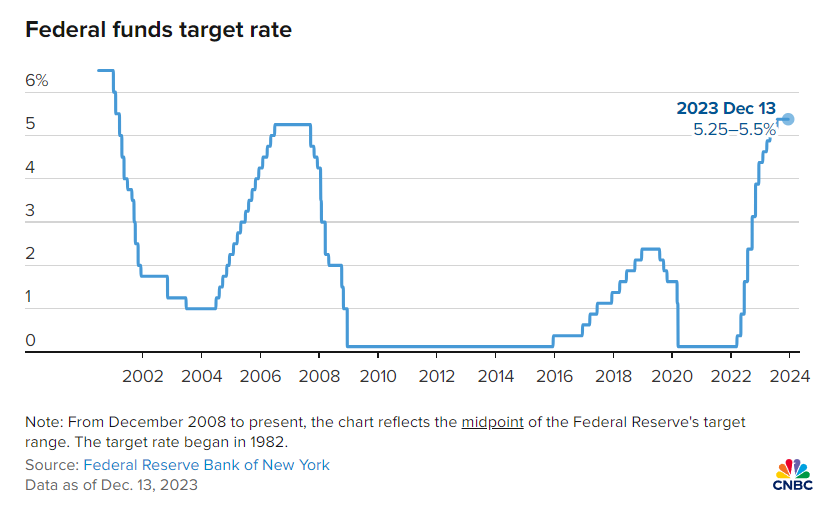

The Federal Reserve on Wednesday held its key interest rate steady for the third straight time and set the table for multiple cuts to come in 2024 and beyond.

With the inflation rate easing and the economy holding in, policymakers on the Federal Open Market Committee voted unanimously to keep the benchmark overnight borrowing rate in a targeted range between 5.25%-5.5%.

Along with the decision to stay on hold, committee members penciled in at least three rate cuts in 2024, assuming quarter percentage point increments. That’s less than market pricing of four, but more aggressive than what officials had previously indicated.

Markets had widely anticipated the decision to stay put, which could end a cycle that has seen 11 hikes, pushing the fed funds rate to its highest level in more than 22 years. There was uncertainty, though, about how ambitious the FOMC might be regarding policy easing. Following the release of the decision, the Dow Jones Industrial Average jumped more than 400 points, surpassing 37,000 for the first time.

The committee’s “dot plot” of individual members’ expectations indicates another four cuts in 2025, or a full percentage point. Three more reductions in 2026 would take the fed funds rate down to between 2%-2.25%, close to the long-run outlook, though there was considerable dispersion in the estimates for the final two years.

In a possible nod that hikes are over, the statement said that the committee would take multiple factors into account for “any” more policy tightening, a word that had not appeared previously.

Along with the interest rate hikes, the Fed has been allowing up to $95 billion a month in proceeds from maturing bonds to roll off its balance sheet. That process has continued, and there has been no indication the Fed is willing to curtail that portion of policy tightening.

Inflation ‘eased over the past year’

The developments come amid a brightening picture for inflation that had spiked to a 40-year high in mid-2022.

“Inflation has eased from its highs, and this has come without a significant increase in unemployment. That’s very good news,” Chair Jerome Powell said during a news conference.

That echoed new language in the post-meeting statement. The committee added the qualifier that inflation has “eased over the past year” while maintaining its description of prices as “elevated.” Fed officials see core inflation falling to 3.2% in 2023 and 2.4% in 2024, then to 2.2% in 2025. Finally, it gets back to the 2% target in 2026.

Economic data released this week showed both consumer and wholesale prices were little changed in November. By some measures, though, the Fed is nearing its 2% inflation target. Bank of America’s calculations indicate that the Fed’s preferred inflation gauge will be around 3.1% year over year in November, and actually could hit a 2% six-month annualized rate, meeting the central bank’s goal.

https://www.cnbc.com/2023/12/13/fed-interest-rate-decision-december-2023.html