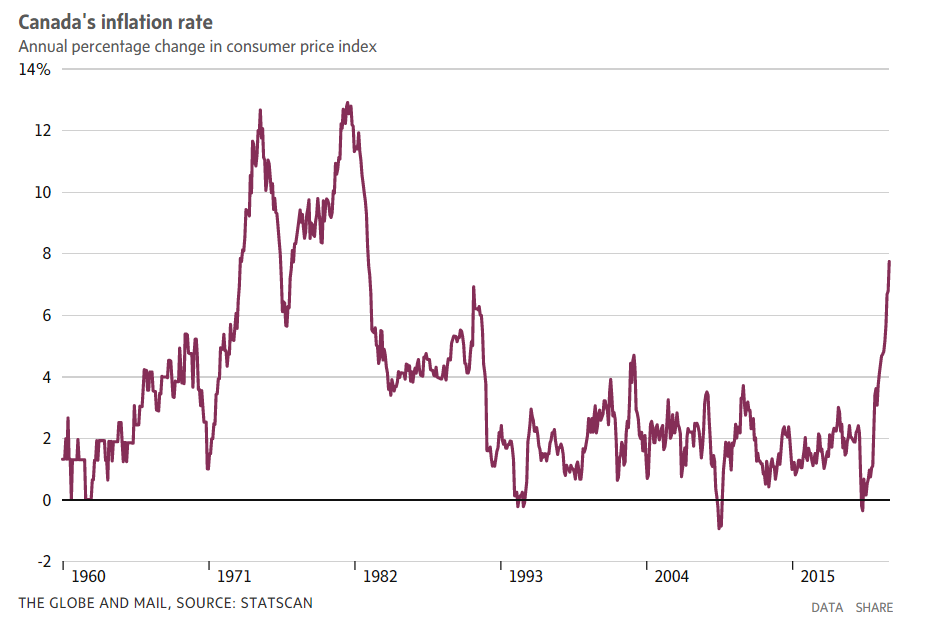

Canada’s inflation rate spikes to 7.7% in May, highest since 1983

Canadian inflation accelerated to the highest rate in nearly four decades in May as calls broaden for policy makers to find new ways of curbing runaway price growth.

The consumer price index (CPI) rose 7.7 per cent in May from a year earlier, rising from April’s 6.8-per-cent pace, Statistics Canada said on Wednesday. It was the highest inflation rate since 1983 and part of a broader surge in prices that’s taken hold in advanced economies.

The recent jump in energy prices, stoked by the Russia-Ukraine war, is having a tangible effect on the numbers. Gasoline prices rose 12 per cent in May alone and were up 48 per cent from a year earlier; the national average price for regular unleaded remains north of $2 a litre.

Super savers are fighting rising grocery costs – and inflation – one deal at a time

Still, consumers are feeling the pressure on several fronts – from surging costs in the grocery aisle and at furniture stores, to pricey hotel rates and escalating rents.

“Price pressures continued to be broad-based, pinching the pocketbooks of Canadians and in some cases affecting their ability to meet day-to-day expenses,” Statscan said in its report.

To tamp down inflation, central bankers have embarked on their quickest pace of interest rate hikes in decades. The Bank of Canada has raised its benchmark interest rate at three successive meetings, taking it to 1.5 per cent from a pandemic low of 0.25 per cent. Last week, the U.S. Federal Reserve hiked its key rate by three-quarters of a percentage point, bringing the target range to between 1.5 per cent and 1.75 per cent. Central bankers have indicated that several more rate hikes are coming in order to bring inflation to heel.

The Bank of Canada will make its next rate decision on July 13. Several financial analysts expect the central bank to match the Fed with its own outsized hike of 75 basis points.

“The Bank of Canada needs to get a handle on prices soon,” Royce Mendes, macro strategist at Desjardins Securities, wrote in a note to clients. “The acceleration in inflation will likely force the Bank of Canada to raise rates a further 75 [basis points], a jumbo-sized move central bankers should have made earlier this month.”

Global markets have plunged recently as investors sour on the state of the economy. Central bankers are trying to tame inflation via higher interest rates, but without sending the economy into a recession – an outcome that is dimming as lofty inflation persists.

Of late, there have been growing calls for governments to find new ways of easing the financial pressures that households are under. On Sunday, Bank of Nova Scotia published a report that called on the federal Liberal Party to do more to tackle inflation, largely via less government spending. “It is fair to say that fiscal policy authorities in Canada are doing nothing of any significance to slow inflation at the moment,” the report said.

Speaking to a Bay Street audience last week, Deputy Prime Minister Chrystia Freeland pointed to $8.9-billion in previously announced measures that will help various Canadians with their living expenses, including a 10-per-cent increase in Old Age Security for seniors over 75 and increased funding for child care and rent support. Ms. Freeland did not announce any new measures that day.

U.S. Treasury Secretary Janet Yellen, who met with Ms. Freeland in Toronto on Monday, said the White House was considering a range of policy options to tackle inflation, including a gas tax cut. Ms. Freeland would not rule anything out, but said a reduction in gas taxes would hamper efforts to shrink the deficit, and she pointed to carbon tax rebates that households receive.

On both sides of the border, consumers are growing more pessimistic about the economy. Thus far, their spending is holding up well, helped by the hordes of cash that many households accumulated during the pandemic, when spending options were limited. But those savings are being eroded by high inflation, and waning confidence could translate into weaker spending.

Leave a Reply

You must be logged in to post a comment.