TD Bank’s second-quarter profit tops estimates, boosted by real estate lending and better loan margins

Author: Consultant

-

Bank of Canada 50-basis-point June 1 hike a done deal, economists say

Bank of Canada 50-basis-point June 1 hike a done deal, economists say

The Bank of Canada will hike its overnight rate by 50 basis points on June 1, according to all 30 economists polled by Reuters, who see interest rates at least a half-point higher by year-end than predicted just one month ago.

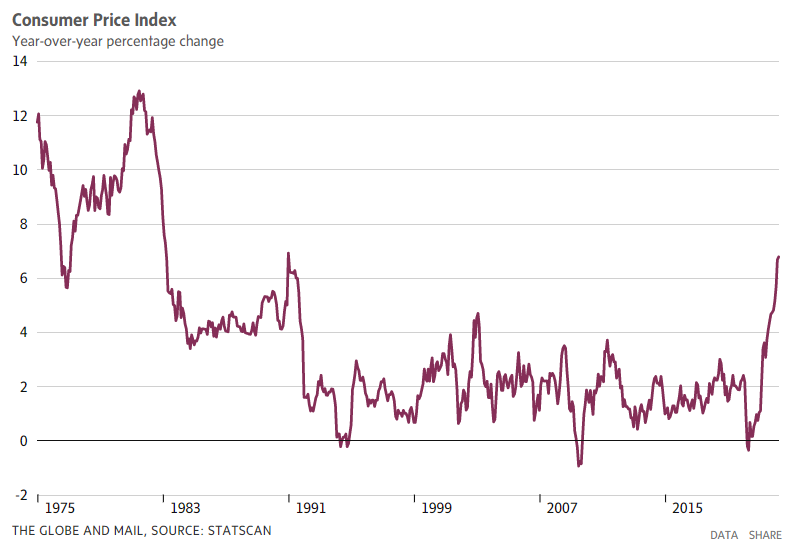

The BoC seems set to follow an aggressive path similar to that taken by the Federal Reserve to tame soaring inflation, which hit over a three-decade high of 6.8% in April and has now been above the central bank’s 1-3% range for more than a year.

After a 50 basis-point hike in April, its biggest single increase in 22 years, BoC Governor Tiff Macklem said interest rates may need to go above the neutral range – currently estimated to be between 2% and 3% – for a period of time to get inflation back to target.

The BoC was expected to lift its overnight rate by another half a percentage point at its June 1 meeting, taking its lending rate to 1.50%, according to all respondents in a May 20-25 poll. That was in line with money markets pricing.

Just a month back, economists forecasted a 25-basis-point hike in June.

“The BoC is laser-focused on taming inflation but once the overnight rate reaches a more neutral level, it will be more conscious of the potential trade-off between returning inflation expediently to target and prolonging the economic cycle,” said Josh Nye, senior economist at Royal Bank of Canada.

“We don’t expect the BoC will make monetary policy restrictive but if stubbornly high inflation forces it to do so that would amplify recession risk.”

A smaller sample of economists who answered an additional question were nearly split on whether the current tightening campaign would lead to a recession, with seven of 14 saying it would not and the remaining it would trigger one.

Canada’s economy is likely to be particularly sensitive to higher rates after Canadians borrowed heavily during the pandemic to participate in a red-hot housing market.

Thirteen of 30 respondents in the poll forecasted rates to rise to 2.25% in the third quarter, 10 expected rates to be 2.00% and six expected 2.50%. Only one economist expected rates to be 1.75% by end-September.

After that, 25 of 30 respondents expected rates to rise to 2.50% or more in the fourth quarter, including six predicting them to reach 2.75% and another six expecting rates at 3.00% by end-2022. Only four expected rates to be 2.25% and one predicted rates to be 1.75%.

Poll medians showed rates at 2.25% next quarter and 2.50% in the fourth quarter. The BoC was expected to hike rates to 2.75% in the first quarter of 2023 and stay on the sidelines at least until the end of next year.

Inflation was expected to average 5.9% this quarter before easing to 5.0% and 4.4% in the next two quarters, according to a separate poll.

While inflation was expected to cool significantly next year it was still forecast to stay above the central bank’s target until at least 2024.

“Right now, the BoC’s attention remains firmly focused on inflation. Gov. Macklem hinted that market expectations of a 50-basis-point hike in June would likely be met as he promised to restore price stability ‘forcefully’ if needed,” noted Christian Lawrence, senior cross-asset strategist at Rabobank.

“That said, the dangers of hiking into a recession are not lost on the bank, but dampening demand is the only tool they have to try to slow inflation, and that spending needs to be moderated to try to reach an equilibrium. Rising inflation expectations are a core concern,” Lawrence said.

-

US GDP contracts further in 1Q

US GDP contracts further in 1Q

The U.S. economy contracted 1.5% on an annualized basis in the first quarter of 2022, according to revised data released by the Bureau of Labor Statistics on Thursday. Economists surveyed by Refinitiv were expecting a seasonally adjusted annual contraction of 1.3%.https://6ffcdf125ec74efcdac07f5dd6bd72de.safeframe.googlesyndication.com/safeframe/1-0-38/html/container.html

The new downward revision for gross domestic product, the broadest measure of goods and services produced across the economy, comes after a previously reported 1.4% contraction. It was the first drop in GDP since the second quarter of 2020 – in the depths of the COVID-19 recession – and followed a robust 6.9% expansion in the final three months of 2021.

The contraction was partially attributed to the nation spending more on imports from other countries than it did on U.S. exports. The trade gap slashed first-quarter GDP by 3.2 percentage points. Also contributing to the weakness was a slower restocking of goods in stores and warehouses, which had built up their inventories in the previous quarter for the 2021 holiday shopping season, knocking nearly 1.1 percentage points off the January-March GDP.

FED MINUTES SUGGEST INTEREST RATE HIKES COULD COME FASTER THAN THE MARKET EXPECTS

The data comes as inflation continues to run near a 40-year high and weigh on growth, with consumer price index, a wide-ranging measure of goods and services, including food, autos, gasoline, health care and rent, rising 8.3% in April from a year ago. Prices jumped 0.3% in the one-month period from March. On a monthly basis, average hourly earnings dropped 0.1% in March, when accounting for the inflation spike. On an annual basis, real earnings dropped 2.6% in April.

Despite the slowing growth and record-high inflation, consumer spending grew 3.1% on an annual basis from January through March. Employers have also added more than 400,000 jobs for 12 straight months and the unemployment rate is near a half-century low.

The economy is widely believed to have resumed its growth in the current quarter. In a survey released this month, 34 economists told the Federal Reserve Bank of Philadelphia that they expect GDP to grow at a 2.3% annual pace from April through June and 2.5% for all of 2022. Still, their forecast marked a sharp drop from the 4.2% growth estimate for the current quarter in the Philadelphia Fed’s previous survey in February.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The nonpartisan Congressional Budget Office has projected that GDP will grow 3.1% in 2022, driven by strong consumer spending and demand for services. The budget office expects growth to slow slightly in coming years, forecasting a GDP of 2.2% in 2023 and 1.5% in 2024.

Meanwhile, the CBO expects inflation will remain elevated in the near-term, with the consumer price index expected to hit 4.7% for the entirety of 2022. While that is down slightly from the 6.7% recorded in 2021 – the highest level in four decades – it’s still significantly higher than the Federal Reserve wants. Inflation is not expected to fall to the Fed’s preferred level of 2% until 2024, according to the CBO.

Minutes from the U.S. central bank’s May 3-4 meeting released on Wednesday show that policymakers stressed the need to raise interest rates quickly in order to bring consumer prices closer to their 2% goal. Officials voted unanimously to raise the benchmark federal fund rate by 50 basis points earlier this month, and agreed that similarly sized hikes are on the table at upcoming meetings in June and July.

The Fed is banking on its ability to engineer a so-called soft landing: Raising borrowing rates enough to slow growth and cool inflation without causing a recession. Many economists, though, are skeptical that the central bank can pull it off. More than half the economists surveyed by the National Association for Business Economics foresee at least a 25% probability that the U.S. economy will sink into recession within a year.

-

Large Cap Stocks With Earnings In Next 7 Days

Earnings In Next 7 Days

-

Before the Bell: May 24

Before the Bell: What every Canadian investor needs to know today

Equities

Wall Street futures fell early Tuesday after the previous session’s broad-based rally. Major European markets were also down. TSX futures were steady as markets return to business after a long weekend.

Ahead of the North American open, futures tied to the three key U.S. indexes were all in the red, with Nasdaq futures falling nearly 2 per cent at one point. On Monday, the Nasdaq jumped 1.59 per cent while the Dow gained 1.98 per cent and the S&P/500 rose 1.86 per cent. The S&P/TSX Composite Index was closed for the Victoria Day holiday weekend.

“The equity downtrend which started in late April remains well-entrenched,” Elsa Lignos, global head of FX strategy with RBC, said.

“While days like Monday offer some relief, overnight futures are lower, this time being pinned on weaker guidance from Snap, hitting all social media stocks.”

Shares of Snapchat-owner Snap saw its shares fall 28 per cent in premarket trading at the company warned in a note to employees that the company expects to miss targets for adjusted profit and revenue in the current quarter.

In this country, investors will be awaiting earnings from Canada’s biggest banks this week. Bank of Nova Scotia and Bank of Montreal report on Wednesday. CIBC, TD Bank and RBC follow on Thursday. National Bank releases its latest results on Friday.

The Globe’s James Bradshaw reports that investors are expecting a strong quarter from the banks, but attention will be focused on the impact of rising rates as the Bank of Canada looks to continue raising borrowing costs to head off high inflation. Analysts are looking ahead for signs the rate of growth in banks’ lending could be starting to slow as rising interest rates and economic turmoil begin to eat into demand for mortgages and other new loans.

Overseas, the pan-European STOXX 600 fell 0.64 per cent by midday, off early morning lows. Britain’s FTSE 100 slid 0.14 per cent. Germany’s DAX and France’s CAC 40 were down 0.89 per cent and 0.90 per cent.

In Asia, Japan’s Nikkei finished off 0.94 per cent. Hong Kong’s Hang Seng lost 1.75 per cent.

TSX 60 FUTURES

1,228.00+8.10 (0.66%)

DOW FUTURES

31,647.00-187.00 (-0.59%)

S&P 500 FUTURES

3,930.25-40.50 (-1.02%)

PAST DAY

0.66%-0.60%-1.04%

CLOSE, MAY 20

8:03 A.M., MAY 24

SOURCE: BARCHART

Commodities

Crude prices steadied in early going as economic concerns and worries about the impact of COVID-19 restrictions in China offset tight global supply.

The day range on Brent is US$111.70 to US$113.30. The range on West Texas Intermediate is US$108.61 to US$110.54. Brent saw a modest gain on Monday while WTI was flat on the session.

“Oil prices moved sideways once again overnight, trading in relatively narrow ranges as China growth fears cap the upside of prices, while the Ukraine conflict and the refined petroleum product supply squeeze in the U.S. support the downside,” OANDA senior analyst Jeffrey Halley said in an early note.

Fears of a global recession continue to spark concern among traders. International Monetary Fund Managing Director Kristalina Georgieva said she did not expect a recession but the prospect also wasn’t off the table.

Asked at a panel at the World Economic Forum whether she expected a recession, Ms. Georgieva said: “No, not at this point. It doesn’t mean it is out of the question.”

Prices, meanwhile, were underpinned by expectations of strong demand as the U.S. heads toward the Memorial Day weekend and the likelihood of increased travel.

In other commodities, gold prices were higher as the U.S. dollar pulled back.

Spot gold was up 0.3 per cent at US$1,858.19 per ounce by early Tuesday morning, after rising to its highest since May 9 of $1,865.29 on Monday.

U.S. gold futures rose 0.4 per cent to US$1,854.40.

“The technical picture continues to remain supportive, and it seems only a marked U.S. dollar recovery will cap gold’s rally,” Mr. Halley said.

SPOT GOLD

US$1,859.40+11.60 (0.63%)

WTI

US$110.04-0.19 (-0.17%)

HIGH GRADE COPPER

US$4.29-0.06 (-1.38%)

PAST DAY

0.63%-0.23%-1.38%

CLOSE, MAY 23

8:04 A.M., MAY 24

SOURCE: BARCHART

Currencies

The Canadian dollar was lower amid tentative global risk sentiment while its U.S. counterpart hit its weakest level against a group of currencies in nearly a month.

The day range on the loonie is 78.04 US cents to 78.40 US cents.

There were no major Canadian economic releases on Monday’s calendar. Investors will get a reading on March retail sales from Statistics Canada on Thursday. Early estimates suggest a gain of 1.4 per cent for the month.

On world markets, the U.S. dollar index fell 0.3 per cent to 101.79, its lowest level since April 26, according to figures from Reuters.

The euro was up 0.4 per cent at US$1.0729 in early London trading after ECB chief Christine Lagarde said interest rates were likely to be in positive territory by the end of the third quarter.

In bonds, the yield on the U.S. 10-year note was down at 2.81 per cent in the predawn period.

CANADIAN DOLLAR/U.S. DOLLAR

US$0.7814-0.0017 (-0.2196%)

PAST DAY

PREV. CLOSE1:29 A.M., MAY 24

0:00 A.M., MAY 24

US$0.7806

8:04 A.M., MAY 24

US$0.7814

SOURCE: BARCHART

More company news

Zoom Video Communications Inc raised its full-year adjusted profit forecast on Monday, betting on robust demand from large businesses in a hybrid work environment. Revenue from Zoom’s high-paying enterprise customers jumped 31 per cent in the first quarter, representing 52 per cent of its total revenue, the company said.

Broadcom Inc is in talks to acquire cloud service provider VMware Inc in a US$60-billion deal which would further diversify the chip manufacturer’s business into enterprise software, people familiar with the matter told Reuters. Broadcom is in discussions to pay about US$140 per share in cash and stock for VMware, the sources said.

Vacation rental company Airbnb Inc will shut down all listings and experiences in mainland China from July 30, it said on Tuesday, joining a long list of Western internet platforms that have opted out of the Chinese market. The company made the announcement on its official WeChat account without elaborating on the reasons behind the decision. The San Francisco-based company said Chinese users would still be allowed to book listings and experiences abroad.

Best Buy Co Inc cut its full-year profit forecast on Tuesday, joining other major U.S. retailers to warn of an inflation hit, even as the electronics seller reported better than feared sales in the early part of the year. “Macro conditions worsened since we provided our guidance in early March which resulted in our sales being slightly lower than our expectations. Those trends have continued into Q2 and, as a result, we are revising our sales and profitability expectations for the year,” Best Buy CEO Corie Barry said.

Economic news

(9:45 a.m. ET) S&P Global PMIs for May.

(10 a.m. ET) U.S. new home sales for April. The Street is forecasting an annualized rate decline of 1.7 per cent.

(12:20 p.m. ET) U.S. Fed Chair Jerome Powell makes welcoming remarks to the National Center for American Indian Enterprise Development 2022 Reservation Economic Summit

With Reuters and The Canadian Press

-

A glimmer of hope for food prices? Indonesia lifts palm oil export ban

A glimmer of hope for food prices? Indonesia lifts palm oil export ban

London (CNN Business)Indonesia will lift a ban on exports of palm oil starting next week, a move that could ease a tight global market and relieve some of the pressure on food prices.President Joko Widodo said in a statement on Thursday that he had made the decision “based on the current supply and price of cooking oil” and in consideration of the 17 million workers employed in the Indonesian palm oil industry.Indonesia accounts for nearly 60% of global palm oil production. It banned exports late last month in a bid to maintain domestic supplies and keep prices of its staple cooking oil down. News of the ban sent Malaysian crude palm oil futures prices — the global benchmark — soaring.

Prices fell back 1% Thursday after Widodo’s announcement, according to the Malaysia stock exchange.

Higher prices have squeezed global consumers at the worst possible time. Palm oil is a key ingredient in food and cosmetics. WWF estimates that it’s used in nearly 50% of all packaged products in supermarkets.

As well as being a major producer of wheat, Ukraine is one of the world’s biggest exporters of sunflower oil — a common substitute for palm oil — but Russia’s invasion has disrupted production, according to consultancy LMC International.Droughts in South America and Canada, have also constrained supplies of soybean oil and canola oil, respectively.Spiraling global inflation and shortages of key goods have increased levels of global food insecurity.World food prices jumped to their highest levels ever in March, the Food and Agriculture Organization of the United Nations (FAO) said last month. According to its report, “war in the Black Sea region spread shocks through markets for staple grains and vegetable oils.”The FAO Food Price Index — which measures the monthly change in international prices of a basket of food commodities — was 33.6% higher than in March 2021.Prices fell back slightly in April, but the risk of a global food crisis hasn’t gone away. World Food Programme chief David Beasley said on Wednesday that failure to open the closed ports in Ukraine to get grains moving out will bring millions of people to the brink of starvation.

UN Secretary General Antonio Guterres said on Wednesday that the war in Ukraine, on top of all the other global crises, “threatens tens of millions of people with food insecurity, malnutrition, mass hunger & famine.”

-

After rocky period, Montreal’s Lightspeed says payment-processing growth could push eventual profit

After rocky period, Montreal’s Lightspeed says payment-processing growth could push eventual profit

Lightspeed Commerce Inc. LSPD-T +7.46%increase said its loss more than doubled in the latest quarter after a rocky eight months, but said it believes it’s on a path to eventual profitability amid growth in its payment-processing services.

The point-of-sale, payments and e-commerce company is used by 163,000 restaurants, retailers and hospitality providers. Its revenue grew 78 per cent to US$146.6-million in the quarter that ended in March, from US$82.4-million a year earlier, beating analysts’ consensus forecast of US$141-million.

The boost was largely driven by an increased volume of payments that Lightspeed processed as it brought on new merchants and watched the world’s retailers re-open. The average monthly revenue it receives per retailer also grew by 35 per cent, to US$270 from US$200.

But the Montreal-based software business’s loss widened to US$114.5-million in the quarter, or 77 U.S. cents per share, from US$42-million or 34 U.S. cents per share last year. But Lightspeed forecast a brighter next few years than some analysts did, with revenue of between US$740-million and US$-760-million over its next fiscal year, and an adjusted lost of US$35-million to US$40-million, equal to about 5 per cent of its revenue.

Lightspeed’s Toronto-listed shares experienced volatile trading after markets opened Thursday, at times seeing jumps of up to 4 per cent, but shares were down 0.42 per cent to $25.91 shortly before 10 a.m. ET.

“Simply put, the pandemic was not our environment,” chief executive officer Jean Paul Chauvet said on an analyst conference call Thursday morning. “What we’ve seen in the last few months was a strong return to physical everywhere.”

The company has been rocked since last September as its share price collapsed by more than 80 per cent. That month, short-seller Spruce Point Capital Management alleged it had found inconsistencies in Lightspeed’s disclosures about its customer base, its potential market and revenue per customer. The company said Spruce Point’s allegations contained “inaccuracies and mischaracterizations,” but its share price soon began to plummet. The damage was exacerbated by both the broad selloff of tech stocks and the rise of the COVID-19 Omicron variant, which threw many jursidictions’ (and retailers’) planned reopening plans into disarray.

Chief executive officer Dax Dasilva stepped down last February, four months after the short-seller report and 17 years after he first founded the company, becoming executive chairman as its president, Mr. Chauvet, took over the top job.

Investors have sent Lightspeed shares climbing in recent days, with shares up 28 per cent from the company’s year-to-date low of $20.52 on May 11 to $26.02 on the Toronto Stock Exchange at Wednesday’s close.

Following a pile of acquisitions in recent years, Lightspeed has been integrating its services for retailers and restaurants into one-stop-shop platforms since late last year, combining longtime services such as point-of-sale software with e-commerce offerings such as inventory management.

-

Canada’s inflation rate hits new 31-year high in April as grocery prices soar

Canada’s inflation rate hits new 31-year high in April as grocery prices soar

Canada’s inflation rate hit a new 31-year high in April as prices surged for groceries and other everyday items, part of broad-based price hikes that are getting tougher for people to avoid.

The Consumer Price Index rose 6.8 per cent in April from a year earlier, Statistics Canada said Wednesday, edging up from 6.7 per cent in March. It was the latest in a string of troublesome reports: Also on Wednesday, Britain said its inflation rate hit a 40-year high of 9 per cent, while in the U.S. it recently came in at 8.3 per cent.

On a monthly basis, consumer prices in Canada rose 0.6 per cent. The average of the Bank of Canada’s core measures of annual inflation – which strip out volatile items, such as gasoline, and give a better sense of underlying price pressures – jumped to 4.2 per cent from 3.9 per cent.

Explainer: What does inflation mean for the cost of living in Canada? Here’s what you need to know

Inflation is surging for many reasons, including rising commodity prices, some of which are tied to the Russia-Ukraine war; the persistence of supply-chain disruptions, such as the recent idling of some Chinese factories because of COVID-19 policies; and rampant consumer demand for some products, particularly durable goods, many of which are produced overseas.

In turn, the surge is heaping financial stress on many households. In April, the average hourly wage rose 3.3 per cent on an annual basis, or much lower than inflation – meaning, the average worker is seeing their purchasing power decline, a trend that’s been in place for several months.

“These are some eye-watering numbers,” said Royce Mendes, head of macro strategy at Desjardins Securities, in an interview. “The issue is not just that inflation is high – and in fact, persistently has been running high – it’s that the breadth of price increases is such that Canadians are having a lot of difficulty avoiding inflation.

Several financial analysts on Bay Street expect inflation to breach 7 per cent soon, in part because of rising costs at gas stations. The Bank of Canada “really should be open to doing whatever it takes to bring inflation down in the near term,” Mr. Mendes said.

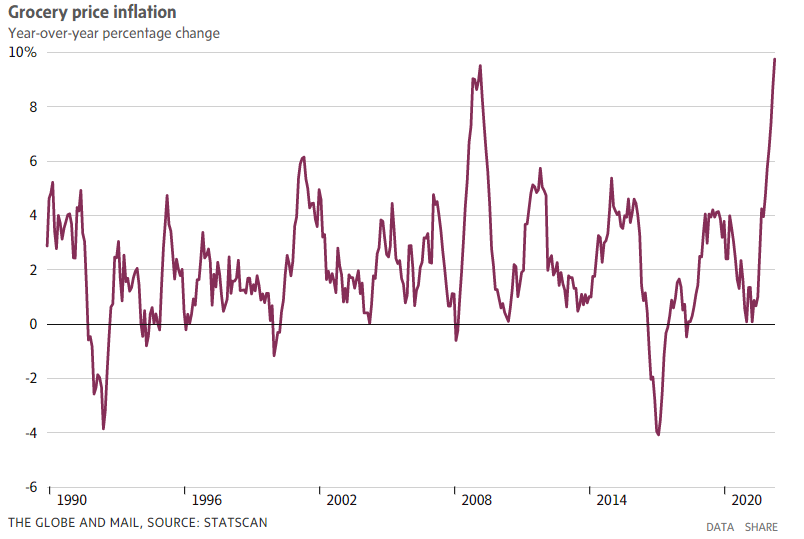

Households are getting a frequent reminder of inflation at the supermarket. Grocery prices rose 10 per cent in April, the steepest annual increase since 1981. Statscan noted that gains are “broad-based, with consumers paying more for nearly everything at the grocery store.” Over the past year, the price of pasta has risen nearly 20 per cent, fresh fruit by 10 per cent and coffee by around 14 per cent.

Statscan said that “Russia’s invasion of Ukraine in late February put upward price pressure on food products that use wheat,” on account of both countries being major wheat exporters. “Poor weather in growing regions has also impacted prices for food,” the agency said in Wednesday’s report, noting that higher costs of food production – notably, for fertilizer and natural gas – are being passed on to consumers as well.

Housing was another source of pain. Shelter costs rose 7.4 per cent, the largest annual increase in nearly four decades. In part, that was because of sharply higher prices for energy to heat homes. Rents also rose 4.5 per cent, with larger jumps in Ontario (5.3 per cent) and British Columbia (6.4 per cent).

Gasoline prices fell slightly in April, but were still up 36 per cent from a year earlier. With the national average price of gas soaring above $2 a litre this week, energy should continue to put upward pressure on inflation.

“Barring a deep dive in oil prices in coming weeks and months, we expect that the worst is yet to come on the headline readings, and that inflation north of 6 per cent will still be with us by the end of this year,” Doug Porter, chief economist at Bank of Montreal, wrote in a client note.

Central bankers face a tough task in bringing inflation under control and defending their credibility as stewards of low and stable price growth. With Wednesday’s report, the annual inflation rate has now exceeded the Bank of Canada’s target range of 1 per cent to 3 per cent for 13 consecutive months.

The Bank of Canada has embarked on its inflation-fighting process, raising its policy rate twice this year, which took it to 1 per cent from a record low of 0.25 per cent. Bank officials say they intend to raise the benchmark rate to a “neutral” range – which neither stimulates the economy nor inhibits it – of 2 per cent to 3 per cent in short order. The central bank makes its next rate decision on June 1. Financial analysts expect another outsized rate hike of half a percentage point, matching the decision in April.

Toni Gravelle, a deputy governor at the Bank of Canada, said last week that interest rates may need to be raised above neutral under some circumstances, such as persistent supply-chain issues or a strong bump in consumer demand as COVID-19 restrictions ease.

However, he also said there were scenarios in which the bank could pause its rate-hike cycle, including if financially stretched households are forced to drastically reduce their spending owing to onerous debt-servicing costs or if commodity prices start to decline.

“These considerations should make it clear that we are not on a pre-set path of policy rate increases aimed at getting to a specific ‘terminal’ rate,” Mr. Gravelle said in a speech. “Our decisions are not on autopilot.”

Mr. Mendes of Desjardins said the risk is that central bankers move too slowly in raising interest rates and that, subsequently, the public’s view of high inflation becomes entrenched. In that scenario, he said, central banks may have to aggressively raise interest rates, which could have debilitating effects on the economy.

“Every day that inflation remains more than triple the Bank of Canada’s target, it becomes more difficult to engineer a soft landing,” he said.

-

U.S. weekly jobless claims rise; continuing claims lowest since 1969

U.S. weekly jobless claims rise; continuing claims lowest since 1969

- Initial claims for state unemployment benefits increased 21,000 to a seasonally adjusted 218,000 for the week ended May 14, the highest level since January, the Labor Department said on Thursday. Economists polled by Reuters had forecast 200,000 applications for the latest week.

- Though claims have been largely treading water since hitting more than a 53-year low of 166,000 in March, the labor market is rapidly tightening and generating strong wage gains that are helping to fan overall inflation in the economy.

- There were a record 11.5 million job openings at the end of March. Claims are down from an all-time high of 6.137 million in early April 2020.