Bank stocks are back.

After slumping throughout much of 2022 and 2023, the share prices of Canada’s Big Six have been on a tear for more than a year as fears subside over high interest rates, a weak housing market and stretched household finances.

The group has rallied 44 per cent from its recent lows in October, 2023, easily outperforming the S&P/TSX Composite Index by about 11 percentage points – all while paying attractive dividends.

But this impressive group performance masks an unusually stark divergence between leading bank stocks and laggards.

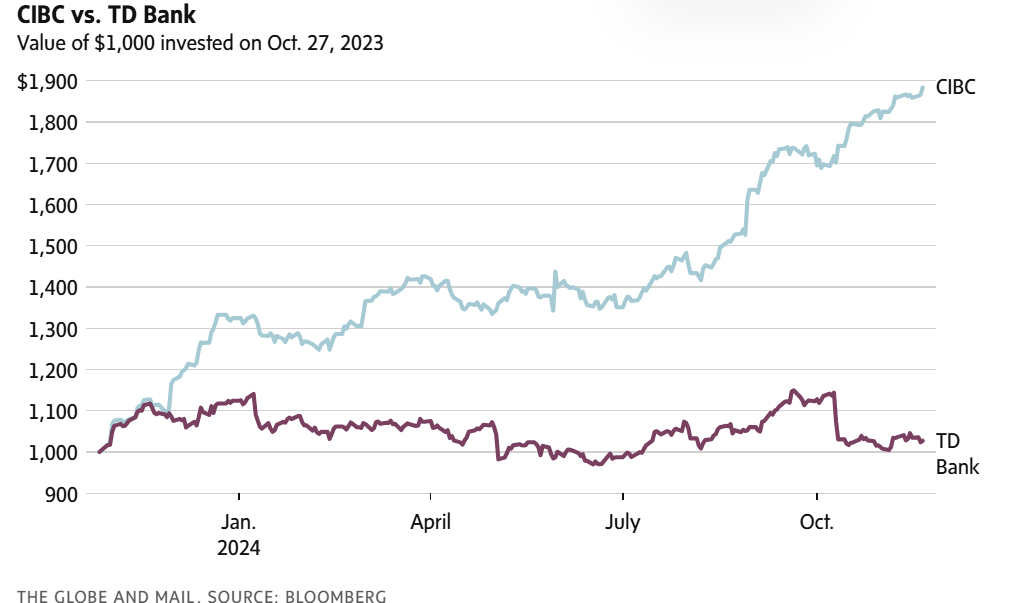

Though less than 20 percentage points often separates them, the difference has grown as wide as 85 percentage points over the past 13 months. That is a gargantuan spread for entities that are essentially in the same business of underwriting loans, managing wealth and advising on deals.

“You’re starting to see clear winners out there,” Tony Ciero, senior portfolio manager at Caldwell Securities, said in an interview.

The way he sees it, interest rates are a key source of the divergence. Some banks suffered more than others as interest rates rose through 2022 and 2023, stoking concerns about loan losses as borrowing costs soared. Now, falling rates are also rewarding banks disproportionately as some stand to benefit more than others as concerns about loan losses subside.

Canadian Imperial Bank of Commerce CM-T -0.07%decrease sits comfortably at one end of the performance spectrum, with a gain of nearly 87 per cent (not including dividends) since October, 2023. At the other end, Toronto-Dominion Bank TD-T -0.89%decrease has gained just 2 per cent over this period, to Nov. 20.

Perhaps TD can be dismissed as an outlier, after the bank’s anti-money laundering lapses culminated in a US$3-billion fine in October and a cap on the bank’s U.S. asset growth.

Even so, CIBC is nearly 60 percentage points ahead of Bank of Montreal BMO-T +0.72%increase and 45 percentage points ahead of Bank of Nova Scotia BNS-T +0.10%increase.

“Our strategy is working, and it’s working well,” Victor Dodig, CIBC’s chief executive officer, said during a conference call with analysts in late August, after the bank reported its third-quarter financial results.

But CIBC isn’t the only cylinder firing within the banking sector. Both Royal Bank of Canada RY-T -0.54%decrease and National Bank of Canada NA-T -0.30%decrease have outperformed their peers, with gains of 57 per cent and 60 per cent, respectively, further underscoring the chasm between the haves and have-nots.

So how does an investor find the next haves?

Analyst reports, which offer sophisticated approaches to stock valuations, credit health and financial forecasts, can certainly help.

But you may discover that different analysts come to different conclusions, with conflicting views about the best bet. And when analysts do agree on a favourite, overwhelming consensus can suggest that a stock has too much optimism priced in and may disappoint lofty expectations.

Consider, then, adding the following four strategies to the mix.

We’ll be the first to admit that these approaches can look a little quirky at first glance. That’s because they virtually ignore fundamental issues such as strategy, leadership, acquisitions and the economic landscapein which banks function.

But they may shed some light on what has been driving Canadian bank stocks over the past year and could serve as useful add-ons to your current approach to picking bank stocks. Think of them as extra tools in the toolbox.

Embrace the laggard

This approach is for steely-nerved number crunchers who can ignore bad news: Rank bank stocks by their performance over the past 12 months, then pick the worst performer – that’s right, the dud, the dog or whatever you want to call it – and hang on for dear life in the hope that a rebound kicks in.

It often does. Big banks are well-run, highly regulated and stable financial giants that track the Canadian economy over time. More importantly, they tend to recover from short-term setbacks relatively fast, which can turn dips into buying opportunities.

“Canada is a special market when it comes to banking because it’s an oligopoly. You just don’t have the cut-throat competition that you see in the United States,” Alexander MacDonald, a portfolio manager at GlobeInvest Capital Management, said in an interview.

According to this approach, CIBC would have stood out as a buying opportunity before the current upswing began. From October, 2022, to October, 2023, while the entire banking sector struggled with rising interest rates and a shaky economy, the lender’s share price trailed its peers with a decline of 18 per cent.

The bank’s relatively high exposure to the Canadian housing market, through its large mortgage book, looked like a risk and was likely a reason for the stock’s lacklustre performance.

One year later, though, rates have begun to decline and exposure to the Canadian housing market is no longer a dead weight. Bingo! – CIBC has emerged as the top-performing big bank stock.

Though the long-term track record for the pick-the-laggard strategy is impressive – and a safer approach involves overweighting the three underperformers and underweighting the three overperformers – keep in mind that it has endured its share of misfires when losers kept losing.

Yeah, we’re referring to Scotiabank here. The bank was the laggard in 2020 and then underperformed all but one of its peers in 2021. In 2022, the bank emerged again as the laggard and underperformed all of its peers in 2023.

Move over, Scotiabank. Today’s top laggard is TD.

Gains in its share price have trailed its peers by 53 percentage points over the past 13 months. TD is also a distant 26 percentage points behind the second-worst laggard, Bank of Montreal.

Some analysts aren’t upbeat: “We believe it will be difficult for TD to outperform its peers over the medium term, as it has limited strategic flexibility, lower earnings/dividend growth and significant cultural change coming,” Darko Mihelic, an analyst at RBC Dominion Securities, said in a mid-October note.

Clearly, the case for TD’s recovery is anything but rock-solid. But this strategy doesn’t sweat the details.

Grab the biggest dividend

If you’re looking for a simpler approach to picking bank stocks, this one is straightforward. Rank Canadian bank stocks based on dividend yield or annualized payout divided by share price. Pick the highest yield and let the quarterly distributions flow.

The simplicity rests on a solid premise: Big banks offer reliable dividends, so why not grab the biggest?

Given their modest payout ratios – they generally distribute 40 per cent to 50 per cent of their profits in dividends – and large capital buffers, “banks have a lot more capacity to absorb ups and downs in their business if there is a near-term bump in profitability,” Monica Yeung, a portfolio manager at TD Asset Management, said in an interview.

A year ago, CIBC and Bank of Nova Scotia stood out for their extra-large dividend yields of more than 7 per cent, which made both stocks look like strong buying opportunities using this approach.

However, the strategy is hit-and-miss. Yes, both stocks have soared over the past year, but Scotiabank still sits among the bottom three performers.

More problematic: bank stocks with lower dividend yields have also performed well. RBC and National Bank trail only CIBC since October, 2023, even though the two banks had the lowest dividend yields among the Big Six banks at the start of the period.

Still, with bond yields declining and guaranteed investment certificates no longer the cash geysers they once were, there’s something to be said about turning to bank stocks for a source of income. Today’s top candidates: Scotiabank – again – offers the highest dividend yield of 5.4 per cent. TD has the second-highest yield, at 5.2 per cent.

Chase dividend growth

Rather than focusing on stocks with the highest dividend yields, this strategy looks at the banks that are delivering the biggest dividend increases.

A stock with a fast-rising dividend can offer a better income stream over the longer term than a stock whose quarterly payout is stuck in neutral. As well, generous dividend increases can reflect robust financial health and strong profit growth.

National Bank has been generating the best dividend growth among the Big Six banks.

It raised its quarterly payout by 7.8 per cent over the past year. That is considerably better than the 4.1-per-cent hikes by its peers, on average. And it is a lot better than miserly Scotiabank, which did not increase its quarterly payout at all over the same period.

National Bank also leads the way over the past five years, with average dividend growth of 10.2 per cent, according to data from Bloomberg.

Beyond receiving more income, investors have also benefited from a rising share price. National Bank is up 54 per cent over the past year and has led its peers by 64 percentage points over a five-year period.

Today’s best bet using this strategy: Stick with National Bank.

Though dividend growth can’t be predicted with any certainty, investors can make an educated guess using payout ratios, which tell you how much of a bank’s profits are being distributed in the form of dividends. National Bank’s ratio is the lowest among the Big Six, at 41.2 per cent, according to bank filings.

That’s also at the low end of the bank’s objective of distributing 40 to 50 per cent its income as dividends, which suggests there’s still plenty of room for increases.

“When we think about the next cycle of dividend hikes, which should come this quarter, National Bank probably has the most capacity to increase its dividend,” Ms. Yeung said.

Pursue profit growth

Banks tend to deliver steady but unspectacular profit growth over time unless they are rebounding from a horrendous period of loan losses and economic mayhem.

But do some banks deliver more than others? You bet, and in recent years profit growth has lined up nicely with stock performance.

National Bank, the best big-bank stock over the past five years in terms of cumulative gains, also has the best annualized five-year profit growth, at 10.5 per cent. That’s about twice the pace of its nearest competition, CIBC, over the same period. These results don’t include Canadian Western Bank, which National Bank is in the process of acquiring.

But Scotiabank may be the bank to watch now. Yes, Scotiabank.

Scott Thomson, who was recruited from outside the sector to lead the bank in 2023, has a clear mandate to turn things around and make shareholders happy. To achieve that, he has set bold efficiency targets and narrowed the bank’s focus to North America, which some investors are applauding.

“The biggest attraction is the pivot in strategy,” Mr. MacDonald said.

“For years, they’ve been pouring money into Latin America, which hasn’t been working out for them. So to see them getting away from that, there’s potentially some light at the end of the tunnel,” he said.

It is making moves already. In August, Scotiabank announced a deal to buy a minority stake in KeyCorp, injecting much-needed capital that should drive the U.S. regional bank’s net interest income, which will feed into Scotiabank’s profits.

As well, Scotiabank reported that its efficiency ratio – which compares expenses to revenue (lower is better) – declined to 56 per cent in the bank’s fiscal third quarter, down from 56.5 per cent a year ago. Its goal is to bring the ratio down 50 per cent over the next several years.

And the bank leads its peers with estimated profit growth of 8.3 per cent in fiscal 2025, according to FactSet. Scoff if you want. But as the past year demonstrates, winning bank stocks can emerge from humble beginnings.