At midday (June 23): Resource stocks send TSX lower

Canada’s main stock index fell on Thursday, led by weakness in resource stocks and on concerns over a global recession due to aggressive interest rate hikes.

At 10:39 a.m. ET, the Toronto Stock Exchange’s S&P/TSX composite index was up 60.38 points, or 0.32%, at 18,943.66.

Meanwhile, U.S. stock indexes inched higher as easing government bond yields lifted high-valued growth stocks.

“This is more a continuation of what we saw yesterday, i.e the sense that even though (Fed Chair Jerome) Powell reiterated he would be coming down strongly on inflation at the possible risk of growth, stocks took some comfort from that as rampant inflation is just as negative for equity valuations as is lower growth,” said Stuart Cole, head macro economist at Equiti Capital.

“But uncertainty is still the name of the game, and this is why we are seeing asset price moves that don’t always seem to make too much sense.”

Powell said on Wednesday the U.S. Federal Reserve is “strongly committed” to bringing down inflation that is running at a 40-year high while policymakers are not trying to cause a recession in the process.

Bombardier Inc jumped 4% to the top of the index after it said on Wednesday that workers on a key program for the business jet maker ratified a new labor contract that will deliver pay hikes of up to 18.5% over five years.

The broader industrial sector rose 0.4%, while the energy sector slid 1.7% as oil prices edged higher on Thursday after earlier falls as investors weighed the risks of recession and how fuel demand will be affected by rising interest rates and tight supplies.

Brent crude futures rose by 50 cents, or 0.5%, to $112.24, having dropped to as low as $108.04 earlier in the session.

U.S. West Texas Intermediate (WTI) crude futures were up 35 cents, or 0.3%, at $106.54 after touching a session low of $102.32.

In Toronto, the materials sector, which includes precious and base metals miners and fertilizer companies, lost 1.4%, weighed down by weakness in copper prices.

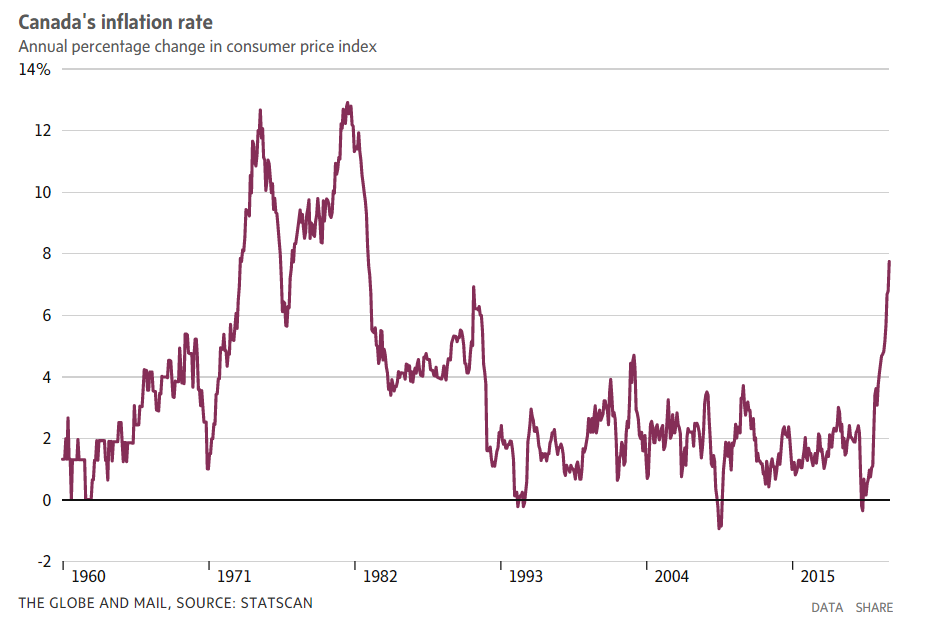

In the previous session, the benchmark index slipped after data showed that domestic inflation accelerated to 7.7% in May, the highest since January 1983.

Meanwhile, Bank of Canada Senior Deputy Governor Carolyn Rogers said on Wednesday that inflation in Canada was much too high and did not rule out a 75-basis-point increase at the central bank’s July decision

Stocks rose in morning trading on Wall Street Thursday and added to gains for the week as investors remain focused on inflation and rising interest rates.

The S&P 500 rose 0.5%. The Dow Jones Industrial Average rose 101 points, or 0.3%, to 30,580 and the Nasdaq rose 0.7%.

Big technology and health care companies did much of the heavy lifting. Microsoft rose 1.2% and Johnson & Johnson rose 1.5%.

Energy stocks fell as oil prices edged lower. Valero fell 2.6%.

Bond yields fell significantly. The yield on the 10-year Treasury fell to 3.03% from 3.15% late Wednesday.

Major indexes are on track for weekly gains amid turbulent trading and a broader slump that has kept the benchmark S&P 500 in the red for 10 of the last 11 weeks. Stocks have swung between sharp gains and losses as investors try to determine whether a recession is looming.

The central bank is attempting to temper inflation’s impact with higher interest rates, but Wall Street is worried that it could go too far in slowing economic growth and actually bring on a recession.

Investors are monitoring Fed Chair Jerome Powell’s second day of testimony to Congress. He is testifying to a House committee Thursday, a day after testifying to a Senate committee.

On Wednesday Powell said a recession was “certainly a possibility” as the U.S. central bank tries to rein in inflation. He is speaking to Congress a week after the Fed raised its benchmark interest rate by three quarters of a percentage point, its biggest hike in nearly three decades. Fed policymakers also forecast a more accelerated pace of rate hikes this year and next than they had predicted three months ago, with its key rate to reach 3.8% by the end of 2023. That would be its highest level in 15 years.

Earlier Thursday the Labor Department said fewer Americans applied for jobless benefits last week as the U.S. job market remains robust despite four-decade high inflation. The solid job market is a bright point in an otherwise weakening economy, with consumer sentiment and retail sales showing increasing damage from inflation.

Stubbornly high inflation and weak data from other sectors of the economy remain a key concern for Wall Street. High prices on everything from food to clothing have pressured consumers to shift spending from big ticket items like electronics to necessities. The pressure has been worsened by record-high gasoline prices that show no sign of abating amid a supply and demand disconnect.

Reuters and The Associated Press