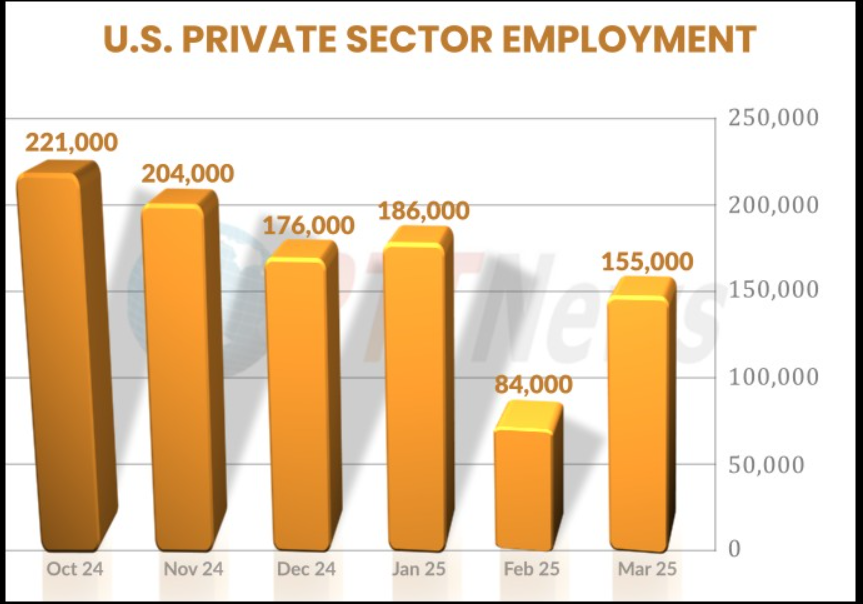

Private sector employment in the U.S. increased by more than expected in the month of March, according to a report released by payroll processor ADP on Wednesday.

ADP said private sector employment jumped by 155,000 jobs in March after climbing by an upwardly revised 84,000 jobs in February.

Economists had expected private sector employment to grow by 105,000 jobs compared to the addition of 77,000 jobs originally reported for the previous month.

“Despite policy uncertainty and downbeat consumers, the bottom line is this: The March topline number was a good one for the economy and employers of all sizes, if not necessarily all sectors,” said ADP chief economist Nela Richardson.

The report said the manufacturing sector delivered stronger-than-average job gains for the second straight month, adding 21,000 jobs.

Meanwhile, ADP said construction hiring slowed, while the natural resources and trade, transportation, and utilities sectors lost jobs.

ADP also said year-over-year pay gains slowed to 4.6 percent for job-stayers and to 6.5 percent for job-changers. The1.9 percentage point pay premium for job-changers matches a series low last seen in September.

On Friday, the Labor Department is scheduled to release its more closely watched report on employment in the month of March, which includes both public and private sector jobs.

Economists currently expect employment to increase by 140,000 jobs in March after climbing by 151,000 jobs in February. The unemployment rate is expected to remain unchanged at 4.1 percent.