDP growth as my proxy for recessions rather than official data from the National Bureau of Economic Research to be able to apply the same measure in Canada. But, to my eye, GDP shrinkage does a pretty good job of flagging the major economic downturns of the last few decades.

You’d be right to quibble about the idea that negative spreads cause recessions in all cases. For instance, it is preposterous to think they were behind the 2020 recession, which was prompted by the pandemic and its related restrictions. (While an economic slowdown might have occurred in a world that didn’t suffer from the COVID-19 pandemic, we can’t turn back time to test the matter.)

The spread between 10-year and three-month U.S. Treasury bond yields stands at 0.20 of a percentage point on Sept. 7, according to data from the U.S. Treasury Department. While the spread has yet to go negative, it is low enough to be worrisome because the U.S. Federal Reserve is expected to follow the Bank of Canada with a boost to its benchmark rate later this month of, perhaps, 0.75 of a percentage point.

While the linkage between negative spreads and recessions appears to be strong in the U.S., it has been weaker in our home and native land.

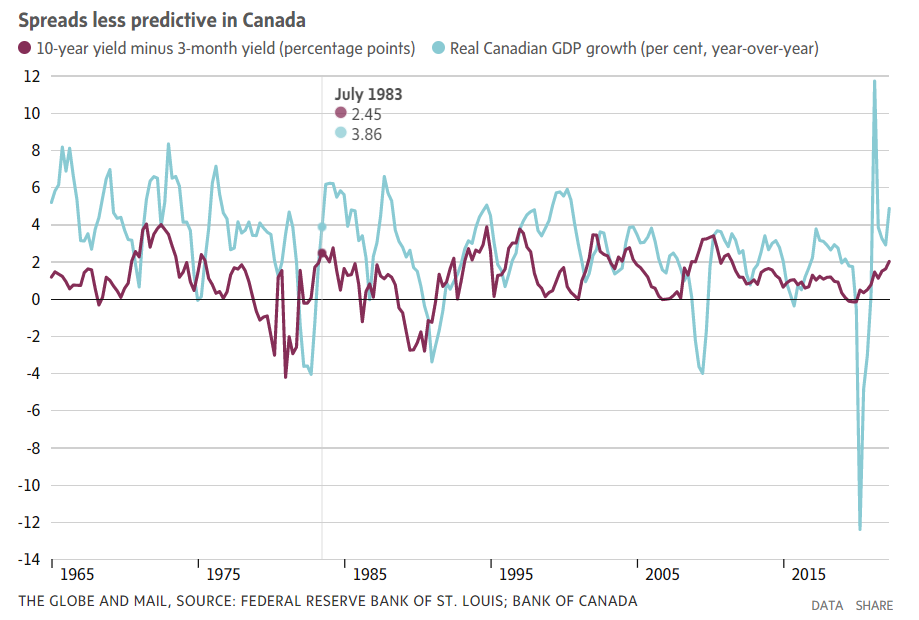

The second graph shows the history of the spread between 10-year Government of Canada bond yields and three-month yields, along with year-over-year real Canadian GDP growth.

I’ll start with the good news and a touch of confirmation bias. Many significant slowdowns have occurred in Canada roughly a year after the yield spread turned negative. For instance, the hard times of 1982, 1990 and 2008 were all heralded by inverted yield curves.

On the other hand, it’s easy to spot several notable whiffs. For instance, spreads predicted recessions in the late 1990s and early 2000s, but they failed to materialize. Hard times also occurred without accompanying negative spreads, such as the 2015 downturn that was fuelled by the collapse of the oil patch.

It’s not clear why spreads failed to be a reliable predictor of recessions in Canada. It might be due to our smaller economy, the influence of our giant neighbour to the south, the significance of our energy and resource sectors, or a combination of these and other factors.

But the recent U.S. experience might also have arisen more by chance than cause and effect. There have only been a handful of economic downturns in recent times and it’s easy to imagine that recessions might arise in other ways. After all, a prime example is provided by the recession of 2020.

Nonetheless, I think it’s unwise to ignore the actions of the central banks when they are trying to cool the economy by aggressively boosting short-term interest rates. After all, such actions have led to some of the most painful recessions in the past, and cracks are already starting to appear in the Canadian real estate market. In my view, we’ll be fortunate to avoid a serious economic slowdown over the next year or so.