Canada’s trade deficit widened in November as gold shipments plunged and exports of automobiles and parts hit a three-year low.

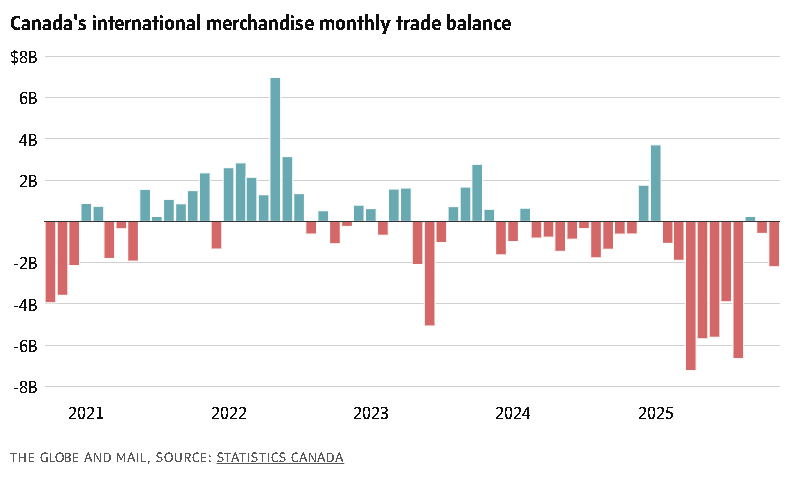

Goods exports declined 2.8 per cent while imports declined 0.1 per cent, Statistics Canada reported Thursday. That brought the merchandise trade deficit, the difference between goods imports and exports, to $2.2-billion in November from $395-million the month before.

The result was mainly owing to a massive swing in gold shipments, which have been a key but volatile driver of export growth over the past year. Excluding metal and non-metallic mineral products, the export picture looked more positive, rising 2.5 per cent and increasing in eight out of 11 categories.

Trade with the United States continued to slide, while there were some signs that Canada’s diversification push is gaining traction.

Only 56 per cent of imports came from the U.S., which is the lowest share since records began in 1997, excluding the pandemic, according to Bank of Montreal senior economist Shelly Kaushik. On the other side of the ledger, 68 per cent of Canadian exports went to the U.S., also well below historic norms.

“Looking through the volatility from energy and metals prices, it’s clear that Canadian trade flows remain under pressure as long as uncertainty stays elevated. Despite some support from diversification, trade headwinds will remain until we get certainty in the form of relief on sectoral tariffs and clarity on the future of USMCA,” Ms. Kaushik wrote in a note to clients, referring to the North American free-trade agreement.

Exports of services decreased 1.5 per cent in November, while services imports rose 0.5 per cent. This left services trade essentially in balance.

U.S. trade deficit widens by the most in nearly 34 years in November

Through much of 2025, gold was a star Canadian export, thanks to the extraordinary run-up in the price of the yellow metal. In September and October alone, the value of gold exports surged by $4.7-billion.

Gold exports then plunged by $3.2-billion in November. This was mostly driven by a decline in volumes – rather than prices – which fell 35 per cent month-to-month. Statscan noted a sharp drop in shipments to Britain, the United States and Hong Kong.

Since November, gold prices have continued their stratospheric rise, hitting a record US$5,500 an ounce earlier this week.

Exports of automobiles and parts also decreased 11.6 per cent from October to November. This was mainly the result of lower auto production in November, owing to a semiconductor shortage that has affected the auto industry, Statscan said.

Exports of heavy trucks and buses – which make up a much smaller part of the Canadian auto industry – declined 53.8 per cent following the introduction of U.S. tariffs on heavy vehicles at the start of November.

The decline in gold and auto exports was partly offset by an 8.5-per-cent rise in energy exports. Oil and crude bitumen exports rebounded after temporary shutdowns at refineries in the U.S. had curtailed shipments the month before.

Meanwhile, the value of imports declined slightly, falling in seven out of 11 categories, although this was driven by lower prices rather than lower volumes. There was a notable decline in energy and auto imports, balanced against by an increase in consumer goods and pharmaceutical imports.

“Smoothing through the noise, Canadian export volumes remain a few per cent below their pretariff levels. The recovery in Canada’s overall trade picture has been uneven, and businesses can anticipate challenging conditions in the months ahead,” Toronto-Dominion Bank economist Marc Ercolao wrote in a note to clients.

Ottawa, Seoul agree to work on bringing South Korean auto sector manufacturing to Canada

In the face of U.S. protectionism, Ottawa is trying to promote trade diversification. Prime Minister Mark Carney and his ministers have been travelling the world pursuing new trade agreements and trying to rustle up overseas business for Canadian companies. This includes the resumption of stalled trade talks with India and an agreement with China earlier this month to lower tariffs on a portion of electric vehicles in return for lower Chinese tariffs on Canadian canola and seafood products.

Trade with non-U.S. partners increased through 2025, particularly with Germany, Britain, China and Japan. And in November, exports to Germany rose 54 per cent, while exports to China rose 8.8 per cent.

“Canada’s recent strategic partnership with China may alleviate some strain in key sectors like autos and agriculture. But the future of North American trade will be highly contingent on the outcome of the upcoming review of the USMCA agreement,” Mr. Ercolao wrote.

The larger trade deficit will weigh on Canadian economic growth numbers in the fourth quarter, as net exports are added or subtracted from the GDP calculation. On Wednesday, the Bank of Canada published a new forecast, estimating that GDP growth essentially flatlined in the fourth quarter.

Statistics Canada will publish November GDP numbers on Friday.

Leave a Reply

You must be logged in to post a comment.