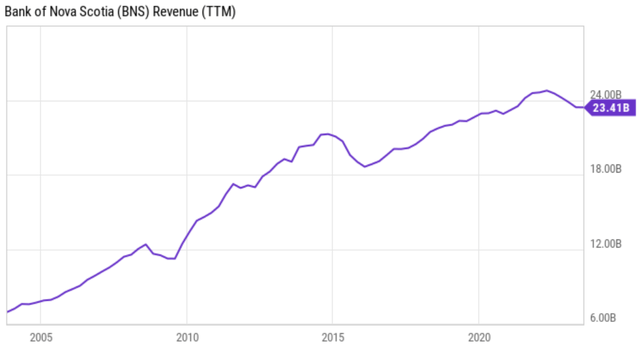

Bank of Nova Scotia BNS-T -2.17%decrease is cutting 3 per cent of its global work force ahead of launching its strategic turnaround plan, deepening the streak of job cuts on Bay Street this year.

The restructuring plans announced Wednesday – which also include trimming some real estate holdings and writing down the value of an investment in China-based Bank of Xi’an Co. Ltd. – mark chief executive officer Scott Thomson’s first major move to slash costs since taking on the top job in February.

Scotiabank said that the $590-million in charges to cover the costs will affect its fourth-quarter earnings per share by about 49 cents and its common equity tier 1 ratio – a measure of a lender’s ability to absorb losses – by approximately 10 basis points. (A basis point is one-hundredth of a percentage point.) Scotiabank expects to book the cost savings from these cuts by 2025.

Canada’s fourth-largest lender is preparing to unveil an overhaul strategy as Mr. Thomson seeks to revive the lender’s beleaguered share price. He has said that the plan – set to be unveiled in December – will focus on improving employee culture to improve customer experience, as well as expanding its Canadian business and rejigging its international unit in Latin America.

Scotiabank said in a statement its cuts to its team of 91,000 employees are a result of the bank’s digitization and automation efforts, as well as changes in how customers access their banking products and services. The lender is also continuing to streamline its operations to reallocate resources to key areas where it believes it can expand its business. It did not disclose the total number of jobs affected.

Scotiabank CEO Scott Thomson unveils first leadership shakeup

Some of Canada’s other major banks have been trimming their teams as the lenders face mounting expenses, rising provisions for potential loan defaults and tightening capital requirements. Scotiabank joins Royal Bank of Canada RY-T -1.63%decrease and Bank of Montreal BMO-T -2.29%decrease in unveiling broader cutsin recent months.

In an internal note to Scotiabank employees viewed by The Globe and Mail, Mr. Thomson said that the leadership team is treating affected staff “compassionately and with care,” and helping people find new jobs in the bank, where possible.

“I know this change is difficult and I want to thank you for your support and continued focus on delivering for our clients, the bank and each other,” Mr. Thomson said in the memo. “Today’s announcement is an important step in enabling our new strategy. Moving forward, we will be focused on unlocking our significant potential and ensuring our bank is better equipped to deliver profitable and sustainable growth.”

RBC was the first major lender to signal staffing reductions. During its third-quarter results release at the end of August, the bank said that its number of full-time employees fell 1 per cent from the previous quarter as workers left the bank. It said it expects to further decrease its work force by 1 per cent to 2 per cent next quarter.

Bank of Montreal also shed jobs, reducing its work force by 2.5 per cent. The costs related to the staff cuts stretched across the bank, but largely stemmed from the bank’s Canadian personal and commercial banking unit, its corporate division and its capital markets business.

Scotiabank’s work-force reductions will result in a restructuring charge and severance provisions of about $247-million.

RBC analyst Darko Mihelic said that the moves mark “a small step in the right direction” and that he interprets “the write-downs as a clean-up of the balance sheet.”

The layoffs were part of a broader announcement on costs that Scotiabank expects to affect its earnings results for the fourth quarter. The bank is consolidating its real estate footprint. It anticipates a charge of $63-million in the fourth quarter as it vacated certain premises and service contracts.

“Restructuring charges at the Canadian banks in difficult revenue environments are not unusual, and we may see other banks follow suit (as early as Q4),” BMO analyst Sohrab Movahedi said in a note to clients.

It will also post an impairment charge of $280-million related to the bank’s 18-per-cent investment in Bank of Xi’an. The China-based lender’s $581-million market value has consistently been below the $1-billion carrying value, the Canadian bank said.

Scotiabank has operated in China for 30 years, according to its website. In addition to its investment in Bank of Xi’an, it has two branches in Shanghai and Guangzhou, and a wealth-management joint venture with the Bank of Beijing.

Shares of Scotiabank fell 2.2 per cent in Toronto on Wednesday.