The CEO of Alimentation Couche-Tard Inc. says the convenience store giant is on track to meet its expansion goals despite cost-of-living concerns among customers. In a conference call Tuesday, Alex Miller said the Laval, Que.-based company still plans to reach its goal of 500 new stores by 2028 — a target it first laid out two years ago. The chief executive says Couche-Tard will open 100 new locations in North America this year, with another 73 stores under construction. It counts 17,270 stores across the globe currently. Miller says sales increased in Canada, the U.S. and Europe despite a “challenging consumer environment,” with food products a particular point of growth. On Monday evening, Couche-Tard reported that profits rose 4.5 per cent year-over-year to US$740.6 million in its second quarter. The company, which keeps its books in U.S. dollars, said revenue increased 2.6 per cent to US$17.9 billion during the period ended Oct. 12.

Author: Consultant

-

AI Response: CTC.TO Share Prices: Past 10 Days (Trading Days from November 20–28, 2025)

The ticker CTC.TO refers to Canadian Tire Corporation, Limited (Class A Non-Voting Shares) on the Toronto Stock Exchange (TSX). As of November 29, 2025 (a non-trading day, Saturday), the most recent trading data covers November 20–28, 2025 (7 trading days, excluding weekends and holidays). Prices are in CAD.

Here’s a summary table of the daily closing prices and key metrics:

Date Open High Low Close Volume (K) Change % Nov 20 168.82 168.82 165.65 165.85 162.02 -1.31% Nov 21 166.03 167.11 165.39 166.65 217.61 +0.48% Nov 24 166.14 166.61 164.48 164.83 533.75 -1.09% Nov 25 165.45 170.00 165.00 169.71 426.13 +2.96% Nov 26 169.46 171.61 169.24 169.80 232.90 +0.05% Nov 27 170.50 170.71 169.56 169.70 39.63 -0.06% Nov 28 169.92 170.42 168.77 170.02 284.35 +0.19% Key Observations:

- The stock showed mild volatility, dipping to a low close of 164.83 on Nov 24 before rebounding over 3% the next day.

- Overall, it gained ~2.6% from Nov 20 open to Nov 28 close, trading in a tight range of 164–171.

- Volume spiked on Nov 24–25 (over 400K shares), coinciding with the price dip and recovery, suggesting increased trader interest.

Price Chart: Closing Prices (Nov 20–28, 2025)

https://artifacts.grokusercontent.com/chartjs

Grok can make mistakes. Always check original sources.

Explanation of Price Movements and Reasons

Canadian Tire’s stock has been relatively stable in late November 2025, with minor fluctuations amid broader market trends in the retail sector. The company operates in automotive, sporting goods, and general merchandise, making it sensitive to consumer spending, interest rates, and seasonal holiday demand. Here’s a breakdown of key drivers based on recent developments:

- Post-Q3 Earnings Momentum (Early-Mid November Impact): The stock’s mild uptrend from Nov 24 onward can be traced to positive spillover from Q3 2025 results announced on Nov 6. Canadian Tire reported solid revenue growth, beat earnings expectations, and announced a 16th consecutive annual dividend increase to $7.10 per share (yield ~4.2%). They also initiated a $200M share repurchase program, signaling confidence in undervaluation. This boosted investor sentiment, contributing to the ~3% rebound on Nov 25.

- Technical Dip and Recovery (Nov 24–25): The brief -1.09% drop on Nov 24 aligned with the stock crossing below its 50-day moving average (~171 CAD), a bearish technical signal that often prompts selling. However, high volume (533K shares) suggests bargain-hunting, leading to a quick recovery. Analysts view this as a “buy the dip” opportunity in a strong 2025 performer, with shares up ~20% YTD amid cooling inflation and lower rates spurring discretionary spending.

- Strategic Initiatives and Broader Outlook: Recent discussions on the “True North Initiative” (a multi-year transformation for efficiency and digital growth) have supported stability. With holiday season underway, expectations for robust retail sales (e.g., automotive and home goods) are lifting the stock, though low volume on Nov 27 indicates cautious trading ahead of U.S. Thanksgiving impacts. Analysts have raised price targets to ~$180–$190, citing margin improvements and buybacks. No major negative catalysts emerged in the period.

Overall, the stock’s resilience reflects positive fundamentals outweighing short-term technical noise. For real-time updates, check Yahoo Finance or the company’s investor site.

-

AI Response: Reasons for Aritzia Inc. (ATZ.TO) Share Price Increase in the Past 10 Days (November 19–28, 2025)

Aritzia’s stock surged approximately 11.27% over the specified period, building on a broader 37.21% gain since its October 9, 2025, pivot bottom and a 139.5% rise over the last 12 months. This momentum reflects sustained investor confidence in the company’s operational turnaround, fueled by strong fiscal Q2 results (ended August 31, 2025) and positive retail sector dynamics. Below, I outline the key drivers, supported by recent financials, analyst actions, and market sentiment.

1. Lingering Momentum from Strong Fiscal Q2 Earnings (Reported October 9, 2025)

- Aritzia’s Q2 results exceeded expectations, with revenue of CAD 728.7 million (up 31% YoY, beating estimates of CAD 698 million) and adjusted EBITDA of CAD 136 million (15% above consensus). Comparable sales grew 14.2%, driven by 23% U.S. expansion, while gross margins improved to 40.5% due to better inventory management post-2023 challenges.

- EPS of CAD 0.71 beat forecasts of CAD 0.62, signaling efficient cost controls and pricing power in the “Everyday Luxury” segment. This performance validated the company’s strategic shift toward premium women’s apparel and accessories, with brands like Wilfred and Babaton gaining traction.

- The earnings triggered an 8-day winning streak ending November 25 (gains of ~0.84% that day alone), as investors priced in the high end of Q4 guidance (31% sales growth, adjusted for an extra week). The stock’s technical buy signal from October has held, with support levels at CAD 103.68 providing a floor for further upside.

2. Analyst Upgrades and Raised Price Targets

- Post-earnings, analysts turned more bullish. Jefferies raised its target to CAD 92 from CAD 87 (Buy rating), citing “robust comparable sales growth, particularly in the U.S.” CIBC followed with a hike to CAD 94 from CAD 87, emphasizing marketing and digital initiatives.

- The consensus 12-month target now stands at CAD 109.23 (implying ~0.92% upside from CAD 112.20 close), with 6 of 13 analysts recommending Buy. William Blair maintained a bullish stance, highlighting U.S. market penetration. This coverage, combined with a positive earnings call sentiment (strong revenue growth despite tariff headwinds), amplified buying pressure.

- Broader retail optimism—e.g., strong Q3 reports from peers like Ross Stores (ROST) and Gap (GAP) showing sales acceleration—reinforced Aritzia’s narrative, debunking “weak consumer” fears and boosting sector multiples.

3. U.S. Expansion and Operational Improvements

- Key to the surge: Three upsized flagship store reopenings (two in New York, one in Chicago) and 11 new boutiques in Q2/Q3, driving 23% U.S. comparable sales growth. This expansion counters prior inventory overhangs, with management guiding for continued high-single-digit U.S. comps in Q3.

- Strategic investments in digital (e.g., enhanced e-commerce personalization) and supply chain (e.g., Nedap partnership for item-level inventory visibility announced November 28) are powering unified commerce, reducing stockouts and improving margins. These moves position Aritzia for holiday strength, with early Black Friday buzz (e.g., Super Puff promotions) signaling resilient affluent spending.

- Broader context: A “K-shaped” recovery in retail favors premium players like Aritzia (up ~100% YTD), as high-income consumers prioritize quality amid economic uncertainty.

4. Market Sentiment and Technical Factors

- Social and investor chatter highlights the stock’s breakout, with users noting it’s “nearing a double on the year” and up 350% from 2023 lows. This reflects retail investor enthusiasm (44% ownership), aligning with institutional buying.

- Technically, the stock hit a 52-week high of ~CAD 112.50 on November 27, with moderate bullish buying pressure (50-60th percentile historical score). No major resistance until CAD 120, per pivot analysis.

- External tailwinds: Easing liquidity concerns (per ARK Invest commentary) and holiday season ramp-up (e.g., 67% revenue lift on November 25 vs. normal days) support discretionary spending.

Potential Risks and Outlook

While the uptrend is robust, challenges include tariff impacts (~170 bps margin drag in FY2026) and competition in U.S. retail. Management’s focus on flat-to-positive Q4 comps and CAD 850 million sales guidance suggests sustained gains, but a pullback to CAD 103 support could occur if holiday data disappoints.

In summary, the increase stems from validated growth execution, analyst endorsement, and favorable retail momentum—positioning Aritzia as a standout in a selective consumer recovery. For real-time updates, monitor TSX filings or Yahoo Finance. If you’d like a deeper dive into financials or peers, let me know!

-

European Stocks Close On Positive Note Despite Shaky Start

Despite a sluggish spell early on in the session, European stocks closed higher on Friday, gaining some strength gradually past noon. Investors assessed the most recent regional and U.S. economic data, and continued to bet on an interest rate cut by the Federal Reserve in December.

The pan European Stoxx 600 climbed 0.25%. The U.K.’s FTSE 100 gained 0.27%, while Germany’s DAX and France’s CAC 40, both ended higher by 0.29%. Switzerland’s SMI edged up 0.02%.

DAX gained about 3.2% in the week, while the FTSE climbed nearly 2%, and the CAC 40 added 1.15%.

Among other markets in Europe, Czech Republic, Denmark, Iceland, Ireland, Netherlands, Poland and Russia closed on firm note.

Austria, Belgium, Norway and Spain edged up marginally.

Finland, Greece, Portugal, Turkiye closed weak, while Sweden ended flat.

In the UK market, Easyjet climbed 3%. Antofagasta moved up 2.53%. Fresnillo, British American Tobacco, BP, IMI, WPP, Informa, Rio Tinto, Entain, Glencore, Bunzl and Shell gained 1 to 2%.

Whitbread tanked 11.5%. Burberry Group ended nearly 3% down. Sainsbury (J), Mondi, 3i Group, Tesco, Babcock International and Hikma Pharmaceuticals lost 1 to 2.2%.

In the German market, Deutsche Boerse gained about 2.5%. The German stock exchange operator said it is in exclusive talks to acquire European fund distribution platform Allfunds Group Plc in a €5.3 billion ($6.1 billion) cash and stock deal.

Infineon, Volkswagen, Symrise, Deutsche Telekom, Siemens Energy, SAP and Scout24 gained 0.7 to 1.7%.

Delivery Hero soared 10%. The food delivery company is facing pressure from several major shareholders to consider selling the company or divesting parts of its business.

Rheinmetall and Daimler Truck Holding ended sharply lower.

In the French market, Stellantis climbed more than 2%. ArcelorMittal, LVMH, Bouygues, Bureau Veritas, BP and STMicroElectronics aslo closed notably higher.

Accor, Renault, Essilor, Kering and Edenred ended on a weak note.

In economic news, data from Destatis showed German retail sales dropped unexpectedly in October, decreasing by 0.3% month-on-month, offsetting the 0.3% increase in September. Economists had forecast a monthly increase of 0.1%.

However, on a yearly basis, retail sales grew 0.9% in October, slightly faster than the 0.8% increase in September.

In nominal terms, retail sales dropped 0.1% from September but increased 2.4% from a year ago.

Germany’s import prices slid 1.4% in October from a year ago, after falling 1% in September, a separate data from Destatis showed. Prices have been falling since April.

The annual fall was largely driven by the 15.1% decline in energy prices. Moreover, prices of capital goods and consumer goods were down 0.5% and 1%, respectively.

Month-on-month, import and export prices moved up 0.2% each in October.

Data from statistical office INSEE showed France’s economy expanded by 0.5% quarter-on-quarter in Q3 2025, accelerating from 0.3% in the previous quarter and confirming preliminary estimates. This marks the sharpest quarterly expansion since the second quarter of 2023. On an annual basis, GDP expanded 0.9%, up from 0.7% in Q2, marking the strongest growth in a year.

France’s annual inflation rate held steady at 0.9% in November, unchanged from October and below the 1% forecast, according to preliminary estimates. On a monthly basis, the CPI fell by 0.1%, after a 0.1% rise in October.

Meanwhile, the EU-harmonised CPI rose 0.87% year-on-year, matching October’s rate and remaining below the 1% forecast. It decreased by 0.2% from the previous month, following a 0.1% increase in October.

Data from the Society of Motor Manufacturers and Traders Limited showed UK car production fell 23.8% year-on-year in October to 59,010 units, the lowest October output since 1952. The sharp drop was due to the cyberattack in late August on Jaguar Land Rover, the largest carmaker.

-

OPEC+ likely to hold oil output levels steady during first quarter of 2026, sources say

OPEC+ is likely to leave oil output levels unchanged at its meetings on Sunday and to agree on a mechanism to assess members’ maximum production capacity, two delegates from the group and a source familiar with OPEC+ talks told Reuters.

The eight OPEC+ countries which have been gradually raising output in 2025 are expected to keep their policy to pause hikes in the first quarter of 2026 unchanged, the two delegates said.

OPEC+, which groups the Organization of the Petroleum Exporting Countries and allies led by Russia, pumps about half the world’s oil and has been discussing for years production capacity figures against which members’ output targets are set.

The full OPEC+ group is expected to agree on the capacity mechanism in a separate meeting on Sunday, said the sources, who all spoke on condition of anonymity.

OPEC said in May this capacity assessment would be used as reference for 2027 output baselines.

OPEC, Saudi and Russian authorities did not immediately reply to a Reuters request for comment.

Ministers are scheduled to hold four online meetings on Sunday starting with OPEC ministers only at 13:00 GMT, the two delegates said. This will be followed by meetings of the Joint Ministerial Monitoring Committee (JMMC), of all OPEC+ ministers and ending with a meeting of the eight members.

OPEC+ discussed the capacity issue in September at a technical level. Previous baseline discussions have often been fraught as they determine the size of the production cuts each member will contribute. Angola quit the group in 2024 over a disagreement on its production target.

OPEC+ had been curtailing supplies for years until April when the eight members began to raise production to recover market share. The cuts had peaked in March, amounting to 5.85 million barrels per day, almost 6 per cent of world output, in total.

The eight – Saudi Arabia, Russia, UAE, Kazakhstan, Kuwait, Iraq, Algeria and Oman – have raised output targets by around 2.9 million bpd from April to December, and agreed the first-quarter pause at their last meeting.

OPEC+ ministers are also expected to not make any changes to group-wide production targets for 2026, which include a 2 million bpd cut shared by most members in place until the end of next year, the sources added.

-

So much for Canada’s manufacturing-job rebound

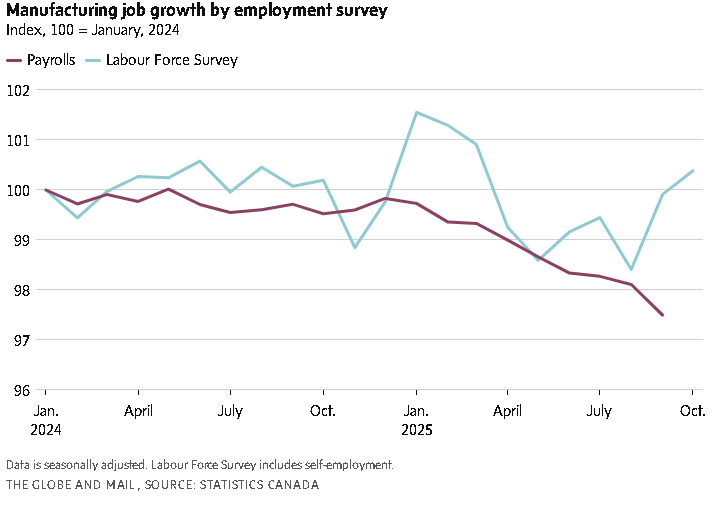

For two months Canada’s most closely watched survey of the job market has reassuringly signalled that a rebound in manufacturing employment is under way.

Actual employer payrolls suggest that growth was an illusion.

In September, Canada’s manufacturing sector shed more than 9,500 jobs from the month before, the ninth straight monthly decline this year, according to Statistics Canada’s survey of employment, payrolls and hours, released Thursday.

It’s a stark contrast from the agency’s Labour Force Survey (LFS), which polls households about their employment status and is more current.

In October, employment in the manufacturing sector was up by 36,500 jobs from August, according to the LFS, and had largely rebounded from declines after U.S. President Donald Trump’s broad tariffs on Canada began in March.

Economists have regularly highlighted the growing disparity between the two surveys and what it says about the resilience of Canada’s economy to the trade war.

They’ve noted the LFS survey has not yet fully accounted for the slowdown in Canada’s population growth, which paints an excessively rosy jobs picture.

Looking at the household survey alone, “you could be forgiven for thinking that the local economy is in the midst of a surprising boom,” wrote David Rosenberg, president of Rosenberg Research & Associates, in a note to clients.

Yet the payroll survey showed overall employment tanked by 58,000 in September, he added, with the number of jobs contracting in 80 per cent of all industries that month.

Decoder is a weekly feature that unpacks an important economic chart.

-

Canada’s GDP rebounds in third quarter, but trade numbers mask broader weakness

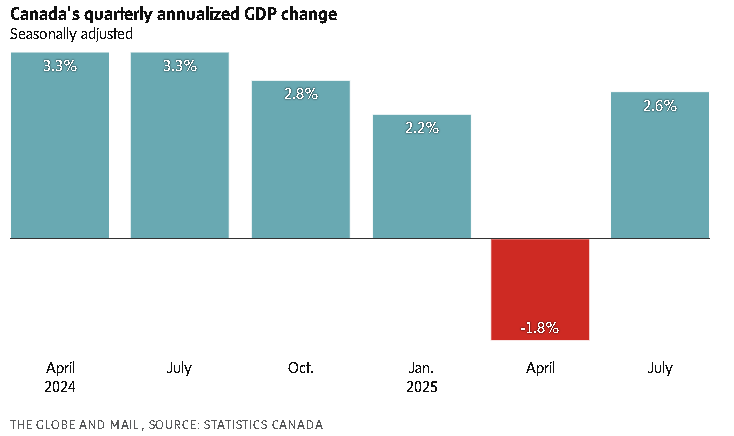

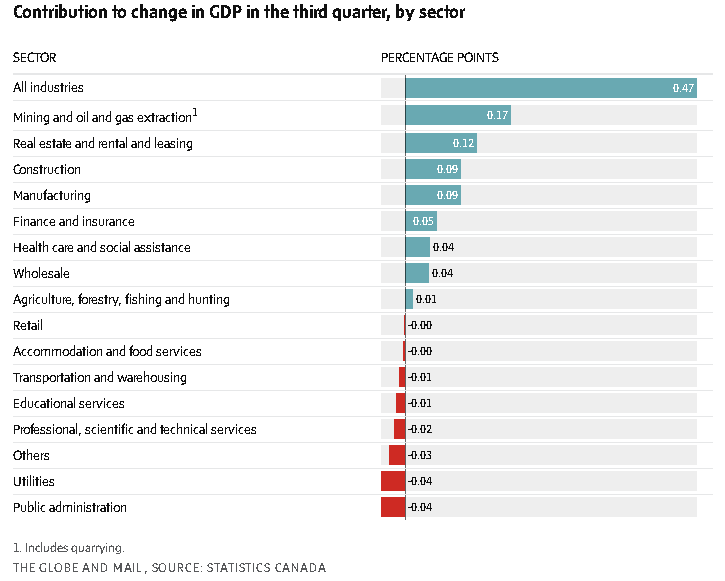

The Canadian economy rebounded sharply in the third quarter, although much of the upside surprise was driven by a swing in imports and exports that masked underlying weakness in domestic demand.

Canada’s real gross domestic product grew at an annualized rate of 2.6 per cent in the third quarter, Statistics Canada reported Friday, after a downwardly revised 1.8-per-cent contraction in the second quarter.

That blew past Bay Street expectations and helped Canada avoid two consecutive quarters of GDP decline, or what some analysts refer to as a “technical recession.” However, the strong headline result had more to do with idiosyncratic trade numbers than a broad-based improvement in the economic climate.

Meanwhile, Statscan’s flash estimate showed a GDP contraction in October, suggesting the economy is struggling to maintain momentum in the face of continued uncertainty about U.S. trade policy.

While the details of the report were mixed, the strong headline number reinforced Bay Street expectations that the Bank of Canada will hold interest rates steady at its next decision announcement on Dec. 10. The central bank indicated last month that it has likely finished its monetary policy easing cycle.

Rita Trichur: As Trump meddles with the Fed, Carney must safeguard the Bank of Canada’s independence

The bounce-back in GDP was led by a large swing in Canada’s balance of trade. Imports plunged at an annualized rate of 8.6 per cent, the biggest quarterly contraction since the fourth quarter of 2022. At the same time, exports rose 0.7 per cent, led by crude oil and bitumen shipments. This followed a historic 25-per-cent contraction in the second quarter.

Because a positive trade balance (more exports than imports) adds to GDP, the drop in imports pushed up the headline number.

“Overall final domestic demand was flat in Q3, so the stronger-than-expected rebound in headline GDP more so reflects a mathematical boost from falling imports rather than underlying economic strength,” said Tony Stillo and Michael Davenport, economists with Oxford Economics, in an e-mail.

“We still think the Canadian economy is in a fragile position and expect it will struggle to grow in the near term amid US tariffs, elevated trade policy uncertainty, and much slower population growth.”

GDP growth was supported by a 12.2-per-cent annualized increase in government investment, with a focus on the military. Spending on weapon systems jumped 82 per cent in the quarter (not annualized).

There was also a 6.7-per-cent annualized pickup in residential investment, as the housing market showed signs of life after many quarters of stagnation.

At the same time, key markers of economic health remained subdued. Business investment was flat, with companies wary of making big decisions in the face of U.S. tariffs and uncertainty over the future of the continental free trade pact, which is up for review next year.

Meanwhile, consumer spending contracted slightly, driven by fewer vehicle purchases after a rush to buy cars in the second quarter.

“The Canadian economy is set to swing back in the opposite direction in Q4. Even assuming a rebound in November GDP due to temporary strike impacts holding back the prior month’s reading, growth is likely to stall,” wrote Katherine Judge, senior economist at Canadian Imperial Bank of Commerce, in a note to clients.

“While we still see the BoC as on hold in December, the trend in final domestic demand isn’t encouraging and exports showed little sign of recovering from the tariff-induced Q2 hit. Our forecast assumes that we see definitive progress on renewing CUSMA and a recovery in business confidence improving quarterly growth rates in 2026,” she said, referring to the continental trade agreement.

Statscan warned that the GDP numbers could be subject to “larger than normal revisions,” given that the agency was missing several key pieces of trade data because of the U.S. government shutdown.

-

Carney, Smith sign sweeping energy deal, pledge new pipeline to West Coast

Alberta and Ottawa havesigned a sweeping new energy accord that both sides say will position Canada as a global energy superpower while still working toward net-zero emissions.

The deal includes a pledge for a new bitumen pipeline to the West Coast with Indigenous co-ownership and the suspension of clean electricity regulations for Alberta with the proviso that the province increase its industrial carbon price.

The memorandum of understanding also says the federal government won’t implement its oil and gas emissions cap and, if the pipeline comes to fruition, the government would adjust the current oil tanker ban so bitumen could be exported to Asian markets.

Some Liberal MPs question sustainability of Alberta energy deal touted by Carney

The deal, which Prime Minister Mark Carney and Alberta Premier Danielle Smith signed Thursday, adds that the two sides will consult with British Columbia.

“Canada and Alberta agree to engage with British Columbia immediately in a trilateral discussion on the pipeline project, and during the potential development and construction of the bitumen pipeline referred to in this MOU, and to further the economic interests of B.C. related to their own projects of interest that involve the Province of Alberta including interties,” the MOU says.

“In addition, Canada will work with B.C. on other projects of national interest in their jurisdiction.”

The new pipeline could carry one million barrels a day and would be in addition to projects Trans MountainCorp.is pursuing to boost capacity on the system.

While B.C. supports expanding capacity on the Trans Mountain pipeline, Premier David Eby has said he’s not in favour of a new pipeline to his province’s coast – nor the idea the oil tanker ban could be lifted to support it.

He has also expressed frustration over not being at the table while Mr. Carney and Ms. Smith’s governments were hammering out the deal.

The MOU commits to working with oil sands companies to strike a deal by April on implementing the Pathways project, which focuses on carbon capture and storage, solvent-based replacements or other things that could reduce emissions intensity.

That agreement will include enforcement mechanisms to ensure those projects are built.

The fact the MOU commits Alberta to increasing its industrial carbon price marks a reversal for the province. In May, Ms. Smith froze the price at $95 per tonne,even though it was supposed to be increased to $110 per tonne in 2026 to align with federal pricing.

Now, both levels of government are committing to a new industrial carbon pricing agreement by April 1 that will see Alberta’s price ramp up to $130 per tonne.

The clean electricity regulations will be suspended in the meantime and, once a new industrial pricing agreement is reached, will be lifted entirely for Alberta.

The MOU also commits both sides to a methane equivalency agreement by April, with a 2035 target date and a 75-per-cent reduction target relative to 2014 methane emission levels.

In a news release, Ms. Smith called the MOU her province’s opportunity to take the first steps toward being a global energy superpower and prove that resource development and sustainability can co-exist.

“There is much hard work ahead of us, but today is a new starting point for nation building as we increase our energy production for the benefit of millions and forge a new relationship between Alberta and the federal government,” she said.

Which Indigenous communities would be interested or able to co-own a bitumen pipeline is unclear.

Government officials who briefed reporters on the technical aspects of the deal earlier Thursday said that had yet to be decided.

support any lifting of the oil tanker ban.

Haida Hereditary Chief Guujaaw has said there is nothing that could make the risks worth it.

“What they’re talking about is doubling production in the tar sands, the most toxic muck hole in the world. Why would anybody consider that?” he said. “And is global warming over? Is it all of a sudden okay to start increasing production again?”

The words climate and environment do not appear anywhere in the MOU, but it does commit both sides to achieving net-zero greenhouse gas emissions by 2050.

The agreement is likely to inflame tensions inside Mr. Carney’s caucus. MPs have already been raising concerns internally that the agreement amounts to the Liberals turning their backs on the fight to combat climate change. Many MPs said Wednesday they were waiting to see the full text of the agreement before providing a public reaction.

Among the projects referenced in the MOU is the construction of thousands of megawatts of artificial intelligence computing power.

Alberta is already eyeing AI data centres as a potential economic boon for the province and wants to draw in $100-billion of investment in the sector over the next five years.

With a report from Andrea Woo in Vancouver

-

U.S. weekly jobless claims fall amid steady labour market conditions

The number of Americans filing new applications for unemployment benefits fell to a seven-month low last week, pointing to still-low layoffs, though the labour market is struggling to generate enough jobs for those out of work amid economic uncertainty.

The absence of labour market deterioration in the weekly jobless claims report from the Labor Department on Wednesday argued against the Federal Reserve cutting interest rates again next month, with inflation still elevated, economists said. U.S. central bank officials are divided over whether to lower borrowing costs further, though recent comments from top policy-makers have shifted market expectations strongly in favour of another quarter-point reduction at the Dec. 9-10 meeting.

“No one can construe any story about a surge in layoffs from this report,” said Carl Weinberg, chief economist at High Frequency Economics. “The message to the Fed from this data point is that there is no reason to rush to cut rates in December.”

Initial claims for state unemployment benefits dropped 6,000 to a seasonally adjusted 216,000 for the week ended Nov. 22, the lowest level since April. Economists polled by Reuters had forecast 225,000 claims for the latest week.

U.S. consumer confidence falls in November as view of jobs market, inflation worsens

The report was released a day early because of the Thanksgiving holiday on Thursday. Unadjusted claims jumped 25,712 to 243,992 last week. The increase, however, was less than the 32,642 rise that had been expected by the seasonal factors, the model used by the government to strip out seasonal fluctuations from the data.

Unadjusted claims soared in California and there were notable increases in Illinois, New York and Pennsylvania.

Economists say President Donald Trump’s aggressive trade and immigration policies had created an environment where businesses are reluctant to lay off or hire more workers, leading to what they and policy-makers call a “no hire, no fire” labour market. But some companies, including Amazon, are stepping up job cuts as they integrate artificial intelligence into some roles. Economists expect these job cuts could show up in the claims data next year, though filings have not always in the past increased in tandem with announced layoffs.

Despite the low level of layoffs, labour market slack is steadily rising. The number of people receiving unemployment benefits after an initial week of aid, a proxy for hiring, increased 7,000 to a seasonally adjusted 1.960 million during the week ending Nov. 15, the claims report showed. The so-called continuing claims covered the period during which the government surveyed households for November’s unemployment rate.

The government has extended the data collection period for November’s employment report, including for nonfarm payrolls, following the recently ended 43-day shutdown.

November’s employment report will be released on Dec. 16, and will include October nonfarm payrolls. There will be no unemployment rate for October as the longest shutdown in history prevented the collection of the household survey data.

U.S. stocks opened higher. The dollar gained versus a basket of currencies. U.S. Treasury prices rose.

Continuing claims increased between the October and November survey period. A survey from the Conference Board on Tuesday showed its labour market measure, which correlates with the Labor Department’s unemployment rate, worsening in November.

“The latest claims data indicate hiring remains too weak to absorb the low numbers of people losing their jobs,” said Samuel Tombs, chief U.S. economist at Pantheon Macroeconomics.

“Unemployment likely is rising faster than the claims data would usually imply, given that recent graduates who are struggling to find their first job and former federal workers who volunteered for buyout offers earlier this year are ineligible to claim.” The government reported last week that the unemployment rate increased to 4.4% in September from 4.3% in August.

Though businesses are reluctant to boost hiring, they are spending more on equipment, underpinning the economy. A separate report from the Commerce Department’s Census Bureau showed non-defense capital goods orders excluding aircraft, a closely watched proxy for business spending, jumped 0.9 per cent in September after an upwardly revised 0.9% increase in August.

Economists had forecast these so-called core capital goods orders rising 0.2 per cent after a previously reported 0.4 per cent increase in August. The report was delayed by the recently ended 43-day shutdown of the government.

Delayed report shows U.S. retail sales up slightly in September

There were strong increases in orders for computers and electronic products, electrical equipment, appliances and components as well as transportation equipment and primary metals. But orders for machinery barely rose.

There have been wild swings in core capital goods orders this year as businesses responded to Trump’s sweeping import duties. Business surveys showed the tariffs have undercut manufacturing, which accounts for 10.2 per cent of the economy. But a surge in AI investment has boosted some segments of manufacturing.

Shipments of core capital goods soared 0.9 per cent after dipping 0.1 per cent in August. Business spending on equipment increased at a robust pace in the first half of the year. Economists expect investment in equipment was solid in the third quarter.

The Atlanta Federal Reserve is forecasting gross domestic product increased at a 4.0-per-cent annualized rate in the July-September quarter. The delayed third-quarter GDP report will be released on Dec. 23. The economy grew at a 3.8-per-cent pace in the second quarter.

Orders for durable goods, items ranging from toasters to aircraft meant to last three years or more, rose 0.5 per cent in September after advancing 3.0 per cent in August.

“One thing is certain and that is this is going to be a gigantic quarter for real GDP growth, although admittedly it is only a rear-view mirror look back at the third quarter, which was before the government shutdown,” said Christopher Rupkey, chief economist at FWDBONDS.

“Whichever side of the fence you are on, Fed officials are unlikely to press hard for a Fed rate cut in December.”