Broad increase in U.S. producer prices underscores tough inflation battle for Federal Reserve

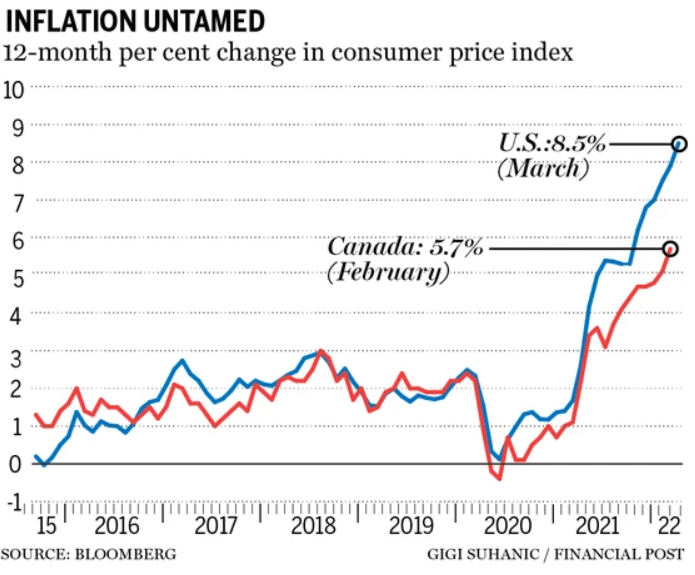

U.S. monthly producer prices increased by the most in more than 12 years in March amid strong demand for goods and services, the latest sign of persistently high inflation that could compel the Federal Reserve to aggressively tighten monetary policy.

The report from the Labor Department on Wednesday also showed strong underlying inflation pressures at the factory gate, raising doubts that a decline in the cost of goods, excluding food and energy, in March reported in Tuesday’s consumer prices data would be sustainable. Economists expect the U.S. central bank will hike rates by 50 basis points next month, and soon start trimming its asset portfolio.

“The broad-based increases reinforce yesterday’s CPI report that will keep the Fed on its aggressive tightening path in the coming months,” said Will Compernolle, a senior economist at FHN Financial in New York. “Supply chain easing, especially on the goods side of production, will be an important source of disinflation for the Fed to successfully achieve its goal of price stability.”

The producer price index for final demand increased 1.4 per cent, the largest gain since the government revamped the series in December 2009, after rising 0.9 per cent in February.

Goods prices increased 2.3 per cent, matching February’s advance. A 5.7 per cent rise in energy prices accounted for more than half of the increase in the PPI last month. There were increases in gasoline and electricity, but natural gas prices fell. Energy prices jumped 7.5 per cent in February.

Food prices climbed 2.4 per cent, though the cost of beef and veal fell 7.3 per cent. Wholesale prices of iron and steel scrap also rose, but the cost of cold rolled steel sheet and strip declined.

Inflation was initially fanned by a massive cash infusion from the government to cushion against the devastating impact of the coronavirus pandemic, which unleashed strong demand for goods and strained supply chains. Supply bottlenecks had started to ease, but progress was stalled by the Russia-Ukraine war. Renewed lockdowns in China to contain rising COVID-19 cases are also seen disrupting supply chains.

Services inflation is also building up amid the rolling back of pandemic restrictions on businesses. Wholesale services prices jumped 0.9 per cent in March after climbing 0.3 per cent in February. A 1.2 per cent rise in margins for final demand trade services, which measure changes in margins received by wholesalers and retailers, accounted for more than 40 per cent of the rise in services.

Stocks on Wall Street were higher. The dollar was steady against a basket of currencies. U.S. Treasury yields fell.

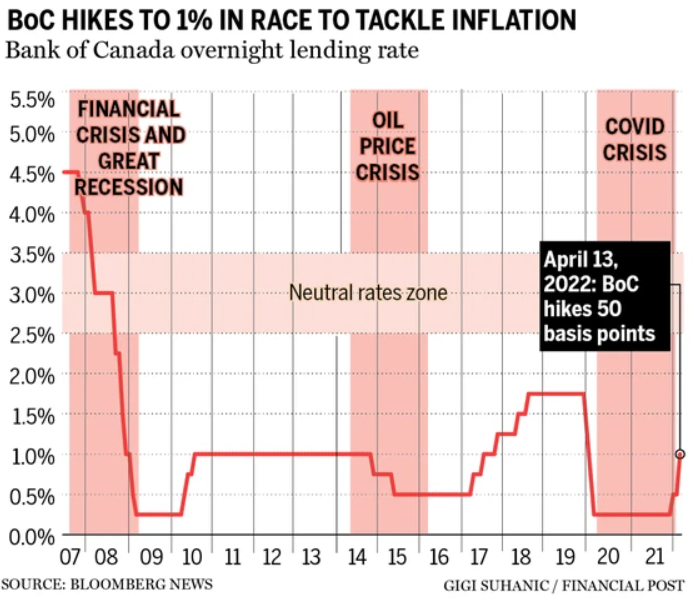

The Fed in March raised its policy interest rate by 25 basis points, the first hike in more than three years. Minutes of the policy meeting published last Wednesday appeared to set the stage for big rate increases down the road.

The cost of transportation and warehousing services also increased strongly last month. There were also gains in prices of hotel and motel accommodation, airline fares, in-patient care as well as hardware, building materials and supplies retailing.

But the cost of securities brokerage, dealing and investment advice fell 5.4 per cent. Portfolio management fees also decreased.

In the 12 months through March, the PPI jumped 11.2 per cent, the largest year-on-year increase since the current series was introduced in November 2010, after advancing 10.3 per cent in February.

Economists polled by Reuters had forecast the PPI rising 1.1 per cent and accelerating 10.6 per cent year-on-year. Excluding the volatile food, energy and trade services components, producer prices accelerated 0.9 per cent in March. The so-called core PPI increased 0.2 per cent in February. In the 12 months through March, the core PPI soared 7.0 per cent after rising 6.7 per cent in February.

The government reported on Tuesday that monthly consumer prices increased by the most in 16-1/2 years in March. But core goods prices dropped by the most in two years, restraining monthly underlying consumer inflation in March. That offered cautious hope that inflation, which by all measures has far exceeded the Fed 2 per cent target, has peaked.

Following last month’s strong core PPI readings, some economists said it was too soon talk about a sustained moderation in the monthly pace of core inflation. Based on the CPI and PPI data, economists are estimating that the core personal consumption expenditures (PCE) price index rose by about 0.3 per cent in March after climbing 0.4 per cent in February.

The core PCE price index is one of the inflation measures watched by Fed officials. It is forecast increasing by 5.3 per cent year-on-year in March after accelerating 5.4 per cent in February, which was the biggest rise since 1983.

“We would caution however that the ‘peak’ in core inflation could appear to be more of a ‘plateau’ over the coming months,” said Veronica Clark, an economist at Citigroup in New York. “While core PCE might not climb any higher on a year-on-year basis, we would increase 5%