https://www.cnbc.com/2023/10/28/israel-hamas-war-gaza-live-updates.html

Author: Consultant

-

Calendar : Oct 30 – Nov 3

Monday October 30

Euro zone economic confidence

Germany’s real GDP and consumer prices

Bank of Japan’s monetary policy meeting (through Tuesday).

(10:30 a.m. ET) U.S. Dallas Fed Manufacturing Activity for October.

(3:30 p.m. ET) Bank of Canada Governor Tiff Macklem and Senior Deputy Governor Carolyn Rogers appear before the House Standing Committee on Finance.

Earnings include: Air Canada; Gibson Energy Inc.; McDonald’s Corp.; TMX Group Ltd.; Topaz Energy Corp.; Toromont Industries Ltd.

—

Tuesday October 31

China manufacturing PMI

Japan jobless rate, retail sales and industrial production

(8:30 a.m. ET) Canada’s monthly real GDP for August. The Street is projecting an increase of 0.1 per cent from July.

(8:30 a.m. ET) U.S. employment cost index for Q3. The consensus is a rise of 1.0 per cent from Q2 and up 4.3 per cent year-over-year.

(9 a.m. ET) U.S. S&P CoreLogic Case-Shiller Home Price Index for August. Consensus is a rise of 0.8 per cent from July and up 2.0 per cent year-over-year.

(9 a.m. ET) U.S. FHFA House Price Index for August. The Street is estimating an increase of 0.5 per cent month-over-month and up 5.4 per cent year-over-year.

(9:45 a.m. ET) U.S. Chicago PMI for October.

(10 a.m. ET) U.S. Conference Board Consumer Confidence Index for October.

Also: U.S. Fed meeting begins

Earnings include: Amgen Inc.; Advanced Micro Devices Inc.; Caterpillar Inc.; Centerra Gold Inc.; First Capital Realty Inc.; First National Financial Corp.; International Petroleum Corp.; Pfizer Inc.; Stellantis NV

—

Wednesday November 1

(8:15 a.m. ET) U.S. ADP National Employment Report for October. Estimate is an increase of 150,000 jobs (versus a rise of 89,000 in September).

(9:30 a.m. ET) Canada’s S&P global manufacturing PMI for October.

(9:45 a.m. ET) U.S. S&P global manufacturing PMI for October.

(10 a.m. ET) U.S. ISM manufacturing PMI for October.

(10 a.m. ET) U.S. construction spending for September. Consensus is a month-over-month rose of 0.4 per cent/

(10 a.m. ET) U.S. Job Openings & Labor Turnover Survey for September.

(2 p.m. ET) U.S. Fed announcement with chair Jerome Powell’s press conference to follow.

(4:15 p.m. ET) Bank of Canada Governor Tiff Macklem and Senior Deputy Governor Carolyn Rogers appear before the Senate Standing Committee on Banking, Commerce and the Economy.

Also: Canadian and U.S. auto sales for October.

Earnings include: Airbnb Inc.; Bausch + Lomb Corp.; Canada Goose Holdings Inc.; Capital Power Corp.; Cenovus Energy Inc.; Ceridian HCM Holding Inc.; Cogeco Inc.; Cogeco Communications Inc.; CVS Health Corp.; Estee Lauder Companies Inc.; GFL Environmental Holdings Inc.; IGM Financial Inc.; InterRent REIT; Kinaxis Inc.; Mondelez International Inc.; NexGen Energy Ltd.; Nutrien Ltd.; Parkland Fuel Corp.; PayPal Holdings Inc.; Qualcomm Inc.; Secure Energy Services Inc.; Spin Master Corp.; SSR Mining Inc.; Vermilion Energy Inc.

—

Thursday November 2

China’s current account surplus

Bank of England’s monetary policy announcement

(8:30 a.m. ET) U.S. initial jobless claims for week of Oct. 28. Estimate is 210,000, flat from the previous week.

(8:30 a.m. ET) U.S. productivity and unit labour costs for Q3. Consensus estimates are annualized rate increases of 4.0 per cent and 0.7 per cent, respectively.

(10 a.m. ET) U.S. factory orders for September. The Street is expecting a month-over-month increase of 1.7 per cent.

Also: Ontario’s fall economic statement

Earnings include: Apple Inc.; Barrick Gold Corp.; Bausch Health Companies Inc.; Baytex Energy Corp.; BCE Inc.; Bombardier Inc.; Canadian Natural Resources Ltd.; Canfor Corp.; Colliers International Group Inc.; ConocoPhillips; Crescent Point Energy Corp.; Eli Lilly and Co.; Ero Copper Corp.; Fairfax Financial Holdings Ltd.; First Majestic Silver Corp.; Gildan Activewear Inc.; Interfor Corp.; Labrador Iron Ore Royalty Corp.; Lightspeed Commerce Inc.; Maple Leaf Foods Inc.; Open Text Corp.; Pason Systems Inc.; Pembina Pipeline Corp.; Primo Water Corp.; RioCan REIT; Shopify Inc.; Starbucks Corp.

—

Friday November 3

Japan’s markets closed

Euro zone jobless rate

Germany’s trade surplus

(8:30 a.m. ET) Canadian employment for October. The Street expects an increase of 0.1 per cent, or 25,000 jobs, from September with the unemployment rate rising 0.1 per cent to 5.6 per cent.

(8:30 a.m. ET) U.S. nonfarm payrolls for October. Consensus is an increase of 180,000 jobs from September with the unemployment rate remaining 3.8 per cent.

(9:45 a.m. ET) U.S. S&P global services and composite PMI for October.

(10 a.m. ET) U.S. ISM services PMI for October.

Earnings include: Alibaba ADR; AltaGas Ltd.; Arc Resources Ltd.; Brookfield Business Partners LP; Brookfield Renewable Partners LP; Cameco Corp.; Capstone Mining Corp.; Enbridge Inc.; Energy Fuels Inc.; Magna International Inc.; Restaurant Brands International Inc.; Telus International Inc.; TransAlta Renewables Inc.; Westshore Terminals Investment Corp.

-

Canadian Market Witnessing Another Weak Spell

Published: 10/26/2023 12:32 PM ET

Canadian stocks are turning in a mixed performance on Thursday with investors largely making cautious moves, digesting the latest batch of Canadian and U.S. economic data, and a slew of earnings updates.

Investors are also reacting to the European Central Bank’s interest rate decision, and its outlook for future monetary policy path.

The benchmark S&P/TSX Composite Index is down 98.77 points or 0.52% at 18,849.08 nearly half an hour past noon.

Technology and materials shares are weak. Utilities, financials and a few stocks from the real estate sector are faring well.

Celestica Inc (CLS.TO) is plunging 12.7%. Shopify Inc (SHOP.TO) is down by about 3%. Constellation Software (CSU.TO), Opex Text Corp (OTEX.TO), BlackBerry (BB.TO) and Docebo Inc (DCBO.TO) are down 1.4 to 3%.

Materials shares K92 Mining Inc (KNT.TO), Endeavour Silver Corp (EDR.TO), Seabridge Gold (SEA.TO), Oceanagold (OGC.TO), Agnico Eagle Mines (AEM.TO) and First Quantum Minerals (FM.TO) are down 3 to 4%. Eldorado Gold (ELD.TO) and Franco-Nevada (FNV.TO) are also sharply lower.

Utilities shares Boralex Inc (BLX.TO), Hydro One (H.TO), Transalta Corp (TA.TO), Fortis Inc (FTS.TO) and Algonquin Power and Utilities Corp (AQN.TO) are gaining 1.3 to 2.4%.

Canadian Utilities (CU.TO) is up more than 2%. The company reported third quarter 2023 adjusted earnings of $87 million ($0.32 per share), compared to $120 million ($0.45 per share) in the third quarter of 2022.

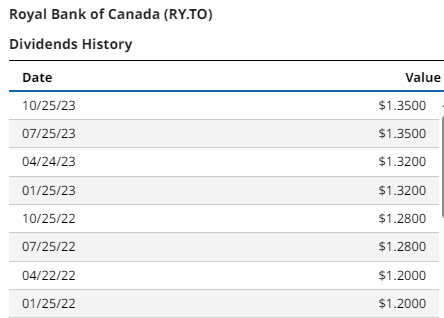

In the financials sector, Fairfax Financial Holdings (FFH.TO) is up 2%. Onex Corp (ONEX.TO), CDN Western Bank (CWB.TO), Bank of Montreal (BMO.TO) and Royal Bank of Canada (RY.TO) are up 1 to 1.6%.

FirstService Corporation (FSV.TO) reported consolidated revenues of $1.12 billion for the third-quarter, up 16% compared to the year-ago quarter. The stock is up 0.6%.

ATCO Ltd. (ATO.X.TO) reported third quarter 2023 adjusted earnings of $81 million ($0.71 per share), compared to $87 million ($0.76 per share) in the year-ago quarter. The stock is gaining about 1.3%.

Precision Drilling Corporation (PD.TO) reported third-quarter net earnings of $20 million or $1.45 per share compared to $31 million or $2.26 per share in the corresponding quarter last year. The stock is down by about 4%.

On the economic front, a report from the Canadian Federation of Independent Business showed Canada’s CFIB Business Barometer long-term optimism index fell for the second straight month to 47.2 in October 2023 from 48.7 in the prior month. It was the lowest reading since April 2020.

Data from Statistics Canada showed average weekly earnings of non-farm payroll employees in Canada remained unchanged at 4.2% year-on-year to $1,218 in August of 2023, after the July reading was revised down from 4.3%.

-

Bank of Canada Governor Tiff Macklem says interest rates may be at peak

The Bank of Canada (BoC) may not have to raise its key overnight rate further if inflation cools in line with the central bank’s expectations, Governor Tiff Macklem said in an interview with the Canadian Broadcasting Corp.

“The economy is not overheated anymore and … we do think there’s more inflation relief in the pipeline, and if that comes through, we won’t have to raise rates further,” Macklem said in a CBC Radio interview aired on Thursday.

The BoC on Wednesday held its key overnight rate at a 22-year high of 5.0 per cent but left the door open to more hikes, saying price risks were on the rise and inflation could exceed its target for another two years.

The bank increased rates 10 times between March 2022 and this July, with inflation peaking at more than 8 per cent last year.

Most analysts do not expect another rate increase in this cycle, and money markets see only a 14 per cent chance of one when the BoC makes its next policy announcement on Dec. 6.

A Reuters poll of economists published on Friday showed that the majority do not see rates going higher, but they do see them staying at the current level for at least six months.

Macklem said the BoC would be looking for “clear evidence” inflation is heading toward the bank’s 2 per cent target before it would cut interest rates.

“If we can get inflation down, interest rates can come down from where they are. They’re probably not going back to where they were pre-COVID,” Macklem said on the CBC’s “The Current” morning radio show.

The BoC’s key overnight rate was 1.75 per cent at the start of 2020, before being rapidly slashed to 0.25 per cent when the pandemic hit.

-

West Fraser Timber third-quarter earnings, sales lower compared with last year

West Fraser Timber Co. Ltd. says it earned US$159 million in the third quarter, compared with US$216 million a year earlier.

The Vancouver-based company says sales were US$1.7 billion, down from US$2.1 billion during the third quarter last year.

Earnings per diluted share were US$1.81, down from US$2.50 last year.

President and CEO Ray Ferris says the third quarter saw a continuation of challenging demand, especially in lumber.

As a result, Ferris says the company executed curtailments at several locations.

He says the company continues to focus on what it can control, such as improving flexibility and lowering costs.

This report by The Canadian Press was first published Oct. 25, 2023.

Companies in this story: (TSX:WFG)

-

AEM: Q3 Earnings Snapshot

Agnico Eagle Mines Ltd. (AEM) on Wednesday reported third-quarter earnings of $178.6 million.

On a per-share basis, the Toronto-based company said it had profit of 36 cents. Earnings, adjusted for non-recurring costs, were 44 cents per share.

The results exceeded Wall Street expectations. The average estimate of six analysts surveyed by Zacks Investment Research was for earnings of 43 cents per share.

The gold mining company posted revenue of $1.64 billion in the period.

Agnico shares have decreased 6% since the beginning of the year. In the final minutes of trading on Wednesday, shares hit $48.81, a rise of 13% in the last 12 months.

-

CPKC reports third-quarter results

-

Teck Resources raises cost estimates for QB2 project in Chile

Teck Resources Ltd. raised the cost estimates for its QB2 copper project in Chile as it reported its latest quarterly results and lowered its production guidance for copper, molybdenum and steelmaking coal for the year.

The mining company says it now expects the QB2 project to cost between US$8.6 billion and $8.8 billion, up from earlier guidance for between US$8.0 billion and US$8.2 billion.

The update came as Teck says it earned a profit attributable to shareholders of C$276 million or 52 cents per diluted share for the quarter end Sept. 30 compared with a loss of C$195 million or 37 cents per share a year earlier.

Revenue totalled C$3.60 billion, down from C$4.26 billion in the same quarter last year.

On an adjusted basis, Teck says it earned 76 cents per diluted share, down from an adjusted profit of C$1.74 per diluted share a year earlier.

In its guidance, Teck lowered its annual copper production forecast to 320,000 to 365,000 tonnes from 330,000 to 375,000 tonnes for this year and cut its annual molybdenum production guidance to 3.0 million to 3.8 million pounds from 4.5 million to 6.8 million pounds. It also said it expects steelmaking coal production this year to be between 23.0 million and 23.5 million tonnes, down from earlier expectations for 24.0 million to 26.0 million tonnes.

This report by The Canadian Press was first published Oct. 24, 2023.