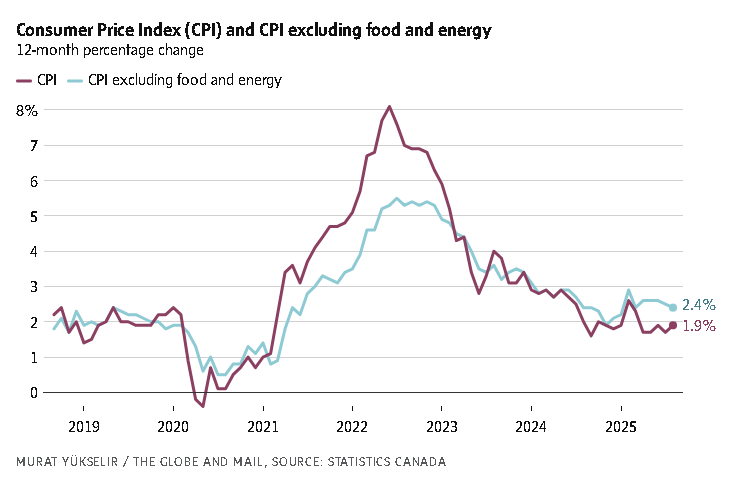

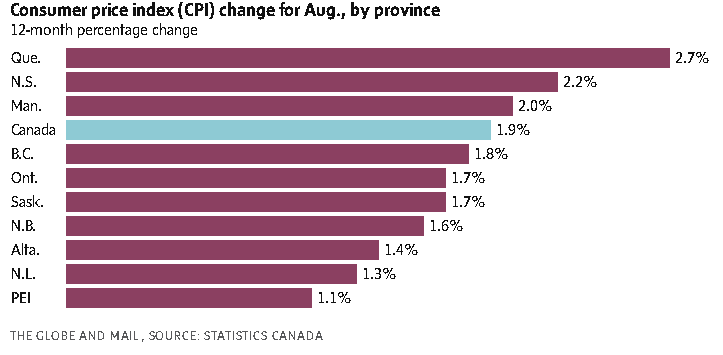

Canada’s inflation rate rose to 1.9 per cent in August, increasing by less than economists had forecasted and solidifying expectations of an interest rate cut on Wednesday.

Statistics Canada reported on Tuesday that the annual inflation rate rose from 1.7 per cent in July. The acceleration in headline inflation was driven by a smaller annual increase in gasoline prices in August relative to July.

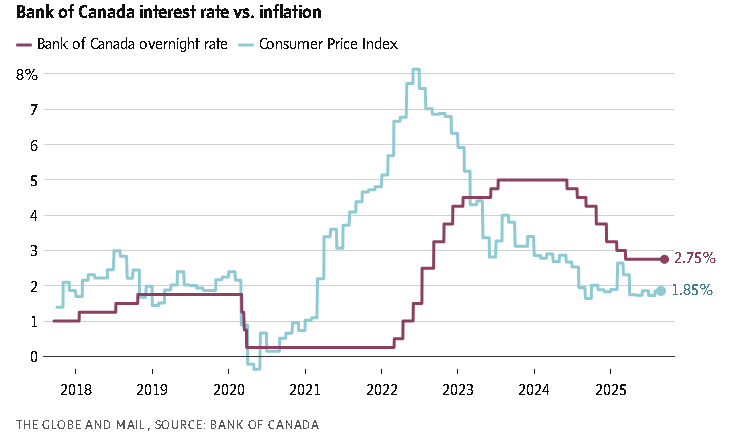

The Bank of Canada will have a close eye on Tuesday’s consumer price index report as it gears up for its interest rate announcement on Wednesday. Economists widely expect the central bank will resume cutting interest rates as U.S. tariffs slow economic growth.

CIBC senior economist Andrew Grantham said, “inflation remains unthreatening,” noting that core measures of inflation which strip out volatility in price movements have decelerated slightly.

“So all in all, really, this is not an obstacle for the Bank of Canada to cut interest rates tomorrow, and we continue to forecast a 25-basis-point move,” he said in an interview.

The Bank of Canada’s key measures of inflation continued to hover around three per cent last month. Meanwhile, inflation excluding gasoline prices rose by 2.4 per cent, down slightly from the previous three months.

Mr. Grantham expects the central bank to deliver another interest rate cut in October, as well.

The Bank of Canada’s key interest rate currently stands at 2.75 per cent.

Traders now see about a 93-per-cent chance of a quarter-percentage-point cut on Wednesday, up from about 87 per cent prior to the inflation report, according to LSEG data.

The Bank of Canada has held off on cutting interest rates since March, opting to monitor how the U.S. trade war evolves and whether inflation remains at bay.

Economists were somewhat concerned by a pick-up in inflation in the spring and the prospect of a trade war raising prices further. But those anxieties have faded as data come in milder than expected.

Mr. Grantham said that in hindsight, the pick-up in inflation in the spring was being driven by retaliatory tariffs Canada placed on U.S. goods, which affected food products in particular.

Prime Minister Mark Carney dropped many of Canada’s retaliatory tariffs this month, in a bid to further trade negotiations with the U.S.

“It’s very difficult to make the case that underlying inflationary pressures are anything but weak at the moment,” said Royce Mendes, managing director and head of macro strategy at Desjardins.

“That’s even more true given the fact that Canada’s retaliatory tariffs have mostly been eliminated, so any price increases that were due to those tariffs are likely to normalize, and in some cases, we could even see price declines in some categories.”

While headline inflation remained around the Bank of Canada’s two-per-cent target, Canadians continued to see the cost of food and shelter rise faster than overall price growth last month.

Food prices rose by 3.4 per cent, compared with 3.3 per cent in July. Shelter costs increased at a slower pace of 2.6 per cent, down from 3 per cent the previous month.

Leave a Reply

You must be logged in to post a comment.