Published: 2/2/2024 5:01 AM ET |

Gold held steady on Friday after climbing in the previous session on weak U.S. labor market data.

Spot gold was marginally lower at $2,054.28 per ounce, while U.S. gold futures were virtually unchanged at $2,071.10.

Gold prices were poised for their biggest weekly gain in nine weeks as the dollar softened, and bond yields dipped on weak U.S. labor market data.

U.S. jobless claims rose last week, and fourth quarter unit labor costs undershoot forecasts while business activity in the manufacturing sector continued to contract in January, separate reports showed on Thursday.

Despite the Fed’s hawkish tone, economists continue to believe it is a matter of “when, not if” the U.S. central bank will eventually lower rates.

By RTTNews Staff Writer ✉ | Published: 2/2/2024 5:01 AM ET |

Gold held steady on Friday after climbing in the previous session on weak U.S. labor market data.

Spot gold was marginally lower at $2,054.28 per ounce, while U.S. gold futures were virtually unchanged at $2,071.10.

Gold prices were poised for their biggest weekly gain in nine weeks as the dollar softened, and bond yields dipped on weak U.S. labor market data.

U.S. jobless claims rose last week, and fourth quarter unit labor costs undershoot forecasts while business activity in the manufacturing sector continued to contract in January, separate reports showed on Thursday.

Despite the Fed’s hawkish tone, economists continue to believe it is a matter of “when, not if” the U.S. central bank will eventually lower rates.

read moreRTTNews1y   New York AG Warns Crypto Investors Against RiskyCrypto InvestmentsTop Biotech IPOs Of 2021 That Soared As Much As 500%-Share Story New York AG Warns Crypto Investors Against RiskyCrypto InvestmentsTop Biotech IPOs Of 2021 That Soared As Much As 500%-Share StoryFacebookLinkedInTwitterTelegramWhatsAppCopyAboutLogin |

CME Group’s FedWatch Tool currently indicates a relatively modest 37.5 percent chance of a March rate cut but a nearly 100 percent chance rates will be lower by early May.

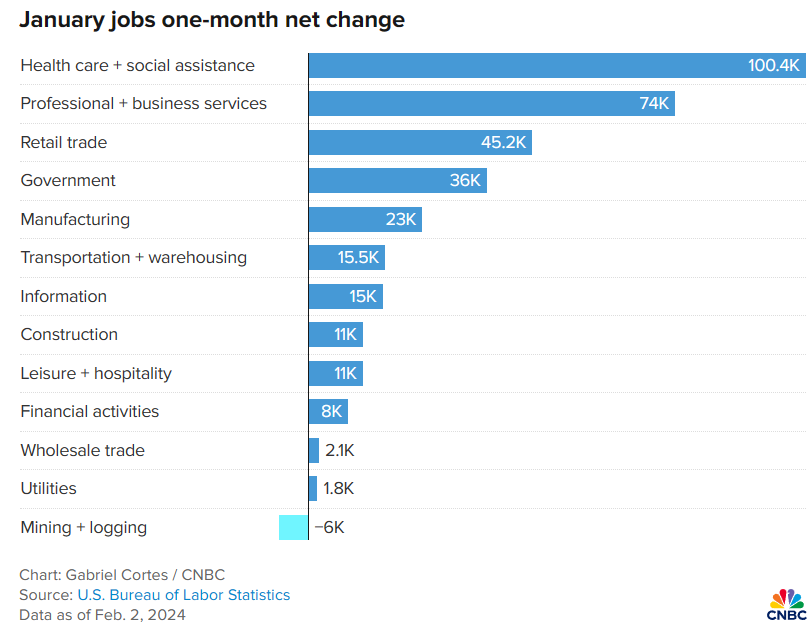

The Labour Department is scheduled to release its more closely watched report on January employment later in the day.

Economists expect employment to increase by 180,000 jobs in January after an increase of 216,000 jobs in December.

The unemployment rate is expected to inch up to 3.8 percent from 3.7 percent.

U.S. University of Michigan’s consumer sentiment results for January and factory orders figures for December are also awaited.