Bank of Canada raises key rate by 1 percentage point, surprising markets with biggest move since 1998

The Bank of Canada increased its benchmark interest rate by one percentage point on Wednesday, the most aggressive rate hike since 1998 and a larger move than investors and private-sector economists were expecting.

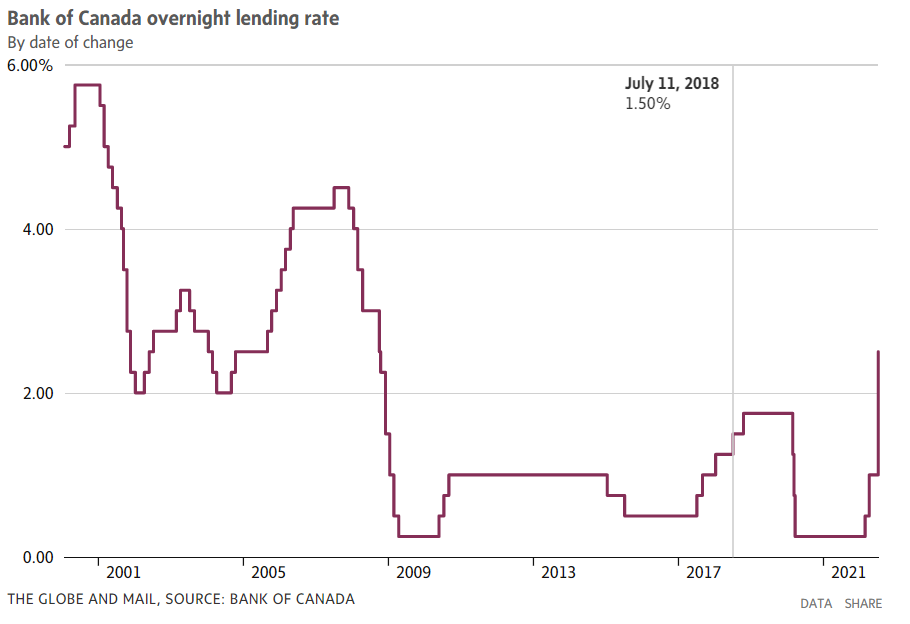

The central bank’s governing council voted to raise its policy rate to 2.5 per cent from 1.5 per cent. This is the fourth consecutive interest rate increase since March, and puts the Bank of Canada ahead of its peers when it comes to tightening monetary policy in the face of the most significant inflation shock in a generation.

“With the economy clearly in excess demand, inflation high and broadening, and more businesses and consumers expecting high inflation to persist for longer, the governing council decided to front-load the path to higher interest rates,” the bank said in its rate decision statement.

The bank signaled that interest rates will need to keep rising to cool down Canada’s overheated economy and slow the pace of consumer price growth.

Ahead of Wednesday’s announcement, investors and private-sector economists were widely expecting a 0.75 percentage point increase. Governor Tiff Macklem and his team, however, opted for a super-sized move in response to broadening inflation pressures and worrying signs that inflation expectations are becoming unanchored.

“We know that higher interest rates will add to the difficulties that Canadians are already facing with high inflation. But the strain of higher interest rates in the short term will bring inflation down for the long term,” Mr. Macklem said in a news conference following the rate announcement.

The bank now expects the rate of inflation to average 7.2 per cent in 2022 and 4.6 per cent in 2023 – considerably higher than it forecast in April. It does not expect inflation to return to its 2 per cent target until the end of 2024.

Economic growth, meanwhile, is expected to slow sharply in the second half of the year and into next year, as a combination of high inflation and tighter financial conditions erodes household spending and business investment.

The bank is not forecasting a recession in Canada in the next two years, and Mr. Macklem said he believes a so-called soft landing is possible, where inflation comes down without a sharp rise in unemployment. That said, the longer inflation remains high, the bigger the risk that it becomes baked into consumer and business psychology, requiring a more forceful response from the central bank.

“The path to this soft landing has narrowed because elevated inflation is proving more persistent. And this requires stronger action now so consumers and businesses can be confident that inflation will return to it’s 2 per cent target,” Mr. Macklem said.

Wednesday’s supersized rate hike cements a remarkable pivot that has taken place in recent months at the Bank of Canada and other central banks around the world.

Mr. Macklem and his team held interest rates near zero for the first two years of the COVID-19 pandemic, and were slow to start tightening monetary policy even as inflation began to pick up last year. This changed in March. Since then, the bank has been pushing interest rates higher at the fastest pace in decades.

The annual rate of inflation hit 7.7 per cent in May, the highest since 1983. Inflation is becoming impossible to avoid, with more than half of the components of the consumer price index rising at an annual rate of more than 5 per cent in May. That’s aggravating cost-of-living concerns for many Canadians and testing central bank credibility.

Higher rates make it more expensive for businesses and households to borrow money. This won’t do much to tamp down global inflationary pressures, such as supply chain bottlenecks and higher commodity prices, which have surged in the wake of Russia’s invasion of Ukraine. But it could help cool demand in the Canadian economy.

“The Canadian economy is overheated. There are shortages of workers and of many goods and services. Demand needs to slow so supply can catch up and price pressures ease,” Mr. Macklem said.

The rapid rise in interest rates is also aimed at keeping inflation expectations anchored. One of the biggest concerns for central bankers is preventing people from losing faith in its inflation target.

The longer consumer prices keep surging, the more inflation will become entrenched in people’s psychology as happened in the 1970s. The fear is that a wage-price spiral could develop, where business and consumers expect higher prices, and so set higher prices and demand higher wages in a self-reinforcing cycle.

“Surveys indicated more consumers and businesses are expecting inflation to be higher for longer, raising the risk that elevated inflation becomes entrenched in price- and wage-setting. If that occurs, the economic cost of restoring price stability will be higher,” the bank said in its rate decision statement.

Higher interest rates are already impacting key segments of the economy, notably in the housing market. In the Toronto region, the largest real estate market in the country, the number of home resales dropped 41 per cent in June compared to last year. The typical Toronto home price is down nearly 10 per cent from the March peak to June.

Leave a Reply

You must be logged in to post a comment.