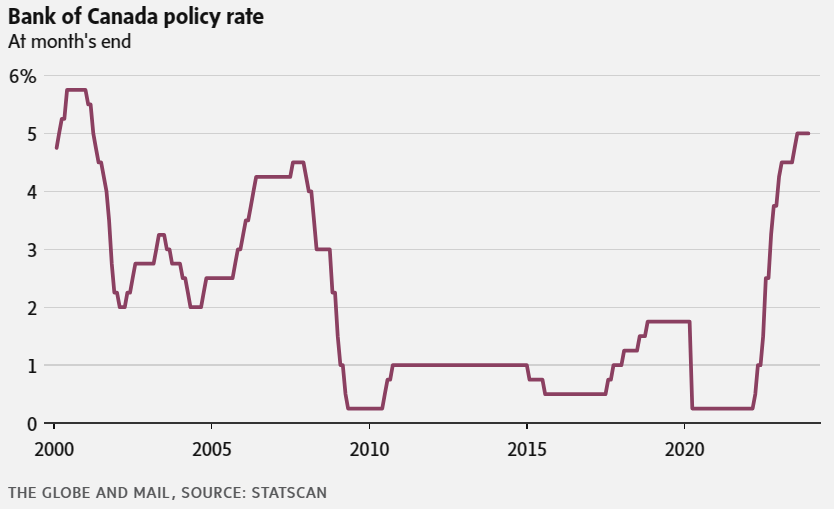

The Bank of Canada held its policy rate steady at 5 per cent for the third consecutive decision and warned that it could raise rates again. It said monetary policy is working to cool inflation but gave few hints that it is preparing to lower rates.

Markets believe the bank will start cutting rates in the first half of next year.https://charts.theglobeandmail.com/Zn08W/1/

- Who feels the sting of higher-for-longer economics?

- This calculator compares how interest rates affect the cost of your mortgage

- What is your mortgage trigger rate? This calculator helps you estimate it

Find updates from our reporters and columnists below.

12:15 P.M.

What’s next?

- Deputy Governor Toni Gravelle will deliver an Economic Progress Report on Thursday outlining the bank’s rationale for today’s decision. The speech in Windsor, Ont., starts at 12:50 p.m. ET, followed by a news conference at 2:10 p.m. ET.

- The Bank of Canada’s next interest rate announcement is on Jan. 24. It will also publish its quarterly Monetary Policy Report, with updated forecasts for inflation and economic growth.

- Statistics Canada will release November inflation data on Dec. 19 and October GDP numbers on Dec. 22.

- The U.S. Federal Reserve’s next rate announcement is on Dec. 13. Most economists expect the Fed to hold interest rates steady but will be watching for any changes of tone that hint at where U.S. monetary policy is headed.

Leave a Reply

You must be logged in to post a comment.