Cameco Announces Second Quarter Results, Continued Disciplined Execution Of Strategy; Well-Positioned As Multi-Asset Nuclear Fuel Supplier Across The Fuel Cycle

Business Wire – 1 hour ago

Cameco (TSX: CCO; NYSE: CCJ) today reported its consolidated financial and operating results for the second quarter ended June 30, 2022 in accordance with International Financial Reporting Standards (IFRS).

“Our results reflect the very deliberate execution of our strategy of full-cycle value capture. And, we are benefiting from higher average realized prices in both our uranium sales and our fuel services sales as the market continues to transition and geopolitics continue to highlight concentration of supply concerns,” said Tim Gitzel, Cameco’s president and CEO.

“In the drive for a clean energy profile, policy makers and business leaders must recognize that there is a need to balance affordability and security. Too much focus on intermittent, weather dependent, renewable energy, has left some jurisdictions struggling with power shortages and spiking energy prices, or dependence on Russian energy supplies. The good news for us is that many are turning to nuclear – which provides safe, reliable, affordable, carbon-free baseload electricity while also offering energy security and independence.

“It is still early days, but we are seeing some utilities beginning to pivot toward procurement strategies that more carefully weigh the origin risk. This year has already been a contracting success with over 45 million pounds added to our portfolio of long-term uranium contracts and we continue to have a significant and growing pipeline of contract discussions. And, we are being strategically patient as our primary driver is value and we have significant leverage to market improvements with unencumbered pounds in the ground. Additionally, we are focusing our efforts on capturing conversion business as conversion prices are at record-highs.

“We remain committed to our supply discipline. Discipline that balances delivering low-cost pounds into committed sales contracts and maintaining unencumbered supply for future years, by preserving our tier-one assets. Tier-one assets like Cigar Lake, that will benefit us for years to come, and where we announced in May that we had increased our ownership of this proven, permitted and fully licensed Saskatchewan mine. Further, at Cigar Lake we have been able to catch up on development work and we are now expecting to produce 18 million pounds (100% basis) in 2022. However, our overall production forecast remains unchanged at up to 11 million pounds our share, a benefit of being a multi-asset producer, as the increase at Cigar Lake largely offsets a slower rampup at the Key Lake mill due to some delays in our work schedule.

“We continue to transition from care and maintenance to operational readiness at McArthur River and Key Lake, increasing the workforce on site and moving into early-stage commissioning. At the Key Lake mill, we have encountered some challenges with respect to the availability of critical materials, equipment and skills for some of our critical automation, digitization and other projects. In addition, after four years on care and maintenance, we have experienced some normal commissioning issues as we work to safely and systematically integrate the existing and new assets with updated operating systems at the mill. We have adjusted our schedule to accommodate these delays and anticipate first production will be deferred to later in the fourth quarter. As a result, we are expecting up to 2 million pounds production (100% basis) this year.

“Thanks to our deliberate actions and conservative financial management we have been and continue to be resilient. With $1.4 billion in cash and cash equivalents and short-term investments on our balance sheet, improving fundamentals for our business and our decision to prepare McArthur River/Key Lake for production, we have line of sight to a significant improvement in our future financial performance.

“We are optimistic about Cameco’s role in capturing long-term value across the fuel chain and supporting the transition to a net-zero carbon economy. We have tier-one assets that are licensed, permitted, long-lived, are proven reliable, and that have expansion capacity. These tier-one assets are backed up by idle tier-two assets and what we think is the best exploration portfolio that leverages existing infrastructure. We are vertically integrated across the nuclear fuel cycle. We have locked in significant value for the fuel services segment of our business in the recent price transition in the conversion market and we are exploring opportunities to further our reach in the nuclear fuel cycle and in innovative, non-traditional commercial uses of nuclear power in Canada and around the world.

“We believe we have the right strategy to achieve our vision of ‘energizing a clean-air world’ and we will do so in a manner that reflects our values. Embedded in all our decisions is a commitment to addressing the environmental, social and governance risks and opportunities that we believe will make our business sustainable over the long term.”

- Q2 net earnings of $84 million; adjusted net earnings of $72 million: Results are driven by normal quarterly variations in contract deliveries and the continued execution of our strategy, including the operational readiness activities to reach planned tier-one production by 2024. Adjusted net earnings is a non-IFRS measure, see below.

- Strong performance in the uranium and fuel services segments: Second quarter results reflect the impact of higher average realized prices in both the uranium and fuel services segments under our long-term contract portfolio. In our uranium segment we produced 2.8 million pounds (our share) during the quarter and delivered 7.6 million pounds at an average realized price 41% higher than the same period last year. In our fuel services segment average realized prices were 8% higher than in the second quarter of 2021.

- Contracting success continues while maintaining leverage to higher prices: In our uranium segment, since the beginning of 2022, we have been successful in adding over 45 million pounds to our portfolio of long-term uranium contracts. Nevertheless, we maintain leverage to higher prices with significant unencumbered future productive capacity and a large and growing pipeline of uranium business under discussion. However, we are being strategically patient in our discussions to capture as much value as possible in our contract portfolio. In addition, we are focusing our efforts on capturing the improved pricing for our UF6 conversion services under long-term contracts.

- Cigar Lake ownership increase: As announced in May, we along with Orano acquired Idemitsu Canada Resources Ltd.’s 7.875% participating interest in the Cigar Lake Joint Venture. Our ownership stake in Cigar Lake now stands at 54.547%, 4.522 percentage points higher than it was prior to the transaction.

- Cigar Lake production update: We have been successful in catching up on development work that had been deferred from 2021 and now expect to produce 18 million pounds at Cigar Lake (100% basis) in 2022; our share including our increased ownership is approximately 9.5 million pounds.

- Update to operational readiness for McArthur River/Key Lake: During the quarter we continued to advance the recruitment, training and operational readiness activities at the McArthur River mine and Key Lake mill. We expensed the operational readiness costs directly to cost of sales, which totaled approximately $45 million during the quarter. There are now approximately 670 employees and long-term contractors employed at the mine and mill. When we resume operations later this year, we expect to have approximately 850 employees and long-term contractors. Our operational readiness activities are transitioning from construction to early-stage commissioning of our mining and milling circuits at McArthur River and Key Lake. Critical automation and digitization projects are being tied into existing infrastructure. In addition, asset condition assessments and subsequent repair and reassembly of all equipment is winding down. However, we have seen some delays to our work schedule at the Key Lake mill. We have encountered some challenges with respect to the availability of critical materials, equipment and skills. In addition, after four years on care and maintenance, we have experienced some normal commissioning issues as we work to safely and systematically integrate the existing and new assets with updated operating systems. We have adjusted our schedule to accommodate these delays and anticipate first production will be deferred to later in the fourth quarter. As a result, we are expecting up to 2 million pounds production (100% basis) this year.

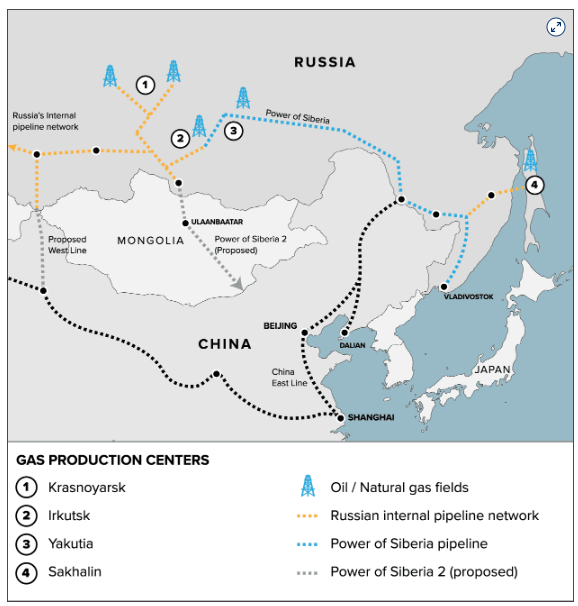

- JV Inkai shipments still delayed: We continue to work with Inkai and our joint venture partner, Kazatomprom, to secure an alternate shipping route that doesn’t rely on Russian rail lines or ports. In the meantime, we continue to delay shipment of our share of Inkai production destined for our Blind River refinery. Year-to-date we have taken no deliveries from our share of Inkai’s 2022 production. While the work on enabling shipping via the Trans-Caspian route continues, we have no confirmed date for when the first shipment with our share of Inkai’s production will proceed via that route. Should JV Inkai be unable to execute its sales transactions due to its inability to ship our share of its 2022 production, our 2022 equity earnings and our dividend may be impacted, depending on how and when the issue is resolved.

- Strong balance sheet: As of June 30, 2022, we had $1.4 billion in cash and cash equivalents and short-term investments and $997 million in long-term debt. In addition, we have a $1 billion undrawn credit facility.

- 2022 outlook updated: The split between Cigar Lake and McArthur River/Key Lake has changed as noted above however, overall, our share of production from our tier-one assets remains unchanged at up to 11 million pounds for 2022. We have updated our outlook for purchase, sales/deliveries, average realized price and direct administration costs. See Outlook for 2022 in our second quarter MD&A for more information.