The Bank of Canada kept its benchmark interest rate steady on Wednesday and offered little guidance about where monetary policy will go next as U.S. protectionism continues to reshape the Canadian economy.

As widely anticipated, the bank’s governing council kept the policy rate at 2.25 per cent, where it has been since October.

Governor Tiff Macklem said this level “remains appropriate” given the bank’s outlook for slow, but positive economic growth, and subdued inflation. But he was non-committal about how long the bank would remain on hold or what its next move might be.

“Uncertainty around our forecast is heightened and the range of possible outcomes is wider than usual. U.S. Trade policy remains unpredictable, and geopolitical risks are elevated,” Mr. Macklem said, according to the prepared text of his press conference opening statement.

“The consensus was that elevated uncertainty makes it difficult to predict the timing or direction of the next change in the policy rate,” he added.

Financial markets expect the bank to remain on hold through 2026.

Live updates on today’s Bank of Canada rate decision

Mr. Macklem and his team are navigating an unusually complex economic landscape. U.S. tariffs have hammered Canadian exports and undercut business confidence, leading to a slowdown in investment and hiring. Unemployment remains elevated at 6.8 per cent, with young people and workers in tariff-exposed industries bearing the brunt of labour market weakness.

After a healthy rebound in gross domestic product growth in the third quarter of 2025, the bank now thinks GDP growth flatlined in the fourth quarter – with volatility driven by sharp swings in trade and business stockpiling.

The bank’s new forecast, published Wednesday in its quarterly Monetary Policy Report, sees muted growth going forward, as economic activity is held back by trade uncertainty and slow population growth.

GDP is expected to grow 1.1 per cent in 2026 and 1.5 per cent in 2027, which is largely unchanged from the last projection in October.

This forecast remains highly conditional on U.S. trade policy, particularly the outcome of the upcoming review of the North American free trade pact, which Mr. Macklem flagged as an “important risk to the outlook.”

Bank of Canada’s Tiff Macklem on lessons from the trade war and what risks he sees ahead

There are also questions about how well, and how quickly, Canadian businesses and consumers can adjust to a world where preferential access to the U.S. market is no longer guaranteed.

“The transition to the new trade environment could be smoother than we expect, with stronger business and household spending,” Mr. Macklem said. “Alternatively, the labour market could weaken further as trade impacts deepen, leading to lower household spending. Financial conditions could also tighten if volatility returns to markets.”

Ultimately, the key question for the central bank is how this economic disruption feeds into consumer prices and inflation. And here, the bank appears relatively sanguine.

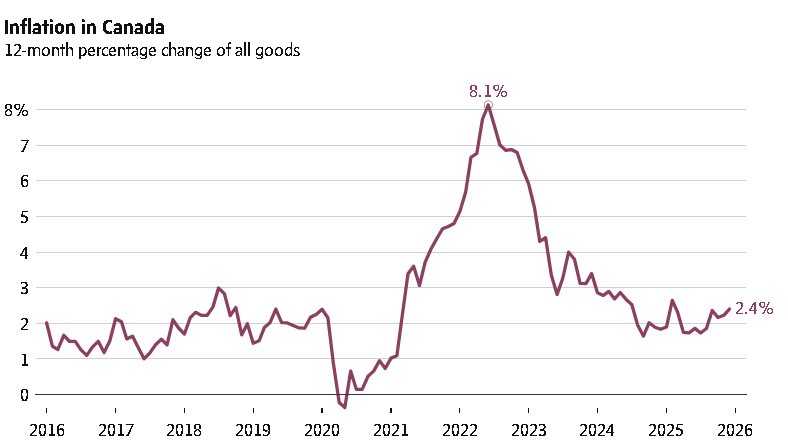

Consumer Price Index inflation came in at 2.4 per cent in December, slightly above the bank’s 2-per-cent target. But the uptick in headline inflation was driven mostly be unusual year-over-year price comparisons due to the 2024 GST and HST tax holiday.

The bank expects inflation to ease further in the coming months and to remain around 2 per cent through the year, as ongoing slack in the economy makes it hard for companies to pass along cost increases due to tariffs and other supply-chain disruptions.

Importantly, the bank expects food price inflation to ease thanks to a recent slowdown in input cost growth across food supply chains.

“Most cost indicators are now rising at a pace broadly consistent with inflation around 2 per cent,” the bank said in its MPR. “For example, growth in unit labour costs has been modest, and most import prices are now rising at a pace close to their historical averages.”

Mr. Macklem said that the bank remains prepared to adjust interest rates if the outlook for inflation or economic growth changes. But reiterated the refrain that monetary policy is not well equipped to deal with the kind of economic disruption Canada is currently facing.

“Monetary policy cannot compensate for the structural damage caused by tariffs, and it cannot target hard-hit sectors of the economy. But it can play a supporting role, helping the economy through this period of structural change, while maintaining inflation close to the 2 per cent target,” he said.

Leave a Reply

You must be logged in to post a comment.