Bank of Canada warns high household debt and elevated home prices pose top risks to economy

The Bank of Canada has warned that household vulnerabilities have worsened over the past year and could lead to stress in the financial system as people struggle to service their debts.

In its latest Financial System Review, the central bank identified high levels of household debt and elevated home prices as the top two vulnerabilities, saying they could even result in a financial crisis.

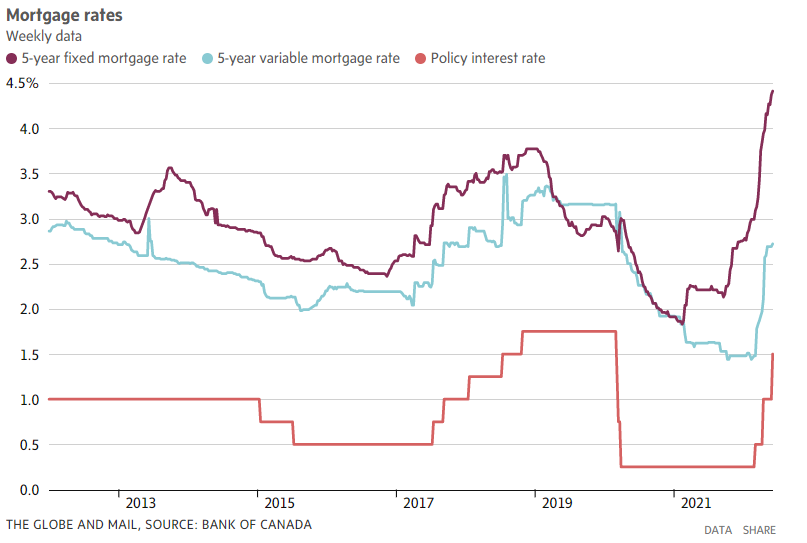

The cost of borrowing has spiked over the past few months and is expected to continue on that path as the Bank of Canada aggressively raises interest rates to combat high inflation.

“Our primary focus is getting inflation back to target. Monetary policy is not housing policy,” central bank governor Tiff Macklem said at a news conference.

Higher interest rates have already slowed real estate activity, with sales declining nationwide and home prices falling in some of the country’s hottest markets. Several private-sector economists have forecast double-digit declines in prices this year, but the central bank said it was too soon to say whether this was the start of a substantial correction.

At the press conference, Mr. Macklem repeatedly stressed that the central bank’s priority was to get inflation back to normal even if that meant a cooldown in the housing market. The bank has raised interest rates at three consecutive rate decisions and has said that intends to keep pushing borrowing costs higher.

“Some moderation in housing would be healthy,” said Mr. Macklem. He did not say how much moderation would be healthy. But in some places like Halton, an affluent region just west of the city of Toronto, the typical home price has dropped 13 per cent over the past three months.

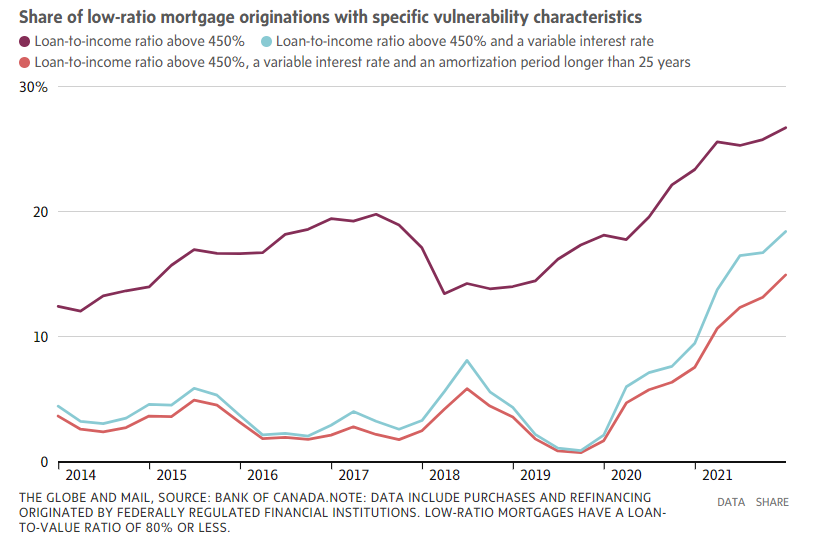

The bank listed several worrisome trends that it has observed over the course of the latest real estate boom: households have increasingly stretched themselves financially to purchase property; home buyers have made smaller down payments relative to the purchase price in recent quarters; and investors have increasingly leveraged the homes they already own to buy new properties.

The high amounts of household debt could eventually become problematic for the financial system as central banks around the world raise interest rates. The global economy could soon start to slow or slip into a recession. That could lead to job losses and make it harder for mortgage holders to make their loan payments.

If home prices drop, that could further restrain homeowners’ ability to use the equity in their homes. Homeowners may be forced to reduce their spending and/or sell their properties.

“If the shock is large enough to cause many households to be in this situation, the size of the impact could create a negative feedback loop between the real economy and the financial system,” the report said. “The likelihood of this risk materializing and its impact on the economy are greater today than in the past.”

The central bank is primarily concerned about the highly indebted Canadians who took out mortgages over the past two years. Borrowers with a loan-to-income ratio above 450 per cent account for over 25 per cent of all mortgage holders – a record high.

Central bank economists have calculated that those borrowers would see a significant jump in mortgage payments at renewal time. If a borrower took out a variable-rate mortgage in 2020 or 2021, they would see a median increase of $1,000 in their monthly payments in 2025 or 2026, the report said.

Despite the growing risks, the central bank said commercial banks remain well-positioned to weather an economic downturn or shock coming from the housing market.

In the event of a “severe and prolonged recession,” Canadian banks would experience a significant hit to their capital buffers but would likely be able to continue lending to businesses and households, the bank said. This is supported by sound mortgage underwriting practices, solid capital ratios and a “robust capacity to generate revenues even in times of stress.”

The Bank of Canada offered a relatively upbeat assessment of corporate balance sheets. The ratio of debt to assets for non-financial companies has declined continuously since its peak in the second quarter or 2020. Meanwhile, the ratio of cash to debt has reached an all-time high.

“This improvement is due in part to the favourable impact that rising commodity prices are having on corporate balance sheets in the resource sector – a sector where firms have historically been more financially vulnerable,” the bank noted.

Companies that use bond markets to raise money will face higher borrowing costs as interest rates rise. But the central bank noted that most outstanding bonds are not set to mature in the next five years.

Still, companies could face challenges servicing their debts if the economy moves into recession, the bank said: “The direct impact of higher interest rates on the financing costs of most publicly listed firms will likely be small but could be problematic if higher rates are accompanied by a shock to firms’ revenues.”

The Financial System Review noted a range of other risks that appear to be growing. Russia’s invasion of Ukraine has increased the chance of a state-sponsored cyberattack against Canadian banks, the central bank said.

Meanwhile, financial stability concerns related to climate change remain a pressing issue. The worry is that asset prices and company valuations do not properly account for risks related to a transition to a lower-carbon economy.

The bank also expanded its analysis of cryptocurrencies. It reiterated its view that cryptocurrencies are “not yet of systemic importance” to the Canadian financial system. Although it did note that interest in the asset class is growing rapidly and expanding from retail investors to institutional investors.

In 2021, about 13 per cent of Canadians owned bitcoin, up from 5 per cent in 2020. The median holding was about $500.

The bank’s principal concern is the lack of regulation in the sector. Many cryptocurrency companies function like traditional financial institutions but with far less oversight.

Leave a Reply

You must be logged in to post a comment.