Author: Consultant

-

OPEC+ to consider another accelerated oil output increase for June, sources say

Several OPEC+ members will suggest the group accelerates oil output hikes in June for a second consecutive month, three sources familiar with OPEC+ talks told Reuters, as a dispute worsens between members over compliance with production quotas.

Oil prices hit a four-year low in April, dragged down by a U.S.-China trade war and an unexpected decision by OPEC+ to increase output by 411,000 barrels per day of oil in May – which was three times more than the group originally planned.

Without specifying how many countries, the three sources said some wanted to increase output by a similar volume to the May increase.

Eight OPEC+ countries will meet on May 5 to decide the June output plan.

The Organization of the Petroleum Exporting Countries and the Saudi Arabian authorities did not immediately respond to Reuters’ requests for comment.

Oil prices, which were up in early trade on Wednesday, later turned negative, with global benchmark Brent crude trading down more than 2 per cent to less than $66 a barrel.

Saudi Arabia pushed for the speedier output increase in May after Kazakhstan and Iraq angered the kingdom by producing well above quotas, OPEC+ sources have said. A meeting of senior OPEC+ ministers on April 5 said compliance had to improve.

Kazakhstan, however, said it would prioritize national interests over those of OPEC+ when deciding on output levels.

The Kazakh energy minister told Reuters on Wednesday the country was unable to curtail the output of independent oil majors on its territory and would not shut down its own oil fields as that would damage their future production.

“Kazakhstan’s statement cements our view that OPEC+ may implement another accelerated three-month unwind again in the May meeting and it may continue again in July and through the summer,” said Amrita Sen, co-founder of Energy Aspects.

Kazakh oil output fell in the first two weeks of April by 3 per cent from the March average but was still above the OPEC+ quota it had pledged to meet after months of overproduction.

Iraq, the group’s largest overproducer, also said it will curb output, but has so far increased exports in April month-on-month, data from industry monitor Kpler showed.

Not all of the eight OPEC+ countries, which are raising production as part of the winding down of earlier voluntary output cuts, support speedier output increases.

Some countries, including Russia, preferred to stick to the earlier approved slower monthly output hikes of 135,000 bpd to avoid a price crash, two separate OPEC+ sources said.

The OPEC+ production increases have followed calls from U.S. President Donald Trump for OPEC to lower oil prices and his return to his policy of “maximum pressure” on Iran whose oil exports Washington wants to reduce to zero.

Trump is due to visit Saudi Arabia in May and says the kingdom one of the United States’ most important allies in the Middle East.

The May and potential June hikes are part of a plan by Russia, Saudi Arabia, the United Arab Emirates, Kuwait, Iraq, Algeria, Kazakhstan and Oman to gradually unwind their most recent output cut of 2.2 million bpd.

OPEC+ also has 3.65 million bpd of other output cuts in place until the end of next year to support the market.

-

Economic Calendar: April 28 – May 2

Monday April 28

China industrial profits

Germany retail sales

(8:30 a.m. ET) Canadian wholesale trade for March.

(10:30 a.m. ET) Bank of Canada’s Market Participants Survey for Q1.

Also: Canadian federal election

Earnings include: Domino’s Pizza Inc.; Nucor Corp.; Waste Management Inc.; Welltower Inc.

**

Tuesday April 29

Japan’s markets closed

ECB three-year CPI expectations

Euro zone and Germany consumer confidence

(8:30 a.m. ET) U.S. goods trade deficit for March.

(8:30 a.m. ET) U.S. wholesale and retail inventories for March.

(9 a.m. ET) U.S. S&P CoreLogic Case-Shiller Home Price Index (20 city) for February. The Street expects a rise of 0.3 per cent from January and up 4.6 per cent year-over-year.

(9 a.m. ET) U.S. FHFA House Price Index for February. Cosnensus is a rise of 0.3 per cent from January and a 3.9-per-cent gain year-over-year.

(10 a.m. ET) U.S. Conference Board Consumer Confidence Index for April.

(10 a.m. ET) U.S. Job Openings & Labor Survey for March.

Earnings include: AstraZeneca ADR; Coca-Cola Co.; First National Financial Corp.; Gildan Activewear Inc.; Honeywell International Inc.; Kraft Heinz Co.; Mondelez International Inc.; New Gold Inc.; PayPal Holdings Inc.; Pfizer Inc.; S&P Global Inc.; Spotify Technology SA; Starbucks Corp.; United Parcel Service Inc.; Visa Inc.

**

Wednesday April 30

China PMI

Japan retail sales and industrial policy

Euro zone GDP

Germany GDP, CPI and unemployment

(8:15 a.m. ET) U.S. ADP national employment report for April.

(8:30 a.m. ET) Canada’s monthly GDP for February. The Street is projecting a month-over-month decline of 0.1 per cent.

(8:30 a.m. ET) U.S. real GDP and price index for Q1. Consensus is annualized rate increases of 0.3 per cent and 3.1 per cent, respectively.

(8:30 a.m. ET) U.S. employment cost index for Q1. Consensus is a rise of 0.9 per cent from Q4 and up 3.5 per cent year-over-year.

(9:45 a.m. ET) U.S. Chicago PMI for April.

(10 a.m. ET) U.S. personal spending and income for March. The Street is forecasting month-over-month gains of 0.6 per cent and 0.4 per cent, respectively.

(10 a.m. ET) U.S. core PCE price index for March. Consensus is an increase of 0.1 per cent from February and 2.5 per cent year-over-year.

(10 a.m. ET) U.S. pending home sales for March.

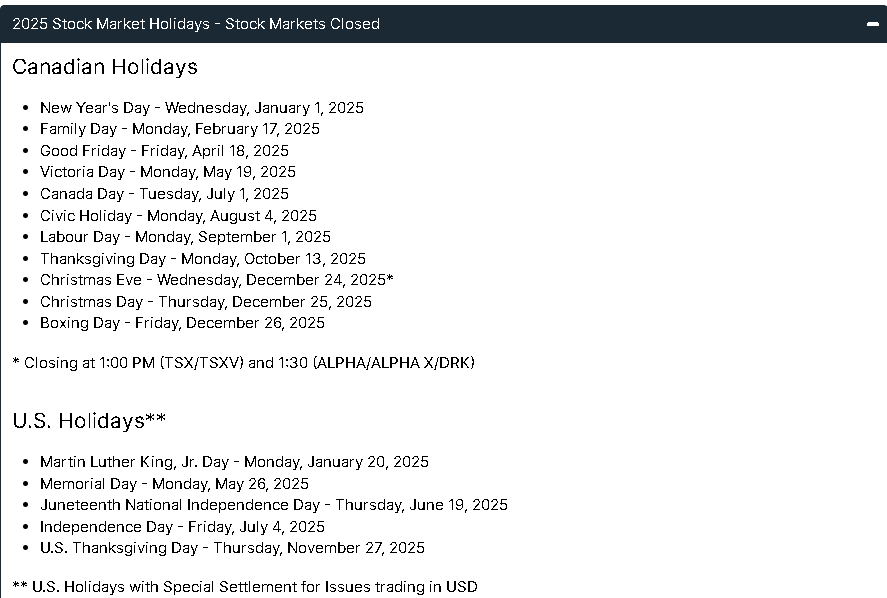

(1:30 p.m. ET) Bank of Canada’s summary of deliberations for the April 16 decision are released.

Earnings include: Alamos Gold Inc.; Bausch + Lomb Corp.; Brookfield Infrastructure Partners LP; Capital Power Corp.; Caterpillar Inc.; Cenovus Energy Inc.; CGI Inc.; Ebay Inc.; GFL Environmental Holdings Inc.; Ivanhoe Mines Ltd.; Loblaw Companies Ltd.; Meta Platforms Inc.; Methanex Corp.; Microsoft Corp.; Open Text Corp.; Paramount Resources Ltd.; Parkland Fuel Corp.; Qualcomm Inc.; Spin Master Corp.; Toromont Industries Ltd.

**

Thursday May 1

China’s markets closed.

Bank of Japan monetary policy meeting and outlook report

(8:30 a.m. ET) Canadian provincial GDP for 2024.

(8:30 a.m. ET) U.S. initial jobless claims for week of April 26. Estimate is 227,000, up 5,000 from the previous week.

(9:30 a.m. ET) Canada’s S&P global manufacturing PMI for April.

(9:45 a.m. ET) U.S. S&P global manufacturing PMI for April.

(10 a.m. ET) U.S. ISM manufacturing PMI for April.

(10 a.m. ET) U.S. construction spending for March. The Street expects a month-over-month increase of 0.3 per cent.

Also: U.S. and Canadian auto sales for April

Earnings include: AltaGas Ltd.; Amazon.com Inc.; Andlauer Healthcare Group Inc.; Apple Inc.; Aritzia Inc.; Bombardier Inc.; Cameco Corp.; Canadian National Railway Co.; Capstone Mining Corp.; Eldorado Gold Corp.; Eli Lilly & Co.; Endeavour Mining Corp.; Fairfax Financial Holdings Ltd.; Mastercard Inc.; McDonald’s Corp.; NexGen Energy Ltd.; TC Energy Corp.

**

Friday May 2

China’s markets closed

Japan jobless rate

Euro zone CPI, jobless rate and manufacturing PMI

(8:30 a.m. ET) U.S. nonfarm payrolls for April. The Street expects an increase of 125,000 from the March with the unemployment rate remaining 4.2 per cent and average hourly wages rising 0.3 per cent.

(10 a.m. ET) U.S. factory orders for March. Consensus is a month-over-month gain of 4.4 per cent.

Earnings include: Brookfield Renewable Partners LP; Chevron Corp.; Cigna Corp.; Exxon Mobil Corp.; Imperial Oil Ltd.; Magna International Inc.; Shell ADR; Sprott Inc.; Westshore Terminals Investment Corp.

-

Agnico: Q1 Earnings Snapshot

Agnico Eagle Mines Ltd. (AEM) on Thursday reported first-quarter profit of $814.7 million.

The Toronto-based company said it had net income of $1.62 per share. Earnings, adjusted for non-recurring gains, were $1.53 per share.

The results topped Wall Street expectations. The average estimate of five analysts surveyed by Zacks Investment Research was for earnings of $1.39 per share.

The gold mining company posted revenue of $2.47 billion in the period.

Agnico shares have increased 53% since the beginning of the year. In the final minutes of trading on Thursday, shares hit $119.63, an increase of 88% in the last 12 months.

_____

This story was generated by Automated Insights (http://automatedinsights.com/ap) using data from Zacks Investment Research.

Access a Zacks stock report on AEM at https://www.zacks.com/ap/AEM

-

Gold Pulls Back Sharply, Snaps Two-Week Winning Streak

| Published: 4/25/2025 2:30 PM ET |

On the heels of the notable rebound seen in the previous session, gold futures showed a significant move back to the downside during trading on Friday.

Gold for April delivery tumbled $49.60 or 1.5 percent to $3.282.40 an ounce after surging $55.70 or 1.7 percent to $3,332 an ounce during Thursday’s session.

With the sharp pullback on the day, the price of the precious metal slid $26.30 or 0.8 percent for the week, snapping a two-year week winning streak.

Gold futures gave back ground amid signs of easing trade tensions between the U.S. and China, with President Donald Trump refuting China’s claims that the two countries have not held any trade negotiations.

“They had a meeting this morning,” Trump told reporters on Thursday. “It doesn’t matter who ‘they’ is. We may reveal it later, but they had meetings this morning, and we’ve been meeting with China.”

Several reports citing U.S. businesses also said China has exempted some U.S. imports from its 125 percent tariffs

On the U.S. economic front, a report released by the University of Michigan showed consumer sentiment in the U.S. deteriorated modestly less than previously estimated in the month of April.

The University of Michigan said its consumer sentiment index for April was upwardly revised to 52.2 from a preliminary reading of 50.8. Economists had expected the index to be unrevised.

Despite the upward revision, the consumer sentiment index is still down sharply from 57.0 in March and marks its lowest level since hitting 51.5 in July 2022.

-

Celestica: Q1 Earnings Snapshot

Celestica Inc. (CLS) on Thursday reported first-quarter net income of $86.2 million.

On a per-share basis, the Toronto-based company said it had net income of 74 cents. Earnings, adjusted for stock option expense and non-recurring costs, were $1.20 per share.

The results topped Wall Street expectations. The average estimate of three analysts surveyed by Zacks Investment Research was for earnings of $1.11 per share.

The electronics manufacturing services company posted revenue of $2.65 billion in the period, also surpassing Street forecasts. Three analysts surveyed by Zacks expected $2.55 billion.

For the current quarter ending in June, Celestica expects its per-share earnings to range from $1.17 to $1.27.

The company said it expects revenue in the range of $2.58 billion to $2.73 billion for the fiscal second quarter.

Celestica expects full-year earnings to be $5 per share, with revenue expected to be $10.85 billion.

_____

This story was generated by Automated Insights (http://automatedinsights.com/ap) using data from Zacks Investment Research.

Access a Zacks stock report on CLS at https://www.zacks.com/ap/CLS

-

European Central Bank cuts interest rates, warns of ‘deteriorated’ growth outlook on trade tensions

The European Central Bank made yet another 25-basis-point interest rate cut on Thursday as global tariff turmoil has created widespread uncertainty and spurred fears about the euro zone’s economic growth.

A rate cut was fully anticipated by markets, with an around 94% chance of a 25-basis-point trim being priced in ahead of the decision, according to LSEG data.

The cut takes the ECB’s deposit facility rate, its key rate, to 2.25%. At its highs in mid-2023 it had been at 4%.

Tariff developments in recent weeks are widely seen by analysts and economists as a key reason for the ECB to cut interest rates. Even though many of the initial duties imposed by the U.S., as well as retaliation measures, have been put on ice or eased, fears about how they could affect economic growth have been rife.

Investors will be watching out for any comments regarding tariffs in the ECB Governing Council’s statement and from the central bank’s President Christine Lagarde in her post-meeting press conference.

Market attention will also focus on whether the ECB tweaks its language around the restrictiveness of monetary policy, and if policymakers provide any clues around the hotly debated so-called neutral rate. That is the level at which interest rates neither stimulate nor restrict the economy, and are therefore held at.

While a rate cut was expected, “more importantly for markets will be the extent to which the central bank decides to communicate what it perceives to be the “neutral rate”, and whether monetary policy could turn accommodative – i.e. go below the neutral rate – in the next six to 12 months,” Julien Lafargue, chief market strategist at Barclays Private Bank, said in a note Thursday.

-

Apr 17/25: Gold prices retreat from record high as investors cash in

Gold prices pulled back from a record high on Thursday as investors booked profits following a rally driven by concerns around U.S. President Donald Trump’s latest wave of tariff policies.

Spot gold was down 0.6% at $3,321.89 an ounce, as of 1003 GMT, after touching a record $3,357.40 earlier in the session. Bullion has gained 2.7% so far this week.

U.S. gold futures fell 0.3% to $3,335.60.

“Likely the reversal off fresh all-time highs can be attributed to some profit-taking on the highs. A slightly firmer tone to an otherwise weak U.S. dollar likely took the edge off gold,” said Ross Norman, an independent analyst.

“Price dips are well bought into, suggesting underlying sentiment is very positive.”

The dollar index recovered from near a three-year low on Thursday, making gold more expensive for holders of other currencies.

Gold rose 3.6% on Wednesday, driven by Trump’s order to open a probe into potential tariffs on all critical mineral imports, in addition to reviews into pharmaceutical and chip imports.

Meanwhile, U.S. Federal Reserve Chair Jerome Powell said on Wednesday the Fed would wait for more data before changing interest rates, while also cautioning that Trump’s tariff policies risked pushing inflation further from the central bank’s goals.

Gold, traditionally viewed as a hedge against inflation, also tends to thrive in a low-interest rate environment.

“The market’s interpretation seems to be that gold would benefit either way,” said Carsten Menke, an analyst at Julius Baer.

Demand for physical gold was tepid in India this week as a blistering price rally curbed purchases, while premiums held firm in top consumer China.

“Reduced participation in the rally by traditional gold buyers might signal the move is nearer the end than the beginning. But it’s hard to see a scenario where gold would correct lower just now, other than being technically overbought and overextended,” Norman said.

Spot silver dropped 1.3% to $32.32 an ounce, platinum shed 1.2% to $955.60, and palladium fell 2.5% to $947.94.

-

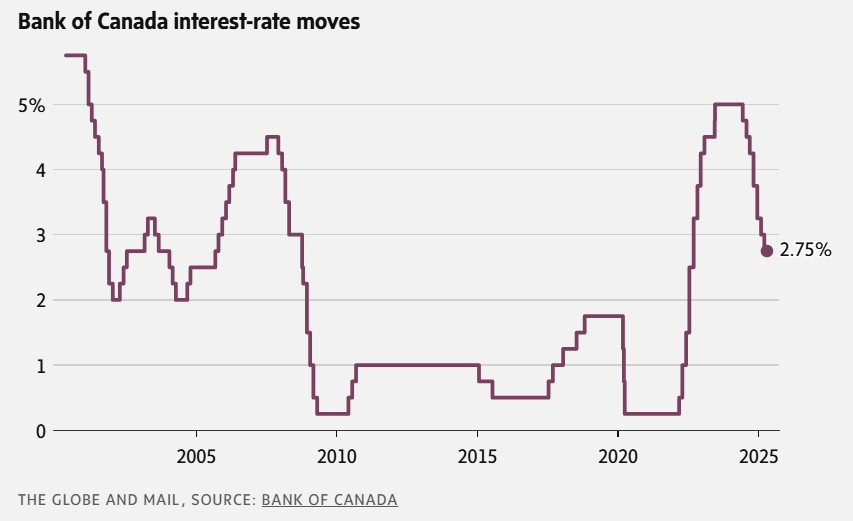

Bank of Canada holds key interest rate steady at 2.75% amid U.S. trade uncertainty

The Bank of Canada held its benchmark interest rate steady at 2.75 per cent on Wednesday, hitting pause on its easing campaign after seven consecutive cuts.

The bank held off publishing a central forecast amid uncertainty about U.S. trade policy, but outlined two possible scenarios. The downside scenario sees Canada entering a recession this year and inflation rising above 3 per cent.