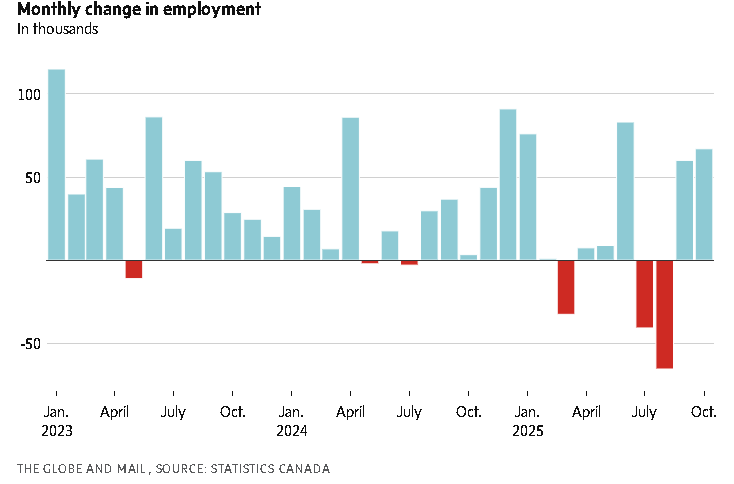

The Canadian economy enjoyed a burst of hiring activity for the second consecutive month in October, offsetting summer job losses and bolstering calls that the Bank of Canada is done cutting interest rates for now.

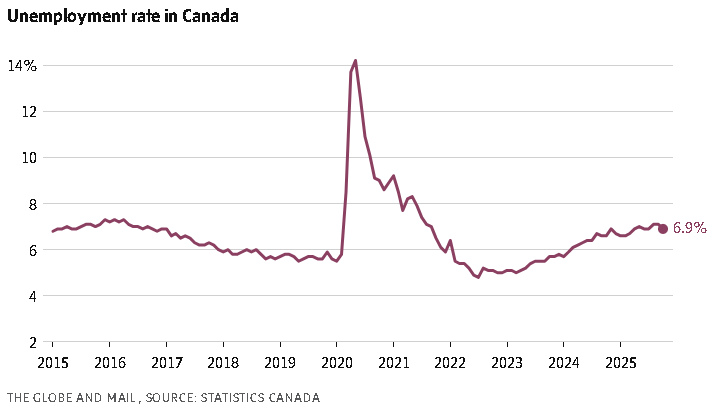

The labour market added 67,000 jobs last month and the unemployment rate fell to 6.9 per cent from 7.1 per cent, Statistics Canada said Friday in a report. Financial analysts were expecting a small loss of 5,000 positions.

Over September and October, the country added a cumulative 127,000 jobs, fully recovering the 106,000 positions that were shed over July and August.

While the Canadian economy has been sideswiped by U.S. tariffs this year, it has also shown some resilience, and early data suggest the country will narrowly avoid a recession. The labour market, which had been weak as the Trump administration started implementing its tariffs, is looking more lively of late.

“It’s too early to tell, but this could end up being the first sign of recovery for an economy that’s been reeling,” Royce Mendes, head of macro strategy at Desjardins Securities, said in a client note. “This reinforces our revised call that the Bank of Canada moves back to the sidelines next month, leaving rates unchanged after easing in September and October.”

Decoder: Job postings expose the U.S. and Canada’s shared employment misery

The odds are slim that the Bank of Canada will cut interest rates at its next decision on Dec. 10. Interest rate swaps, which capture market expectations of monetary policy, are pricing in a 5-per-cent chance of a reduction next month, down from 13-per-cent odds on Thursday, according to Bloomberg data.

Last week, the central bank trimmed its benchmark interest rate to 2.25 per cent, a second consecutive cut after several pauses to assess the fallout of protectionist U.S. trade policies. Bank of Canada Governor Tiff Macklem stressed that monetary policy can only accomplish so much when the economy is going through structural changes because of trade frictions, and that rates may be “at about the right level” to keep inflation in check.

Despite a challenging business climate, Friday’s labour report showed some rebounds in distressed areas.

Ontario, for example, added 55,000 jobs in October. The province’s economy has been slammed by U.S. tariffs targeting the automotive and steel industries, a sluggish real estate sector and layoffs in postsecondary education.

Doug Porter, chief economist at Bank of Montreal, said in a research note that “there were lots of signs that the Blue Jays run made a mark” in provincial hiring, with sizeable gains seen in hospitality, recreation and retail.

The national youth unemployment rate, meanwhile, fell to 14.1 per cent from 14.7 per cent in September, the first decline since February. The jobless rate for the 15-to-24 age cohort had previously reached its highest level in 15 years, excluding the early pandemic years of 2020 and 2021.

There were, however, some weak spots in Friday’s report. The entirety of October’s job gains were in part-time work, and most industries shed positions during the month. Statscan noted that from January to October, employment in goods-producing industries has fallen by 54,000, largely because of losses in construction and manufacturing.

The outlook is hardly certain, as well. The North American trade agreement is up for renegotiation next year, and Ottawa has been unable to secure relief for certain industries getting battered by hefty U.S. tariffs. A recent Bank of Canada survey of businesses found that most are not planning to increase the size of their work forces over the next year.

“The Canadian labour market appears to be recovering, although truer tests of the strength of that recovery are still to come given the recent volatility seen in this data release,” Andrew Grantham, senior economist at CIBC Capital Markets, said in a client note. “We expect that employment gains will slow down again but, with population growth also decelerating, the unemployment rate should continue a gradual move lower during 2026.”

Mr. Grantham added: “That would be in-line with the Bank of Canada’s current thinking that interest rates are low enough to support a recovery within the economy, and because of that we continue to forecast no more cuts from here.”

Leave a Reply

You must be logged in to post a comment.