Coachers Corner – June 2022

Coachers Corner – June 2022

Earnings Season

RTMA July 11

JPMorgan Chase says second-quarter profit fell 28% after building reserves for bad loans

https://www.cnbc.com/2022/07/14/jpmorgan-jpm-2q-2022-earnings.html

JULY 14 Dow futures fall more than 300 points as traders weigh potential for big rate hikes

Stock futures fell Thursday as traders assess the possibility of even tighter U.S. monetary policy on the back of a hot inflation report. Traders also looked ahead to earnings from major U.S. banks.

Dow Jones Industrial Average futures shed 335 points, or 1.1%. S&P 500 futures were 1.1% lower, and Nasdaq 100 futures were down 1%.

The consumer price index rose 9.1% on the year in June, higher than a Dow Jones estimate for an 8.8% year-over-year increase. Core CPI, which excludes volatile prices of food and energy, was 5.9%, also ahead of a 5.7% estimate.

In addition, the Beige Book, released Wednesday by the Fed showed worries of an upcoming recession amid high inflation.

The CPI report also impacted treasuries, sending the 2-year Treasury yield up nine basis points to about 3.138% while the yield on the 10-year Treasury fell about 4 basis points to 2.919. An inversion of the two is a popular signal of a recession.

The report also opened the door for a big Federal Reserve rate increase later this month, with the fed funds futures market now pricing in a hike of as much as 1% — or 100 basis points.

“The takeaway for investors is that Fed policy remains data-dependent and the central bank will continue on an aggressive tightening path until inflationary pressures peak decisively,” strategists at BCA Research wrote in a note. “Persistent price pressures call for another jumbo hike at the July 26-27 FOMC, but there is still room for the data to improve before the September meeting, 8 weeks later.”

Earnings season continues Thursday with JPMorgan Chase and Morgan Stanley scheduled to report before the bell on Thursday.

Weekly jobless claims and the June producer price index report, which measures prices paid to producers of goods and services, will also be released Thursday. Both reports will give further insight into the economy.

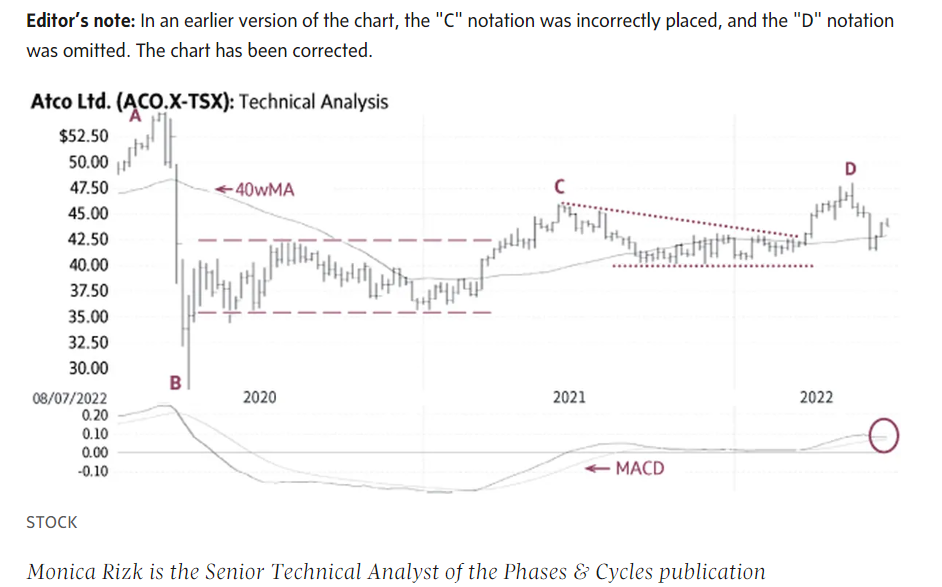

Bullish on Atco Ltd.

Atco ACO-X-T +0.80%increase (Friday’s close $44.09) had a major decline in early-2020 (A-B), followed by a recovery rally and a two-part base formation. The first part consisted of a horizontal trading range mostly between $36 and $43 (dashed lines) and after a minor rise above this range (C) it settled into a very bullish “descending triangle formation” (dotted lines). The recent breakout (D) signalled a change from a base-building pattern to the start of a rising trend. The current correction should provide a good entry level. A rise above $45 would suggest the resumption of the uptrend.

There is good support near $41-42; only a sustained decline below this level would be negative.

Point & Figure measurements provide targets of $52 and $55. Higher targets are also visible.

Cogeco Communications Q3 profit increases five per cent to $100.3-million

Cogeco Communications Inc. CCA-T says its net profit in the third quarter increased five per cent to $100.3-million on a boost in revenues.

The Montreal-based company says profit attributable to shareholders was the equivalent of $2.16 per diluted share, up from $2.01 per share or $95.7-million a year earlier.

Revenue for the three months ended May 31 was $728.1-million, up 16.6 per cent from $624.3-million in the third quarter of 2021.

American broadband services revenue increased 31.7 per cent while Canadian broadband services revenue was 2.5 per cent higher as a result of last year’s $4.6-million revenue cut from the retroactive impact of the CRTC’s decision on wholesale high-speed internet access services and organic revenue growth.

Cogeco Communications says it expects fiscal 2023 revenue will grow two to four per cent in constant dollars with net capital expenditures ranging between $750-million and $800-million, including up to $230-million to expand its footprint in Canada and the U.S.

Chief executive Philippe Jette says the results were in line with expectations despite the “increasingly challenging economic contest.”

“The financial and operational performance was in line with expectations, while the number of customer additions reflected slower activity in the industry,” he said in a news release issued after markets closed.

July 14: Before the Bell

Equities

Wall Street futures fell early Thursday as traders weigh the prospect of a more aggressive Federal Reserve and await U.S. bank earnings. Major European markets were down in morning trading. TSX futures were also weaker the day after the Bank of Canada raise rates by a full percentage point.

In the early premarket period, U.S. futures were down by roughly 1 per cent across the board. On Wednesday, the Dow, S&P and Nasdaq indexes all saw declines in the wake of a hotter-than-expected reading on inflation. The S&P/TSX Composite Index closed Wednesday’s session down 0.34 per cent.

Rate concerns continue to stalk markets after the Bank of Canada surprised by hiking its key policy rate to 2.5 per cent from 1.5 per cent. In the U.S., new figures showed the annual rate of inflation jumped to 9.1 per cent in June, raising speculation that the Fed – which raised rates by three quarters of a percentage point at its last meeting – could follow suit later this month.

“The US inflation report was ugly,” Swissquote senior analyst Ipek Ozkardeskaya said.

“A CPI figure above the 9-per-cent psychological level boosts the idea that the Federal Reserve (Fed) won’t hesitate to continue its aggressive rate increases to abate inflation,” she said. “Pricing on Fed funds futures now gives more than 80-per-cent chance for a 100 basis point hike at the next FOMC meeting, due by the end of this month.”

In this country, Bank of Canada Governor Tiff Macklem is scheduled to speak at a webinar hosted by the Canadian Federation of Independent Business later Thursday. The event is private, but a recording of the conversation will be published online this afternoon.

On the corporate side, U.S. markets get bank earnings ahead of the opening bell. JPMorgan and Morgan Stanley are scheduled to report results. Other U.S. banks, including Citigroup, will follow on Friday.

On Bay Street, Cogeco Communications Inc. reported a 5-per-cent increase in net profit to $100.3-million. The Montreal-based company says profit attributable to shareholders was the equivalent of $2.16 per diluted share, up from $2.01 per share or $95.7-million a year earlier. Revenue for the three months ended May 31 was $728.1-million, up 16.6 per cent. The results were released after the close on Wednesday.

Overseas, the pan-European STOXX 600 was down 0.95 per cent. Britain’s FTSE 100 fell 0.93 per cent. Germany’s DAX and France’s CAC 40 were off 0.86 per cent and 1.06 per cent, respectively.

In Asia, Japan’s Nikkei gained 0.62 per cent. Hong Kong’s Hang Seng slid 0.22 per cent.

Commodities

Crude prices fell in early going, weighed down by global economic concerns and a high U.S. dollar.

The day range on Brent is US$97.45 to US$100.39. The range on West Texas Intermediate is US$93.80 to US$97. Both benchmarks were down more than 2 per cent in the predawn period.

“A wrath of economic data, monthly oil reports, and President [Joe] Biden’s trip to the Mideast will weigh on oil prices, but none of this will change how tight the oil market remains right now,” OANDA senior analyst Ed Moya said.

“WTI crude might stay in the mid-US$90s for a while before it makes a return to the US$100 level.”

Crude prices were tempered Thursday by growing expectations that the Fed will hike rates even more aggressively and increased concerns about a possible recession. A higher U.S. dollar, which hit a 20-year high on Wednesday, also hit crude prices, making purchases more expensive for holders of other currencies.

In other commodities, gold prices fell 1 per cent on Thursday, as Treasury yields and the dollar rose.

Spot gold dropped 1 per cent to US$1,718.69 per ounce by early Thursday morning. U.S. gold futures also lost 1 per cent to US$1,717.70.

Currencies

The Canadian dollar reversed course after the previous session’s gains on the back of a bigger-than-expected rate increase by the Bank of Canada as its U.S. counterpart hit its highest level in two decades against a group of world currencies.

The day range on the loonie is 76.53 US cents to 77.11 US cents. The loonie was at the lower end of that spread early Thursday morning.

Canadian markets will get May manufacturing shipments early Thursday followed by remarks later in the day from Bank of Canada Governor Tiff Macklem.

On world markets, the U.S. dollar index, which weighs the greenback against a group of currencies, rose a fifth of a percent on the day to 108.500, according to figures from Reuters. The index is up 13 per cent so far this year.

The U.S. dollar advanced more than 1 per cent against the yen, pushing it above 139 yen per dollar for the first time since 1998. It was last up 1.3 per cent at 139.18 yen per U.S. dollar.

Euro fell as much as 0.5 per cent on the day and was last down 0.3 per cent at US$1.00310. On Wednesday, the euro fell below parity with the U.S. dollar for the first time in two decades.

In bonds, the yield on the benchmark 10-year note was up at 2.965 per cent in the predawn period.

Economic news

(8:30 a.m. ET) Canada’s manufacturing sales and new orders for May.

(8:30 a.m. ET) Canada’s construction investment for May.

(8:30 a.m. ET) U.S. initial jobless claims for week of July 9.

(8:30 a.m. ET) U.S. PPI Final Demand for June.

US Inflation rose 9.1% in June

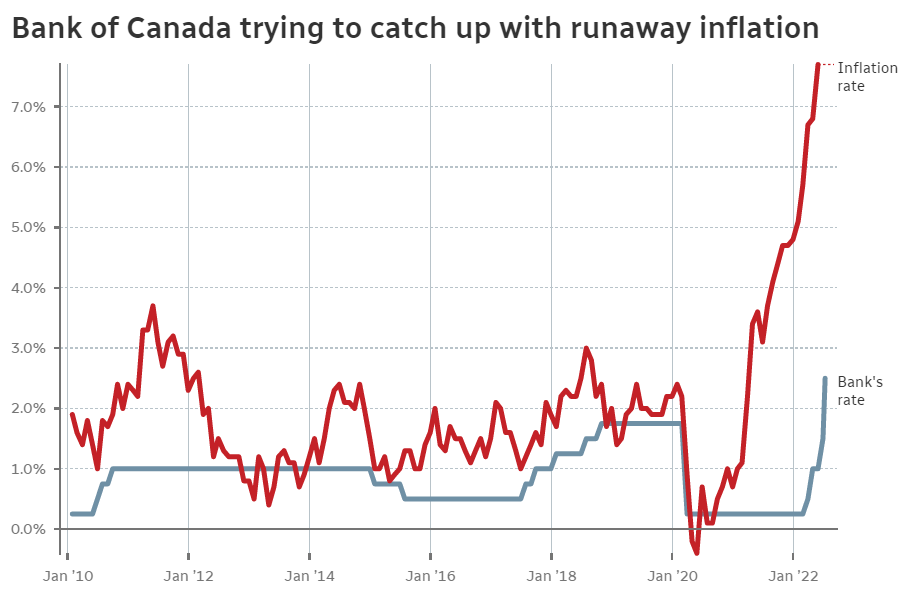

Bank of Canada hikes interest rate to 2.5% — biggest jump since 1998

The Bank of Canada has raised its benchmark interest rate by the largest amount in more than 20 years, sharply increasing the cost of borrowing in an attempt to rein in runaway inflation.

Canada’s central bank raised its benchmark interest rate Wednesday by a full percentage point to 2.5 per cent. That’s the biggest one-time increase in the bank’s rate since 1998.

The bank’s rate impacts the rate that Canadians get from their lenders on things like mortgages and lines of credit.

All things being equal, a central bank cuts the lending rate when it wants to stimulate the economy by encouraging people to borrow and invest. It raises rates when it wants to cool down an overheated economy.

After slashing its rate to record lows at the start of the pandemic, the bank has now raised its rate four times since March as part of an aggressive campaign to fight inflation, which has risen to its highest level in 40 years.

Economists had been expecting the bank to raise its rate by three-quarters of a percentage point, but the full percentage point increase was ahead of even those high expectations. And even after this record-setting increase, more hikes are expected, because of how serious the spectre of stubbornly high inflation is.

Bank of Canada governor Tiff Macklem said the bank made the decision to front-load its rate-hiking campaign because Canadians “are getting more worried that high inflation is here to stay. We cannot let that happen.”

“We are increasing our policy interest rate quickly to prevent high inflation from becoming entrenched. If it does, it will be more painful for the economy — and for Canadians — to get inflation back down,” he said, noting that the bank doesn’t expect the official inflation rate to come down to three per cent until next year, and wont get back to its two per cent target until 2024.

The impact of higher rates will be felt most directly on the housing market, as variable rate mortgages are closely tied to the central bank’s rate.

Canada’s housing market was red hot for most of the pandemic, as record low rates fuelled demand and pushed prices up to their highest levels ever. But that direction turned in the first part of this year, as the central bank’s signal that higher rates were coming took the wind out of the sails of insatiable demand.

Average prices have fallen since March across the country, the Canadian Real Estate Association says. Wednesday’s rate hike will do nothing to reverse that trend.

Existing owners on variable rate loans, and those looking to buy, will likely notice their mortgage rates go up almost immediately.

The hike is exactly what home owner Tim Capes was worried about last month when he switched his home loan from a variable rate to a fixed term.

“We felt the pain every time interest rates would go up and we’d get a letter from the bank that our mortgage would go up by a certain amount and the budget would get a tiny bit tighter,” he told CBC News in an interview.

After seeing his payment go up each time the central bank raised its rate in March, April and then June, Capes decided to bite the bullet and lock in at a fixed rate that is costing him about $700 more per payment than he was paying before, but at least comes with the certainty that it won’t change for the next five years.

“I definitely wish I had done it earlier when the rates were even lower because definitely selecting a variable in the first place was a mistake,” the Markham, Ont., resident said. “But we ultimately decided it was a mistake we could afford to correct. So we did.”

Economists are expecting several more rate hikes to come, and so is Capes.

“As those rate hikes start happening, it’s a lot easier knowing that my mortgage isn’t going up with every single rate hike.”