https://www.cnn.com/world/live-news/israel-lebanon-war-hezbollah-10-1-24-intl-hnk/index.html

Category: Uncategorized

-

Economic Calendar: Sept 30 – Oct 4, 2024

Monday September 30

China PMI and current account surplus

Japan industrial production and retail sales

Canada’s National Day for Truth and Reconciliation (stock markets open; bond markets closed)

(9:45 a.m. ET) U.S. Chicago PMI for September.

(1:55 p.m. ET) U.S. Fed chair Jerome Powell gives luncheon address at NABE conference.

Earnings include: Carnival Corp.

—

Tuesday October 1

China’s markets closed (through Friday)

More stories below advertisement

Japan jobless rate and manufacturing PMI

Euro zone CPI and manufacturing PMI

(9:30 a.m. ET) Canada’s S&P Global Manufacturing PMI for September.

(9:45 a.m. ET) U.S. S&P Global Manufacturing PMI for September.

(10 a.m. ET) U.S. ISM Manufacturing PMI for September.

(10 a.m. ET) U.S. construction spending for August. The Street is projecting a month-over-month rise of 0.1 per cent.

(10 a.m. ET) U.S. Job Openings & Labor Turnover Survey for August..

Also: Canadian and U.S. auto sales for September.

Earnings include: Nike Corp.; Paychex Inc.

—

Wednesday October 2

Euro zone jobless rate

(8:15 a.m. ET) U.S. ADP National Employment Report for September.

Also: OPEC JMMC meeting

Earnings include: NovaGold Resources Inc.; Tilray Inc.

—

Thursday October 3

Japan services and composite PMI and consumer confidence

Euro zone services and composite PMI

(8:30 a.m. ET) U.S. initial jobless claims for week of Sept. 27. Estimate is 220,000, up 2,000 from the previous week.

(9:30 a.m. ET) Canada’s S&P Global Services PMI for September.

(9:45 a.m. ET) U.S. S&P Global Services/Composite PMI for September.

(10 a.m. ET) U.S. ISM Services PMI for September.

(10 a.m. ET) U.S. factory orders for August. Consensus is a month-over-month rise of 0.1 per cent.

Earnings include: Constellation Brands Inc.; Richelieu Hardware Ltd.

—

Friday October 4

(8:30 a.m. ET) U.S. nonfarm payrolls for September. The Street is expecting a rise of 130,000 jobs from August with the unemployment rate remaining 4.2 per cent and average hourly earnings up 0.3 per cent (and 3.8 per cent year-over-year).

(10 a.m. ET) Canada’s Ivey PMI for September.

-

US: Inflation measure closely watched by the Fed fell to 2.2% in August

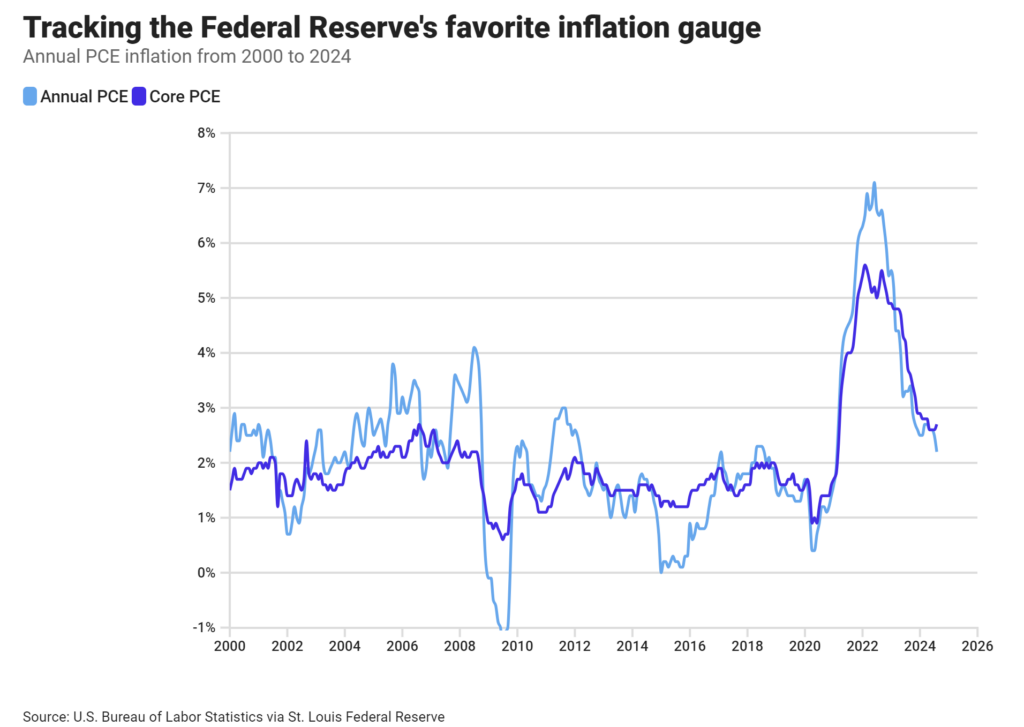

An inflation gauge closely watched by Federal Reserve policymakers continued to slow in August as the pace of price growth trended closer to the Fed’s target.

The Commerce Department reported Friday that the personal consumption expenditures (PCE) price index rose 0.1% from the prior month and 2.2% year over year. The annual figure came in cooler than the estimates of economists polled by LSEG.

Core PCE, which excludes volatile food and energy prices, rose 0.1% for the month and increased 2.7% from a year ago, in line with estimates and little changed from a month ago.

The Federal Reserve is focusing on the PCE headline figure as it tries to bring the pace of price increases back to 2%, although policymakers view the core data as a better indicator of inflation. Both the core and headline figures suggest that inflation is continuing to cool.

https://www.foxbusiness.com/economy/inflation-measure-closely-watched-fed-fell-2-2-august

-

Sputtering Canadian economy fuels calls for big rate cut

Canada’s gross domestic product expanded at a faster-than-expected 0.2 per cent rate in July, but an advance estimate indicated that growth likely stalled in August, data showed on Friday, bolstering hopes for a supersized interest rate cut next month.

Economists welcomed the July growth but looked at it mostly as a blip sandwiched between two months in which activity was flat and reiterated that GDP would fall well below the Bank of Canada’s third-quarter estimate.

“Growth appears to be tracking just over 1 per cent for Q3, well below the Bank of Canada’s 2.8 per cent forecast,” Royce Mendes, head of macro strategy at Desjardins Group, wrote in a note.

He said he expected the Canadian central bank would deliver a 50-basis-point rate cut on Oct. 23.

Analysts polled by Reuters had forecast GDP would rise 0.1 per cent in July, after zero growth in June.

The economy grew in July despite the negative impact of wildfires on several industries, with growth driven by services-producing industries, primarily retail trade, public sectors and finance and insurance, Statistics Canada said.

The expected economic weakness in August likely is due to a contraction in manufacturing, transportation and warehousing which would essentially offset growth in oil and gas extraction and the public sector, Statscan said.

The BoC forecast in July that the economy would grow 2.8 per cent in the third quarter, but data released since then have led economists to predict growth of about half that figure.

“The preliminary estimate of unchanged GDP in August suggests that the momentum was short-lived and puts third-quarter growth on track to surprise marginally to the downside of our already downbeat forecast of 1.2 per cent annualized,” said Olivia Cross, North America economist at Capital Economics.

She expects a 50-basis-point rate cut next month.

The BoC has cut interest rates three times since June, moving in quarter-percentage-point steps, but has said it could shift to larger cuts if the economy needs a boost.

Money markets see just over a 50 per cent chance of a half-percentage-point reduction in borrowing costs at the central bank’s next announcement and are fully pricing in another 25-basis-point cut in December.

The Canadian dollar was trading down 0.08 per cent to 1.3475 to the U.S. dollar, or 74.21 U.S. cents, after the data. Yields on the two-year Canadian government bonds were down 3.4 basis points to 3.07 per cent.

On Tuesday, BoC Governor Tiff Macklem said it was reasonable to expect more rate cuts given the progress made in cooling inflation and reiterated that the central bank wanted to see growth pick up to absorb economic slack.

Economic growth in July was driven by increases in both services, which grew by 0.2 per cent, and goods industries, which rose by 0.1 per cent, Statscan said.

-

U.S. economy grew at a solid 3% rate last quarter, government says in final estimate

The American economy expanded at a healthy 3 per cent annual pace from April through June, boosted by strong consumer spending and business investment, the government said Thursday, leaving its previous estimate unchanged.

The Commerce Department reported that the nation’s gross domestic product – the nation’s total output of goods and services – picked up sharply in the second quarter from the tepid 1.6 per cent annual rate in the first three months of the year.

Consumer spending, the primary driver of the economy, grew last quarter at a 2.8 per cent pace, down slightly from the 2.9 per cent rate the government had previously estimated. Business investment was also solid: It increased at a vigorous 8.3 per cent annual pace last quarter, led by a 9.8 per cent rise in investment in equipment.

The third and final GDP estimate for the April-June quarter included figures showing that inflation continues to ease, to just above the Federal Reserve’s 2 per cent target. The central bank’s favoured inflation gauge – the personal consumption expenditures index, or PCE – rose at a 2.5 per cent annual rate last quarter, down from 3 per cent in the first quarter of the year. Excluding volatile food and energy prices, so-called core PCE inflation grew at a 2.8 per cent pace, down from 3.7 per cent from January through March.

The U.S. economy, the world’s biggest, displayed remarkable resilience in the face of the 11 interest rate hikes the Fed carried out in 2022 and 2023 to fight the worst bout of inflation in four decades. Since peaking at 9.1 per cent in mid-2022, annual inflation as measured by the consumer price index has tumbled to 2.5 per cent.

Despite the surge in borrowing rates, the economy kept growing and employers kept hiring. Still, the job market has shown signs of weakness in recent months. From June through August, America’s employers added an average of just 116,000 jobs a month, the lowest three-month average since mid-2020, when the COVID-19 pandemic had paralyzed the economy. The unemployment rate has ticked up from a half-century low 3.4 per cent last year to 4.2 per cent, still relatively low.

Last week, responding to the steady drop in inflation and growing evidence of a more sluggish job market, the Fed cut its benchmark interest rate by an unusually large half-point. The rate cut, the Fed’s first in more than four years, reflected its new focus on shoring up the job market now that inflation has largely been tamed.

“The economy is in pretty good shape,” Bill Adams, chief economist at Comerica Bank, wrote in a commentary.

“After a big rate cut in September and considerable further cuts expected by early 2025, interest-rate-sensitive sectors like housing, manufacturing, auto sales, and retailing of other big-ticket consumer goods should pick up over the next year. Lower rates will fuel a recovery of job growth and likely stabilize the unemployment rate around its current level in 2025.”

Several barometers of the economy still look healthy. Americans last month increased their spending at retailers, for example, suggesting that consumers are still able and willing to spend more despite the cumulative impact of three years of excess inflation and high borrowing rates. The nation’s industrial production rebounded. The pace of single-family-home construction rose sharply from the pace a year earlier.

More stories below advertisement

And this month, consumer sentiment rose for a third straight month, according to preliminary figures from the University of Michigan. The brighter outlook was driven by “more favourable prices as perceived by consumers” for cars, appliances, furniture and other long-lasting goods.

A category within GDP that measures the economy’s underlying strength rose at a solid 2.7 per cent annual rate, though that was down from 2.9 per cent in the first quarter. This category includes consumer spending and private investment but excludes volatile items like exports, inventories and government spending.

Though the Fed now believes inflation is largely defeated, many Americans remain upset with still-high prices for groceries, gas, rent and other necessities. Former President Donald Trump blames the Biden-Harris administration for sparking an inflationary surge. Vice President Kamala Harris, in turn, has charged that Trump’s promise to slap tariffs on all imports would raise prices for consumers even further.

On Thursday, the Commerce Department also issued revisions to previous GDP estimates. From 2018 through 2023, growth was mostly higher – an average annual rate of 2.3 per cent, up from a previously reported 2.1 per cent – largely because of upward revisions to consumer spending. The revisions showed that GDP grew 2.9 per cent last year, up from the 2.5 per cent previously reported.

Thursday’s report was the government’s third and final estimate of GDP growth for the April-June quarter. It will release its initial estimate of July-September GDP growth on Oct. 30. A forecasting tool from the Federal Reserve Bank of Atlanta projects that the economy will have expanded at a 2.9 per cent annual pace from July through September.

-

U.S. oil inventories fall more than forecast, crude at 2½-year low: EIA

U.S. oil inventories fell across the board last week, the Energy Information Administration said on Wednesday, drawing down more than expected and with crude oil stockpiles hitting their lowest level in nearly 2-1/2 years.

Crude stocks dropped by 4.5 million barrels to 413 million barrels in the week ended Sept. 20, the EIA said, compared with analysts’ expectations in a Reuters poll for a 1.4 million-barrel draw.

U.S. crude inventories, excluding those in the Strategic Petroleum Reserve, were at their lowest last week since April 2022.

Stocks at the Cushing, Oklahoma, delivery hub for U.S. crude futures rose by 116,000 barrels, marking their first increase since the beginning of August, the EIA said.

“Even oil bears acknowledge that the market is currently under supplied,” said Josh Young, chief investment officer for Bison Interests. He warned there is still strong sentiment in the market that stocks will be over supplied next year.

Oil futures pared losses following the report. Brent crude was at $74.82 a barrel, down roughly 35 cents by 11:06 a.m. EDT (1506 GMT), while U.S. West Texas Intermediate crude was off 49 cents to $71.06 a barrel.

Refinery crude runs fell by 124,000 barrels per day, while utilization rates dropped by 1.2 percentage points to 90.9 per cent of total capacity.

Gasoline stocks fell by 1.5 million barrels in the week to 220.1 million barrels, the EIA said, compared with expectations for a 21,000-barrel draw.

Distillate stockpiles, which include diesel and heating oil, fell by 2.2 million barrels in the week to 122.9 million barrels, more than expectations for a 1.6 million-barrel drop, the EIA data showed.

Distillate inventories on the U.S. Gulf Coast declined by the most last week since September 2021.

“The trend of falling supplies is getting too big to ignore. We hear how bad demand can be and have mixed signals” said Phil Flynn, an analyst with Price Futures Group. “The weakness of demand doesn’t fit with this falling inventory situation,” he added.

Net U.S. crude imports rose last week by 826,000 barrels per day, EIA said, while exports declined by 692,000 bpd to 3.9 million bpd

-

Lightspeed Commerce latest Canadian tech company put up for sale

Lightspeed Commerce Inc.LSPD-T +13.28%increase is officially up for sale, the latest in a series of Canadian tech companies to consider going private following a stock market slump after pandemic restrictions were lifted.

The board of the Montreal-based point-of-sale software vendor has hired U.S.-based investment bank JP Morgan Chase & Co. to run a strategic review of the business that includes a potential sale to a rival tech company or private equity fund, according to a source familiar with the situation.

Lightspeed is in the early stages of the strategic review and there are no assurances the company will be sold, the source said. The Globe and Mail agreed not to name the source because they are not permitted to speak for the company. Reuters first reported that Lightspeed is up for sale.

On Wednesday, Lightspeed’s Toronto Stock Exchange-listed shares jumped and closed up by 13 per cent on news of a possible takeover. The company’s market capitalization is $3.2-billion. Lightspeed sells transaction software to retailers, restaurants, golf courses and hotels.

The company is in the midst of a strategic shift, after the board replaced chief executive officer Jean Paul Chauvet in February with founder and former chief executive officer Dax Dasilva. After retaking control, Mr. Dasilva moved to increase Lightspeed’s sales at a sharper pace while still maintaining a commitment to improve its bottom line.

Despite posting higher revenue in recent years amid rising customer transactions, Lightspeed has failed to reach profitability, although it has lived up to its promises to achieve adjusted operating profitability, a non-GAAP measure that is followed more closely by analysts.

Lightspeed was founded in 2005 and serves customers at 163,000 locations in more than 100 countries. The company has been shifting its business to serve larger customers with US$500,000 or more in annual revenues, which has resulted in Lightspeed shedding many smaller companies – and the subscription revenue it earned from them for using its software.

But the company believes it can grow its business overall by serving the more complex needs of larger clients. The pace and progress of that shift and Lightspeed’s commitment to pursuing higher growth has spooked investors at times in recent years and prompted Mr. Chauvet’s exit early this year.

Shareholders in general have been frustrated with the drop in valuations for software companies that have tried to juggle the pursuit of profitability without sacrificing too much of the revenue growth that had driven investor excitement before that. With private equity firms willing to pay higher valuations than public market shareholders, the temptation has been strong for listed companies to sell out.

Kinaxis Inc. KXS-T +1.28%increase, an Ottawa-based software company that went public a decade ago, has faced public calls in recent weeks from two institutional investors to put itself up for sale. The activist fund managers targeted Kinaxis after its stock fell due to concerns about slowing growth and the sudden departure of chief executive officer John Sicard, announced recently. Kinaxis has a $4.4-billion market capitalization.

In March, Mr. Dasilva said in an interview with The Globe that Lightspeed’s board was considering offers to take the company private, after peers such as Nuvei Corp. announced takeovers. But he indicated his preference was for Lightspeed to stay the course as a public company.

“I think the return of Dax to the role of CEO was a clear sign that this is a board and a CEO that are very focused on ultimately unlocking shareholder value,” said analyst Thanos Moschopoulos at BMO Capital Markets in an interview on Wednesday.

“We’ve seen this play out before. It’s a cyclical dynamic,” said Mr. Moschopoulos. “We fluctuate between markets that are conducive to IPOs and markets that are more challenging, and when valuations are depressed, that in turn leads to privatization behaviour, prompting companies to put themselves up for sale.”

Lightspeed went public in 2019 by selling shares for $16 each and went on an acquisition spree in the following two years. The stock price hit $150 a share in 2021, when investors put premium valuations on digital businesses, then slumped below $20 in recent months. On Wednesday, Lightspeed stock closed at $21.15 on the TSX after the Reuters story broke. The company also lists its shares on the New York Stock Exchange.

Potential bidders for Lightspeed could include established U.S. rivals such as Global Payments Inc. and NCR Corp., which could expand its software product lines by acquiring the Canadian company, and private equity funds willing to back Mr. Dasilva’s turnaround strategy, said analyst Richard Tse at National Bank Financial Markets. “A potentially wide range of prospects could look at this,” he said.

If Lightspeed does get taken over, it will be the latest in a string of Canadian tech companies that raised money over the past five years only to go private when the sector fell out of favour. Nine of the 20 tech companies to launch initial public offerings on the Toronto Stock Exchange during the COVID-19-linked boom have already gone private.

In April, U.S. private equity firm Advent International Corp. acquired Montreal-based online payment company Nuvei NVEI-T +0.40%increasean US$6.3-billion transaction supported by Nuvei founder Phil Fayer and two major institutional shareholders, Novacap and Caisse de dépôt et placement du Québec.

TSX-listed tech companies Absolute Software Corp., mdf commerce

N/Aand TrueContext Corp.

N/A have also recently agreed to buyouts. This wave of privatizations of Canadian tech companies in the past year followed a crash in valuations in late 2021. Lightspeed stock is down more than 85 per cent from its high that year.

Lightspeed’s largest shareholder is the Montreal-based Caisse, with a 16-per-cent stake. Boston-based fund manager Fidelity Investments owns 11 per cent and Mr. Dasilva is also a major shareholder, but he owns less than 10 per cent of the company.

-

Strike at Vancouver grain terminals leaves ships at anchor

Ships are being forced to stay at anchor after a strike that began this week at six Vancouver grain terminals created bottlenecks in the supply chain from the Prairies to the West Coast.

There were 19 vessels waiting to load grain at the Port of Vancouver on Wednesday during what would normally be a busy autumn for exports. But instead of ships being assigned berths when they become vacant, the supply chain for grain is congested.

Port officials have asked ships en route to the West Coast to change to “slow steaming,” meaning to significantly reduce their pace of ocean travel whenever possible.

About 650 members of the Grain Workers Union Local 333 went on strike on Tuesday, after an impasse at the bargaining table with the Vancouver Terminal Elevators’ Association.

Sylvain Charlebois, a professor in food distribution and policy at Dalhousie University, said the bulk grain delays in Western Canada are part of what could be a disruptive autumn for North American logistics, including potential strikes at the Port of Montreal and cargo terminals in the U.S. East Coast and Gulf Coast.

“Even without a strike, the uncertainty is quite painful for companies that are trying to plan ahead,” Mr. Charlebois said in an interview on Wednesday from Halifax.

The strike by grain terminal workers follows shutdowns at Canada’s two largest railways that temporarily disrupted a wide range of freight deliveries for several days in August.

The Saskatchewan Wheat Development Commission and other agricultural groups are urging federal Labour Minister Steven MacKinnon to intervene during the busy harvest season.

“If grain companies are unable to ship grain to terminal elevators, in-country elevators will inevitably fill up, which will impact farmers’ ability to deliver grain,” Saskatchewan Wheat chair Jake Leguee said in a letter to Mr. MacKinnon.

Delays in exports of everything from canola and wheat to barley and oats from the six terminals could add up to $35-million a day, the Grain Growers of Canada said.

Employers at the six grain elevators along Burrard Inlet’s north and south shores said progress has been made on wages, but that there remain disagreements with the union over scheduling and benefits.

Wages vary depending on the job classification. An electrical technologist currently makes $48.80 an hour, for example, while a janitor earns $42.80 an hour. The employers have offered a four-year contact, with wage increases of 5 per cent in the first year, followed by annual hikes of 4 per cent, 4 per cent and 3 per cent.

The previous five-year collective agreement expired on Dec. 31, 2023.

One of the disagreements focuses on employers saying they are seeking flexibility to scale back the scheduling of workers on statutory holidays during slow periods in the spring and summer. But union leaders want to maintain the system of mandatory scheduling that allows for employees to earn double-time rates during shifts on statutory holidays.

After bargaining talks broke off late last week, the two sides in the dispute met on Wednesday in an effort to find common ground with the assistance of the Federal Mediation and Conciliation Service.

“Like any collective bargaining situation, we’re hoping for a positive outcome,” Mr. MacKinnon said in Ottawa.

Fraser Surrey Grain Terminal Ltd. at the Port of Vancouver and Prince Rupert Grain Ltd. in northwest B.C. have continued operating this week because workers there have different collective agreements and are not on strike.

Local 333 is a chartered local of the International Longshore & Warehouse Union Canada.

Meanwhile, Local 514 of the ILWU, representing about 730 ship and dock forepersons, is awaiting a ruling from the Canada Industrial Relations Board. In May, the BC Maritime Employers Association filed a complaint with the labour board, alleging bad-faith bargaining on the part of the local.

Members of the local are supervisors of the ILWU’s rank-and-file workers who went on strike in July, 2023, at B.C. ports. Those employees staged a 13-day strike, returned for several days to their posts and then walked out again for one more day.

Earlier this month, the Federal Court of Appeal confirmed the labour board’s decision that declared the one-day walkout to be illegal, noting the union did not issue the required 72-hour strike notice.

-

Statistics Canada says population grew 0.6 per cent in Q2 to 41,288,599

Statistics Canada says the population of the country reached an estimated 41,288,599 on July 1.

The agency says the total means 250,229 people were added in the second quarter of the year for a growth of 0.6 per cent.

The growth rate was slower than the same quarter of 2023 which saw a 0.8 per cent increase and the 0.7 per cent increase in the second quarter of 2022.

The increase in the population was almost entirely due to international migration which added 240,303 people.