US pledges $200B to G7 infrastructure project to counter China’s Belt and Road Initiative (Hunter Biden….collects a % ???)

Author: Consultant

-

Prince Charles accepted suitcase with 1 million euros from Qatari sheikh, Sunday Times reports

CORRUPTION? Prince Charles accepted suitcase with 1 million euros from Qatari sheikh, Sunday Times reports

larence House said Prince Charles received charitable donations and the correct processes were followed regarding those donations after a British newspaper reported the Prince of Wales once accepted a suitcase containing €1 million ($1.05 million) in cash from a Qatari politician.

According to the Sunday Times, the suitcase containing €1 million in cash was one of three lots of cash he personally received, totaling €3 million, from former Qatari Prime Minister Sheikh Hamad bin Jassim bin Jaber Al Thani between 2011 and 2015. CNN has not independently verified The Sunday Times report.

“Charitable donations received from Sheikh Hamad bin Jassim were passed immediately to one of the Prince’s charities who carried out the appropriate governance and have assured us that all the correct processes were followed,” Clarence House told CNN in a statement.

The Sunday Times reported on one occasion, Sheikh Hamad gave Prince Charles €1 million reportedly stuffed into carrier bags from the upmarket London department store, Fortnum and Mason.

On another occasion, Prince Charles accepted a duffel bag containing €1 million during a private one-on-one meeting at Clarence House in 2015, the Sunday Times reports.

The Sunday Times reports the payments were deposited into the accounts of the Prince of Wales’s Charitable Fund (PWCF), an entity that bankrolls the prince’s private projects and his country estate in Scotland.

A royal source tells CNN they dispute many of the details in the Sunday Times report. The royal source said they do not dispute the fact of the charitable donations and asserted that all the correct processes were followed from what they have looked at, from over a decade ago. They add the report contained several mistakes, and their lawyers are involved.

There is no suggestion the payments were illegal.

-

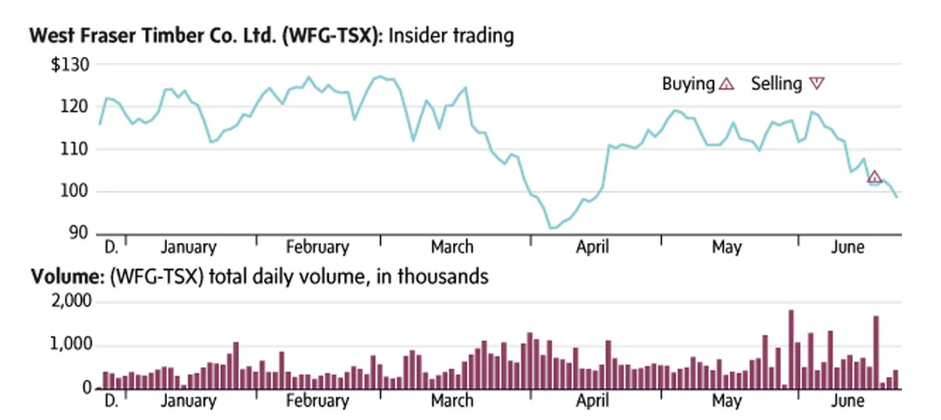

West Fraser Timber VP buys the dip

West Fraser Timber VP buys the dip

Forest product stocks have been cut down this year over fears rising bond yields will destroy housing demand. West Fraser Timber Co. Ltd. WFG-T +4.19%increase is no exception, off more than 15 per cent year-to-date. When it reported first-quarter results, West Fraser noted it has experienced transportation and logistics constraints in North America. On the positive side, West Fraser expects aging housing stock to support repair and renovation demand for lumber, plywood and oriented strand board. Meanwhile, during the recent sell-off an officer bought 2,568 shares in the public market on June 17.

-

TSX Ends On Buoyant Note On Positive Global Cues

TSX Ends On Buoyant Note On Positive Global Cues (june 24)

Published: 6/24/2022 5:52 PM ET

The Canadian stock market ended on a buoyant note on Friday, rebounding strongly after suffering its worst setbacks in three months a day earlier.

Positive global markets and higher crude oil prices helped offset concerns about inflation and rate hikes and prompted investors to indulge in hectic buying right through the day’s session.

The benchmark S&P/TSX Composite Index ended with a gain of 345.79 points or 1.85% at 19,062.91. The index touched a low of 18,828.93 and a high of 19,100.72 in the session.

All the sectoral indexes closed in positive territory. The Health Care Capped Index climbed almost 6%. The Information Technology and Energy Indexes moved up 3.73% and 3.29%, respectively. The consumer staples, industrials and materials indexes gained 2.2% to 2.3%. Communications, consumer discretionary and real estate stocks too ended with strong gains.

Tecsys Inc (TCS.TO) soared 10.5%. Docebo Inc (DCBO.TO) surged up 8.9% and MTY Food Group (MTY.TO) climbed nearly 7%. Kinaxis Inc (KXS.TO), Shopify Inc (SHOP.TO), Boyd Group Services (BYD.TO), goeasy (GSY.TO), Precision Drilling Corp (PD.TO), Cargojet (CJT.TO) and West Fraser Timber (WFG.TO) gained 4 to 8%.

BlackBerry (BB.TO) gained nearly 6% after reporting stronger than expected first quarter revenue thanks to growth in its auto products and cybersecurity services segments. The company said that revenue from its internet-of-things segment that includes its auto products grew the fastest in the first quarter at 19%, with a gross margin of 84%.

On the economic front, data from Statistics Canada showed average weekly earnings of non-farm payroll employees in Canada rose for the eleventh consecutive month in April, increasing by 4% year-on-year to C$ 1,170.1.

-

Supreme Court overturns Roe v. Wade, ending 50 years of federal abortion rights

Supreme Court overturns Roe v. Wade, ending 50 years of federal abortion rights

- Roe v. Wade had permitted abortions during the first two trimesters of pregnancy in the U.S. since 1973.

- Almost half the states are expected to outlaw or severely restrict abortion as a result of the Supreme Court’s decision.

- Roe was overturned in the court’s ruling on Dobbs v. Jackson Women’s Health Organization.

-

Canadian Stocks Tumble On Recession Fears; TSX Falls To New 52-week Low (June 23)

Canadian Stocks Tumble On Recession Fears; TSX Falls To New 52-week Low (June 23)

Canadian stocks tumbled on Thursday, pushing the benchmark S&P/TSX Composite Index to a new 52-week low, as rising possibility of a recession weighed on sentiment.

Energy stocks were under pressure as crude oil prices fell sharply on concerns about outlook for energy demand. Materials shares fell as well on weak bullion prices.

Several stocks from the financial sector declined sharply, while healthcare and technology stocks posted strong gains. Consumer staples and utilities stocks had a good outing as well.

The S&P/TSX Composite Index ended with a loss of 286.92 points or 1.51% at 18,717.12, after hitting a low of 18,661.52.

The Energy Capped Index tanked nearly 7%. MEG Energy (MEG.TO), Baytex Energy (BTE.TO), Crescent Point Energy (CPG.TO), Arc Resources (ARX.TO) and Nuvista Energy (NVA.TO) lost 10 to 12.5%. Whitecap Resources (WCP.TO), Enerplus Corp (ERF.TO), Vermilion Energy (VET.TO), Tourmaline Oil Corp (TOU.TO) and Cenovus Energy (CVE.TO) lost more than 8%.

The Materials Capped Index shed more than 5%. First Quantum Minerals (FM.TO) tanked more than 12%. Teck Resources (TECK.B.TO), Hudbay Minerals (HBM.TO), Capstone Mining (CS.TO), Nutrien (NTR.TO), Lundin Mining Corp (LUN.TO), Ero Copper (ERO.TO) and Interfor Corp (IFP.TO) were among the other major losers.

National Bank of Canada (NA.TO), Fairfax Financial Holdings (FFH.TO), Toronto-Dominion Bank (TD.TO), CDN Western Bank (CWB.TO), Canadian Imperial Bank of Commerce (CM.TO), Bank of Nova Scotia (BNS.TO), Bank of Montreal (BMO.TO) and Laurentian Bank (LB.TO) lost 2 to 4%.

The Health Care Capped Index climbed 5.1%. Tilray Inc (TLRY.TO) soared 12%. Aurora Cannabis (ACB.TO) climbed 8.8%, Canopy Growth Corp (WEED.TO) zoomed 7.3% and Cronos Group (CRON.TO) surged 6.35%. Bausch Health Companies (BHC.TO) ended stronger by nearly 3.5%.

The Information Technology Capped Index surged up 4.12%. Lightspeed Commerce (LSPD.TO) and Shopify Inc (SHOP.TO) gained 7.8% and 7.7%, respectively. Evertz Technologies (ET.TO), Hut 8 Mining (HUT.TO), Magnet Forensics (MAGT.TO) and Desartes Systems Group (DSG.TO) ended higher by 5.3 to 6.4%. Nuvei Corp (NVEI.TO), Telus International (TIXT.TO), Absolute Software (ABST.TO) and Kinaxis Inc (KXS.TO) also posted strong gains.

In economic news, manufacturing sales in Canada fell 2.5% month-over-month in May of 2022, following a 1.7% rise in April, preliminary estimates showed. Wholesale sales in Canada likely rose by 2% from a month earlier in May of 2022, following a 0.5% fall in the previous month.

-

Oil up more than $1 but set for second weekly drop on recession fears

Oil up more than $1 but set for second weekly drop on recession fears

Oil rose by more than $1 a barrel on Friday supported by tight supply, although crude was heading for a second weekly fall on concern that rising interest rates could push the world economy into recession.

U.S. Federal Reserve Chair Jerome Powell said on Thursday the central bank’s focus on curbing inflation was “unconditional”, adding to fears about more interest rate hikes that have weighed on financial markets.

Brent crude was up $1.42, or 1.3%, at $111.47 a barrel by 0952 GMT, while U.S. West Texas Intermediate (WTI) crude gained $1.29, or 1.2%, to $105.56. Both benchmarks were heading for a second weekly decline.

“Increasing recession fears appear to be prompting a culling of heavy speculative long positioning in both contracts, even as in the real world, energy tightness is as real as ever,” said Jeffrey Halley, analyst at brokerage OANDA.

Oil came close this year to an all-time high of $147 reached in 2008 as Russia’s invasion of Ukraine exacerbated tight supplies just as demand has been recovering from the COVID pandemic.

Crude has gained support from the almost total shutdown of output in OPEC member Libya due to unrest. The Libyan oil minister said on Thursday the National Oil Corporation chairman was withholding production data from him, raising doubts over figures he issued last week.

Stephen Brennock of oil broker PVM said recession fears dominated sentiment, adding: “That being said, the consensus remains that the oil market will see high demand and tight supply over the summer months, thereby limiting the downside.”

The Organization of the Petroleum Exporting Countries and its allies, known as OPEC+, meet on June 30 and are expected to stick to an earlier plan to accelerate slightly hikes in oil production in July and August, rather than provide more oil.

The latest U.S. oil inventory figures, which will give a snapshot of supply tightness in the top consumer, have been delayed to next week.

-

Saudi crown prince’s visit to Turkey signals an ‘utterly remarkable’ posture change for Erdogan

Saudi crown prince’s visit to Turkey signals an ‘utterly remarkable’ posture change for Erdogan

- Since 2020, an informal boycott on Turkish goods in Saudi Arabia has been in place, and the kingdom for a period barred travel and flights into Turkey.

- A joint statement issued following the leaders’ talks detailed a new period of bilateral ties, including the removal of trade restrictions, more scheduled talks and a possible currency swap.

- This comes as Turkey faces an economic crisis, with inflation at a record high of more than 70% and a severely depreciated currency.

-

Powell acknowledges Fed rate hikes could cause unemployment to climb

Powell acknowledges Fed rate hikes could cause unemployment to climb

Powell – who was testifying before the House Financial Services Committee as part of a regular, semi-annual update on monetary policy – said it is “certainly possible” to control inflation without causing unemployment to rise, but suggested that may not be the case.

“There is a risk that unemployment will move up, from what is a historically low level though,” the Fed head said.

Economic projections from the Fed’s June meeting show that officials expect the national unemployment rate to climb slightly over the next two years, rising from the current rate of 3.6% to 3.9% at the end of 2023 and 4.1% at the end of 2024. Powell said that an unemployment rate of that level would “still be very strong,” though it means some workers could be laid off.