Royal Bank of Canada increased its quarterly dividend as the bank reported its fourth-quarter profit rose compared with a year ago. The bank says it will now pay a quarterly dividend of $1.64 per share, up from $1.54 per share. The increased payment to shareholders came as RBC reported net income of $5.43 billion or $3.76 per diluted share for the quarter ended Oct. 31, up from a profit of $4.22 billion or $2.91 per diluted share a year ago. Revenue totalled $17.21 billion, up from $15.07 billion in the same quarter last year, while its provisions for credit losses amounted to $1.01 billion, up from $840 million a year ago. On an adjusted basis, RBC says it earned $3.85 per diluted share in its latest quarter, up from an adjusted profit of $3.07 per diluted share in the same quarter last year. Analysts on average had expected an adjusted profit of $3.53 per share, according to estimates compiled by LSEG Data & Analytics. This report by The Canadian Press was first published Dec. 3, 2025.

Author: Consultant

-

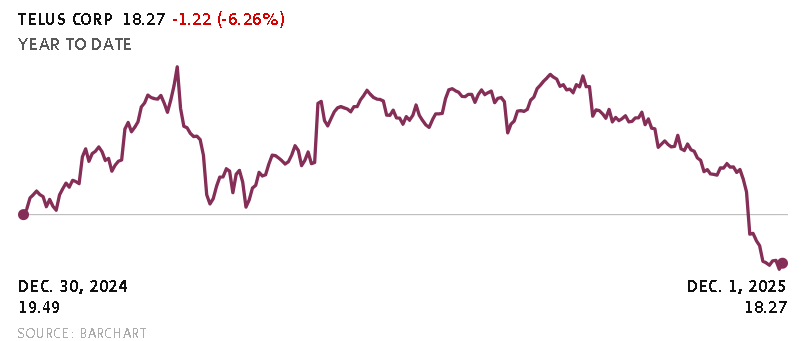

Telus halts dividend increases after analysts call payout growth plan unsustainable

Telus Inc. T-T +2.90%increase is pausing its dividend growth until its “share price reflects growth prospects,” the company said in a release Wednesday morning.

The company’s stock price was tradingat $18.27on the Toronto Stock Exchange as of market close on Tuesday,down 6.9 per cent year-to-date and 17 per cent from this time last year, on concerns about the company’s debt load.

The pause is a divergence from Telus’s previous plan to continue mounting the dividend payout but at a slower rate. In May, the company reduced its dividend growth target to between 3-per-cent and 8-per-cent growth annually from 2026 to 2028.

Now, the company will continue to pay its quarterly dividend at the most recent level of $0.41 per share, “until such time as our share price and associated dividend yield better reflects the considerable growth prospects of Telus,” said chief executive officer Darren Entwistle, in the release.

Pausing dividend growth will help Telus reach its leverage goals of three times net-debt-to-earnings before interest, taxes, depreciation and amortization by the end of 2027, the company said. Telus had $25.7-billion in long-term debt as of Sept. 30.

The move comes after suggestions from some analysts that the telecom company’s dividend payout growth plan was unsustainable.

Andrew Willis: Telus needs to kick its addiction to dividend hikes

In a recent interview, Telus chief financial officer Doug French said the company expects to end 2025 with a cash-flow payout ratio of about 75 per cent, and to remain close to that ratio in the coming years.

However, analysts from J.P. Morgan and Veritas Investment Research calculated the figures differently, saying they viewed that ratio as remaining above 100 per cent for the next few years.

In a note to investors Wednesday morning, CIBC director of institutional equity sales Veleyny Saavedra said the move “should act as a clearing event for the market,” and would position the company well for long-term value creation.

“We see them as incrementally positive and expect the Street to react favorably,” she said.

This is the second telecom company to attract attention this year because of its dividend. In May, BCE halved its dividend payout – which at the time had a yield of 13 per cent, widely seen as unsustainable – in order to allocate that cash elsewhere.

-

Scotiabank reports $2.21B Q4 profit up from $1.69B a year ago

Scotiabank says it earned $2.21 billion in net income for its fourth quarter, up from $1.69 billion in the same quarter last year. The bank says the profit amounted to $1.65 per diluted share for the quarter ended Oct. 31, up from $1.22 per diluted share in the same period a year ago. Revenue totalled $9.80 billion, up from $8.53 billion in the same quarter last year. The bank’s provision for credit losses amounted to $1.11 billion for the quarter, up from $1.03 billion a year ago. On an adjusted basis, Scotiabank says it earned $1.93 per diluted share in its latest quarter, up from an adjusted profit of $1.57 per diluted share a year ago. Analysts on average had expected an adjusted profit of $1.84, according to estimates compiled by LSEG Data & Analytics. This report by The Canadian Press was first published Dec. 2, 2025.

-

Shopify working to resolve login issues for merchants amid Cyber Monday

Shopify Inc. says it is investigating as some merchants encounter error messages amid the busy Cyber Monday shopping blitz. Its online dashboard says merchants may experience issues when trying to login to Shopify, or while attempting to contact Shopify Support. Some merchants may also encounter problems with point-of-sale checkouts due to not being able to access point-of-sale systems. The issues first arose around 9:45 a.m. ET, with Shopify later saying it continues to investigate and “apply mitigations.” The company says that to help avoid complications, merchants should remain logged in on any devices that are currently logged in. Digital sales have remained strong this holiday season, with a new report by Salesforce showing that Canadian online sales for the weekend following Black Friday were up nine per cent compared with a year ago.

-

Canadian Big 6 Banks Q4 2025 Earnings Release Dates

As of December 1, 2025, the major Canadian banks (often called the “Big 6”) are entering their fiscal Q4 2025 earnings season, which covers results for the period ending October/November 2025. These dates are based on confirmed announcements from company investor relations pages, analyst reports, and financial calendars. Releases typically occur before market open (Eastern Time), followed by conference calls later in the day.

Earnings season kicks off this week, with all reports expected between December 2–5, 2025. Analysts anticipate strong overall results (e.g., ~24% YoY EPS growth for the group), driven by lower provisions for credit losses and resilient loan growth, though TD Bank faces headwinds from U.S. regulatory issues. Note: Dates can shift slightly; always verify on the company’s IR site.

Earnings Schedule Table

Bank Ticker (TSX) Earnings Date Time (ET) Key Notes Bank of Nova Scotia (Scotiabank) BNS December 2, 2025 (Tuesday) Before Open Kicks off season; focus on international ops and credit losses. Royal Bank of Canada (RBC) RY December 3, 2025 (Wednesday) Before Open Consensus EPS: C$3.55; record Q3 momentum expected to continue. National Bank of Canada NA December 3, 2025 (Wednesday) Before Open Smaller peer; may lag group on growth but strong in Quebec market. Toronto-Dominion Bank (TD) TD December 4, 2025 (Thursday) Before Open EPS forecast: ~C$2.00; U.S. retail weakness a watch point. Canadian Imperial Bank of Commerce (CIBC) CM December 4, 2025 (Thursday) ~5:30 AM EPS forecast: C$2.05; emphasis on digital banking and capital strength. Bank of Montreal (BMO) BMO December 4, 2025 (Thursday) Before Open Potential beat on U.S. ops; group-high expectations for positive surprises. Additional Context

- Overall Outlook: Banks are “priced for perfection” at ~13x forward P/E (above 20-year avg of 10.5x), so beats could drive 5-10% stock pops, while misses may pressure shares amid economic uncertainty (e.g., 6.9% unemployment). Focus areas: Credit loss provisions (expected to ease), loan growth (subdued but stabilizing), and 2026 guidance.

- Where to Watch Live: Company IR sites (e.g., rbc.com/investor-relations), Yahoo Finance Earnings Calendar, or BNN Bloomberg for calls.

- Historical Note: Last year (Q4 2024), results were mixed with beats from RBC/Scotiabank but misses at TD/CIBC; executives braced for “cautious optimism” in 2025.

-

Calendar: Dec 1 – Dec 5

Monday December 1

China PMI

Japan capital spending and manufacturing PMI

Euro zone manufacturing PMI

(9:30 a.m. ET) Canada’s S&P Global Manufacturing PMI for November.

(9:45 a.m. ET) U.S. S&P Global Manufacturing PMI for November.

(10 a.m. ET) U.S. ISM Manufacturing PMI for November.

Also: Canadian and U.S. auto sales for November.

Earnings include: MongoDB

–

Tuesday December 2

Japan consumer confidence

Euro zone jobless rate and CPI

Earnings include: Bank of Nova Scotia; CrowdStrike Holdings Inc.; Marvell Technologies Inc.; Pure Storage Inc.

–

Wednesday December 3

Japan and Euro zone services and composite PMI

(8:15 a.m. ET) U.S. ADP National Employment Report for November.

(8:30 a.m. ET) Canada’s labour productivity for Q3.

(8:30 a.m. ET) U.S. import prices for September. The Street expects a rise of 0.1 per cent for August and up 0.4 per cent year-over-year.

(9:15 a.m. ET) U.S. industrial production for September. Consensus is a rise of 0.1 per cent from August with capacity utilization remaining at 75.8 per cent.

(9:30 a.m. ET) Canada’s S&P Global Services PMI for November.

(9:45 a.m. ET) U.S. S&P Global Services and Composite PMI for November.

(10 a.m. ET) U.S. ISM Services PMI for November.

Earnings include: Descartes Systems Group Inc.; Dollar Tree Inc.; EQB Inc.; GameStop Corp.; Ivanhoe Electric Inc.; National Bank of Canada; North West Company Inc.; Royal Bank of Canada; Salesforce Inc.; Snowflake Inc.

–

Thursday December 4

Euro zone retail sales

(8:30 a.m. ET) U.S. initial jobless claims for week of Nov. 29. Estimate is 223,000, up 7,000 from the previous week.

(10 a.m. ET) Canada’s Ivey PMI for November.

(10 a.m. ET) U.S. Global Supply Chain Pressure Index for November.

Earnings include: Bank of Montreal; BRP Inc.; Canadian Imperial Bank of Commerce; Dollar General Corp.; Hewlett Packard Enterprise Co.; Kroger Co.; Lululemon Athletica Inc.; Toronto-Dominion Bank

–

Friday December 5

Japan household spending

Euro zone real GDP

Germany factory orders

(8:30 a.m. ET) Canadian employment for November. The Street expects an unchanged reading month-over-month with the unemployment rate rising 0.1 per cent to 7.0 per cent and average hourly wages up 3.4 per cent year-over-year.

(10 a.m. ET) U.S. personal spending and income for September. Consensus is month-over-month increases of 0.3 per cent for both.

(10 a.m. ET) U.S. core PCE price index for September. The Street is projecting a rise of 0.2 per cent from August and up 2.9 per cent from the same period a year ago.

(10 a.m. ET) U.S. University of Michigan Consumer Sentiment for December.

(3 p.m. ET) U.S. consumer credit for October.

Earnings include: Laurentian Bank of Canada

-

Barrick Completes Hemlo Transaction

All amounts expressed in U.S. dollars

TORONTO, Nov. 26, 2025 (GLOBE NEWSWIRE) — Barrick Mining Corporation (NYSE:B)(TSX:ABX) (“Barrick” or the “Company”) announced today that it has completed the divestiture of the Hemlo Gold Mine (“Hemlo”) in Canada to Carcetti Capital Corp., to be renamed to Hemlo Mining Corp. (“HMC”), for a total consideration of up to $1.09 billion, inclusive of $875 million in cash received on closing, $50 million in HMC shares received on closing, and a production and tiered gold price-linked cash payment structure of up to $165 million starting in January 2027 for a five-year term1.

The Company would like to thank the Biigtigong Nishnaabeg and the Netmizaaggamig Nishnaabeg First Nations for their cooperation and support related to the operation of Hemlo.

About Barrick Mining Corporation

Barrick is a leading global mining, exploration and development company. With one of the largest portfolios of world-class and long-life gold and copper assets in the industry—including six of the world’s Tier One gold mines—Barrick’s operations and projects span 18 countries and five continents. Barrick is also the largest gold producer in the United States. We create real, long-term value for all stakeholders through responsible mining, strong partnerships and a disciplined approach to growth. Barrick shares trade on the New York Stock Exchange under the symbol ‘B’ and on the Toronto Stock Exchange under the symbol ‘ABX’.

-

Nov 28/26: Natural Gas Futures Market News and Commentary

Nat-Gas Prices Soar as Forecasts for Below Normal US Temperatures

Barchart – Fri Nov 28, 2:07PM CST

January Nymex natural gas (NGF26) on Friday closed up by +0.292 (+6.41%).

Jan nat-gas prices rallied sharply on Friday, surging to an 8.5-month nearest-futures high on expectations of colder US weather, potentially boosting heating demand for nat-gas. The Commodity Weather Group on Friday said weather models shifted cooler in the US, with intense cold seen in the Northeast and Great Lakes region for December 3-7. Also, forecasts indicate below-normal temperatures in the coming weeks for the Northeast and the Great Lakes.

Higher US nat-gas production is a bearish factor for prices. On November 12, the EIA raised its forecast for 2025 US nat-gas production by +1.0% to 107.67 bcf/day from September’s estimate of 106.60 bcf/day. US nat-gas production is currently near a record high, with active US nat-gas rigs recently posting a 2-year high.

US (lower-48) dry gas production on Friday was a record 113.4 bcf/day (+8.3% y/y), according to BNEF. Lower-48 state gas demand on Friday was 98.6 bcf/day (+9.2% y/y), according to BNEF. Estimated LNG net flows to US LNG export terminals on Friday were 18.5 bcf/day (+4.4% w/w), according to BNEF.

As a supportive factor for gas prices, the Edison Electric Institute reported last Wednesday that US (lower-48) electricity output in the week ended November 15 rose +5.33% y/y to 75,586 GWh (gigawatt hours), and US electricity output in the 52-week period ending November 15 rose +2.9% y/y to 4,286,124 GWh.

Wednesday’s weekly EIA report was bullish for nat-gas prices, as nat-gas inventories for the week ended November 21 fell by -11 bcf, a larger draw than the market consensus of -9 bcf but less than the 5-year weekly average of a -25 bcf draw. As of November 21, nat-gas inventories were down -0.8% y/y and were +4.2% above their 5-year seasonal average, signaling adequate nat-gas supplies. As of November 26, gas storage in Europe was 77% full, compared to the 5-year seasonal average of 88% full for this time of year.

Baker Hughes reported Wednesday that the number of active US nat-gas drilling rigs in the week ending November 28 rose by +3 to 130 rigs, a 2.25-year high. In the past year, the number of gas rigs has risen from the 4.5-year low of 94 rigs reported in September 2024.

-

Shopify lays off staff to keep team ‘fast, sharp and focused’

Shopify Inc. says it has laid off some of its staff to help streamline the e-commerce software giant. Spokesperson Ben McConaghy would not provide a number of workers losing their jobs but says in an email to The Canadian Press that the cuts impact a “fraction of a per cent” of Shopify’s team. Financial markets firm LSEG Data & Analytics counted 8,100 Shopify employees as of December 2024. One per cent of that figure amounts to about 81 staff. McConaghy says the layoff is meant to remove from the organization layers of complexity that don’t add merchant value. He says the cut will keep Shopify fast, sharp and focused on long-term merchant success. Earlier in the year, the company made artificial intelligence use an expectation for all workers and embedded the technology into performance reviews and product development. This report by The Canadian Press was first published Nov. 26, 2025. Companies in this story: (TSX:SHOP)