April 25 – April 29

Monday April 25

Japan department store sales

Germany business climate

(8:30 a.m. ET) Canadian wholesale trade for March.

(8:30 a.m. ET) U.S. Chicago Fed National Activity Index for Match.

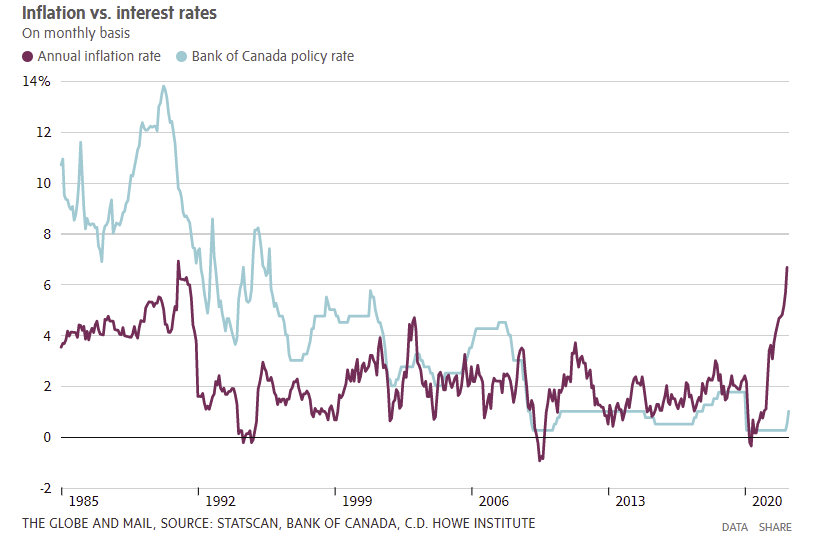

(11 a.m. ET) Bank of Canada Governor Tiff Macklem and Senior Deputy Governor Carolyn Rogers appear before the House of Commons Standing Committee on Finance

Earnings include: Coca-Cola Co.

—

Tuesday April 26

Japan jobless rate

(8:30 a.m. ET) Canadian manufacturing sales for March.

(8:30 a.m. ET) U.S durable goods and core orders for March. The Street is forecasting increases of 1.0 per cent and 0.5 per cent from February, respectively.

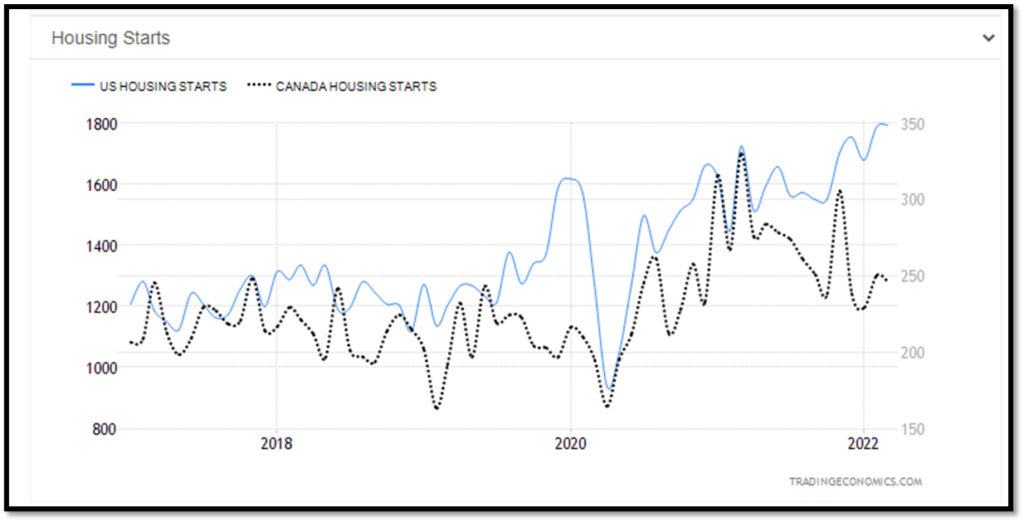

(9 a.m. ET) U.S. Case-Shiller Home Price Index (20 city) for February. Consensus is a rise of 1.5 per cent from January and 19.2 per cent year-over-year.

(9 a.m. ET) U.S. FHFA House Price Index for February. Consensus is an increase of 1.5 per cent month-over-month and 18.5 per cent year-over-year.

(10 a.m. ET) U.S. new home sales for March. Consensus is an annualized rate rise of 0.4 per cent.

(10 a.m. ET) U.S. Conference Board Consumer Confidence Index for April.

Earnings include: Air Canada; Canadian National Railway Co.; Capstone Mining Corp.; First National Financial Corp.; First Quantum Minerals Ltd.; General Electric Co.; General Motors Co.; Morguard North American Residential; PepsiCo Inc.; Raytheon Technologies Corp.; Texas Instruments Inc.; United Parcel Service Inc.; Visa Inc.; Winpak Ltd.

—

Wednesday April 27

Bank of Japan monetary policy meeting (thru Thursday)

Germany consumer confidence

(8:30 a.m. ET) U.S. goods trade deficit for March.

(8:30 a.m. ET) U.S. wholesale and retail inventories for March.

(10 a.m. ET) U.S. pending home sales for March. Consensus is a decline of 0.5 per cent from February.

(6:30 p.m. ET) Bank of Canada Governor Tiff Macklem and Senior Deputy Governor Carolyn Rogers appear before the Senate Standing Committee on Banking, Trade and Commerce

Earnings include: Aecon Group Inc.; Alamos Gold Inc.; Allied Properties REIT; Alphabet Inc.; Atco Ltd.; Boeing Co.; Canadian Pacific Railway Ltd.; Canadian Utilities Ltd.; Cenovus Energy Inc.; CGI Inc.; Choice Properties REIT; FirstService Corp.; Lundin Mining Corp.; Meta Platforms Inc; Methanex Corp.; New Gold Inc.; Norfolk Southern Corp.; PayPal Holdings Inc.; Qualcomm Corp.; Teck Resources Ltd.; T-Mobile US Inc.; Yamana Gold Inc.

—

Thursday April 28

Japan retail sales and industrial production

Germany CPI

Euro zone economic and consumer confidence

(8:30 a.m. ET) Canada’s Survey of Employment, Payrolls and Hours for February is released.

(8:30 a.m. ET) U.S. initial jobless claims for week of April 23. Estimate is 180,000, down 4,000 from the previous week.

(8:30 a.m. ET) U.S. real GDP and GDP deflator for Q1. Consensus is annualized rate rises of 1.0 per cent and 7.2 per cent, respectively.

(11 a.m. ET) U.S. Kansas City Fed Manufacturing Activity for April.

Also: Ontario budget

Earnings include: AbbVie Inc.; Agnico Eagle Mines Ltd.; AltaGas Ltd.; Amazon.com Inc.; Apple Inc.; Baytex Energy Corp.; BCE Inc.; Caterpillar Inc.; Celestica Inc.; Constellation Software Inc.; Eldorado Gold Corp.; Eli Lilly and Co.; Ford Motor Co.; Intel Corp.; McDonald’s Corp.; Merck & Co. Inc.; Microsoft Corp.; Newcrest Mining Ltd.; OceanaGold Corp.; Pason Systems Inc.; Precision Drilling Corp.; Secure Energy Services Inc.; Southern Copper Corp.; Stryker Corp.; TFI International Inc.; Twitter Inc.; West Fraser Timber Co Ltd.; Whitecap Resources Inc.

—