Before the Bell: What every Canadian investor needs to know today

Equities

Wall Street futures fell early Wednesday after the previous session’s bounce as traders await fresh comments from Federal Reserve chair Jerome Powell. Major European markets were down, giving up gains from the previous day. TSX futures were also weaker.

In the early premarket period, futures linked to all three main U.S. indexes were underwater, with Nasdaq futures off by roughly 2 per cent. On Tuesday, the Nasdaq ended up 2.51 per cent while the S&P 500 added 2.45 per cent and the Dow gained more than 600 points. The S&P/TSX Composite Index finished up 0.38 per cent extending the rebound from Friday’s rout on gains in energy shares.

On Wednesday, markets will have a close eye on an appearance by Mr. Powell on Capitol Hill, looking for indications of how aggressive the Fed will be in hiking rates as it looks to temper high inflation.

“Jerome Powell’s semiannual testimony could turn the market mood sour again as the Fed chief is expected to reiterate his strong commitment to fighting inflation even if it means slower economy and a softer jobs market,” Swissquote senior analyst Ipek Ozkardeskaya said in an early note.

“Yesterday’s rally in stocks could be another dead cat bounce, and we may see the market painted in red in the following sessions,” she said.

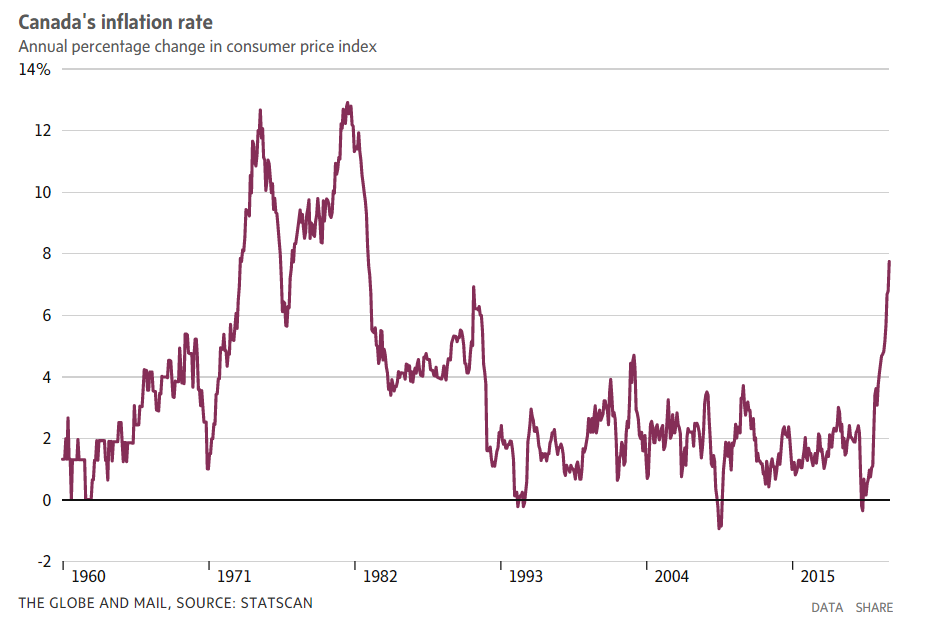

In this country, inflation is front and centre with the release of the May consumer price index figures from Statistics Canada ahead of the start of trading.

In April, the annual rate of inflation hit a decades high of 6.8 per cent and economists are expecting to see a further spike in this morning’s report. Forecasts suggest the annual rate could touch 7.4 per cent in May. Economists are increasingly expecting the Bank of Canada to hike rates at its next policy meeting by 75 basis points following a similar move recently by the Fed.

“Our economists expect Canadian CPI to have jumped yet again, to 7.4 per cent from 6.8 per cent in April, driven mainly by surging prices at the pump and grocery bills,” RBC chief currency strategist Adam Cole said.

“Pressure on energy and food prices in particular will persist. But prices are rising across the board. Almost 60 per cent of the CPI basket is growing faster than the top end of the Bank of Canada’s 1-per-cent to 3-per-cent target range.”

Inflationary pressures along with the Fed’s latest outsized move on rates raise the odds that the Bank of Canada will follow suit in July, he said.

“The pace and magnitude of future rate hikes still depends heavily on inflation going forward,” Mr. Cole said. “And roughly half of Canada’s current headline rate is driven by global rather than domestic cost pressures.”

On the corporate side, Canadian investors will get results early Wednesday from Sobeys-parent Empire Co. Ltd.

Overseas, the pan-European STOXX 600 fell 1.67 per cent morning trading. Britain’s FTSE 100 was down 1.31 per cent. Germany’s DAX and France’s CAC 40 were off 2.27 per cent and 1.78 per cent, respectively.

In Asia, Japan’s Nikkei finished down 0.37 per cent. Hong Kong’s Hang Seng dropped 2.56 per cent on weakness in tech stocks.

TSX 60 FUTURES

1,149.70-13.00 (-1.12%)

DOW FUTURES

30,173.00-352.00 (-1.15%)

S&P 500 FUTURES

3,716.75-51.00 (-1.35%)

PAST DAY

-1.12%-1.15%-1.35%4:28 A.M., JUNE 22

CLOSE, JUNE 21

5:26 A.M., JUNE 22

SOURCE: BARCHART

Commodities

Crude prices fell in early going with an expected move by U.S. President Joe Biden to ease costs for drivers tempering sentiment.

The day range on Brent is US$108.62 to US$114.45. The range on West Texas Intermediate is US$103.20 to US$109.76. Both benchmarks were down more than 4 per cent in the predawn period.

“There is a distinct lack of drivers behind this move, and certainly no headlines to justify it,” OANDA senior analyst Jeffrey Halley said.

“I surmise that President Biden’s expected announcement of a temporary suspension of Federal fuel taxes [on Wednesday] has prompted the selling, and I do note the U.S.-centric WTI contract is leading the charge lower.”

Later in the day, Mr. Biden is expected to call for a temporary suspension of the U.S. federal tax on gasoline, according to a report by Reuters. The move is aimed at addressing high costs for consumers and soaring inflationary pressures.

Later Wednesday, traders will also got the first of two weekly U.S. inventory reports, with new figures from the American Petroleum Institute. More official government figures will follow on Thursday morning.

In other commodities, gold prices slid alongside a firmer U.S. dollar.

Spot gold fell 0.3 per cent to US$1,826.41 per ounce by early Wednesday morning, extending losses to a fourth straight session. U.S. gold futures dropped 0.6 per cent to US$1,827.40.

“Although gold’s interminable range-trading continued overnight, the falls of the past three sessions hint that any upward momentum for the yellow metal is doing an Elvis and is leaving the building,” Mr. Halley said.

“Gold has been grinding lower, even as U.S. yields and the U.S. dollar trade sideways,” Mr. Halley said.

SPOT GOLD

US$1,831.30-8.50 (-0.46%)

HIGH GRADE COPPER

US$3.90-0.14 (-3.55%)

WTI

US$104.04-5.42 (-4.95%)

PAST DAY

-0.41%-3.32%-5.00%

CLOSE, JUNE 21

5:05 A.M., JUNE 22

SOURCE: BARCHART

Currencies

The Canadian dollar was weaker, hit by uncertain risk sentiment and lower commodities prices, while its U.S. counterpart advanced against a basket of world currencies.

The day range on the loonie is 76.94 US cents to 77.43 US cents.

Canadian investors will get inflation figures ahead of the start of trading with economists expecting to see another spike in price pressures.

On world markets, the U.S. dollar index, which weighs the greenback against a group of currencies, was up 0.33 per cent at 104.8, according to figures from Reuters.

The euro fell 0.4 per cent to US$1.0497.

The yen slid 0.3 per cent to 136.3 per U.S. dollar, having hit 136.71 in early trade, its lowest since October 1998, Reuters reports.

Other commodities-linked currencies were also lower. The Norwegian krone fell 1.3 per cent against the U.S. dollar. The Australian dollar slid 1.1 per cent to US$0.6898 by early Wednesday.

In bonds, the yield on the U.S. 10-year note was lower at 3.222 per cent.

CANADIAN DOLLAR/U.S. DOLLAR

US$0.7708-0.0032 (-0.4122%)

PAST DAY

PREV. CLOSE

0:00 A.M., JUNE 22

US$0.7711

5:05 A.M., JUNE 22

US$0.7708

SOURCE: BARCHART

More company news

Boeing expects supply chain problems to persist almost until the end of 2023, led by labour shortages at mid-tier and smaller suppliers, partly due to the faster-than-expected return of demand, its chief executive said on Wednesday. Boeing said last month that production of its 737 aircraft had been slowed by shortages of a single type of wiring connector, while some of its airline customers had been forced to cancel flights due to a lack of staff in the post-pandemic recovery. “The shift from demand to now supply issues … is remarkable, the speed with which it happened,” Boeing Chief Executive David Calhoun said at Bloomberg’s Qatar Economic Forum in Doha.

Economic news

(8:30 a.m. ET) Canada’s CPI for May.

(9:30 a.m. ET) U.S. Fed Chair Jerome Powell testifies to the Senate Banking Committee.

With Reuters and The Canadian Press