Thomson Reuters Corporation provides business information services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. It operates in five segments: Legal Professionals, Corporates, Tax & Accounting Professionals, Reuters News, and Global Print. The Legal Professionals segment offers research and workflow products focusing on legal research and integrated legal workflow solutions that combine content, tools, and analytics to law firms and governments. The Corporates segment provides a suite of content-enabled technology solutions for legal, tax, regulatory, compliance, and IT professionals. The Tax & Accounting Professionals segment offers research and workflow products focusing on tax offerings and automating tax workflows to tax, accounting, and audit professionals in accounting firms. The Reuters News segment provides business, financial, and international news to media organizations, professional, and news consumers through news agency and industry events. The Global Print segment offers legal and tax information primarily in print format to legal and tax professionals, governments, law schools, and corporations. The company was formerly known as The Thomson Corporation and changed its name to Thomson Reuters Corporation in April 2008. The company was founded in 1851 and is headquartered in Toronto, Canada. Thomson Reuters Corporation is a subsidiary of The Woodbridge Company Limited.

How the Company Makes Money

Thomson Reuters generates revenue primarily through subscription-based models and software licensing. Its key revenue streams include:

1) Legal Professionals: Providing legal research tools, case law databases, and analytics solutions.

2) Financial Professionals: Offering financial market data, trading platforms, and analytical tools for investment professionals.

3) Tax and Accounting: Supplying software and services for compliance, tax planning, and accounting professionals.

4) Media: Licensing news content and providing insights to media organizations. Additionally, strategic partnerships with technology firms enhance its service offerings and expand its market reach, contributing substantially to its revenue growth.

Thomson Reuters (TRI) Financial Statements

Thomson Reuters (TRI) Dividend Date & History

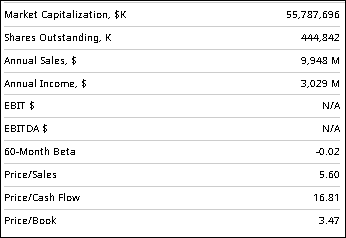

Here’s a data-driven review of Thomson Reuters (trading on the Toronto Stock Exchange as TRI.TO) share price trend over the past 3 months and a forward look at growth expectations over the next 3 months based on the most recent market data and analyst forecasts available.

1. Recent 3-Month Share Performance (Trend)

Over the last 3 months, TRI.TO has experienced a significant pullback:

- The stock has declined sharply, with one snapshot showing a drop of around -27.8% over 1 month and -31.1% YTD as of early February 2026.

- The decline reflects broad market selling pressure and sector rotation, with TRI underperforming broader indices.

- Intraday quotes have shown the stock trading near its 52-week low range (~C$118–C$125) versus a cycle high near ~C$299.

- Technical indicators currently lean bearish, with some systems flagging “sell” momentum.

Summary: The past 3 months have seen weak performance and volatility, propelled by downgrades, profit taking, and general risk-off sentiment in equities.

2. Drivers Behind the Recent Trend

Several factors have influenced this downward trend:

Earnings & Guidance

- TRI has delivered sequential revenue growth and reaffirmed its guidance in recent reported quarters, with organic revenue increases driven by AI-enhanced offerings.

Analyst Revisions

- Some analysts have cut price targets recently — notably National Bank reducing targets (which triggered a sharp one-day drop).

Market Position

- TRI’s business leans on subscription-based and enterprise services (legal, tax, accounting), which historically offers stability, but earnings depend on broader macro spending.

3. Forward Outlook (Next 3 Months)

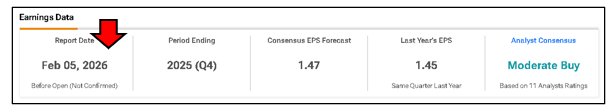

Over the next quarter, near-term stock direction will be influenced by earnings results, broader market performance, and sentiment toward value/tech stocks. Here’s what analysts project:

Analyst Price Targets & Consensus

- Most major brokerages maintain a Buy or Hold consensus, even with some downward target revisions.

- Average 12-month price targets sit well above current levels (often in the ~C$180–C$260+ range), suggesting medium-to-long-term upside from current prices, though this is beyond the next 3 months.

Short-Term Signals

Bullish Factors:

- Strong core revenue and continued investment in AI tools—especially for legal and tax workflows—support longer-term growth.

- Buybacks and recurring revenue reduce earnings volatility and can underpin near-term support.

Bearish/Neutral Factors:

- Technical indicators and recent price declines indicate near-term resistance remains until sentiment stabilizes.

- Macro headwinds (higher rates, slower corporate IT spend) could delay discretionary growth.

4. Growth Expectations — Quantitative Summary

| Timeframe | Expected Trend / Signal |

| Past 3 Months | Weak / Downtrend; underperformed major indices |

| Next 1–3 Months (Technicals) | Mixed to cautious; bearish bias unless earnings beat expectations |

| 3–12 Months (Consensus) | Generally moderate Buy with significant potential upside |

Analyst Consensus (12-Month):

- Price targets generally ~C$180–C$260+ versus current ~C$120s, a substantial implied upside.

Bottom Line — What Investors Should Know

✅ Strengths

- Recurring revenue model, strong brand, and AI-driven product expansion support fundamental growth.

- Analyst coverage mostly positive long-term.

⚠️ Near-Term Headwinds

- Recent price weakness and technical bearish signals suggest caution for the next few weeks.

- Market sentiment and macro variables (rates, spending) will strongly influence stock movement.

Catalysts to Watch

- Upcoming earnings releases (e.g., next quarterly report).

- Any new guidance on AI products or subscription growth.

- Broader market trend shifts (value rotation, rate moves).

Leave a Reply

You must be logged in to post a comment.