Canada’s inflation rate accelerated by more than expected in September, but not enough to deter the Bank of Canada from cutting interest rates next week, according to several analysts.

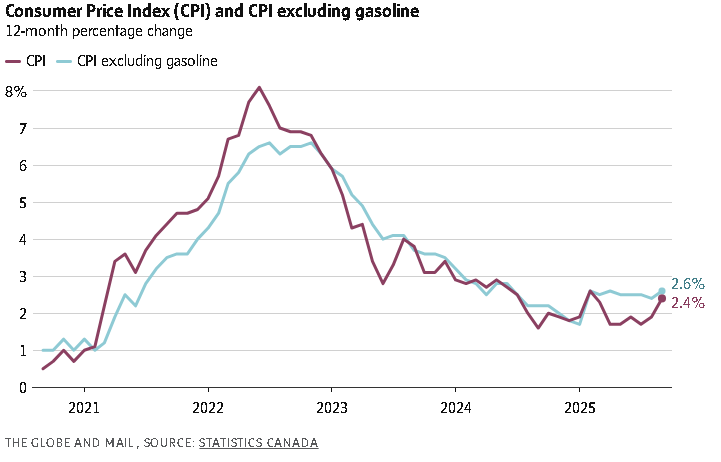

The Consumer Price Index rose 2.4 per cent in September on an annual basis, up from August’s 1.9-per-cent pace, Statistics Canada said Tuesday. Financial analysts were expecting an inflation rate of 2.2 per cent.

The CPI results were heavily influenced by fluctuations in fuel costs. Year over year, gas prices fell by 4.1 per cent in September, but that was less than a 12.7-per-cent decline in August, putting upward pressure on headline inflation.

Excluding gas, consumer prices have risen by 2.6 per cent over the past year, up from 2.4 per cent in August.

Just after the CPI report, investors were pricing in a 66-per-cent chance that the Bank of Canada will cut interest rates by a quarter-point on Oct. 29, according to Bloomberg data. That’s down from 75-per-cent odds before the report was published.

How today’s inflation report has shifted market and economist predictions for BoC rate cuts

Still, with core measures of inflation remaining in check, several economists on Bay Street said the Bank of Canada was poised to continue cutting rates next week.

“Consumer prices posted surprisingly strong gains in September, but measures of underlying inflation suggest much less cause for concern,” said Royce Mendes, head of macro strategy at Desjardins Securities, in a note to clients.

“While there might be scope for debate about inflation, there should be no disagreement that the economy is weak and in need of support,” he added.

The Bank of Canada resumed cutting rates in September after three consecutive holds, finding that growth and employment concerns outweighed the upside risks to inflation from tariffs. The bank’s benchmark interest rate is now 2.5 per cent.

Bank of Canada finds downbeat businesses and consumers ahead of rate decision

Inflation has picked up in various categories. For example, grocery prices have risen by 4 per cent over the past year, and have been trending higher since April, 2024. Statscan noted that several items – including beef and coffee – have contributed to the upturn.

Still, there are signs that Canada isn’t facing a reignited inflation crisis. The Bank of Canada’s core measures of inflation – which strip out volatile movements in the CPI – rose by an annual average of 3.15 per cent in September, a tad higher than 3.1 per cent in August.

Andrew Grantham, senior economist at CIBC Capital Markets, said in a client note that “core measures of inflation were just subdued enough to support” another quarter-point rate cut, which would bring the policy rate to 2.25 per cent.

Speaking to media last week, Bank of Canada Governor Tiff Macklem said the economic outlook for the rest of the year was tepid.

“It’s going to be growth, but it’s going to be soft growth. It’s not going to feel very good, and it’s certainly not going to be enough to close the output gap,” Mr. Macklem said.

The Canadian economy shrank at an annualized rate of 1.6 per cent in the second quarter as exports to the United States plummeted. The unemployment rate, meanwhile, has risen to 7.1 per cent as companies get cautious on hiring.

Private-sector forecasters expect the economy to eke out growth in the third quarter, but continue to struggle as U.S. tariffs weigh on Canadian exports. The Trump administration has hammered a number of Canadian industries with duties, including steel, aluminum and autos.

The Globe and Mail reported on Tuesday that Canada and the U.S. could sign a trade deal on steel, aluminum and energy later this month, but that automobiles and softwood lumber wouldn’t be part of the agreement.

On Monday, the Bank of Canada published surveys of businesses and consumers that reflected a downbeat mood from both camps. For instance, most companies do not expect to increase the size of their workforce over the next year, according to survey results.

Stephen Brown, deputy chief North America economist at Capital Markets, said he was leaning toward another rate cut next week, despite the upside surprise in the CPI.

“Overall, there’s no clear message from the CPI, although we’re still leaning toward another rate cut this month following Governor Tiff Macklem’s somewhat dovish comments on the growth outlook last week,” he said in a note to clients.