The Bank of Canada is widely expected to cut interest rates again this week, with the fragile business climate and a new bout of trade uncertainty predicted to outweigh concerns about an uptick in inflation.

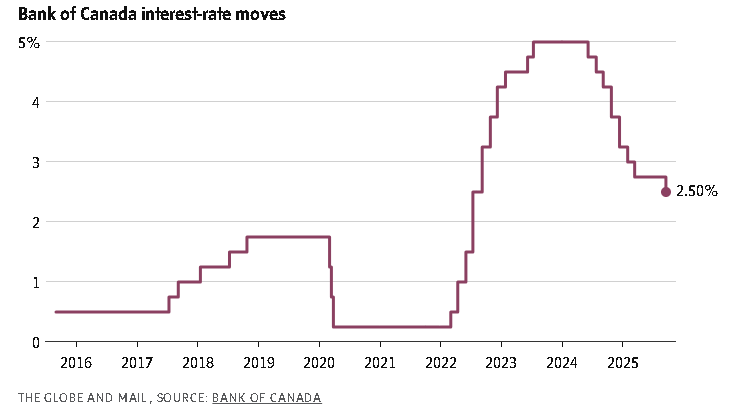

After months on the sidelines, the central bank resumed monetary policy easing last month, citing a “weaker economy and less upside risk to inflation.” It lowered the policy rate by a quarter-percentage-point to 2.5 per cent.

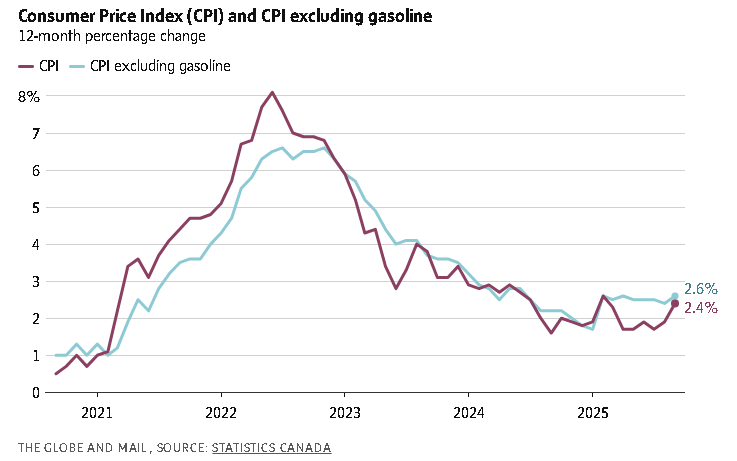

Since then, the Canadian economy has thrown off mixed signals. There was a rebound in employment in September and a larger-than-expected jump in inflation that month, to 2.4 per cent from 1.9 per cent.

But exports remain weak, GDP growth is lacklustre and business sentiment is in the dumps.

In recent days, U.S. President Donald Trump has called off trade negotiations with Canada and threatened an additional 10-per-cent tariff on the country in anger over a Government of Ontario TV ad critical of protectionism.

Bank of Canada Governor Tiff Macklem tipped his hand ever-so-slightly in a call with reporters at the end of a recent trip to Washington for the annual meetings of the World Bank and International Monetary Fund.

He said the bank wouldn’t put too much weight on the surprisingly robust September jobs numbers, and warned that economic growth is going to be tepid in the coming quarters.

“It’s going to be growth, but it’s going to be soft growth. It’s not going to feel very good, and it’s certainly not going to be enough to close the output gap,” Mr. Macklem said, noting that the bank is projecting GDP growth of around 1 per cent in the second half of the year.

Financial markets have picked up these dovish signals and now see a roughly 95-per-cent chance the bank proceeds with another cut on Wednesday, according to LSEG data.

“The market is leaning so heavily to a rate cut now that a decision to hold would lead to a nasty whipsaw in yields,” Bank of Montreal chief economist Douglas Porter wrote in a note to clients.

“While the bank is not going to let the market drive its decisions, the Governor chose to not lean against rate-cut pricing in his latest public remarks – quite the opposite, in fact. Accordingly, it appears that the die is cast for a [quarter-point] trim next week, and we expect a bit more later on given the ongoing and damaging uncertainty on the U.S./Canada trade front.”

The big question on Bay Street isn’t whether the bank will cut on Wednesday. It’s what happens after that, and what signals Mr. Macklem sends about the direction of monetary policy.

The bank will also publish a new forecastfor inflation and economic growth in its quarterly Monetary Policy Report – something it has avoided doing since January, opting instead to lay out upside and downside tariff scenarios.

The bank has already lowered interest rates significantly over the past year-and-a-half, and a cut on Wednesday would bring the benchmark rate to 2.25 per cent, the lower end of what central bank economists consider to be the “neutral range” for interest rates.

Many analysts and investors think the bank will stop there, and remain on hold through the next year – although some think more stimulus will be needed to stabilize Canada’s tariff-battered economy.

With all the downside risks to the Canadian economy from the trade war with the United States, it may seem surprising that financial markets aren’t pricing in more interest-rate cuts.

Mr. Trump has hammered Canada’s auto, steel, aluminum and lumber industries with double-digit tariffs, leading to layoffs and plant closures.

Most other goods remain exempt from the President’s blanket 35-per-cent “fentanyl tariff,” but there’s a risk that negotiations over the renewal of the United States-Mexico-Canada free-trade agreement could break down next year, exposing more of the Canadian economy to tariffs.

Mr. Trump’s threats over the weekend only add to the trade turbulence.

But central bankers have made it clear they don’t see monetary policy as the main lever for dealing with a trade war, which both weighs on economic growth and pushes up prices.

“This is the stagflation problem,” said Jeremy Kronick, vice-president of economic analysis and strategy at the C.D. Howe Institute, referring to the predicament of slow growth combined with high inflation that pulls interest rates in opposite directions.

“I’m in the camp, personally, that thinks the weakness in the economy is going to outweigh the inflationary effects, and I think we’re going to need cuts, probably more than just the one. But I also think that you have to be careful, certainly coming out of an inflationary episode like we’ve had for a couple of years,” Mr. Kronick said in an interview.

The latest numbers showed that inflation has not been entirely whipped.

Headline inflation was 2.4 per cent in September, led by an unflattering year-over-year comparison for gasoline prices and a 4-per-cent rise in grocery prices.

Core inflation measures, which capture underlying price pressures, remain at around 3 per cent – the upper end of the bank’s 1-per-cent to 3-per-cent inflation-control band.

Mr. Macklem has said monetary policy will play a supporting role to fiscal policy in helping the Canadian economy adjust to the structural shock caused by the abrupt end of continental free trade.

Less than a week after the rate decision, Prime Minister Mark Carney, Mr. Macklem’s old boss at the central bank, will release his first budget.

This is expected to show a sharp rise in the federal deficit, given a huge increase in spending on defence and infrastructure, as well as an attempt to reorient government expenditures toward capital projects and away from current consumption.

Dawn Desjardins, chief economist at Deloitte Canada, said there’s only so much monetary policy can do in a moment like this. What’s needed is a broader economic policy shift that improves business confidence and encourages investment in spite of the trade disruptions.

“For businesses, I think interest rates are sufficiently low. It’s more the uncertainty quotient. So how do we as a country … incentivize businesses to start to invest in their companies? That, to me, is not necessarily something that monetary policy, especially right now, is going to be able to do,” she said in an interview.

The Bank of Canada rate decision is happening the same day as a rate decision by the U.S. Federal Reserve.

The Fed is widely expected to cut interest rates for the second time in a row following a relatively benign U.S. inflation report on Friday.

Leave a Reply

You must be logged in to post a comment.