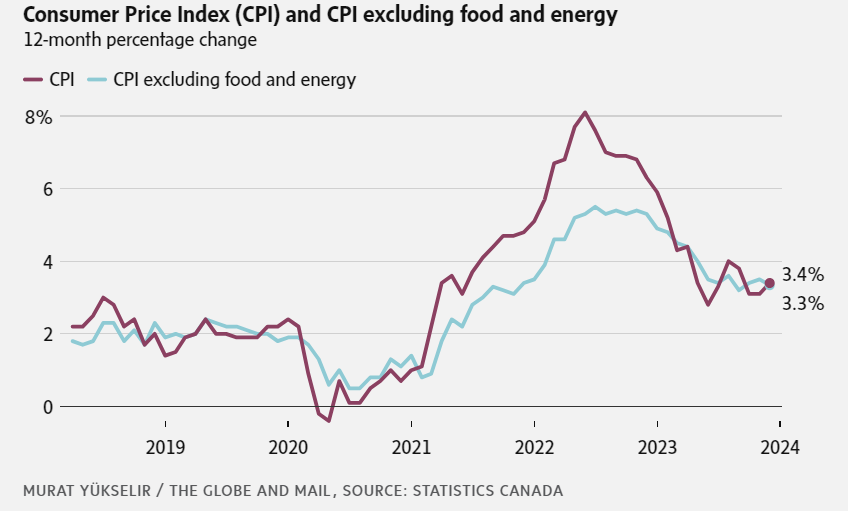

Canada’s annual inflation rate rose to 3.4 per cent in December, up from 3.1 per cent in November, Statistics Canada said Tuesday – matching financial analysts’ expectations.

The Bank of Canada is broadly expected to continue to hold its key interest rate at five per cent at its next decision on Jan. 24. However, the timing of the first interest rate cut is expected to be driven by how fast inflation falls and how sharply the economy softens this year.

The January 2024 inflation report will be released on February 20.

Markets react to the latest inflation data

Markets were taken a little off guard with the higher-than-expected core readings of inflation, with the Canadian dollar immediately rising to 74.30 cents US, up about a tenth of a cent and the two-year government of Canada bond yield bumping up an additional couple basis points. At 8:42 a.m. ET, Canada’s two-year bond yield was fetching 3.873 per cent, up about 9 basis points for the session and widening its spread against the equivalent U.S. note. Implied interest-rate probabilities in swaps markets saw modest moves as well, but nothing that meaningfully changes what traders see ahead for moves this year in the Bank of Canada overnight rate. Markets are pricing in about a 30 per cent chance of a cut in the BoC overnight rate at its March meeting, rising to 73 per cent odds by April. Prior to today’s inflation release, those probabilities stood at 40 per cent and 87 per cent, respectively.

Regardless, money markets remain convinced we’ll see the bank start cutting rates in the first half of this year, with 99 per cent odds of at least a quarter point cut by June. Nearly 125 basis points of cuts are currently priced into markets by the end of this year.

Leave a Reply

You must be logged in to post a comment.