Category: Uncategorized

-

Banking regulator asks lenders to set aside more capital as mortgage risks mount

Canada’s main banking regulator has directed lenders to hold more capital against mortgages that have seen their repayment terms extend beyond the original terms due to the record pace of interest rate hikes, to contain risks building in the system.

The country’s nearly $2-trillion mortgage market has been shaken up by the central bank’s interest rate hikes, with many homeowners only able to make interest payments, resulting in their mortgage repayment terms getting longer. This rare phenomenon, called the negative amortization, has had the regulator worried about the financial health of the banks.

The Office of the Superintendent of Financial Institutions (OSFI) announced revised capital guidelines, which kicks in next year, “will require institutions to hold more capital for mortgages where payments don’t cover the interest portion of the loan (i.e., negatively amortizing mortgages),” the regulator said in a statement on Friday.

“We believe these incremental changes add additional resilience to Canada’s financial system,” Superintendent Peter Routledge said.

To deal with the rising risks in mortgage loans, the top six banks have jointly set aside about $3.5-billion towards bad debt provisions in their latest quarterly earnings, denting their profits.

During the first nine months of the fiscal year, the banks have set aside $9.45-billion, more than four-times the amount set aside in the prior year.

Among the top six banks, Bank of Montreal, Canadian Imperial Bank of Commerce, Royal Bank of Canada and Toronto Dominion offer fixed-payment variable rate mortgage options. Bank of Nova Scotia and National Bank of Canada’s variable-rate offerings have payments that adjust upward with rates.

The Bank of Canada’s has raised interest rate to a 22-year high of 5 per cent which has pushed up variable-rate mortgages. In cases where the repayments are fixed, they largely go toward the interest portion of the loan and sometimes do not ever cover the interest owed.

The rise in global bond yields have made it more uncertain for homeowners as they brace for a shock interest rate jump in their mortgages when it is time for renewal.

OSFI has made changes to including its Capital Adequacy Requirements, Life Insurance Capital Adequacy Test, Minimum Capital Test, and Mortgage Insurer Capital Adequacy Test.

Fitch in a recent note said that the change can be “comfortably absorbed,” impacting common equity tier 1 ratios by less than 2 per cent of the average third quarter average of 13.5 per cent for the four banks with exposure.

The changes will not lead to an increase in monthly payments for consumers who currently have a mortgage, OSFI said.

For banks with a fiscal year end of Oct. 31, the revised CAR guideline is effective Nov. 1, 2023.

Shares of the big six banks have lost between roughly 3 per cent and 12 per cent of their value so far this year.

-

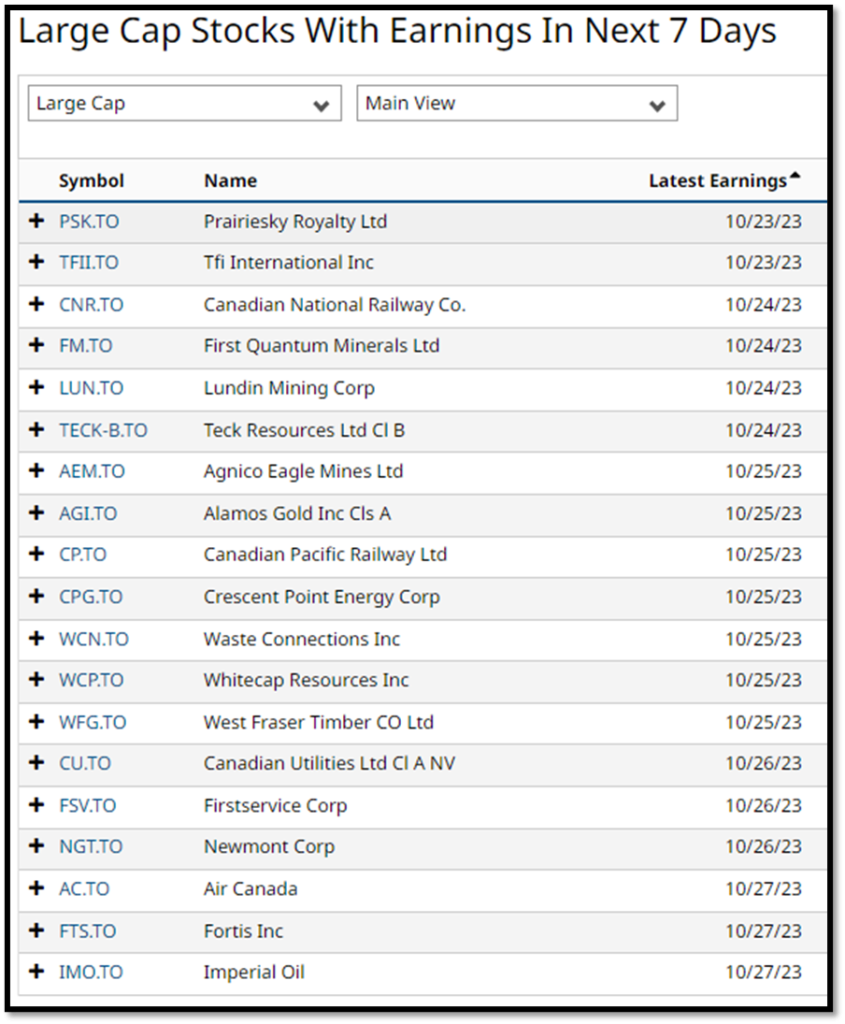

Calendar: Oct 23 – Oct 28

Monday October 23

Euro zone consumer confidence

(8:30 a.m. ET) U.S. Chicago Fed National Activity Index for September.

(2 p.m. ET) U.S. budget balance for September.

Earnings include: PrairieSky Royalty Ltd.; TFI International Inc.

—

Tuesday October 24

Japan and euro zone PMI

(8:30 a.m. ET) Canada’s new housing price index for September. Analyst estimate is flat month-over-month and down 0.8 per cent year-over-year.

(9:45 a.m. ET) U.S. S&P Global PMIs for October.

Earnings include: Alphabet Inc.; Canadian National Railway Co.; Coca-Cola Co,; Danaher Corp.; General Electric Co.; General Motors Co.; Halliburton Co.; Microsoft Corp.; Morguard North American Residential; Neighbourly Pharmacy Inc.; Nucor Corp.; Teck Resources Ltd.; Texas Instruments Inc.; Verizon Communications Inc.; Visa Inc.; 3M Inc.

—

Wednesday October 25

(10 a.m. ET) Bank of Canada policy announcement and Monetary Policy Report release with Governor Tiff Macklem’s press conference to follow.

(10 a.m. ET) U.S. new home sales for September. The Street is projecting an annualized rate increase of 1.2 per cent.

(4:35 p.m. ET) U.S. Fed Chair Jerome Powell delivers the opening remarks at the Moynihan Lecture in Social Science and Public Policy in Washington.

Earnings include: Agnico Eagle Mines Ltd.; Alamos Gold Inc.; Allied Properties REIT; Boeing Co.; Canfor Corp.; Celestica Inc.; Champion Iron Ltd.; IBM; Meta Platforms Inc.; Methanex Corp.; New Gold Inc.; Tamarack Valley Energy Ltd.; Thermo Fisher Scientific Inc.; T-Mobile US Inc.; Waste Connections Inc.; West Fraser Timber Co Ltd.; Whitecap Resources Inc.

—

Thursday October 26

ECB policy announcement with President Christine Lagarde’s press conference to follow

(8:30 a.m. ET) Canada’s Survey of Employment, Payrolls and Hours for August.

(8:30 a.m. ET) Canadian manufacturing sales for September.

(8:30 a.m. ET) U.S. initial jobless claims for week of Oct. 21. Estimate is 209,000, up 11,000 from the previous week.

(8:30 a.m. ET) U.S. real GDP and GDP deflator for Q3. Consensus forecasts are annualized rate rises of 4.4 per cent and 2.5 per cent, respectively.

(8:30 a.m. ET) U.S. goods trade deficit for September.

(8:30 a.m. ET) U.S. wholesale and retail inventories for September.

(8:30 a.m. ET) U.S. durable and core orders for September. The Street expects rises of 1.4 per cent and 0.1 percent from August, respectively.

(10 a.m. ET) U.S. pending home sales for September. Consensus is a month-over-month decline of 1.0 per cent.

(11 a.m. ET) U.S. Kansas City Manufacturing Activity Survey for October.

Earnings include: Advantage Oil & Gas Ltd.; Amazon.com Inc.; Atco Ltd.; Bristol-Myers Squibb Co.; Canadian Utilities Ltd.; Caterpillar Inc.; Eldorado Gold Corp.; FirstService Corp.; Ford Motor Co.; Honeywell International Inc.; Intel Corp.; Mastercard Inc.; Merck & Co. Inc.; Newmont Goldcorp Corp.; Shopify Inc.; United Parcel Services Inc.; Winpak Ltd.

—

Friday October 27

China industrial profits

Japan CPI

(8:30 a.m. ET) Canadian wholesale trade for September.

(8:30 a.m. ET) U.S. personal spending and income for September. The consensus projections are month-over-month increases of 0.5 per cent and 0.4 per cent, respectively.

(8:30 a.m. ET) U.S. core PCE price index for September. The Street expects a rise of 0.3 per cent from August and 3.7 per cent year-over-year.

(10 a.m. ET) U.S. University of Michigan Consumer Sentiment Survey for October.

Also: Ottawa’s budget balance for August.

Earnings include: AbbVie Inc.; Allkem Ltd.; Chevron Corp.; Exxon Mobil Corp.; Fortis Inc.; Imperial Oil Ltd.

-

Dow closes nearly 300 points lower after 10-year Treasury yield tops 5% for the first time since 2007: Live updates

Stocks retreated Friday as a surge in the 10-year Treasury yield prompted broader concerns about the state of the economy.

The S&P 500 shed 1.26% to 4,224.16 and registered its first losing week in three. The Nasdaq Composite dropped 1.53% to 12,983.81. The Dow Jones Industrial Average lost 286.89 points, or 0.86%, to end at 33,127.28, dragged down in the session by American Express following a mixed earnings report.

The yield on the benchmark 10-year Treasury crossed 5% for the first time in 16 years on Thursday, a level that could ripple through the economy by raising rates on mortgages, credit cards, auto loans and more. Not to mention, it offers investors an attractive alternative to stocks.

https://www.cnbc.com/2023/10/19/stock-market-today-live-updates.html

-

Canadian Stocks Move Sharply Lower Amid Worries About Bond Yields

Published: 10/20/2023 4:24 PM ET

Extending the pullback seen over the two previous sessions, Canadian stocks showed a significant move to the downside during trading on Friday.

After coming under pressure early in the session, the benchmark the benchmark S&P/TSX Composite Index saw further downside in late-day trading before closing down 233.17 points or 1.2 percent at 19,115.64.

Concerns about the recent surge in treasury yields continued to weigh on Canadian stocks, with the yield on the U.S.’ benchmark ten-year note climbed above 5 percent for the first time since July 2007.

The recent advance by yields reflects ongoing worries about the outlook for interest rates, with the Federal Reserve signaling rates will remain higher for longer than previously anticipated.

Fears the Israel-Hamas war may escalate into a broader regional crisis also contributed to the negative sentiment on Bay Street.

Israeli Defense Minister Yoav Gallant told troops gathered at the Gaza border on Thursday that they would soon see the Palestinian enclave “from inside.”

Additionally, reports emerged that U.S. troops are being targeted at several military bases across Iraq and Syria, while a U.S. Navy warship destroyed cruise missiles and drones fired toward Israel by Houthi rebels in Yemen.

Telecom stocks turned in some of the market’s worst performances on the day, with the S&P/TSX Capped Communications Index plunging by 2.1 percent.

Financial, utilities and real estate stocks also saw considerable weakness, while energy stocks came under pressure amid a downturn by the price of crude oil.

In Canadian economic news, a report from Statistics Canada said Canadian retail sales edged down 0.1 percent to C$66.1 billion in August.

Statistics Canada said sales were down in six of nine subsectors and were led by decreases at motor vehicle and parts dealers.

Core retail sales, which exclude gasoline stations and fuel vendors and motor vehicle and parts dealers, fell by 0.3 percent during the month.

-

Don’t lose sleep over Enbridge’s dividend

Evidently, you’re not the only investor who is nervous about Enbridge ENB-T -0.89%decrease. In the past 16 months, the pipeline operator’s shares have lost more than one-quarter of their value as dividend stocks of all kinds have been hammered by surging interest rates and fears of slowing economic growth. Enbridge’s stock, which closed Friday at $43.63 in Toronto, is now languishing about 34 per cent below its record high of more than $66, reached in 2015.

As Enbridge’s shares have slumped, its dividend yield – which moves in the opposite direction to the price – has climbed to more than 8 per cent. The yield has also gotten a boost from annual increases in the dividend, which has nearly tripled over the past decade.

Given Enbridge’s outsized yield, it’s reasonable to ask: Is the dividend safe? Or will Enbridge meet the same fate as Algonquin AQN-T -2.69%decrease, Kinder Morgan KMI-N -0.12%decrease and other former dividend-growth darlings whose rich payouts were ultimately unsustainable?

The short answer is: I don’t think you need to lose any sleep.

One reason for the recent weakness in Enbridge’s stock price is its agreement in September to acquire gas utilities in five U.S. states from U.S-based Dominion Energy Inc. D-N -1.53%decrease for US$14-billion. To help finance the acquisition, which was done at an attractive price of about 16.5 times the utilities’ earnings, Enbridge issued $4.6-billion of shares to a syndicate of underwriters in what is known as a bought deal.

However, to sell such a large chunk of stock amid less-than-favourable market conditions, the new shares were priced at $44.70 – a discount of more than 7 per cent to Enbridge’s closing price before the acquisition was announced.

Cory O’Krainetz, an analyst with Odlum Brown, called the bought deal price “disappointing.” But he said the acquisition, which will nearly double Enbridge’s lower-risk utilities business and create new avenues for growth, was “an opportunity Enbridge couldn’t refuse and … should be value accretive to shareholders. We expect Enbridge shares to trade at or below the equity offer price over the near term, but we see significant upside over the long term.”

Mr. O’Krainetz was right about Enbridge trading below the bought deal price, as the market has to absorb nearly 103 million new shares. But he’s not the only analyst who sees the gas utility acquisitions as being a good long-term fit for Calgary-based Enbridge.

The deal, which includes utilities in Ohio, North Carolina, Utah, Wyoming and Idaho, is “a unique opportunity given its scale and attractive valuation,” Robert Catellier, an analyst with CIBC World Markets, said in a note to clients. By reducing the weighting of Enbridge’s liquids pipelines business to about 50 per cent from 57 per cent, and increasing its utilities weighting to 22 per cent from 12 per cent, the acquisition accelerates Enbridge’s transition to lower-carbon energy and lowers its business risk thanks to the increase in its regulated earnings.

While Mr. Catellier acknowledged that Enbridge still faces risks related to securing the remaining funding for the transaction, he said the opportunity to invest about $1.7-billion annually in the rate base of the U.S. utilities will enhance Enbridge’s ability to achieve its target of mid-single-digit growth in EBITDA (earnings before interest, taxes, depreciation and amortization) over the next several years. Rate base is the value of assets on which a utility is permitted to earn a regulated rate of return, so an increasing rate base leads to higher earnings.

Enbridge’s growing earnings, in turn, should support future dividend increases, while preserving the company’s investment-grade credit ratings and keeping its dividend payout ratio within its target range of 60 per cent to 70 per cent of distributable cash flow per share, the company said. (Enbridge defines DCF as operating cash flow, minus preferred share dividends, maintenance capital expenditures and other unusual and non-operating items.)

Still, investors should temper their expectations for dividend growth. Until a few years ago, Enbridge was hiking its payout at double-digit percentage rates annually, but future raises will likely be in the low single digits. Mr. Catellier projects that the annual dividend will increase by 3.1 per cent to $3.66 for 2024, which is in line with the 3.2-per-cent raise that Enbridge announced last November.

So, not only does Enbridge’s dividend appear to be safe, but it will almost certainly continue to grow, albeit at a modest pace. Hopefully, you’re feeling a little less antsy now.

E-mail your questions to jheinzl@globeandmail.com.

-

TC Energy’s B.C. pipeline route bolstered by deal with Ksi Lisims LNG

An Indigenous-backed project seeking to export liquefied natural gas has signed a deal to support TC Energy Corp.’s TRP-T -0.13%decrease pipeline plans in northern British Columbia, leaving Enbridge Inc.’s ENB-T -0.20%decrease competing route in limbo.

The Nisga’a Nation, Western LNG and a group of natural gas producers called Rockies LNG are partners in their proposed Ksi Lisims LNG project near Gitlaxt’aamiks, which is home to the Nisga’a Lisims government led by elected president Eva Clayton.

Calgary-based TC Energy has been hired to work on revised designs for the planned Prince Rupert Gas Transmission (PRGT) pipeline, according to documents filed by Ksi Lisims this week to the B.C. Environmental Assessment Office. The filings are part of an application to obtain an environmental assessment certificate.

The PRGT route was originally intended to stretch nearly 900 kilometres from northeast B.C. to Lelu Island near Prince Rupert, B.C., and supply natural gas to Pacific NorthWest LNG. But Malaysia’s state-owned Petronas cancelled the Pacific NorthWest LNG joint venture in 2017.

Revisions need to be made to shorten the route so that natural gas would be transported from northeast B.C. to a site at Wil Milit on Pearse Island on the West Coast.

Ksi Lisims said its agreement with TC Energy calls for PRGT “to preserve the regulatory permits, prepare amendments for a potential delivery point to the site and develop work plans for the next phase.”

The decision by Ksi Lisims to sign the contract with TC Energy means Enbridge’s proposed Westcoast Connector Gas Transmission pipeline venture faces an uncertain future.

Enbridge spokesperson Jesse Semko said in a statement on Thursday that Westcoast Connector will continue to do work on its pipeline route. “That work includes discussing this proposed project with Indigenous groups, commercial partners and other stakeholders while simultaneously ensuring alignment with the B.C. government’s emission reduction, climate change and hydrogen strategy,” he said.

Westcoast Connector and PRGT initially received their environmental assessment certificates in 2014, and won approval for five-year extensions in 2019, giving them until Nov. 25, 2024, to “substantially start” pipeline construction.

“TC Energy would be responsible for obtaining any additional regulatory approvals, as well as potentially constructing, operating and owning this pipeline,” Ksi Lisims told the B.C. regulator.

Rockies LNG, whose president is Charlotte Raggett, is based in Calgary. Members of the group of gas producers are Birchcliff Energy Ltd., Advantage Oil & Gas Ltd., Peyto Exploration & Development Corp., NuVista Energy Ltd., Paramount Resources Ltd., Ovintiv Inc., Crescent Point Energy Corp. and Tourmaline Oil Corp., which announced this week that it will be acquiring another Rockies member, Bonavista Energy Corp.

The Nisga’a Nation, which signed a treaty in 1998, is welcoming the regulatory application by Ksi Lisims.

In March, the B.C. government introduced new environmental standards for LNG projects in a bid to spur net-zero emissions of greenhouse gases by 2030.

“We’re proud to see our net-zero project take another step forward,” Ms. Clayton said in a statement. “Ksi Lisims LNG is a once-in-a-generation opportunity for our people to build prosperity and economic independence.”

Ksi Lisims plans to use two floating facilities to produce LNG, with hydroelectricity powering motors for compressors in the liquefaction process. The project would then deploy other vessels to ship LNG to Asia, starting exports by early 2028.

“Ksi Lisims LNG will be one of the most significant Indigenous-supported industrial developments in Canadian history. The project is an example of economic reconciliation in action,” Ksi Lisims spokesperson Rebecca Scott said in a statement.

But climate activist organizations say the focus should be on renewable energy, not on fossil fuels such as natural gas and LNG. The David Suzuki Foundation and the Pembina Institute published separate studies in May that issued climate warnings about looming LNG exports from B.C.

A neighbouring First Nation, the Lax Kw’alaams, expressed doubts last year that Ksi Lisims could meet its goal of net-zero emissions. The Lax Kw’alaams band council opposes the Nisga’a-backed venture.

A portion of the proposed route for PRGT would cross the Gitxsan Nation’s unceded traditional territory.

“We appreciate the opportunity to explore the viability of this important project and will continue our engagement efforts with Indigenous and community partners as we progress discussions in this initial phase,” TC Energy spokesperson Suzanne Wilton said in an e-mail.

While revised route designs will be shorter than originally planned, PRGT would still be longer than the contentious Coastal GasLink pipeline project to be operated by TC Energy.

Coastal GasLink will be supplying the Shell PLC-led LNG Canada joint venture in Kitimat, B.C., where exports of natural gas in liquid form to Asia are slated to begin in mid-2025.

Coastal GasLink’s construction is 98 per cent completed. A group of Wet’suwet’en Nation hereditary chiefs has led a campaign to oppose Coastal GasLink, with 28 per cent of the route crossing the Wet’suwet’en’s unceded traditional territory. Wet’suwet’en hereditary chiefs say they have jurisdiction over that territory.

-

Oct 19 -TSX Closes At 2-week Low As Geopolitical Tensions, Rate Concerns Weigh

| Published: 10/19/2023 5:35 PM ET

The Canadian market closed at a two-week low on Thursday, as stocks fell amid concerns about interest rates and geopolitical tensions.

Healthcare, real estate, utilities and financials shares were among the major losers.

The benchmark S&P/TSX Composite Index ended with a loss of 101.89 points or 0.52% at 19,348.81.

Bausch Health Companies (BHC.TO) ended 5.37% down, and Tilray Inc (TLRY.TO) drifted down nearly 3%.

Real estate stocks Allied Properties (AP.UN.TO) ended nearly 6% down. Granite Real Estate (GRT.UN.TO) ended 3.5% down, while CDN Apartment (CAR.UN.TO), Riocan Real Estate (REI.UN.TO) and Killam Apartment (KMP.UN.TO) lost 2 to 2.7%.

Among the stocks in the Utilities sector, Brookfield Infra Partners (BIP.UN.TO), Innergex Renewable Energy (INE.TO), Algonquin Power and Utilities Corp (AQN.TO), Hydro One (H.TO) and Northland Power (NPI.TO) lost 1.4 to 3.2%.

Financials shares Goeasy (GSY.TO), Sun Life Financial (SLF.TO), Brookfield Corporation (BN.TO), Brookfield Asset Management (BAM.TO), Onex Corp (ONEX.TO) and EQB (EQB.TO) ended down 2.3 to 3%.

Mullen Group Ltd. (MTL.TO) gained 2.3% on strong results. The company reported a net income of $39.1 million, or $0.44 per share, for the third-quarter, up 2.9% and 7.3%, respectively, from a year-ago.

Canada Goose Holdings Inc (GOOS.TO) ended more than 4% down following a rating downgrade.

Data from Statistics Canada showed industrial producer prices in Canada rose by 0.4% in September, easing from an upwardly revised 1.9% hike in August. The Industrial Product Price Index increased 0.6% year-on-year in September following an upwardly revised flat reading in August.

Raw materials price index in Canada rose by 3.5% month-over-month in September, up from a 3% increase in August. Year-on-year, raw materials prices increased 2.4% in September.