Pre-MKT Oct 19

Equities

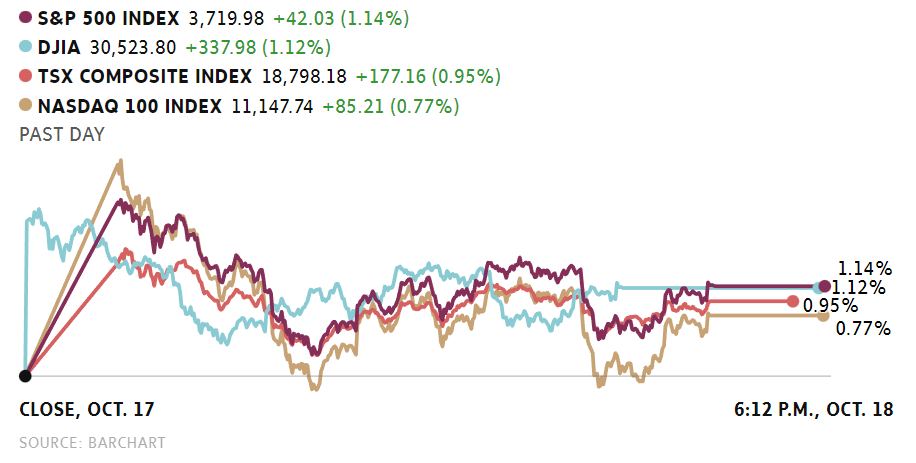

Canada’s main stock index opened higher Tuesday, adding to the previous session’s advance. On Wall Street, key indexes were also up in early trading on the back of positive earnings from Goldman Sachs and Johnson & Johnson.

At 9:31 a.m. ET, the Toronto Stock Exchange’s S&P/TSX composite index was up 275.83 points, or 1.48 per cent, at 18,896.85.

The Dow Jones Industrial Average rose 511.7 points, or 1.70 per cent, at the open to 30,697.52. The S&P 500 rose 68.3 points, or 1.86 per cent, at the open to 3,746.26, while the Nasdaq Composite rose 288.2 points, or 2.70 per cent, to 10,963.98 at the opening bell.

“Earnings remain the focus across corporate America while simmering concerns about the path of the Fed and the lack of a pivot from the hawkish stance takes a back seat for now,” Stephen Innes, managing partner with SPI Asset Management, said.

“Expectations are low for this earning season, with many challenges, the hawkish Fed notwithstanding.”

On Monday, sentiment got a lift from better-than-forecast results from Bank of America. Goldman Sachs reports on Tuesday morning. After the bell, markets will get results from Netflix.

Ahead of the start of trading, Goldman said profit applicable to common shareholders fell to US$2.96-billion, or US$8.25 per share, in the quarter ended Sept. 30, from US$5.28-billion, or US$14.93 per share, a year ago. Analysts had expected a profit of US$7.69 per share in the most recent quarter. Shares were up more than 4 per cent in early trading in New York.

“For Q3, Netflix said it hoped to start adding back subscribers, with hopes that they will see growth of 1 million, reversing the decline in Q2,” Michael Hewson, chief market analyst with CMC Markets U.K., said in a note. “For Q3 revenue forecasts were lower than expected at $7.84-billion, although it’s still a 4.7-per-cent increase on the same quarter a year ago.”

In this country, investors got September housing starts before the start of trading. Canada Mortgage and Housing Corp. says the seasonally adjusted annual rate of housing starts for September was 299,589 units, up 11 per cent from 270,397 in August. The increase came as the annual pace of urban starts rose 12 per cent to 276,142 in September.

Overseas, the pan-European STOXX 600 was up 1.13 per cent by midday. Britain’s FTSE 100 rose 1.28 per cent. Markets got a boost at the start of the week after Britain’s new finance minister reversed most of the tax cuts announced just weeks earlier, easing concerns about funding the measures.

Germany’s DAX added 1.79 per cent. France’s CAC 40 was up 1.53 per cent In Asia, Japan’s Nikkei ended up 1.42 per cent. Hong Kong’s Hang Seng rose 1.82 per cent.

Commodities

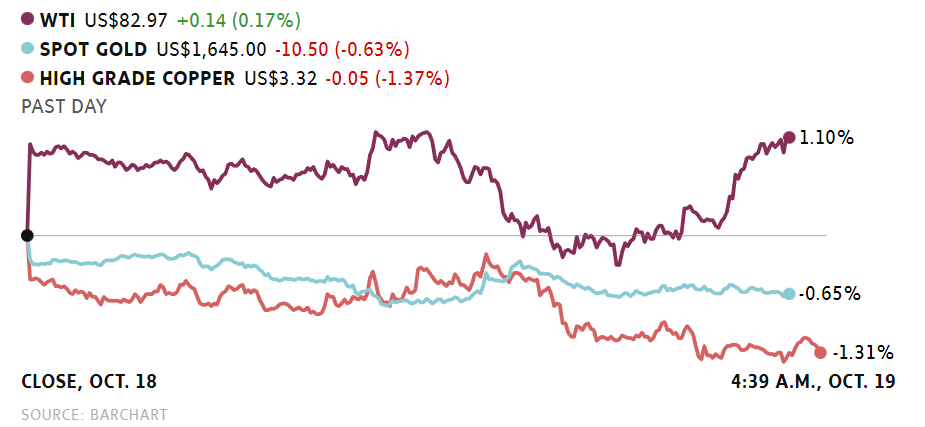

Crude prices wavered in early going, with a softer U.S. dollar being offset by continued concerns about demand in China amid measures to control the spread of COVID-19.

The day range on Brent was US$91.35 to US$92.66 in the early premarket period. The range on West Texas Intermediate was US$85 to US$86.51.

“It’s been another turbulent few weeks in oil markets from global growth concerns to super-sized OPEC+ output cuts and it seems they’re yet to fully settle down,” OANDA senior analyst Craig Erlam said.

“Brent has seen lows of US$82 and highs of US$98 so perhaps what we’re now seeing is it finding its feet somewhere in the middle. Whether that will satisfy the oil alliance only time will tell but there will be some relief that it’s not back in triple figures already, even if that is a result of the ever-worsening economic outlook.”

Crude drew some support early Tuesday from a softer U.S. dollar. The U.S. dollar index, which weighs the greenback against a group of world currencies, fell to its lowest since Oct. 6. A weaker dollar makes crude less expensive for buyers holding other currencies.

Elsewhere, traders continue to watch developments in China, where the government continues with measures aimed at curbing the spread of COVID-19.

Later Tuesday, markets will get the first of two weekly U.S. crude inventory reports with the release of fresh numbers from the American Petroleum Institute. More officials figures follow Wednesday morning from the U.S. Energy Information Administration.

Analysts polled by Reuters are expect to see a weekly increase in crude inventories of about 1.6 million barrels for the week of ended Oct. 14.

Gold prices, meanwhile, were up, also supported by a weaker U.S. dollar.

Spot gold rose 0.2 per cent to US$1,653.31 per ounce by early Tuesday morning.

U.S. gold futures were down 0.3 per cent at US$1,658.50.

Currencies

The Canadian dollar was lower while its U.S. counterpart took a breather against a basket of world currencies.

The day range on the loonie was 72.69 US cents to 73.22 US cents in the predawn period.

“The CAD is under-performing on the session,” Shaun Osborne, chief FX strategist with Scotibank, said.

Traders will get fresh housing starts figures early Tuesday morning from Canada Mortgage and Housing Corp.

On world markets, the U.S. dollar index, which measures the greenback against six major peers, including sterling, the euro and the yen, was down 0.1% at 111.99, after hitting its lowest level since Oct. 6, according to figures from Reuters.

Britain’s pound, meanwhile, paused after rallying about 2 per cent on Monday on the U.K. fiscal turnaround. The pound was last down 0.1 per cent against the U.S. dollar at US$1.1340.

The euro was last up 0.1 per cent at US$0.9855.

Iamgold Corp. has signed a deal to sell its 95 per cent interest in Rosebel Gold Mines N.V. to Chinese company Zijin Mining Group Co. Ltd. for US$360-million in cash.Under the terms of the agreement, Iamgold will also be released from about US$41-million in obligations for certain equipment leases. Rosebel owns the Rosebel gold mine in Suriname and a 70 per cent participating interest in the Saramacca Mine, also located in the South American country. –The Canadian Press

Economic news

(8:15 a.m. ET) Canadian housing starts for September.

(8:30 a.m. ET) Canada’s international securities transactions for August.

(9:15 a.m. ET) U.S. industrial production for September.

(10 a.m. ET) U.S. NAHB Housing Market Index for October.