Author: Consultant

-

Walmart Cuts Q2, FY Profit Outlook; Stock Down

Walmart Cuts Q2, FY Profit Outlook; Stock Down

Walmart Inc. (WMT) cut its profit outlook for the second-quarter and fiscal year 2023, saying that high food and fuel prices are hurting customer’s ability to spend on general merchandise categories. The company anticipates more pressure on general merchandise in the back half.

“.. Food inflation is double digits and higher than at the end of Q1. This is affecting customers’ ability to spend on general merchandise categories and requiring more markdowns to move through the inventory, particularly apparel,” the company said in a statement.

WMT closed Monday regular trading at $132.02 down $0.19 or 0.14%. In the after-hours trading, the stock further dropped $13.12 or 9.94%.

The Retail giant projects comp sales for Walmart U.S., excluding fuel, to be about 6% for the second quarter. It is higher than previously expected with a heavier mix of food and consumables, which is negatively affecting gross margin rate.

For the second quarter, the company now expects adjusted earnings per share to decline around 8% to 9%, operating income to decline 13% to 14% and consolidated net sales growth to be about 7.5%. Analysts polled by Thomson Reuters expect the company to report earnings of $1.81 per share and revenues of $148.25 billion for the second quarter. Analysts’ estimates typically exclude special items. The company said in May that it expected earnings per share to be flat to up slightly, and consolidated net sales growth of 5%.

Net sales for the second-quarter included a headwind from currency of about $1 billion in the second quarter. Based on current exchange rates, the company expects a $1.8 billion headwind in the second half of the year.

The company maintained its expectations for Walmart U.S. comp sales growth, excluding fuel, of about 3% in the back half of the year.

Looking ahead for fiscal year 2023, the company now projects adjusted earnings per share to decline around 11% to 13%, operating income to decline 11% to 13%, and consolidated net sales growth to be about 4.5%.

Excluding divestitures, the company now anticipates adjusted earnings per share for the full year to decline 10% to 12%, operating income to decline 10% to 12% and consolidated net sales growth to be about 5.5%.

The company said in May that it projected annual earnings to decline about 1% and to be flat, excluding divestitures. It also expects consolidated net sales growth of 4 percent in constant currency and about 4.5% to 5%, excluding divestitures.

-

Gold Slips as Investors Prepare for Fed’s Jumbo Rate Hike

Gold Slips as Investors Prepare for Fed’s Jumbo Rate Hike

Gold headed back down after posting the biggest weekly gain since May as investors weighed prospects for tighter US monetary policy and concerns over an economic slowdown.

Bullion hit the lowest level since March 2021 last week, only to rebound as Treasury yields eased following poor US economic data. After raising rates in June by the most since 1994, Federal Reserve policy makers are expected to approve another 75 basis-point hike when they meet July 26-27. Second-quarter GDP data will also indicate whether the US is in a technical recession.

Gold is heading for a fourth monthly loss as Fed tightening and a stronger dollar dim its allure as a haven, overshadowing concerns about inflation and a slowdown. Over the weekend, while former Treasury Secretary Lawrence Summers cast doubt on the likelihood of a soft landing for the US, incumbent Janet Yellen said that she doesn’t see any sign the economy is in a broad recession.

Additional downward pressure on gold has come from waning investor interest, with holdings in bullion-backed exchange-traded funds ebbing for a sixth week, according to initial data compiled by Bloomberg. Hedge funds trading the Comex flipped to being net-short on gold for the first time since 2019, according to data from the Commodity Futures Trading Commission.

“Shanghai traders are accumulating silver,” TD Securities commodity strategy head Bart Melek said in an emailed note. “In sharp contrast to gold, where outflows from most major participants have translated into a liquidity vacuum.”

Spot gold fell 0.5% to $1,719.46 an ounce at 1:52 p.m. in New York. Last week, prices sunk as low as $1,680.99 on Thursday before ending the week 1.1% higher. The Bloomberg Dollar Spot Index weakened 0.1%. All other precious metals fell except platinum. Silver went 0.8% into the red. Spot palladium lead with a 1.4% fall.

-

Cars, Gas power May Retail Sales

Cars, Gas power May Retail Sales

Canadian retail sales jumped 2.2% in May, beating economists’ expectations. Good news right? Well, not really. The gain was driven more by higher prices, especially for gas, than by higher volumes.

Moreover, a preliminary estimate from Statistics Canada suggests weakness to come with sales seen rising just 0.3% in June from the month before, which CIBC economist Katherine Judge says would represent a decline in volumes.

“Indeed, with consumption to shifting towards services, while inflation erodes consumer purchasing power, demand for discretionary goods will be under more pressure ahead,” she wrote.

-

Newmont’s (NEM) Earnings and Revenues Lag Estimates in Q2

Newmont’s (NEM) Earnings and Revenues Lag Estimates in Q2

Newmont Corporation NEM reported net income from continuing operations of $379 million or 48 cents per share in second-quarter 2022, down from $640 million or 80 cents per share in the year-ago quarter.

Barring one-time items, adjusted earnings were 46 cents per share that missed the Zacks Consensus Estimate of 60 cents.

Newmont reported revenues of $3,058 million, almost flat year over year. The figure missed the Zacks Consensus Estimate by 0.5%. Higher average realized gold prices and copper sales volume were partly offset by reduced average realized co-product metal prices.

Newmont Corporation Price, Consensus and EPS Surprise

Newmont Corporation Price, Consensus and EPS Surprise Newmont Corporation price-consensus-eps-surprise-chart | Newmont Corporation Quote

Operational Highlights

Newmont’s attributable gold production in the second quarter increased roughly 3.4% year over year to around1.5 million ounces in the quarter.

Average realized prices of gold rose 0.7% year over year to $1,836 per ounce.

The company’s costs applicable to sales (CAS) for gold were $932 per ounce, up 23.4% year over year. The increase was mainly driven by higher direct operating costs resulting from higher labor costs and increased commodity inputs, including higher fuel and energy costs.

All-in sustaining costs (AISC) for gold were up 15.8% year over year to $1,199 per ounce, mainly due to higher CAS per gold equivalent ounce.

Regional Performance

North America: Second-quarter attributable gold production in North America was 316,000 ounces, down 20% year over year. Gold CAS in the region was $1,124 per ounce, up 46% year over year.

South America: Attributable gold production in South America was 210,000 ounces, up 11% year over year. Gold CAS in the region rose 36% on a year-over-year basis to $982 per ounce.

Australia: Attributable gold in the region was 366,000 ounces, up 22% year over year. Gold CAS in the region was down 7% year over year to $710 per ounce.

Africa: Production in the region totaled 243,000 ounces of gold in the quarter, up 20% year over year. Gold CAS was $838 per ounce, up 10% year over year.

Nevada: Production totaled 290,000 ounces of gold in the quarter, up 2% year over year. Gold CAS was $1,035 per ounce, up 37% year over year.

Financial Position

The company ended the quarter with cash and cash equivalents of $4,307 million, down 6% year over year. At the end of the quarter, the company had long-term debt of $5,568 million, up 11.6% year over year.

Net cash from continuing operations amounted to $1,033 million. Free cash flow totaled $514 million in the second quarter.

Outlook

For 2022, Newmont expects attributable gold production of 6 million ounces. The company also expects gold CAS to be $900 per ounce and AISC to be $1,150 per ounce.

Newmont’s cost guidance reflects the impact of lower production volumes and higher direct operating costs related to labor, energy, consumables and supplies due to sustained inflationary pressures.

Price Performance

Newmont’s shares have declined 14.9% in the past year compared with a 29.5% fall of the industry.

Zacks Investment Research

Image Source: Zacks Investment ResearchZacks Rank & Key Picks

Newmont currently carries a Zacks Rank #3 (Hold).

-

Newmont Announces Second Quarter 2022 Results

Newmont Announces Second Quarter 2022 Results

Business Wire – Mon Jul 25, 6:00AM CDT

Newmont Corporation (NYSE: NEM, TSX: NGT) (Newmont or the Company) today announced second quarter 2022 results.

SECOND QUARTER 2022 RESULTS

- Produced 1.5 million attributable ounces of gold and 330 thousand attributable gold equivalent ounces (GEO) from co-products, an increase of more than 130 thousand total gold equivalent ounces from the first quarter

- Generated $1.0 billion of cash from continuing operations and $514 million of Free Cash Flow (97 percent attributable to Newmont)*

- Reported gold Costs Applicable to Sales (CAS)* of $932 per ounce and All-In Sustaining Costs (AISC)* of $1,199 per ounce

- Adjusted Net Income (ANI) of $0.46 per share and Adjusted EBITDA of $1,149, impacted by increasing costs and declining metal prices

- Updated full-year guidance of 6.0 million ounces of attributable gold production, CAS of $900 per ounce and AISC of $1,150 per ounce; reaffirmed original guidance of 1.3 million gold equivalent ounces from copper, silver, lead and zinc with updated co-product cost guidance of $750 per GEO of CAS and $1,050 per GEO of AISC**

- Updated full-year guidance for development capital spend to $1.1 billion; Provided trends on development capital costs and timeline related to Tanami Expansion 2 and Ahafo North

- Declared second quarter dividend of $0.55 per share, consistent with the previous seven quarters***

- $1 billion share repurchase program to be used opportunistically in 2022, with $475 million remaining***

- Ended the quarter with $4.3 billion of consolidated cash and $7.3 billion of liquidity with a net debt to adjusted EBITDA ratio of 0.3x*

- Advancing profitable near-term projects, including Tanami Expansion 2, Ahafo North and Yanacocha Sulfides

- Completed acquisition of Sumitomo Corporation’s 5 percent interest in Yanacocha, increasing ownership in Sulfides project to 100 percent

- Maintained a clear focus on managing the critical controls that must be in place at all times to prevent fatalities; 155 thousand critical control verifications completed by leaders in the field

- Published our 2021 Sustainability Reporting Suite, including our second Annual Climate Report, prepared in accordance with the Task Force for Climate Disclosure (TCFD) framework, detailing the pathway to achieve 2030 carbon emissions reduction targets and 2050 goal

“Newmont delivered a solid second quarter performance, producing 1.5 million gold ounces and generating $514 million in free cash flow. Through our industry-leading portfolio of assets and projects, our proven integrated operating model, our balanced and disciplined approach to capital allocation and our values-driven commitment to our purpose of creating value and improving lives through sustainable and responsible mining, Newmont remains well-positioned to safely manage through the evolving and unprecedented challenges that face our industry and the world at large.”

– Tom Palmer, Newmont President and Chief Executive Officer

-

Japan slashes fiscal year GDP growth forecast to 2% on global demand slump

Japan slashes fiscal year GDP growth forecast to 2% on global demand slump

Japan’s government slashed its economic growth forecast for this fiscal year largely due to slowing overseas demand, highlighting the impact of Russia’s war in Ukraine, China’s strict COVID-19 lockdowns and a weakening global economy.

The forecast, which serves as a basis for compiling the state budget and the government’s fiscal policy, included much higher wholesale and consumer inflation estimates as surging energy and food costs and a weak yen push up prices.

The world’s third-biggest economy is now expected to expand about 2.0% in price-adjusted real terms in the fiscal year ending in March 2023, according to the Cabinet Office’s projections, presented at the Council on Economic and Fiscal Policy – the government’s top economic panel.

That marked a sharp downgrade from the government’s previous forecast of 3.2% growth released in January. The cut largely stemmed from weaker exports, which the government expects to expand 2.5% compared to 5.5% in the previous assessment.

The government projected 1.1% growth for the following fiscal year starting April 2023.

It released its projections days after the Bank of Japan downgraded expectations for growth for this fiscal year to March 2023 to 2.4% from 2.9% three months ago, and underscored the central bank’s stance to maintain massive stimulus even as several other economies have started to hike rates to curb inflation.

The government forecast overseas demand to subtract real gross domestic product by 0.3 percentage point for the current fiscal year, compared to an expected 0.2 percentage point boost seen previously.

It projected overall consumer inflation, which includes volatile fresh food and energy costs, at 2.6% for this fiscal year compared to 0.9% expected in the previous assessment in January.

Wholesale inflation was estimated at 9.8% for this fiscal year, much higher than 2.0% projected in January, as higher oil and food prices and a weaker yen pushed up raw material cost.

The higher consumer inflation was not expected to weigh greatly on private consumption as stronger spending on services such as travel was seen boosting this fiscal year’s economic growth, a Cabinet Office official said.

For fiscal 2022 and fiscal 2023, the Cabinet Office forecast nominal economic growth of 2.1% and 2.2%, respectively. Higher nominal growth estimates point to government expectations for greater tax revenue.

-

GM, Ford confront Wall Street’s recession fears

GM, Ford confront Wall Street’s recession fears

General Motors Co and Ford Motor Co are about to replay a script they have played out many times before – trying to convince investors they can get through a recession without skidding into the red.

Analysts have been cutting share price targets and profit estimates for the Detroit automakers over the past several weeks, in tandem with downbeat outlooks for the global economy. High energy prices, rising interest rates, inflation, snarled supply chains and stubborn persistence of the COVID virus all bode ill for automaker profits, analysts said.

FORD MOTOR COMPANY

12.85-7.92 (-38.16%)

GENERAL MOTORS COMPANY

34.69-23.94 (-40.84%)

YEAR TO DATE

-38.16%-40.84%

DEC. 30, 2021

JULY 25, 2022

SOURCE: BARCHART

At the same time, some analysts say a recession could be mild, and demand for vehicles could recover more swiftly than in the past. One big difference from past slowdowns is that GM and Ford’s U.S. dealers are not sitting on big inventories of unsold vehicles that would have to be discounted to sell.

“We believe the set-up over a multi-year horizon is skewing more positively,” Bank of America analyst John Murphy wrote in a note, citing lean inventories and pent-up demand from consumers who held off buying as vehicles became scarce and expensive.

Both GM and Ford also have healthy balance sheets, certainly compared to the period leading up to the 2008-2009 financial market crisis that pushed GM into bankruptcy.

GM, which reports results on Tuesday morning, has stuck to its full-year profit guidance, even after disclosing that it had 95,000 vehicles in stock that it could not ship during the second quarter because of missing parts. GM said earlier this month it expects second quarter net income of $1.6 billion to $1.9 billion, below analysts’ expectations of $2.56 billion, as per Refinitiv data.

Ford also kept to its outlook for full-year operating profit of between $11.5 billion and $12.5 billion.

However, Ford is still wrestling with high costs for recalls, and heavy investments to develop more electric vehicles. Bloomberg reported last week that Chief Executive Jim Farley could order that as many as 8,000 jobs be cut from the payroll, largely in operations that support combustion vehicles.

Ford has not commented on the report. But Farley has said several times in recent months that Ford has too many people and is spending too much on quality problems.

-

More than a cultural icon: New report shows Canadian Tire has tremendous impact on country’s economy

More than a cultural icon: New report shows Canadian Tire has tremendous impact on country’s economy

Retailer is a successful business story that generated $18-billion of income for Canadians in 2021

Not many companies in Canada make it to their 100th anniversary – and even fewer do so with the respected reputation and quantifiable community impact of Canadian Tire.

“There are so many moving parts when analyzing the company’s 100-year history, which is an increasingly rare example of a successful Canadian business story,” says Philip Cross, senior fellow at the Fraser Institute, a public policy think-tank.

Cross independently reviewed Public First’s Canadian Tire Corporation Economic Impact Report, which analyzes Canadian Tire Corporation (CTC) and its Associate Dealers. CTC commissioned the report from Public First, a global strategic consultancy, to mark its centenary and explore and quantify the company’s impact on Canadian consumers, businesses, workers and communities. Data in the report was sourced by polling individuals across Canada, CTC financial statements and disclosures, and other information supplied by the corporation and its Associate Dealers.

Cross spent 36 years at Statistics Canada, the last few years as its chief economic analyst. “I’ve expressed a lot of concern in my work on the Canadian business community about the decline in innovation, and [the decline] of Canada’s business presence on the world stage,” says Cross, who wrote the foreword to the report. “We’ve seen so many iconic Canadian firms falter over the past decade. So it was a pleasure to be part of a story that highlights how Canadians can innovate and succeed.”

Cross referenced major Canadian businesses that have faltered or gone out of business entirely, such as Nortel Networks Corporation, Eaton’s and Bombardier Inc., noting that Canadian Tire, on the other hand has flourished, consistently positioned at the forefront of the country’s retail industry, even amid the arrival of U.S.-based retail giants such as Walmart Inc., Home Depot and Target Corporation.

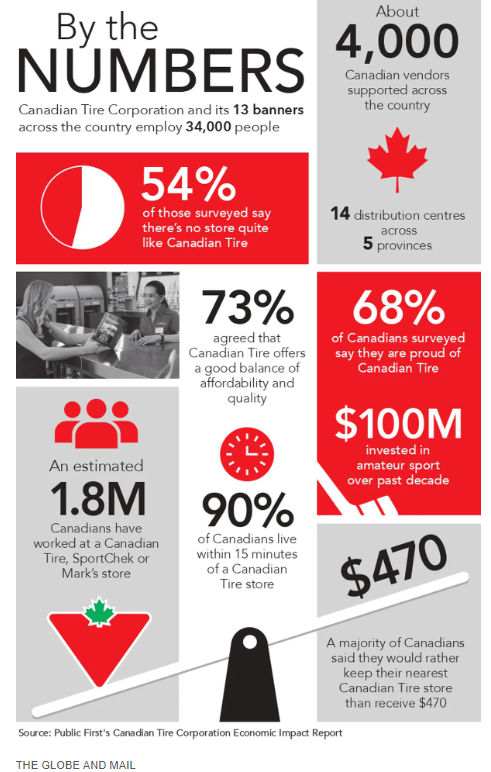

According to the findings of the Economic Impact Report, an estimated $150-billion in economic impact over the past decade has been generated by Canadian Tire Corporation and its Associate Dealers.

Today, more than 500 stores across Canada are run by a network of independent entrepreneurs known as Associate Dealers, who are responsible for creating a retail plan, hiring staff and building a business with products that meet the needs of the communities they serve. This has resulted in a significant number of Canadians finding employment; the report estimates that 1.8 million Canadians have worked at a Canadian Tire, a SportChek or a Mark’s store (both of which are part of the CTC Group of Companies) in the past.

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/S53VD5LZAZGFXOCBCXCQID4SVI.jpg)

THE GLOBE AND MAIL And Canadian Tire stores are a hub of support for other entrepreneurs and small- to medium-sized businesses. Approximately 58 per cent of Canadian Tire store customers surveyed say that they regularly shop at another business while visiting a Canadian Tire store. In total, CTC supports more than 4,000 Canadian businesses across the country. And, for every $1 in profit earned by CTC in 2021, an estimated $14 was generated for other businesses and workers across the Canadian economy.

What really stood out for Cross was the $18-billion in gross value added (GVA) in 2021, which is equivalent to approximately one per cent of gross domestic product.

“That’s significant,” he says. “Basically, it says Canadian Tire generates $18-billion of income for Canadians. To give you an appreciation of how much that is, that’s more than all of the arts, entertainment and recreation industry in this country, which is $14-billion. It’s about the same as all the crops this country produces: $17.7-billion. Auto assemblies, including parts in this country, generate $12.5-billion of income. For one company to drive that is impressive and shows just how much Canadian Tire has worked itself into the Canadian economy.”

The numbers are one way to measure the retailer’s impact. But the report also highlights the deep connection between Canadians and Canadian Tire.

From its humble beginnings in 1922 – when two young Toronto brothers, J.W. and A.J. Billes, launched their own business in car parking – Canadian Tire is one of Canada’s most beloved companies. With more than 500 retail locations nationwide, it remains the go-to destination for Canadians who are preparing for a trip outdoors, looking for new sports equipment, needing to service their car or taking on a home renovation project.

In the report’s customer testimonials, people talked about how their father bought their first bike using Canadian Tire money, or the time they got their first pair of skates, or how their local Canadian Tire is the place to find uniquely Canadian gifts for friends and family.

“I mean, obviously, being a statistician, the numbers strike me first,” Cross says. “But just as important in reading the testimonials is how much Canadian Tire has become an integral part of the fabric of Canadian life. And that’s something that you really can’t capture in numbers … just the way people identify with it as a symbol of Canada. There’s not a lot of business symbols in this country that are symbolic of Canada.”

In the report, 54 per cent of Canadians surveyed agree there is no store quite like Canadian Tire. And when people were asked which stores listed in the survey they would miss if they moved away from Canada, almost half (47 per cent) chose Canadian Tire stores.

Sixty-eight per cent say they are proud of Canadian Tire as a Canadian company. Consumers see it as one of the last remaining truly Canadian companies, a company committed to stocking its shelves with Canadian-made or -designed products, scoring high under words or statements such as “trustworthy” and “care about Canadians.”

“I mean, that’s getting under people’s fingernails,” Cross says. “That’s really connecting with people on an individual and local level.”

CTC’s commitment to responsible retailing, in particular its connection to supporting amateur sports, is a big factor in that. Hockey is Canada’s national game, and Canadian Tire is the largest hockey retailer in Canada. But sports are equally fundamental to the company’s community outreach.

In 2021, CTC and its Associate Dealers helped generate $36.7-million in charitable donations for Canadian Tire Jumpstart Charities (Jumpstart), which is dedicated to helping kids overcome barriers to accessing sport and recreation.

In the report’s polling, more than 2.5 million Canadians say that they know someone who has benefitted from Jumpstart, which has raised more than $200-million in funds since 2005.

In providing equal and inclusive access to local sports, helping communities grow and thrive, and helping children become more active, healthy and confident, the charity has contributed to the positive view Canadians have of the company.

“Being ‘Canadian’ is nice, but it isn’t enough,” Cross says. “People are not going to buy your products just because you’re Canadian. You can’t just plant a flag out front and say, this is going to make us a successful retailer.

“Canadians also want value for their money. They’re going to want you to back up the products that you sell and they’re going to want it at that competitive price. And you have to deliver on all those fronts.”

According to the report, it is estimated that Canadian Tire stores in total create $14.6-billion in consumer surplus – a measure used by economists that looks at what consumers would have been willing to pay for a product and still felt that they were getting their money’s worth.

“Canadians feel that what they are buying from Canadian Tire is giving them value almost twice as much as what they’re paying,” Cross says. “That’s value for money. That’s more than getting your money’s worth. And it’s because of that large consumer surplus that there’s this feeling that, yes, I got a real bargain, and I got more than I paid for. That’s why people go back. That’s the basis of successful retailing.”