- Saudi Arabia’s cabinet on Tuesday approved a memorandum awarding Riyadh the status of dialogue partner in the Shanghai Cooperation Organization.

- The SCO is a political, security and trade alliance that lists China, Russia, India, Pakistan and four other central Asian nations as members.

Category: Uncategorized

-

Saudi Arabia takes step to join China-led security bloc, as ties with Beijing strengthen

-

Lucid to cut 1,300 workers amid signs of flagging demand for its EVs

- Lucid said in a regulatory filing that it is cutting about 18% of its workforce, or roughly 1,300 workers.

- In a letter to employees, CEO Peter Rawlinson said the job cuts will hit “nearly every organization and level, including executives.”

- The company expects to take charges of $24 million to $30 million related to the cuts, most of that in the first quarter.

https://www.cnbc.com/2023/03/28/lucid-to-cut-1300-workers.html

-

Ukraine war live updates: German and British tanks arrive in Ukraine; Russia fires supersonic missiles off Japan’s coast

The first shipment of German and British tanks have arrived in Ukraine, ahead of an expected spring counter-offensive.

Ukraine’s defense ministry said British Challenger 2 tanks had arrived in Ukraine, while Germany’s Defense Ministry said 18 Leopard 2 tanks, ammunition and spare parts had been sent Tuesday.

-

Some young Canadians are downsizing their homes to cut back on their expenses

Last month, Chelsea Hunt and her husband concluded that the cost of living had skyrocketed to a point where they could no longer afford to stay in their apartment and needed to move.

“We were living paycheque to paycheque,” the 26-year-old said.

“We were having to borrow money from one of our parents at different times. I have two babies under two, so it was just a lot to feed all of us and to make our rent every month.”

The family of four packed up their belongings from their Saint John, N.B. apartment and moved in with Hunt’s parents, roughly 30 minutes outside the city.

Despite having to sacrifice their privacy and independence, Hunt described the move as a weight lifted off her and her husband’s shoulders.

She said it’s allowed them to focus on paying off their student loans and car payments since they’re no longer “racking up” their credit cards and paying for groceries, rent and hydro.

Meanwhile, their kids get to spend more time with their grandparents.

Hunt’s story is not unique.

A recent Statistics Canada survey, conducted between Oct. 21 and Dec. 4, 2022, found that more than one-third of Canadians were finding it difficult for their household to meet its financial needs within the previous 12 months.

The survey also found that due to rising prices, 44 per cent of respondents aged 25 to 34 either wanted to purchase a home or move but did not, moved sooner than planned, or chose a more affordable house or rental. For Canadians aged 15 to 24, that figure was 33 per cent.

Before making a move such as downsizing or opting for cohabitation with a loved one or roommate, it’s crucial to reflect and weigh your options and priorities, said Cindy Marques, a certified financial planner and co-founder of MakeCents.

If you prefer to be a city dweller because it makes you happy and feeds your soul, Marques said you’ll have to accept that housing prices are going to “eat up” a larger percentage of your income and you’ll have to cut back in other areas like dining out or shopping in order to save.

But if the cost of living in a big city like Toronto, for example, is too high to bear, then you’ll have to consider moving in with your parents or with a roommate, or moving out of the city altogether to downsize your expenses, said Marques.

“You really do have to consider all the options here,” she said.

Marques strongly encourages those who are choosing to make such moves to be mindful of why they’re doing so in the first place and to keep their sights set on their financial goals.

“If you’re downsizing in terms of rent, is it because you’re saving up for a down payment? Or maybe you’re already an owner and you’re downsizing to a cheaper property because you want to expedite your progress to retirement. OK, write that down, crunch the numbers,” she said.

Otherwise, once you’ve made the change, the extra wiggle room in your wallet might result in your original goals being “lost to lifestyle creep,” said Marques.

“Figure out what is it you’re saving and what are you saving towards.”

Anne Arbour, director of strategic partnerships for the Credit Counselling Society, agreed.

“Have a firm plan and stick to it and hold yourself accountable,” she said.

Arbour recommends that people have a “very clear picture” of their individual finances and budget before deciding to move – disregarding what others in their social circle or age group are doing.

“You should only do what is right for you and your plan and personal situation,” she said.

If you’re planning to move in with loved ones or roommates, she said it’s important to first establish a set of rules and expectations.

“Friends and money or partners and money can bring a whole different level of emotion and stress, so you want to make sure that everybody is on the same page,” said Arbour.

She also noted that there are prices to pay for every move, such as moving costs, land transfer taxes, closing costs and realtor fees, which may add up quickly and cut into your savings. And if you’re moving municipalities, there could be other expenses like higher car insurance premiums, she said.

“It’s not just a short-term solution because it costs money to move,” said Arbour.

For Hunt, moving back home has offered an opportunity for her and her husband to get their finances back in order.

“We’re just looking to pay down our bills and then live on our own,” she said.

Ultimately, if your living situation and finances are causing you “undue stress,” Arbour, with the Credit Counselling Society, said you should reach out for help, “whether it’s a not-for-profit credit counsellor, a trusted friend, or older adults who can offer some perspective.”

“You’re not the only one feeling this way – this is really common.”

-

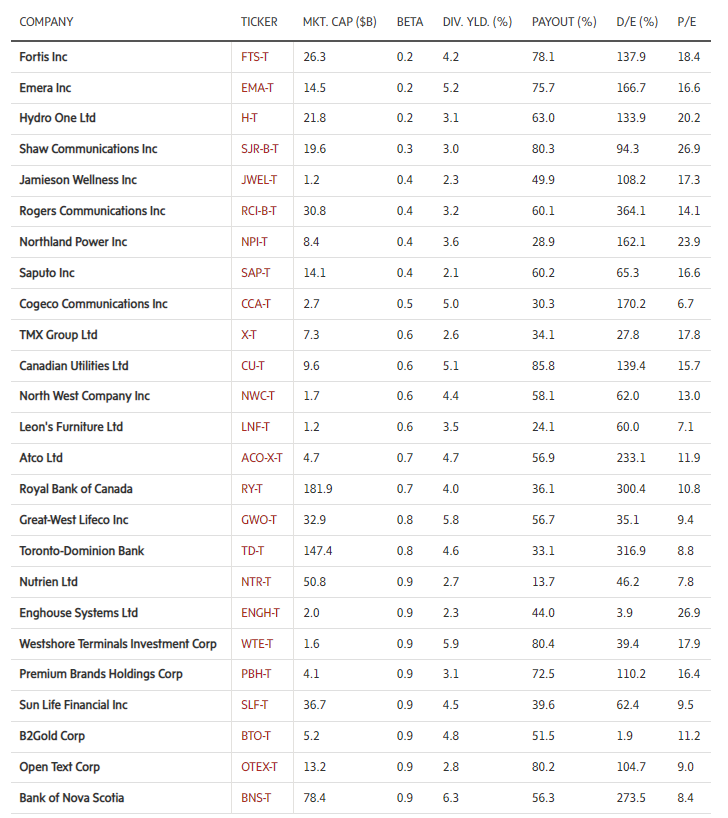

25 Low-volatility Canadian stocks to weather stormy markets (G&M)

Last year was a difficult one in financial markets and 2023 hasn’t faired much better so far. Silicon Valley Bank recently experienced a bank run and was taken over by regulators, heightening market volatility, especially in the financial sector. Combined with interest rate hikes, inflation and recession fears, some investors are nervous. We’ve had some recent client discussions in this regard. As a result, my team member Allan Meyer and I thought we would take a conservative approach and analyze income producing low volatility stocks using our investment philosophy focused on safety and value to see how they stack up in these stormy times.

The screen

We started with Canadian-listed equities with a market cap of $1-billion or more. This is a safety factor. Larger companies tend to offer more stability and liquidity. We used beta to identify our low volatility stocks. It measures how much a stock moves relative to the market. We sorted on this metric in ascending order (and ascending volatility). We also limited the names to those with a beta of less than one as it implies they are less volatile than the general market. Dividend yield is the projected annualized dividend divided by the recent share price. Allan and I love to get paid while we wait for share price appreciation, and as a result we chose securities that yield 2 per cent or more. Payout ratio is the dividend divided by earnings. A lower number is better. It implies the dividend is safer. We have capped payout at 100. Anything above is a warning sign. Debt/equity is our final safety measure. It is the debt outstanding divided by shareholders equity. A smaller ratio indicates a company has lower levels of debt or leverage, as some like to call it. Price/earnings is a valuation metric. The lower the number the better the value. All companies on the list are projected to generate earnings or profit. Earnings momentum is the change in annual earnings over the past quarter. A positive number means earnings are increasing and vice-versa for a negative number. Lastly, we have provided the 52-week total return to track recent performance.

What we found

Sun Life scores well almost across the board for safety and value. B2Gold has the lowest debt, looks good on most measures, and is the only gold name on the list. Northland Power boasts the best earnings momentum, while Cogeco is the least expensive (that is, best value). Both look interesting. Bank of Nova Scotia is the highest yielding but is among the worst performers. Utilities conquer the podium (top three) for least volatile as per beta, and the sector is the most prevalent on the list. Financials would be second.

Investors should contact an investment professional or conduct further research before buying any of the securities listed here.

-

Shoppers Drug Mart moves away from medical cannabis, will transfer patients to Avicanna

Shoppers Drug Mart Inc. is moving away from its medical cannabis distribution business and preparing to transfer patients to a platform run by biopharmaceutical company Avicanna Inc AVCN-T +1.33%increase.

The pharmacy chain owned by Loblaw Companies Ltd. L-T +2.09%increase announced the shift Tuesday, but did not say what prompted the change or how much money Toronto-based Avicanna is paying for Shoppers to refer patients to its MyMedi.ca platform.

“We are grateful for the trust placed in us by our medical cannabis patients over the past few years, and are confident we’ve found the right partner in Avicanna to continue to support them,” said Jeff Leger, Shoppers’ president, in a statement.

His company will start to send customers to Avicanna’s platform in early May, with all of the patients set to be off-loaded from Shoppers’ medical pot service by the end of July. Customers will be able to place orders on Shoppers’ website through the transition period.

Avicanna said it will offer a similar range of products including various formats, brands and “competitive pricing.” Like Shoppers, its online medical portal will strive to educate customers around harm reduction and provide specialty services for distinct patient groups like veterans.

Shoppers first launched its medical cannabis business in Ontario in January 2019, months after recreational pot was legalized in Canada (medical pot was legalized in Canada in 2001) at a time when many predicted the weed sector would be booming in the coming years.

The sector has instead struggled with profitability and as high numbers of recreational cannabis shops cluster in several cities, many retailers and licensed producers have had to drop their prices to stay competitive.

However, Shoppers said it racked up tens of thousands of patients in its four years of existence, providing them with access to cannabis from more than 30 brands including Aphria Inc., Hexo Corp.’s Redecan and the Green Organic Dutchman.

Shoppers’ medical cannabis patients were required to obtain a prescription from a licensed health care provider such as a doctor to begin ordering pot from the company, which shipped orders to their homes.

But the company was unhappy with how medical pot regulations limited its model. Shoppers claimed Tuesday that medical cannabis remains the only medication that is not dispensed in pharmacies.

“As we move away from medical cannabis distribution, we remain firm in our belief that this medication should be dispensed in pharmacies like all others and will continue our advocacy to that end,” said Leger.

Avicanna’s statement did not outline its feelings on the matters, but its chief executive said it was “motivated” to “put our full efforts toward advancing medical cannabis and its incorporation into the standard of care.”

“We are thankful to be selected as the partner for this transition and look forward to introducing MyMedi.ca, supporting patients and providing them with continuity of care,” said Avicanna chief executive Aras Azadian in a statement.

-

Crescent Point to buy Spartan Delta assets in Alberta for $1.7-billion to boost Montney presence

Crescent Point Energy Corp CPG-T +2.37%increase said on Tuesday it would acquire Spartan Delta Corp’s SDE-T -0.07%decrease oil and gas assets in Alberta, for $1.7-billion to expand in the Monteny region, one of North America’s top shale plays.

The deal would immediately add to its excess cash flow per share by 20 per cent, the company said.

The Canadian energy sector has seen a rise in deal-related activity over the past year as companies benefited from higher oil prices amid a supply crunch.

The company said the newly acquired assets are adjacent to its Kaybob Duvernay assets that it bought last December.

Crescent added that the acquisition adds 600 Montney locations in Alberta, or over 20 years of premium drilling inventory.

Calgary-headquartered Crescent said the assets add production capacity worth 38,000 barrels of oil equivalent per day to its portfolio.

The deal is expected to close during the second quarter of 2023.

-

Canadian Market Ends On Firm Note

3/27/2023 5:18 PM ET

The Canadian market ended on a firm note on Monday, led by gains in energy, consumer staples and utilities sectors.

The mood remained positive right through the day’s session amid easing concerns about global banking crisis following the latest developments in the sector.

U.S. Federal Deposit Insurance Corporation (FDIC) said First Citizens BancShares has entered into a loss-share transaction for all deposits and loans of Silicon Valley Bank (SVB).

Remarks by U.S. Fed officials that there is no indication that financial stress is worsening also contributed to the positive sentiment in the market.

The benchmark S&P/TSX Composite Index ended with a gain of 123.25 points or 0.63% at 19,624.74.

The Energy Capped Index surged 2.16%. Athabasca Oil Corp (ATH.TO) and Baytex Energy Corp (BTE.TO) climbed 7.2% and 6.3%, respectively. Cenovus Energy (CVE.TO) advanced 4.2% and MEG Energy Corp (MEG.TO) gained nearly 4%. Vermilion Energy (VET.TO), Crescent Point Energy (CPG.TO), Whitecap Resources (WCP.TO), Suncor Energy (SU.TO) and Imperial Oil (IMO.TO) also rallied sharply.

Consumer staples shares Maple Leaf Foods (MFI.TO), The North West Company Inc (NWC.TO), Weston George (WN.TO) and Loblaw (L.TO) gained 2 to 3.1%.

In the Utilities section, Hydro One (H.TO) gained 2.3% and Brookfield Renewable Partners (BEP.UN.TO) surged nearly 2%, while Altagas (ALA.TO), Canadian Utilties (CU.TO) and Superior Plus Corp (SPB.TO) climbed 1.5 to 1.6%.

Among financials shares, Toronto-Dominion Bank (TD.TO) gained nearly 2%, Laurentian Bank (LB.TO) surged 1.65%, National Bank of Canada (NA.TO) advanced 1.33%, and Sun Life Financial (SLF.TO) gained 1.1% and Bank of Nova Scotia (BNS.TO) moved up nearly 1%.

-

Nutrien Prices Offering Of An Aggregate Of US$1.5 Billion Of 5-Year And 30-Year Senior Notes

Business Wire – Thu Mar 23, 3:21PM CDT

Nutrien Ltd. (TSX and NYSE:NTR) today announced the pricing of US$750 million aggregate principal amount of 4.900percent senior notes due March 27, 2028 and US$750 million aggregate principal amount of 5.800 percent senior notes due March 27, 2053 (together, the “senior notes”). The offering is expected to close on or about March 27, 2023, subject to customary closing conditions. The senior notes, registered under the multi-jurisdictional disclosure system in Canada and the United States, will not be offered in Canada or to any resident of Canada.

Nutrien intends to use the net proceeds from this offering to repay its US$500 million aggregate principal amount of 1.900% senior notes upon their maturity on May 13, 2023, to reduce outstanding indebtedness under its short-term credit facilities, to finance working capital and for general corporate purposes. The senior notes will be unsecured and rank equally with Nutrien’s existing senior unsecured debt. The joint book-running managers for the offering are BMO Capital Markets, Citigroup, Morgan Stanley and Scotiabank.

The offering will be made by way of a prospectus supplement dated March 23, 2023, to Nutrien’s short form base shelf prospectus dated March 11, 2022, filed with the securities regulatory authorities in each of the provinces of Canada, which forms a part of and is included in Nutrien’s registration statement on Form F-10, filed in the United States with the Securities and Exchange Commission (the “SEC”) under the multijurisdictional disclosure system. A final prospectus supplement in respect of the offering of the senior notes will be filed with the same regulatory authorities in Canada and the SEC.

About Nutrien

Nutrien is the world’s largest provider of crop inputs and services, helping to safely and sustainably feed a growing world. We operate a world-class network of production, distribution and retail facilities that positions us to efficiently serve the needs of growers. We focus on creating long-term value for all stakeholders by advancing our key environmental, social and governance priorities.

Advisory

The senior notes are being offered in the United States pursuant to an effective registration statement (including a base shelf prospectus) filed with the SEC. Nutrien has filed a preliminary prospectus supplement related to the offering of the senior notes. Before you invest, you should read the preliminary prospectus supplement, the accompanying base shelf prospectus and other documents that are incorporated by reference therein for more complete information about Nutrien and this offering.

The preliminary prospectus supplement and the accompanying base shelf prospectus are available for free on the SEC website at www.sec.gov. Alternatively, the documents may be obtained by contacting BMO Capital Markets Corp. toll-free at 1-866-864-7760, Citigroup Global Markets Inc. toll-free at 1-800-831-9146, Morgan Stanley & Co. LLC at 1-866-718-1649 and Scotia Capital (USA) Inc at 1-800-372-3930.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the senior notes in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction.