- On Monday, Saudi Arabia said it would extend the 1-million-barrel-per-day production cut it had initially flagged for July into August.

- Unlike alliance-wide OPEC+ policy decisions, voluntary production declines do not require unanimous approval and need not be implemented by all group members.

- Some questions had surfaced over the extent to which Russia will be honoring its voluntary crude production decline pledges.

Category: Uncategorized

-

Saudi energy minister says latest Riyadh-Moscow oil cuts showed unity with Russia

-

Gold listless as investors wait for Fed’s June meeting minutes

Gold prices were flat on Tuesday in thin trading due to a U.S. holiday, while traders awaited the U.S. Federal Reserve’s minutes of the June meeting on Wednesday for more clues on its interest rate hike path ahead.

Spot gold was little changed at $1,921.39 per ounce by 0241 GMT, while U.S. gold futures were flat at $1,929.10.

Trading volume could be light due to a U.S. holiday.

“Right now the headwinds for gold are the expectations of a further 50 bps tightening, more liquidity withdrawal and rates remaining relatively elevated for some time after the Terminal value has been reached,” said Nicholas Frappell, global head of institutional markets, ABC Refinery.

Investors see a nearly 90% chance of a 25-basis-point hike in July, according to CME’s Fedwatch tool, bringing rates into the 5.25% to 5.50% range before cuts are seen after March in 2024. High interest rates discourage investment in non-yielding gold.

The dollar index held steady.

U.S. manufacturing slumped further in June to the lowest reading since May 2020 per data on Monday, yet price pressures continued to deflate since bottlenecks in the supply chain have eased considerably and higher borrowing costs dampen demand.

Markets will also watch for minutes of the June 13 to14 FOMC meeting being released on Wednesday.

While gold prices could recover to $1,940 before a potential drop lower, “the rates background remains a significant drag,” Frappell added.

Japan’s top financial diplomat Masato Kanda said authorities were in close contact with U.S. and other overseas authorities in lieu of the yen falling to a near eight-month low against the dollar last week.

The Reserve Bank of Australia’s policy decision would also be watched during the Asian market hours.

Spot silver rose 0.1% to $22.91 per ounce, platinum was up 0.6% to $912.15 while palladium jumped 2% to $1,253.95.

-

Calendar: July 3 – July 7

Monday July 3

China Caixin Manufacturing Purchasing Managers Index (PMI). Also, Japan, UK and euro area manufacturing data.

(945 am) U.S. S&P Global Manufacturing PMI for June.

(10 am ET) U.S. ISM Manufacturing PMI.

(10 am ET) U.S. construction spending.

Also: June vehicle sales

Canadian markets closed for holiday

==

Tuesday July 4

Germany trade surplus. Australia central bank monetary policy meeting.

STORY CONTINUES BELOW ADVERTISEMENT

(930 am ET) Canada S&P Global Manufacturing PMI

U.S. markets closed for holiday

==

Wednesday July 5

China, Japan, UK and Euro services PMIs. Also: Euro area producer prices and France industrial production data.

(10 am ET) U.S. factory orders. Consensus is a rise of 0.8%

(2 pm ET) U.S. FOMC Minutes from June 13-14 meeting.

==

Thursday July 6

Euro area retail sales; Germany factory orders

(815 am ET) U.S. ADP National Employment Report for June. Consensus is for the creation of 240,000 jobs, easing a bit from May’s 278,000.

(830 am ET) Canada merchandise trade balance. A surplus of $1.5-billion is expected.

(830 am ET) U.S. initial jobless claims for last week.

(830 am ET) U.S. goods and services trade deficit.

(945 am ET) U.S. S&P Globe & Services/Composite PMI for June.

(10 am ET) U.S. ISM Services PMI

(10 am ET) U.S. job openings and labor turnover survey.

==

Friday July 7

Germany industrial production and Italy retail sales reports for May.

(830 am ET) Canada employment report for June. Consensus is for net job gains of 20,000 people, with the unemployment rate holding steady at 5.2%. Average hourly wages are expected to be up 4.9%.

(830 am ET) U.S. nonfarm payrolls for June. Consensus is for net job gains of 225,000, slowing from May’s 339,000. The unemployment rate is expected to be down one notch to 3.6%. Average hourly earnings are expected to be up 4.2% from a year ago.

(10 am ET) Canada Ivey PMI

(10 am ET) Global Supply Chain Pressure Index.

Earnings include: Aritzia Inc.

-

Oil rallies on Saudi and Russian supply cuts for August

Oil rose on Monday after top exporters Saudi Arabia and Russia announced supply cuts for August, overshadowing concern over a global economic slowdown and the potential for further increases to U.S. interest rates.

Saudi Arabia on Monday said it would extend its voluntary cut of one million barrels per day (bpd) for another month to include August, the state news agency said.

Russia, seeking to nudge up global oil prices in concert with Saudi Arabia, will reduce its oil exports by 500,000 bpd in August, Deputy Prime Minister Alexander Novak said on Monday, further tightening global supplies.

The cuts amount to 1.5% of global supply and bring the total pledged by OPEC+ oil prucers to 5.16 million bpd.

Both Riyadh and Moscow have been trying to prop up prices. Brent has dropped from $113 per barrel a year ago, sent lower by concerns of an economic slowdown and ample supplies from major producers.

Brent crude futures were up 0.6%, or 43 cents at $75.84 a barrel by 1119 GMT after gaining 0.8% on Friday. U.S. West Texas Intermediate crude rose 0.7%, or 48 cents to $71.12, having gained 1.1% in the previous session.

“Investors are turning upbeat as the second half of the year kicks off; they expect tighter oil balance and buoyant equities also suggest that recession will be avoided, albeit probably narrowly,” said PVM analyst Tamas Varga.

Prices had fallen earlier in the session after business surveys showed global factory activity slumped in June, as sluggish demand in China and in Europe clouded the outlook for exporters.

Fears of a further economic slowdown denting fuel demand had grown on Friday as U.S. inflation continued to outpace the central bank’s 2% target and stoked expectations it would raise interest rates again.

Higher interest rates could strengthen the dollar, making commodities such as oil more expensive for buyers holding other currencies.

-

Gold slips as stronger dollar, rate hike expectations dent appeal

Gold fell on Monday as a stronger dollar dented the metal’s appeal, with investors awaiting U.S. non-farm payrolls data and minutes of the latest Federal Reserve meeting due later this week for clues on U.S. monetary policy.

Spot gold was down 0.4% at $1,912.63 per ounce by 1113 GMT, while U.S. gold futures fell 0.5% to $1,920.60. Bullion lost 2.5% in the April to June quarter.

There has been a slight decline in safe-haven gold due mainly to the risk-on mood in the market, said Carlo Alberto De Casa, external analyst at Kinesis Money.

But the metal is holding above the $1,900 mark despite the rate hike outlook, and prices could trade in the $1,900-$1,930 range before the release of the minutes of the Fed’s June 13-14 meeting, he added, which should contain further clues on policy.

The dollar index rose 0.2%, making gold more expensive for other currency holders, while the benchmark 10-year U.S. Treasury yield, which last week hit its highest level since March, was last up at 3.854%.

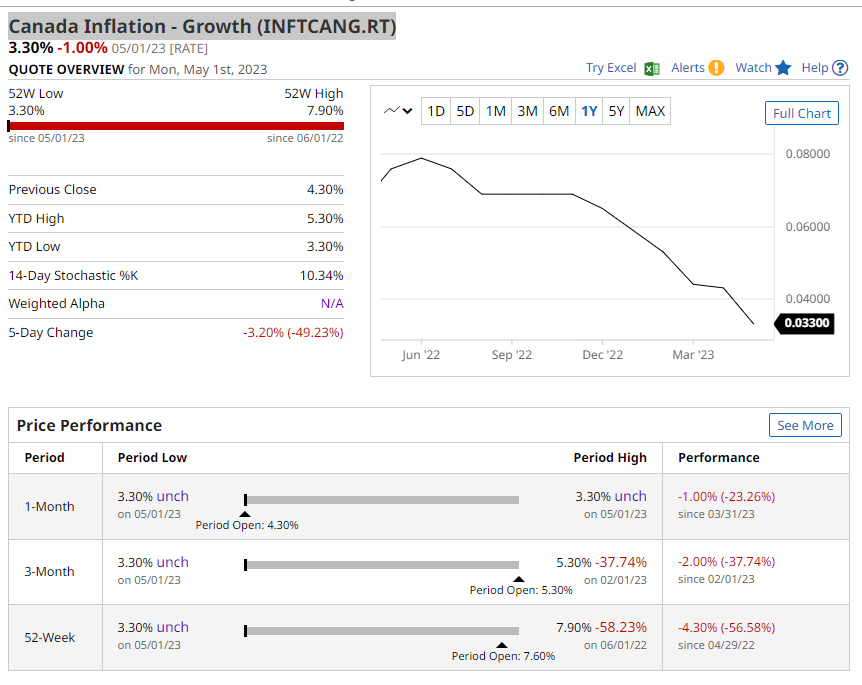

Stagnant U.S. consumer spending in May suggested the Fed’s rate hikes to tame inflation were slowly working. But the core PCE price index, the Fed’s preferred measure of tracking inflation, rose 4.6% year-on-year after climbing 4.7% in April.

It’s therefore too early to suggest the Fed can think about rate cuts, and gold could be dragged below $1,900 again if another strong U.S. jobs report on Friday paves the way for more hawkish policy, Exinity Chief Market Analyst Han Tan said.

High interest rates discourage investment in non-yielding gold. Investors see an 89% chance of a 25 basis-point U.S. rate hike in July, according to CME’s Fedwatch tool.

Among other precious metals, spot silver held steady at $22.76 per ounce, while platinum gained 0.2% to $903.26. Palladium was little changed at $1,227.15.