BMO sees major investment opportunity as Canada ramps up LNG production

The research team at Citi tracks more than 80 global investment themes. The performance tracking for May found some obvious winners, and the worst performing themes offered a few surprises,

“Unsurprisingly, the Top 10 Thematic baskets in the Theme Machine model continue to see Resource-related baskets feature highly, with Ag Demand, Belt & Road, and Mining Capex the top 3 currently. We also find some intuitively compelling baskets in the Top 10 such as Smart Grids (critical for Energy Transition), Supply Chain Solutions (in a complex geopolitical world, read here for more detail), and Manufacturing Onshoring (the ongoing reflex to shorten supply chains for a variety of reasons). The Metaverse (see here and here) sneaks in at number 10″

The worst performers included former winning sectors like genetics, biotechnology, cloud computing, demographics-related heathcare spending and fintech.

“Citi: top 10 and bottom 10 investment themes in May” – (table) Twitter

***

BMO analyst Ben Pham sees extensive investment opportunity as domestic energy producers ramp up LNG (liquefied natural gas) capacity,

“We believe the renewed interest in Canadian liquefied natural gas (LNG) facilities is once again shaping up as a major investment opportunity for Canadian energy infrastructure companies. Companies that might participate include ALA, ENB, FTS, KEY, PPL, and TRP, where we’ve identified close to $15B of potential investment opportunity (most of which is not yet in our financial models). We believe ENB, PPL, and TRP (all rated Outperform) are on solid inside tracks to win the LNG business given strategic positioning, scale, stakeholder relations, and strong development expertise … Demand for Canadian LNG has come back given the Ukraine situation, the surge in natural gas prices (and spreads), and an energy security focus. Shell indicated in April that it was studying the feasibility of a major expansion of its LNG Canada project. Subsequently, Woodfibre LNG issued a notice to proceed with its main contractor, and there have been positive developments related to East Coast LNG. There are just shy of 30 Canadian LNG projects with aggregate proposed capacity of ~350M tonnes per annum (~46bcf/d), but only a small portion will see the light of day. We are optimistic on a second phase of LNG Canada as well as smaller-scale LNG facilities Woodfibre and Port Edward, all on the Canadian West Coast. East Coast and Hudson Bay LNG are compelling areas for LNG facilities, but politics, access to supply, lengthy permitting, stakeholder pushback, and large price tags create challenges to formal sanctioning.”

***

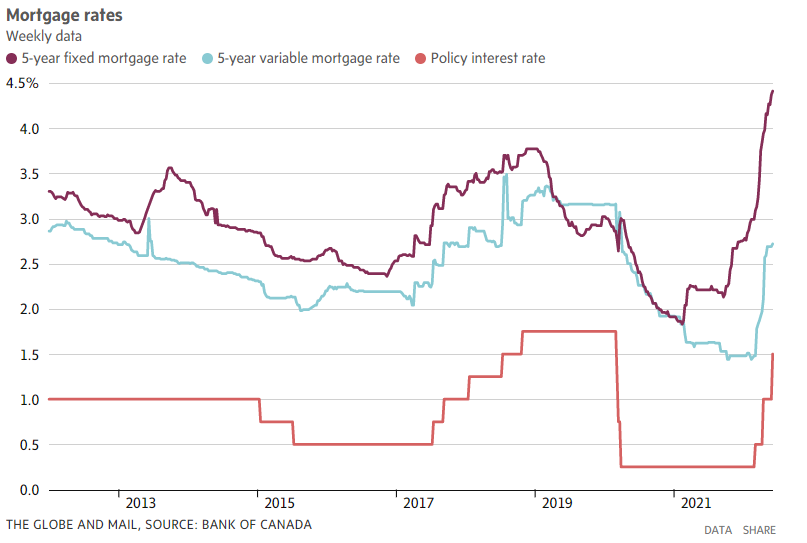

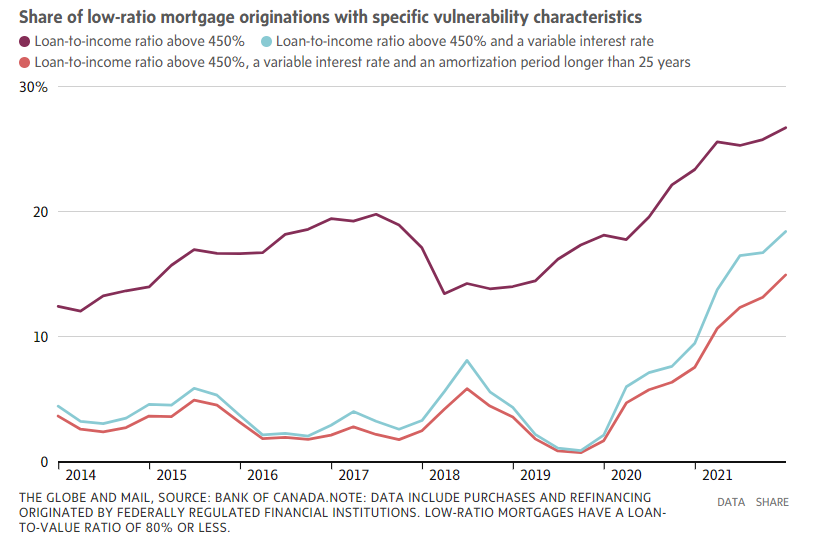

BMO economist Robert Kavcic continues to provide valuable insight into domestic housing markets. Most recently, he notes that Canadians renewing their fixed rate mortgages after five years will see the biggest jump in monthly payments since the 1980s,

“In its Financial System Review, the Bank of Canada pointed out that “households have generally been able to manage their debt servicing costs due to low interest rates since the start of the pandemic. But as mortgages are renewed at higher rates, some households— particularly those that took on a sizable mortgage since the start of the pandemic—will face significantly larger mortgage payments”. Their simulations point to roughly 24%-to-45% increases in monthly carrying costs as mortgages start to renew in the coming years (assumed around 4.5% by 2025/26). That will weigh on disposable income and increase vulnerability for more stretched households. Note that, already today, those coming off fixed-rate mortgages from five years ago will be doing so with comparable rates already a good 2 ppts higher than origination (haven’t seen that since the 1980s). Of course, there are ways to counter that (shift to variable, extend amortization, higher incomes, etc.), but the bigger point is that a decades-long tailwind of lower rates on renewal has reversed, at least for the duration of this cycle.”

“BMO: “Unfriendly [mortgage] Renewals Incoming”” – (research excerpt) Twitter