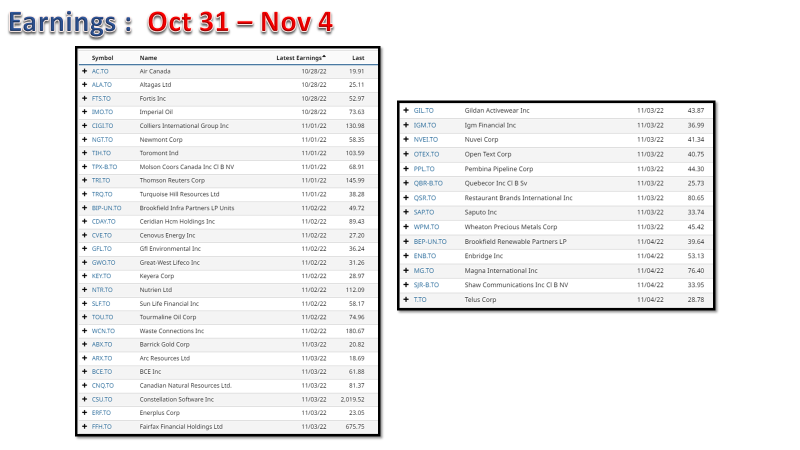

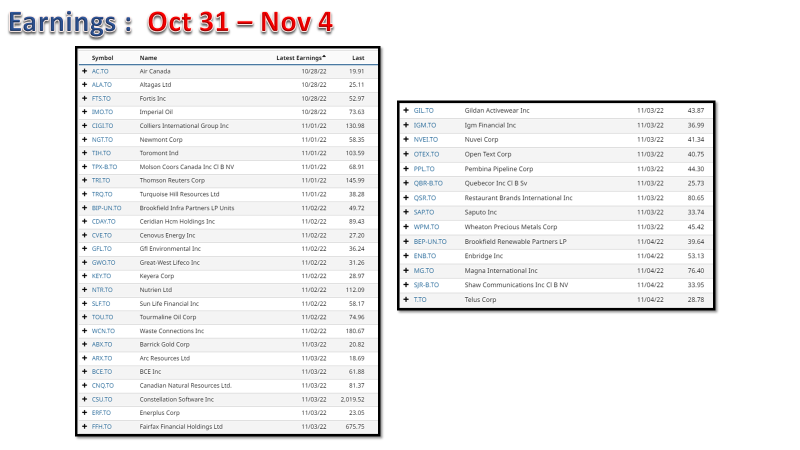

Earnings Due: Oct 28-Nov 4

Earnings Due: Oct 28-Nov 4

Economic Calendar: Oct 31 – Nov 4

Monday October 31

China PMI

Japan industrial production, retail sales and consumer confidence

Euro zone real GDP and CPI

Germany retail sales

(10:30 a.m. ET) U.S. Chicago PMI for October.

(10:30 a.m. ET) U.S. Dallas Fed Manufacturing Activity for October.

Earnings include: Berkshire Hathaway Inc.; Capital Power Corp.; Capstone Mining Corp.; Cargojet Inc.; Gibson Energy Inc.; Mondelez International Inc.; Stryker Corp.

—

Tuesday November 1

China and Japan manufacturing PMI

(9:30 a.m. ET) Canada’s S&P Global Manufacturing PMI for October.

(9:45 a.m. ET) U.S. S&P Global Manufacturing PMI for October.

(10 a.m. ET) U.S. ISM Manufacturing PMI for October. The Street is expecting a reading of 50.0, down from 50.9 in September.

(10 a.m. ET) U.S. construction spending for September.

(10 a.m. ET) U.S. Job Openings and Labour Turnover Survey for September.

(6:30 p.m. ET) Bank of Canada Governor Tiff Macklem and Senior Deputy Governor Carolyn Rogers appear before the Standing Senate Committee on Banking, Commerce and the Economy.

Also: Canadian and U.S. auto sales for October and U.S. Fed meeting begins.

Earnings include: Advanced Micro Devices Inc.; Colliers International Group Inc.; Eli Lilly and Co.; Ero Copper Corp.; International Petroleum Corp.; Ovintiv Inc.; Pfizer Inc.; T-Mobile US Inc.; Thomson Reuters Corp.; Topaz Energy Corp.; Uber Technologies Inc.

—

Wednesday November 2

Euro zone manufacturing PMI

Germany trade surplus and unemployment

(8:15 a.m. ET) U.S. ADP National Employment Report for October.

(2 p.m. ET) U.S. Fed announcement with chair Jerome Powell’s press briefing to follow.

Earnings include: Ballard Power Systems Inc.; Bausch + Lomb Corp.; Brookfield Infrastructure Partners LP; Brookfield Renewable Partners LP; Cenovus Energy Inc.; Ceridian HCM Holding Inc.; CVS Health Corp.; First Capital Reality Inc.; GFL Environmental Holdings Inc.; Great-West Lifeco Inc.; Green Thumb Industries Inc.; Maple Leaf Foods Inc.; MEG Energy Corp.; Nutrien Ltd.; Qualcomm Inc.; Secure Energy Services Inc.; Suncor Energy Inc.; Sun Life Financial Inc.; Waste Connections Inc.

—

Thursday November 3

(8:30 a.m. ET) Canada’s merchandise trade balance for September.

(8:30 a.m. ET) Canadian building permits for September.

(8:30 a.m. ET) U.S. initial jobless claims for week of Oct. 29. Estimate is 222,000, up 5,000 from the previous week.

(8:30 a.m. ET) U.S. productivity for Q3 (preliminary reading). The Street expects an annualized rate rise of 0.2 per cent with unit labour costs up 4.0 per cent.

(8:30 a.m. ET) U.S. goods and services trade deficit for September.

(10 a.m. ET) U.S. factory orders for September. Consensus is a month-over-month rise of 0.3 per cent.

(10 a.m. ET) U.S. ISM Services PMI.

(1:30 p.m. ET) Bank of Canada Deputy Governor Paul Beaudry makes opening remarks in Ottawa at the John Kuszczak Memorial Lecture

Also: Canada’s federal fiscal update

Earnings include: Amgen Inc.; Barrick Gold Corp.; Baytex Energy Corp.; BCE Inc.; Bombardier Inc.; Canadian Natural Resources Ltd.; ConocoPhillips; Enerplus Corp.; Fairfax Financial Holdings Ltd.; Gildan Activewear Inc.; IGM Financial Inc.; Kinaxis Inc.; Labrador Iron Ore Royalty Corp.; Lightspeed Commerce Inc.; Open Text Corp.; Parkland Fuel Corp.; Pembina Pipeline Corp.; Resolute Forest Products Inc.; Restaurant Brands International Inc.; RioCan REIT; Starbucks Corp.; TC Energy Corp.; TransAlta Renewables Inc.; Turquoise Hill Resources Ltd.; Wheaton Precious Metals Corp.

—

Friday November 4

Japan and euro zone PMI

(8:30 a.m. ET) Canadian employment for October. The Street expects an increase of 0.1 per cent, or 10,000 jobs from September with the unemployment rate rising 0.1 per cent to 5.3 per cent.

(8:30 a.m. ET) U.S. nonfarm payrolls for October. The consensus forecast is a rise of 200,000 from September with the unemployment rate increasing 0.1 per cent to 3.6 percent.

(10 a.m. ET) Canada’s Ivey PMI for October.

Earnings include: Alibaba ADR; ARC Resources Ltd.; Canada Goose Holdings Inc.; Duke Energy Corp.; Enbridge Inc.; Magna International Inc.; SNC-Lavalin Group Inc.; Telus International Inc.

Air Canada’s seat sales double, loss narrows as travel rebounds despite airport woes

Air Canada AC-T +3.21%increase more than doubled its seat sales in a chaotic summer as a rebound in travel allowed Canada’s largest airline to narrow its losses.

For the three months ending on Sept. 30, Air Canada lost $508-million, or $1.42 a share, compared with a loss of $640-million ($1.79) in the same period of 2021, Air Canada said on Friday.

Revenue for the period totalled $5.3-billion, up from $2.1-billion in the third quarter of 2021 and nearly matching the $5.5-billion mark set in the same period in 2019, before the pandemic grounded much of the world’s airlines and sent the industry into crisis.

Michael Rousseau, chief executive officer of Air Canada, said on a conference with analysts on Friday he was “very pleased” with the financial results. “They mark an import step in our recovery,” he said, pointing to the quarter’s $644-million operating income and 12.1-per-cent operating margin, the first positive numbers since the pandemic began.

Air Canada is emerging from the pandemic “stronger, more resilient and adaptable,” he said. “COVID has been one of the industry’s greatest challenges in both severity and duration.”

Air Canada to buy 15 more Canadian-built Airbus A220-300 aircraft

In a statement accompanying the earnings release, Air Canada said it flew about 11.5 million passengers in the third quarter, and expects strong demand to persist.

“Air Canada’s solid third-quarter results stem from the ongoing restoration of our extensive network, an improved operational performance, our modern and efficient fleet, as well as leading products and services and an incredible team of employees,” Mr. Rousseau said in a press release.

As travellers returned to flying in the summer, Canada’s major airports were overwhelmed and understaffed. Passengers faced long lines, holds on planes and lengthy delays retrieving their baggage. The companies and government agencies that operate at the airports blamed a shortage of workers and COVID-19 protocols.

“Thanks to the hard work and commitment of our employees, after a difficult June and July, we saw significant operational improvement throughout August and September, with the operation today now on par with prepandemic levels,” Mr. Rousseau said. “Still, we know many customers experienced disruptions travelling this summer, and we sincerely regret any inconveniences that have occurred.”

Investors reacted to the financial results by driving up Air Canada’s share price on the Toronto Stock Exchange by 4 per cent to $20. The share price has fallen by 9 per cent this year.

In the summer of 2019, before the pandemic, Air Canada made a profit of $636-million ($2.25 a share).

In third-quarter financial results released on Friday before markets opened, Air Canada said its operating capacity more than doubled from the same period of 2021. It flew at 79-per-cent of prepandemic seat capacity. Passenger revenue of $4.8-billion tripled from the third quarter of 2021, and operating revenue increased by 2.5 times.

For the fourth quarter of 2022, Air Canada said it will fly about 85 per cent of its prepandemic capacity.

Walter Spracklin, a Royal Bank of Canada stock analyst, said the results beat his expectations. Higher ticket prices offset fuel expenses, and fuller planes helped reduced per-seat costs, Mr. Spracklin said in a note to clients. “Overall, the quarter was above consensus and our estimates, indicating demand for travel was exceptionally strong,” he said.

Imperial Oil Q3 Profit More Than Doubles Compared With Year Ago, Raises Dividend

CALGARY — Imperial Oil Ltd. raised its quarterly dividend by nearly 30 per cent as it reported its third-quarter profit more than doubled compared with a year ago.

The company, which also says it plans to buy back up to $1.5 billion worth of its shares, will now pay a quarterly dividend of 44 cents per share, up from its previous dividend of 34 cents per share.

The increased payment to shareholders came as Imperial said its net income totalled $2.03 billion or $3.24 per diluted share for the quarter ended Sept. 30, up from a profit of $908 million or $1.29 per diluted share in the same quarter a year earlier.

Revenue and other income totalled $15.22 billion, up from $10.23 billion in the third quarter of 2021.

The company says upstream production in the third quarter averaged 430,000 gross oil-equivalent barrels per day compared with 435,000 in the same quarter last year.

In its downstream business, Imperial says quarterly refining throughput averaged 426,000 barrels per day, up from 404,000 in the third quarter of 2021, as capacity utilization hit 100 per cent compared with 94 per cent a year earlier.

This report by The Canadian Press was first published Oct. 28, 2022.

Companies in this story: (TSX:IMO)

Suncor To Acquire Teck Resources’ Stake In Fort Hills Oilsands Project For $1B

CALGARY — Suncor Energy says it has agreed to buy Teck Resources Ltd.’s 21.3 per cent stake in the Fort Hills oilsands project for approximately $1 billion.

The Calgary-based oil and gas company says upon closing of the deal, Suncor’s overall share in Fort Hills will increase to 75.4 per cent.

Suncor says in a release Wednesday that the deal will be funded by cash from asset sales currently underway.

With the completion of the deal, the other partner in the Fort Hills project will be TotalEnergies EP Canada Ltd., which holds a 24.6 per cent stake.

The transaction is subject to regulatory approval and is expected to close in the first quarter of 2023.

The Fort Hills oilsands project is located in Alberta’s Athabasca region, 90 km north of Fort McMurray.

This report by The Canadian Press was first published Oct. 26, 2022

Companies in this story: (TSX:SU)

IEA sees India’s imports of natural gas, oil zoom by 2030

India’s import of natural gas will double and that of oil will rise 50% by 2030 due to soaring domestic demand while production remains subdued, International Energy Agency (IEA) said in its latest outlook released on Thursday.

The demand for natural gas in the country would nearly double to 115 billion cubic meters (bcm) in 2030 from 66 bcm in 2021, with most of the growth coming from manufacturing and other industry, according to IEA’s World Energy Outlook based on the stated policies ..

The Canadian Press – Canadian Press – Tue Oct 25, 4:08PM CDT

MONTREAL — CN Rail has boosted its financial outlook for the year as it reported gains in revenue and adjusted profits in the third quarter on higher volumes and rates, while net income was down.

The Montreal-based railway says net income for the quarter ending Sept. 30 was $1.46 billion, down from $1.69 billion for the same quarter last year.

Adjusted profits for the last quarter were unchanged at $1.46 billion, while last year’s adjusted profits were $1.08 billion after several exclusions including an $886 million payout related to its failed takeover of a U.S. railway.

Revenue of $4.51 billion for the quarter was up from $3.59 billion last year as the company brought in higher fuel surcharge revenue, raised freight rates, and saw higher volumes of coal exports and U.S. grain shipments.

The railway says it now expects to deliver free cash flow of about $4.2 billion in 2022, up from a range of between $3.7 billion and $4 billion it gave in an April guidance.

It also now expects to deliver adjusted, diluted earnings per share growth of about 25 per cent, up from the 15 to 20 per cent it guided in April.

This report by The Canadian Press was first published Oct. 25, 2022.

Companies in this story: (TSX:CNR)

Canada expanding assisted suicide law to include the mentally ill, possibly enable ‘mature minors’

Medical assistance in dying (MAID) has been available in Canada since 2016 and is set to expand in March 2023, extending eligibility to those with a mental illness.

Bill C-7 would allow individuals seeking MAID to apply solely on the basis of a mental disorder. Prior to the bill’s passage, MAID eligibility was based on having a “grievous and irremediable medical condition,” according to a report from the Canadian government on the practice.

Creighton School of Medicine professor Charles Camosy said Wednesday on “Tucker Carlson Tonight” the bill would allow “mature minors” to be euthanized by state doctors without the consent of their parents.

ECB hikes rates by 75 basis points and announces new terms for European banks

The European Central Bank announced Thursday a 75-basis-point interest rate hike — its third consecutive increase this year — while also revealing new conditions for European banks.

Market participants had two questions in mind ahead of the meeting: When will the ECB start reducing its balance sheet, in a process known as quantitative tightening, and what will happen to the lending conditions for banks in the near future?

The ECB announced Thursday that it was changing the terms and conditions of its targeted longer-term refinancing operations, or TLTROs — a tool that provides European banks with attractive borrowing conditions, designed to incentivise lending to the real economy.

“The Governing Council … decided to adjust the interest rates applicable to TLTRO III from 23 November 2022 and to offer banks additional voluntary early repayment dates,” the ECB said.

“In order to align the remuneration of minimum reserves held by credit institutions with the Eurosystem more closely with money market conditions, the Governing Council decided to set the remuneration of minimum reserves at the ECB’s deposit facility rate.”

Because the ECB has been increasing rates faster than expected in the face of soaring inflation, European lenders are benefiting both from TLTROs and higher interest rates. The situation has been described by some as effectively providing a subsidy to banks.

“The optics are bad against the backdrop of a historical shock to households’ income, and political pressure cannot be ignored,” Frederik Ducrozet, head of macroeconomic research at Pictet Wealth Management, said in a note last week.

In addition, the latest rate hike takes the ECB’s main benchmark from 0.75% to 1.5%, a level not seen since 2009 before the sovereign debt crisis. It comes after the central bank rose rates by 50 basis points in July and 75 basis points in September.

The ECB is dealing with both record-high inflation and a slowing economy, with many economists predicting a recession in the region before the end of the year. It’s a fine balance for the central bank, as if it hikes rates aggressively in an effort to deal with inflation, it could cause even more trouble for the wider economy.